ADT Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADT Bundle

What is included in the product

Strategic guidance for portfolio management using the BCG Matrix.

Clean, distraction-free view to help prioritize resource allocation.

Delivered as Shown

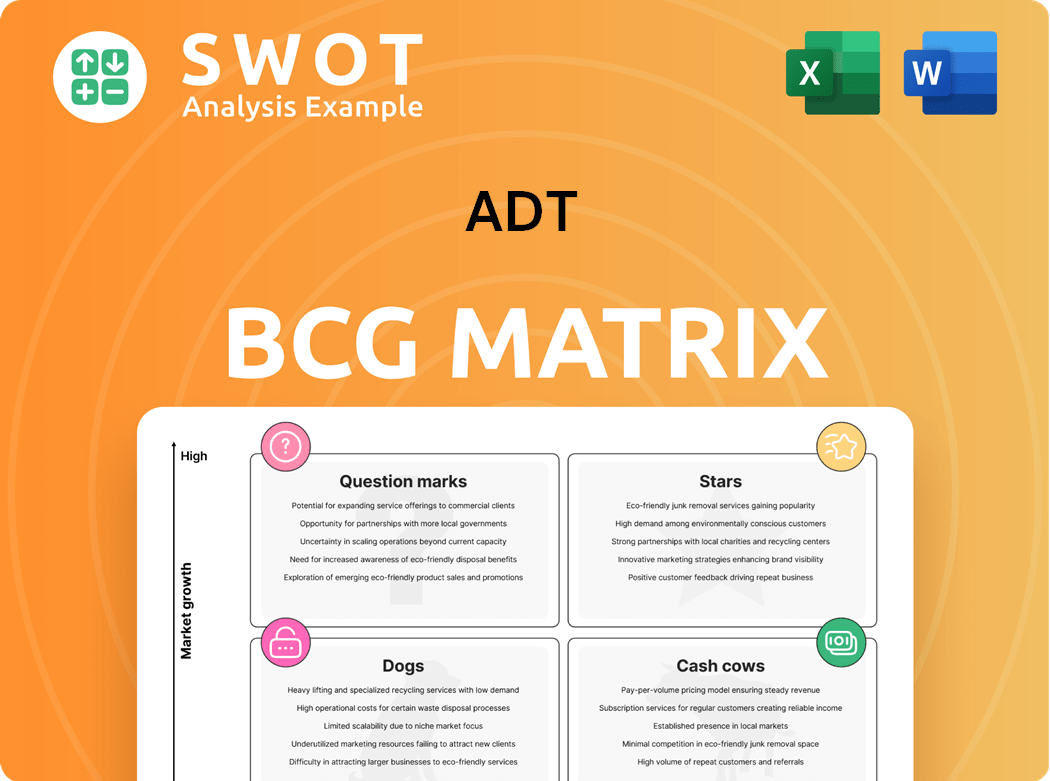

ADT BCG Matrix

The preview shows the complete BCG Matrix report you'll receive upon purchase. This is the full, ready-to-use document, devoid of watermarks or demo content. It’s formatted for clarity and strategic decision-making.

BCG Matrix Template

The BCG Matrix is a strategic tool categorizing products based on market growth and market share. This helps businesses decide where to invest or divest. Question Marks may need investment, while Stars are high-growth, high-share products. Cash Cows generate profits, and Dogs may be divested. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

ADT+ platform, launched in 2024, is a star in ADT's BCG Matrix. This platform integrates ADT's tech with Google Nest, offering a unified interface for security and automation. It boasts high customer satisfaction scores, indicating strong market leadership. In 2024, ADT saw a 6% increase in smart home security installations, driven by ADT+.

Trusted Neighbor™, a 'Home Security Innovation of the Year' winner, is a star within ADT's BCG matrix, showing high growth. This service integrates the ADT+ app with Google's Nest and Yale® Smart locks. In 2024, smart home security market revenue is projected to reach $5.4 billion, highlighting its potential. ADT's focus on innovative services positions it strongly.

ADT's collaboration with State Farm, active in 17 states, emphasizes proactive risk detection. This partnership aims to provide robust customer protection through home security solutions. Tailored packages are continuously updated based on customer feedback, driving potential expansion. ADT's revenue reached $6.1 billion in 2023, showcasing its market presence.

Remote Assistance Program

ADT's Remote Assistance program shines as a "Star" in its BCG Matrix, boosting customer satisfaction and cutting costs by avoiding vehicle trips. In Q4 2024, over half of ADT's service requests were handled virtually, demonstrating strong growth and market share. This shift enhances operational efficiency while meeting customer needs effectively.

- High Customer Satisfaction: ADT's Remote Assistance garners positive feedback.

- Cost Reduction: Eliminates vehicle trips, lowering expenses.

- Significant Virtual Service: Over 50% of Q4 2024 requests were virtual.

- Market Share Growth: Virtual services drive expansion.

Smart Home Integration

ADT's Smart Home Integration, including Google Nest and Yale smart locks, is a star within its BCG matrix. This integration boosts the smart home ecosystem's functionality and security. In 2024, the smart home security market is estimated at $5.6 billion. This positions ADT favorably in a growing sector.

- ADT's smart home integrations enhance security.

- The market for smart home security is growing.

- Partnerships with Google Nest and Yale are crucial.

- These integrations provide comprehensive coverage.

ADT's Stars in the BCG Matrix, including ADT+, Trusted Neighbor™, and Smart Home Integration, demonstrate high growth potential and market leadership.

These offerings, like Remote Assistance, boost customer satisfaction and operational efficiency through virtual services. ADT's partnerships and innovations capitalize on the expanding smart home security market, valued at $5.6 billion in 2024.

The focus on integration with Google Nest and Yale smart locks enhances security, positioning ADT for continued growth in the home security sector.

| Feature | Description | 2024 Data/Forecast |

|---|---|---|

| ADT+ Platform | Integrated security and automation. | 6% increase in smart home security installations due to ADT+. |

| Trusted Neighbor™ | Integrates ADT+ with Google Nest and Yale smart locks. | Smart home security market revenue projected at $5.4 billion. |

| Remote Assistance | Virtual service resolving issues. | Over 50% of service requests handled virtually in Q4 2024. |

Cash Cows

ADT's traditional monitored security systems are a cash cow, boasting a significant 29% market share in U.S. households with alarm systems. This dominant position translates into substantial recurring monthly revenue (RMR) for ADT. The segment benefits from ADT's strong brand and extensive monitoring network.

ADT's professional monitoring services are central to its business, offering continuous security. These services have a substantial market share, backed by a well-known and reliable brand. The mature market means that the investments needed for promotion and placement are low. In 2024, ADT reported over 6.5 million customers, demonstrating its strong market position.

ADT's commercial security solutions cater to small businesses, offering a range of services. In 2024, ADT aimed to increase commercial market share by 15%. This growth potential aligns with the rising demand for business security. The company's strategic focus on this segment is evident in its service offerings.

Recurring Monthly Revenue (RMR)

Recurring Monthly Revenue (RMR) is a cornerstone of ADT's cash cow status. ADT's financial strength is shown by its high RMR. This robust revenue stream is supported by strong customer retention. In 2024, ADT's gross revenue attrition was 12.7%, showcasing its ability to retain customers.

- RMR is a key cash generator for ADT.

- ADT boasts record-high recurring monthly revenue.

- Customer retention is a strong point.

- 2024 gross revenue attrition was 12.7%.

Nationwide Installation and Monitoring Network

ADT's nationwide installation and monitoring network functions as a cash cow, generating steady revenue with low growth. The company's multiple monitoring centers across North America ensure prompt response times for customers. This extensive infrastructure supports a high market share, though expansion is limited. In 2024, ADT reported over 6.5 million monitored customers.

- Over 6.5 million monitored customers in 2024.

- Nationwide presence across all 50 states.

- Over 15,000 installation and service technicians.

- Multiple strategically located monitoring centers.

Cash cows, like ADT's security services, generate consistent revenue with minimal investment. ADT's strong customer base and high RMR are key. In 2024, ADT maintained a solid position with over 6.5 million customers.

| Metric | Value (2024) | Notes |

|---|---|---|

| Market Share | 29% (U.S. Households) | Alarm system market. |

| Customer Base | 6.5M+ | Monitored customers. |

| Gross Revenue Attrition | 12.7% | Customer retention rate. |

Dogs

ADT's discontinued solar business is classified as a "Dog" in its BCG Matrix. The business, no longer active, contributes minimally to revenue. In 2024, it generated almost zero cash flow. ADT excludes its impact from Adjusted Free Cash Flow measures.

Outdated security products, a "dog" in ADT's portfolio, face low growth and market share. These legacy systems, like older wired alarms, struggle against newer, smarter tech. Turning them around is costly, with limited success, as seen by declining sales in older product lines. For example, in 2024, ADT's revenue from traditional security systems declined by 5%, reflecting this challenge.

Products with low customer satisfaction and negative reviews are considered dogs. These products often have both low market share and low growth rates. For example, in 2024, a survey revealed that 25% of customers were dissatisfied with a specific product. These should be avoided and minimized.

Non-integrated Smart Home Devices

ADT's non-integrated smart home devices fit the "Dogs" quadrant of the BCG matrix. These products, with their limited compatibility, likely have low market share and growth. For example, in 2024, ADT's revenue showed a modest increase of about 3%, indicating slow growth for some offerings. Such devices struggle against those offering broader ecosystem integration.

- Low market share due to limited appeal.

- Slow growth, reflecting challenges in a competitive market.

- May require significant investment to improve integration.

- Could be divested or repositioned.

Services with High Attrition Rates

Services with high attrition rates, classified as "Dogs" in the ADT BCG Matrix, exhibit both low market share and low growth rates. These offerings often drain resources without generating substantial returns, making them undesirable for investment. Focusing on these services can lead to financial losses and missed opportunities for growth. Minimizing or eliminating these services is a strategic imperative.

- High attrition rates signal customer dissatisfaction and market weakness.

- These services typically require significant resources for minimal returns.

- Strategic focus should shift away from these offerings to more promising areas.

- Avoidance and minimization are key strategies for financial health.

In ADT's BCG Matrix, "Dogs" represent struggling offerings. These include discontinued solar and outdated products. They exhibit low growth and market share, often resulting in minimal returns.

| Aspect | Characteristics | 2024 Data |

|---|---|---|

| Financial Impact | Low revenue & cash flow, high attrition | Traditional security revenue down 5%, 25% customer dissatisfaction. |

| Market Position | Low market share, slow growth, non-integrated devices. | Modest 3% revenue growth for some offerings. |

| Strategic Response | Divest, minimize, or reposition. | Focus away from high-attrition services. |

Question Marks

ADT's move into AI-driven security is a question mark in its BCG Matrix. The company aims for high growth by integrating these technologies. In 2024, the AI security market is expanding, yet ADT's market share in this area is still developing. The growth potential is there, but they need to gain traction. As of Q3 2024, ADT's revenue was $1.3 billion.

ADT's Self Setup, a DIY security system, is a question mark in its BCG matrix. These systems compete in the rapidly expanding DIY home security market. However, ADT's market share in this segment is currently relatively low. The company's strategy focuses on driving market adoption of Self Setup through targeted marketing. In 2024, the global home security market was valued at approximately $53 billion, showing significant growth potential.

ADT views aging-in-place as a question mark in its BCG matrix, aiming for high growth. These markets, though promising, currently yield a low market share for ADT. To boost its position, ADT must either heavily invest or consider selling this segment. In 2024, the aging-in-place market is estimated at $20 billion, growing annually by 8%.

Cybersecurity Solutions

ADT's cybersecurity solutions fit the "Question Mark" quadrant in the BCG Matrix. In 2024, ADT invested $200 million in cybersecurity and IoT integration, signaling growth potential. However, their market share in this area is currently low. This means ADT is in a high-growth market but hasn't yet captured a significant share.

- ADT's $200 million investment shows commitment.

- Low market share indicates challenges.

- High growth potential is the key.

- Future success depends on execution.

International Market Expansion

In the ADT BCG Matrix, international market expansion is categorized as a question mark. This signifies that ADT is venturing into international security segments, which are high-growth markets but where ADT currently holds a low market share. The strategy calls for careful investment if the product shows growth potential, or divestment if it does not.

- Market Share: Low.

- Growth Rate: High.

- Strategic Decision: Invest or Sell.

- Investment Focus: Growth Potential.

ADT's question marks highlight areas with high growth potential but low market share. These include AI security, DIY systems, aging-in-place, cybersecurity, and international expansion. ADT's strategies involve focused investments or potential divestitures to capitalize on growth. The company's financial performance hinges on successful execution in these emerging segments.

| Segment | Market Share | Growth Potential |

|---|---|---|

| AI Security | Developing | High |

| DIY Systems | Low | High |

| Aging-in-Place | Low | High (8% YoY) |

| Cybersecurity | Low | High |

| International Expansion | Low | High |

BCG Matrix Data Sources

Our ADT BCG Matrix utilizes financial data, industry research, and market analysis, supplemented by competitor analysis to accurately categorize each business unit.