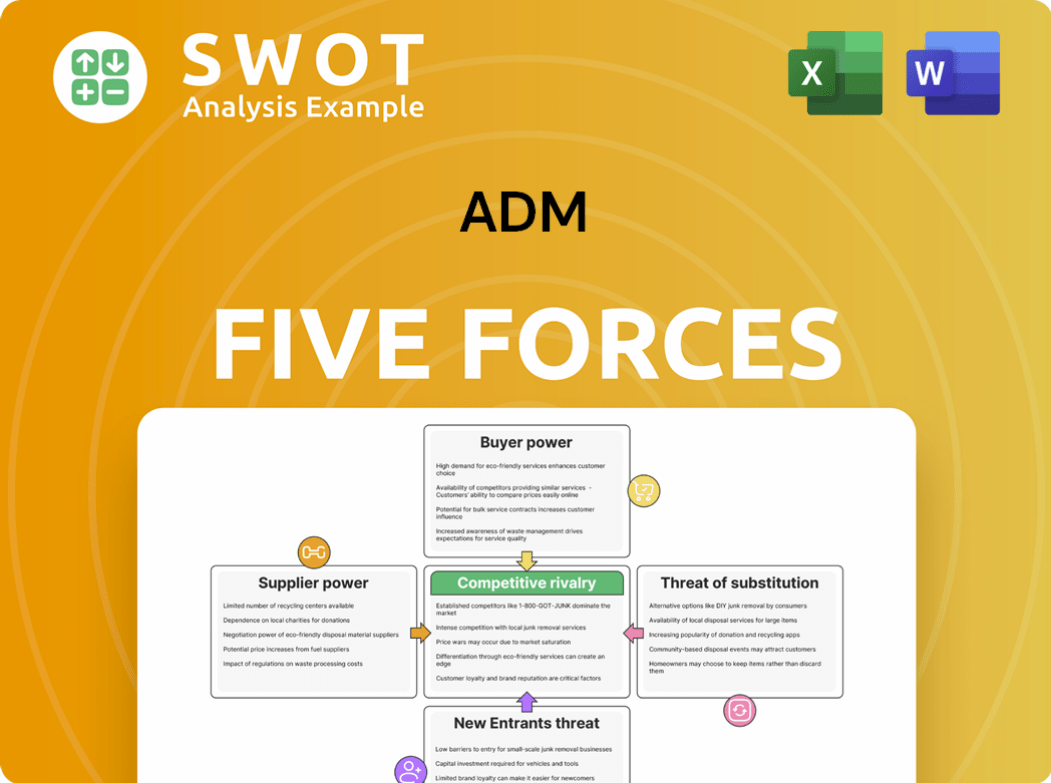

ADM Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADM Bundle

What is included in the product

Assesses ADM's competitive landscape, considering rivals, buyers, suppliers, potential entrants, and substitutes.

Instantly spot hidden opportunities and threats with a visual, intuitive dashboard.

Preview Before You Purchase

ADM Porter's Five Forces Analysis

This document provides a Porter's Five Forces analysis, examining industry competitiveness through factors like rivalry, supplier power, and buyer power. The analysis explores threats of new entrants and substitutes impacting ADM. The preview you see is the same document the customer will receive after purchasing; fully formatted and ready for use.

Porter's Five Forces Analysis Template

ADM's competitive landscape is shaped by five key forces: rivalry among existing competitors, the bargaining power of suppliers, the bargaining power of buyers, the threat of new entrants, and the threat of substitute products or services. Understanding these forces is crucial for assessing ADM's long-term profitability and strategic positioning within the agricultural commodities market. This analysis helps to determine the intensity of competition and potential profit margins. Evaluating these forces informs effective business planning and investment strategies.

Unlock key insights into ADM’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

The agricultural commodity market features millions of farms worldwide, which diffuses supplier power. ADM's extensive global network of suppliers, spanning various countries and farmers, minimizes dependence on any individual source. This broad sourcing strategy strengthens ADM's bargaining position. In 2024, ADM sourced agricultural products from over 200,000 farmers globally, enhancing its negotiation leverage.

ADM strategically manages its supplier relationships, often locking in long-term contracts. These arrangements provide consistent pricing and supply, reducing supplier leverage. For example, in 2024, ADM's cost of goods sold was approximately $67.9 billion. Collaborative initiatives also help ADM manage supplier power, fostering mutual benefits and reducing supplier dominance.

ADM's vertical integration strategy, including owning agricultural land and direct farmer contracts, reduces its reliance on suppliers. This control helps manage costs and supply consistency. In 2024, ADM's revenue reached approximately $90 billion, with significant contributions from its vertically integrated operations. This approach allows ADM to better navigate market fluctuations and supplier dynamics.

Global Sourcing Capabilities

ADM's global sourcing is a strategic advantage. It sources globally, reducing risks from regional issues. This approach boosts ADM's bargaining power with suppliers. In 2024, ADM's revenue reached $89.6 billion, showcasing its market strength.

- Global presence ensures diverse sourcing.

- Reduces supply disruption risks.

- Enhances bargaining power.

- ADM's revenue in 2024: $89.6B.

Supplier Code of Conduct

ADM actively manages supplier relationships through its Supplier Code of Conduct, which emphasizes ethical and responsible sourcing. This approach helps to mitigate the bargaining power of suppliers by setting clear expectations. In 2024, ADM conducted numerous CSR audits to ensure compliance with these standards, limiting undue influence from suppliers. This proactive stance supports ADM's ability to maintain favorable terms.

- ADM's Supplier Code of Conduct promotes ethical sourcing.

- CSR audits are used to ensure suppliers meet standards.

- This approach reduces supplier's undue influence.

- ADM's actions maintain favorable terms.

ADM leverages its global reach and diverse supplier network to limit supplier power. Its strategy includes long-term contracts and vertical integration, ensuring supply and managing costs. ADM’s 2024 revenue of $89.6 billion highlights its market strength and effective supplier management.

| Aspect | Strategy | 2024 Impact |

|---|---|---|

| Supplier Network | Global Sourcing | Reduces risk, enhances bargaining power |

| Contracts | Long-term agreements | Secures supply, manages costs |

| Vertical Integration | Direct farmer contracts | Controls supply, manages fluctuations |

Customers Bargaining Power

ADM's customer base is vast, spanning food, beverage, and animal feed sectors. This diversity weakens customer bargaining power. In 2024, ADM's revenue was diversified. The company's widespread reach helps buffer against customer-specific pressures. Their diversified approach is a strategic strength.

Switching costs significantly impact customer bargaining power. For commodity products, customers face low switching costs, but ADM's specialized ingredients increase these costs. In 2024, ADM's focus on value-added products resulted in a 10% increase in customer retention. Customers using ADM's tailored solutions may find switching to competitors expensive due to formula integrations.

Price sensitivity among customers, particularly in commodity markets, significantly boosts their bargaining power. ADM addresses this challenge by emphasizing value-added products and services. This strategy differentiates ADM's offerings, decreasing the emphasis on price alone. For example, in 2024, ADM's value-added products accounted for a substantial portion of its revenue, reflecting its successful mitigation of price-driven customer power.

Demand for Quality and Innovation

Customers today are increasingly vocal about wanting top-notch, sustainable, and innovative products. ADM's ability to deliver on these expectations plays a crucial role in managing customer power. By focusing on quality and innovation, ADM can potentially reduce how sensitive customers are to price changes and cultivate greater loyalty. This strategic approach helps ADM maintain a competitive edge in the market.

- ADM invested $1.2 billion in capital expenditures in 2024, focusing on innovation and efficiency.

- In 2024, ADM's revenue was approximately $94.4 billion, which was affected by customer demands.

- ADM's sustainability initiatives include a goal to reduce greenhouse gas emissions by 25% by 2035.

- ADM's strategic investments in areas like alternative proteins and flavorings cater to evolving customer preferences.

Impact of Consumer Trends

Consumer trends significantly shape buyer power. Shifting preferences towards healthier, sustainable choices directly influence purchasing decisions. ADM's focus on plant-based proteins and sustainable solutions strategically addresses these changing needs. This adaptation helps mitigate buyer power by aligning with evolving consumer demands. In 2023, ADM's alternative protein sales reached $2.5 billion, showcasing their responsiveness.

- Consumer demand for plant-based products is projected to grow, with the global market estimated to reach $36.3 billion by 2030.

- ADM invested approximately $3 billion in acquisitions and capital expenditures in 2023 to expand its alternative protein and sustainable solutions portfolio.

- ADM's revenue in 2023 was $94.4 billion, indicating strong market position.

ADM's diverse customer base and specialized products reduce customer bargaining power, despite price sensitivity. Switching costs are higher for tailored solutions. Value-added products and innovation are key to managing customer influence, with 2023 alternative protein sales at $2.5 billion.

| Aspect | Impact on Buyer Power | ADM's Strategy |

|---|---|---|

| Customer Diversity | Lowers power | Wide market reach |

| Switching Costs | Influences power | Specialized ingredients |

| Price Sensitivity | Increases power | Value-added products |

Rivalry Among Competitors

ADM faces fierce competition. Key rivals include Cargill, Bunge, and Louis Dreyfus. These firms battle on price, quality, and global presence. This rivalry can squeeze profit margins, as seen in Q3 2024 results.

ADM competes globally with large firms like Bunge and Cargill, alongside regional players, intensifying rivalry. In 2024, ADM's revenue was approximately $90 billion, reflecting its extensive market presence. This global scope means ADM constantly contends with diverse competitors. The agricultural processing sector's global nature fuels intense competition. This dynamic impacts ADM's strategic decisions and profitability.

ADM faces intense rivalry due to the commodity nature of its products. Price competition erodes profit margins, as seen in the 2024 Q1 earnings report where gross profit decreased. This necessitates constant efficiency improvements, evident in ADM's focus on cost-cutting measures. The agricultural commodity market's volatility, influenced by factors like weather and global demand, further intensifies this rivalry. ADM's strategic responses include diversification and value-added product development to mitigate price pressures.

Innovation and Differentiation

ADM combats rivalry by innovating and differentiating its products. This strategy focuses on creating specialized ingredients, which allows for higher profit margins. By offering unique solutions, ADM reduces direct price competition. In 2024, ADM's investments in R&D reached $400 million, supporting its innovation drive.

- R&D Investment: $400 million (2024)

- Specialized Ingredients: Focus on higher-margin products

- Reduced Price Competition: Differentiation as a key strategy

- Margin Improvement: Aim to improve profitability through innovation

Strategic Partnerships

ADM utilizes strategic partnerships to bolster its competitive stance in the market. These collaborations provide access to new markets, technologies, and capabilities, sharpening ADM's competitive edge. For example, ADM has partnered with GoodMills Group to expand its European wheat milling operations. This approach enables ADM to diversify its offerings and increase market presence. These alliances are crucial for staying competitive.

- Partnerships help ADM access new markets and technologies.

- ADM's collaborations enhance its ability to compete effectively.

- Strategic alliances improve ADM's market presence.

- These collaborations are critical for diversification.

ADM contends with intense rivalry from global giants like Cargill and Bunge. Competition drives focus on efficiency and innovation to protect margins. ADM's 2024 R&D investment totaled $400M, aiming for differentiation.

| Metric | Value | Year |

|---|---|---|

| 2024 Revenue (approx.) | $90 billion | 2024 |

| R&D Investment | $400 million | 2024 |

| Gross Profit Decline (Q1) | Reported | 2024 |

SSubstitutes Threaten

The growth of alternative proteins presents a notable threat. Beyond Meat saw a 10.6% decrease in net revenue in 2023, reflecting market shifts. This impacts demand for traditional agricultural products like soybeans and corn, key ingredients in animal feed. The expanding market share of plant-based options influences traditional agricultural commodity valuations. This shift requires adaptation from companies like ADM.

Biotech advancements produce synthetic food ingredients that can replace traditional agricultural products. These substitutes, potentially cheaper and more sustainable, pose a threat. The synthetic biology market is projected to reach $38.7 billion by 2024. This could impact companies like ADM, which relies on agricultural commodities.

Changing consumer preferences significantly impact the threat of substitutes. Increased demand for healthier and sustainable options, like plant-based proteins, challenges traditional products. ADM responds by investing in these areas. In 2024, the plant-based food market is projected to reach $36.3 billion, growing at 8.7% annually. This strategic move helps ADM stay competitive.

Technological Advancements

Technological advancements pose a threat to ADM through substitute products. Innovations like vertical farming and precision agriculture boost efficiency, potentially lowering substitute costs. ADM must actively monitor these shifts to maintain its competitive edge in the market. This proactive approach is crucial for adapting to evolving consumer preferences and market dynamics.

- Vertical farming market is projected to reach $15.7 billion by 2028.

- Precision agriculture technologies could boost crop yields by up to 20%.

- ADM's net sales for 2023 were approximately $64.4 billion.

- Research and development spending is essential to keep up with the competition.

Price Competition

Price competition among substitutes is a critical factor. The adoption of alternatives hinges on their relative cost. Cost-competitive substitutes can diminish demand for conventional agricultural products. For instance, the price of plant-based proteins, a substitute for meat, influences consumer choices. In 2024, the global plant-based food market is expected to reach $36.3 billion, showing its impact.

- Plant-based meat sales increased, indicating a shift.

- Lower prices of substitutes attract price-sensitive buyers.

- Technological advancements drive down substitute costs.

- Market analysis reveals trends in consumer preferences.

The threat of substitutes significantly impacts ADM through alternative products. Plant-based foods and synthetic ingredients challenge traditional commodities. In 2024, the global plant-based food market is expected to hit $36.3 billion, influencing market dynamics.

| Factors | Impact | Data |

|---|---|---|

| Market Growth | Challenges traditional agricultural products. | Plant-based market $36.3B in 2024. |

| Technological Advancements | Reduce costs and increase availability. | Vertical farming $15.7B by 2028. |

| Consumer Preferences | Shift demand towards alternatives. | Plant-based meat sales are rising. |

Entrants Threaten

The agricultural processing industry demands substantial capital for facilities and infrastructure. This includes processing plants, transportation, and storage, creating a significant barrier. For instance, building a modern soybean processing plant can cost hundreds of millions of dollars. This financial hurdle deters new entrants, as seen in 2024 with fewer startups in this sector. High capital needs protect established firms from new competition.

ADM's strong grip on supply chains poses a major entry barrier. They have deep-rooted connections with farmers, ensuring a steady supply of raw materials. Newcomers face a tough challenge replicating this network, requiring considerable time and resources. For example, in 2024, ADM's agricultural services revenue was $74.6 billion, reflecting its supply chain strength. This makes it harder for new players to compete effectively.

Regulatory hurdles significantly impact new entrants in the food and agriculture sector. This industry faces complex regulations covering food safety, environmental protection, and international trade, increasing compliance costs. For example, the FDA's budget for food safety is over $3 billion annually. These costs can be prohibitive, especially for smaller entities. New businesses must invest heavily in compliance to enter the market.

Brand Recognition and Customer Loyalty

ADM benefits from significant brand recognition and robust customer loyalty, acting as a shield against new entrants. New competitors face the challenge of building similar trust and recognition, a process that demands considerable time and marketing expenditure. These established relationships provide ADM with a competitive edge, making it difficult for newcomers to gain market share rapidly. ADM's strong brand is supported by its long history and global presence. The company's marketing spend in 2024 was approximately $600 million, indicating its commitment to maintaining brand strength.

- ADM's brand value is estimated at over $10 billion.

- Customer retention rates for ADM are around 85%.

- New entrants would need to invest heavily, potentially over $500 million, in marketing.

- ADM has over 400 processing facilities worldwide.

Economies of Scale

ADM, as a large company, benefits significantly from economies of scale, a major barrier against new entrants. New competitors often struggle to match ADM's cost structure due to their smaller size and less established operations. ADM's expansive global presence and extensive supply chain further enhance its cost advantages, making it difficult for new players to compete effectively. These economies of scale provide ADM with a significant competitive edge.

- ADM's revenue in 2023 was approximately $94.4 billion.

- ADM operates in over 200 countries, showcasing its global scale.

- Economies of scale allow ADM to spread its fixed costs over a larger production volume.

- New entrants face substantial capital investment to achieve similar operational efficiencies.

New entrants face steep barriers due to capital needs, supply chain control, and regulatory hurdles.

ADM's brand strength and economies of scale further impede newcomers.

These factors limit competition, solidifying ADM's market position.

| Barrier | Impact | Data Point (2024) |

|---|---|---|

| Capital Costs | High initial investment | Soybean plant: $300M+ |

| Supply Chain | Difficult to replicate | ADM Agri Rev: $74.6B |

| Brand Strength | Challenges market entry | ADM's Mkt Spend: $600M |

Porter's Five Forces Analysis Data Sources

The ADM analysis is built upon diverse data, including financial reports, market research, and industry publications. These sources enable a comprehensive review of market dynamics.