ADT SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ADT Bundle

What is included in the product

Analyzes ADT’s competitive position through key internal and external factors

Simplifies complex ADT SWOT analysis for quick team understanding.

What You See Is What You Get

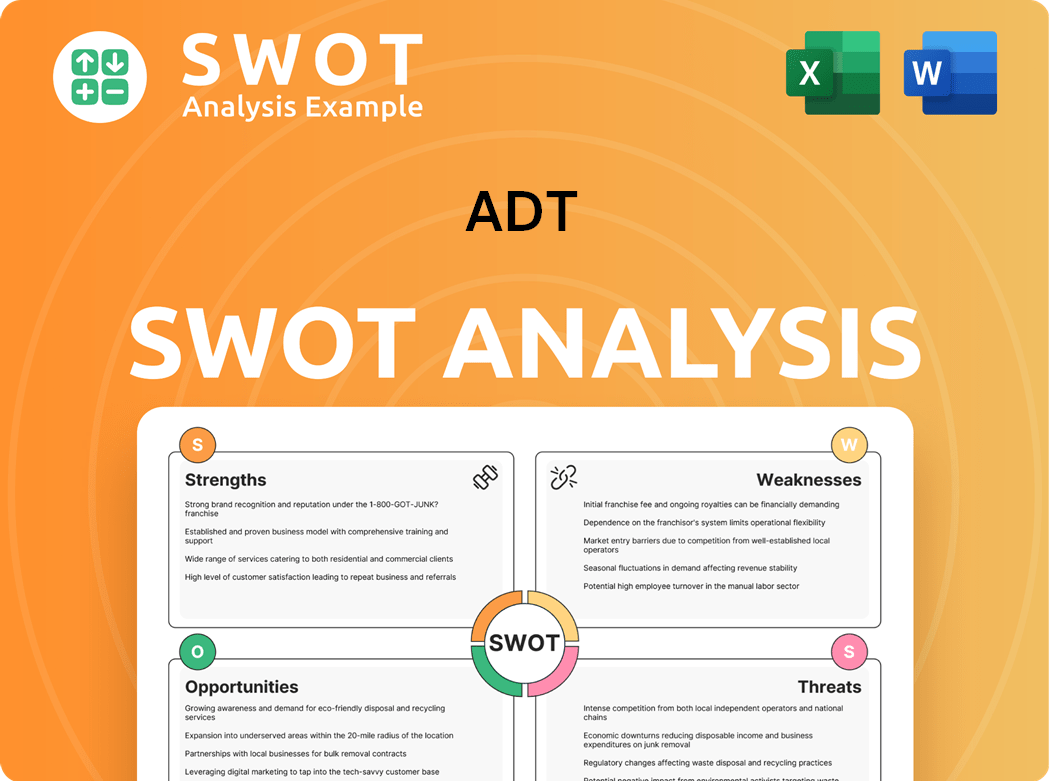

ADT SWOT Analysis

See the actual ADT SWOT analysis you’ll receive! This preview accurately reflects the final, complete document. No edits or alterations; it’s the full, professional report. Upon purchase, download the identical analysis. Get ready to assess ADT's strengths, weaknesses, opportunities & threats!

SWOT Analysis Template

This ADT SWOT analysis previews key strengths like brand recognition and customer base. Weaknesses, such as high debt, are also highlighted. We've touched on opportunities in smart home expansion. And addressed threats like increasing competition.

Get the insights you need to move from ideas to action. The full SWOT analysis offers detailed breakdowns, expert commentary, and a bonus Excel version—perfect for strategy, consulting, or investment planning.

Strengths

ADT's 150+ year history solidifies its brand, making it a household name. In 2024, ADT's strong brand recognition aided in securing 6.3 million monitored customers. This long-standing presence fosters trust, boosting customer loyalty. Positive word-of-mouth referrals further enhance ADT's market position.

ADT's strengths include its extensive monitoring network, operating multiple centers nationwide for 24/7 surveillance. This network ensures rapid emergency response times, crucial for customer security and peace of mind. Redundancy in these centers guarantees continuous service, even during outages. In 2024, ADT's monitoring centers handled over 20 million signals monthly.

ADT's extensive product and service portfolio, including security systems, video surveillance, and smart home tech, strengthens its market position. This broad offering helps ADT attract a diverse customer base, with residential security accounting for a significant portion of its revenue. In 2024, ADT's revenue was approximately $5.3 billion, showcasing the value of its varied offerings.

Partnerships and Integrations

ADT's extensive partnerships and integrations significantly amplify its market reach and service capabilities. ADT's collaborations with major tech and home automation companies allow for seamless integration of security systems. These partnerships enhance user experience and expand ADT's service offerings, attracting a broader customer base. For instance, ADT has partnered with Google, showcasing the integration of its security systems with Google Nest products, further solidifying its market position.

- Strategic alliances with tech giants like Google expand ADT's service offerings.

- These partnerships enhance user experience.

- Enhanced brand recognition and customer loyalty.

- In 2024, ADT's revenue reached approximately $5.4 billion.

Strong Financial Performance

ADT's strong financial performance is evident in its robust operational infrastructure. The company's monitoring centers are strategically located across the U.S., ensuring continuous service. This setup allows for quick emergency responses, enhancing customer trust. Redundancy in the centers guarantees service continuity. ADT reported $1.3 billion in revenue for Q3 2023.

- 24/7 Monitoring: ADT provides round-the-clock professional monitoring services.

- Extensive Network: Operates multiple monitoring centers across the United States.

- Quick Response: Aims for fast response times.

- Redundancy: Ensures continuous service through backup systems.

ADT benefits from its well-established brand and customer loyalty. A vast monitoring network ensures quick response times, crucial for security, with over 20 million monthly signals handled in 2024. The extensive product range, contributing to about $5.4 billion in revenue for the year, adds to market strength. Partnerships with companies like Google enhance service offerings and user experience.

| Strength | Description | Data |

|---|---|---|

| Brand Recognition | Well-known and trusted brand | 6.3 million monitored customers in 2024 |

| Monitoring Network | 24/7 surveillance | Over 20 million signals/month in 2024 |

| Product Portfolio | Diverse security solutions | Approx. $5.4B revenue in 2024 |

Weaknesses

ADT faces high customer acquisition costs, a significant weakness. Marketing, sales, and installation expenses drive up these costs. Their professional installation model and long-term contracts add to the upfront financial burden. This can deter price-sensitive customers. In 2024, ADT's customer acquisition cost per customer was approximately $600.

ADT's reliance on long-term contracts, frequently spanning 36 months or more, presents a weakness. These contracts, while ensuring recurring revenue, can discourage customers preferring flexibility. In 2024, 20% of new customers cited contract length as a deterrent. This rigidity potentially limits ADT's market reach, particularly among those seeking short-term security solutions or trials.

ADT's pricing isn't always straightforward, often needing a quote from sales. This opacity can deter potential customers. Competitors with transparent pricing gain an advantage. Clearer pricing would likely boost customer acquisition and trust. In 2024, ADT's revenue was $5.5 billion, a key factor in pricing decisions.

Cybersecurity Vulnerabilities

ADT's vulnerabilities include cybersecurity weaknesses. Acquiring new customers is costly, involving marketing, sales, and installation expenses. ADT's reliance on professional installation and long-term contracts increases these upfront costs. These expenses may deter budget-conscious customers seeking DIY security solutions.

- In 2024, ADT's customer acquisition cost (CAC) was approximately $400-$600 per subscriber.

- The DIY security market is growing, with companies like SimpliSafe and Ring offering more affordable options.

- Long-term contracts can lock customers into services, but also limit flexibility.

Dependence on Professional Installation

ADT's reliance on professional installation is a weakness, as it locks customers into long-term contracts, typically spanning 36 months or more. These contracts can be a deterrent for those seeking flexible, short-term solutions. In 2024, ADT's contract renewal rate was around 75%, indicating a significant portion of customers remain committed despite the restrictions. Customers may hesitate to commit to lengthy terms.

- Long-term contracts limit flexibility.

- Customers prefer short-term options.

- Contract length impacts customer acquisition.

ADT's high customer acquisition cost, around $400-$600 per subscriber in 2024, remains a significant hurdle.

The reliance on long-term contracts, like 36-month commitments, hinders flexibility, affecting customer acquisition; in 2024, around 20% cited it as a concern.

Cybersecurity vulnerabilities are risks, and the complexities of professional installation and long-term agreements could create hurdles for customers; in 2024, contract renewal was about 75%.

| Weakness | Impact | Data (2024) |

|---|---|---|

| High CAC | Customer Acquisition | $400-$600/subscriber |

| Long-term contracts | Customer flexibility | 20% cited contract length |

| Cybersecurity | Risk Exposure | N/A (Ongoing Concern) |

Opportunities

The smart home market is booming, fueled by consumer demand for automation. ADT can seize this opportunity by broadening its smart home solutions. This involves creating new products and integrating with voice assistants. In 2024, the smart home market is projected to reach $143.4 billion. ADT can leverage this growth.

The video surveillance market is booming, fueled by security concerns and remote monitoring needs. ADT can capitalize on this by providing advanced video analytics, AI surveillance, and cloud storage. This includes upgrading camera tech and enhancing video monitoring services. In 2024, the global video surveillance market was valued at $60.9 billion.

ADT can broaden its scope and offerings through strategic partnerships. Alliances with home builders and insurance firms open doors to new markets. In 2024, ADT's partnerships boosted its customer base. These collaborations enhance brand visibility and drive revenue.

Focus on Cybersecurity Solutions

ADT has an opportunity to capitalize on the growing cybersecurity market. With the rise in cyber threats, demand for robust security solutions is increasing. ADT can enhance its offerings by integrating advanced cybersecurity features into its home security systems. This could include improved data encryption, threat detection, and remote monitoring capabilities.

- The global cybersecurity market was valued at $172.32 billion in 2023 and is projected to reach $403.08 billion by 2030.

- The smart home market is expected to reach $177.3 billion by 2027.

- ADT's revenue for 2023 was approximately $5.4 billion.

Expansion into New Geographies

ADT has opportunities in expanding into new geographies because the demand for video surveillance is rising due to security concerns and remote monitoring desires. ADT can capitalize on this by offering advanced video analytics and cloud-based storage solutions. This allows for enhanced camera technology and improved video monitoring services. In 2024, the global video surveillance market was valued at $47.8 billion, expected to reach $81.7 billion by 2029.

- Market growth driven by security concerns and tech advancements.

- Offer advanced analytics and cloud storage.

- Enhance camera tech and monitoring services.

- Global market valued at $47.8B in 2024.

ADT can tap into the surging smart home market. The market is projected to reach $177.3 billion by 2027, providing ample growth opportunity. ADT should also take advantage of strategic partnerships for revenue and market growth.

Growing cybersecurity demands provide ADT another opportunity. Integrating cybersecurity into home systems enhances security. In 2023, the global cybersecurity market was valued at $172.32 billion, showcasing immense potential.

| Market | 2023 Value | Projected by |

|---|---|---|

| Cybersecurity | $172.32B | $403.08B (2030) |

| Smart Home | - | $177.3B (2027) |

| Video Surveillance (2024) | $60.9B | $81.7B (2029) |

Threats

The security market is fiercely contested. ADT competes with established firms, DIY options, and newcomers. This intense competition puts pressure on pricing and margins. ADT needs to innovate and provide top-tier customer service. In 2024, the market share of ADT was around 20%.

Technological disruption poses a significant threat to ADT. Rapid advancements can quickly make current security products and services outdated. ADT needs to invest in R&D to stay competitive. In 2024, cybersecurity spending reached over $200 billion globally, showing the scale of investment needed. Adapting to AI, cloud, and IoT is crucial.

Economic downturns pose a significant threat by potentially decreasing consumer spending and business investments, which can lower demand for ADT's security offerings. To mitigate this, ADT should diversify its customer base and provide flexible payment plans. Focusing on essential security needs, particularly in recession-resistant markets, is crucial. In 2024, the U.S. GDP growth slowed, signaling potential economic challenges.

Cybersecurity

Cybersecurity threats pose a significant risk to ADT, particularly as the company relies heavily on connected devices and data management. Vulnerabilities in ADT's systems could lead to data breaches, compromising customer information and potentially disrupting service. The increasing sophistication of cyberattacks necessitates continuous investment in cybersecurity measures. ADT's ability to protect its infrastructure and customer data is crucial for maintaining trust and its competitive edge. In 2024, cyberattacks cost businesses an average of $4.45 million.

- Data breaches can lead to financial losses and reputational damage.

- Cybersecurity breaches may disrupt service and impact customer trust.

- Investment in cybersecurity measures is essential to mitigate risks.

- Ransomware attacks are a growing threat in the security industry.

Changing Consumer Preferences

Changing consumer preferences pose a significant threat to ADT. Rapid tech advancements can make existing products obsolete, demanding continuous innovation. ADT needs to invest in R&D and adapt its business model. This includes AI, cloud computing, and IoT technologies. Stagnation could lead to a loss of market share. ADT's 2024 revenue was $5.5 billion, highlighting the need for adaptation to maintain growth.

- Technological Disruption: Rapid obsolescence of existing products.

- Adaptation: Need for continuous innovation and R&D investment.

- Market Share: Risk of losing it due to failure in adaptation.

Competition and price pressures can squeeze ADT's profitability, demanding continuous innovation. Technological disruption means older products quickly become outdated. ADT needs continuous cybersecurity investments to protect data. Economic downturns can lower consumer spending and demand for services.

| Threat | Description | Impact |

|---|---|---|

| Competition | Intense market competition | Pressure on pricing/margins, requires top service. |

| Technological Disruption | Rapid tech advancement | Outdated products, requires R&D investment. |

| Economic Downturns | Reduced consumer spending | Decreased demand for services. |

| Cybersecurity Threats | Data breaches, cyberattacks | Financial losses, service disruption, loss of trust. |

SWOT Analysis Data Sources

This SWOT analysis uses verified financial statements, market trends, and expert opinions for trustworthy and strategic evaluation.