Advance Auto Parts Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advance Auto Parts Bundle

What is included in the product

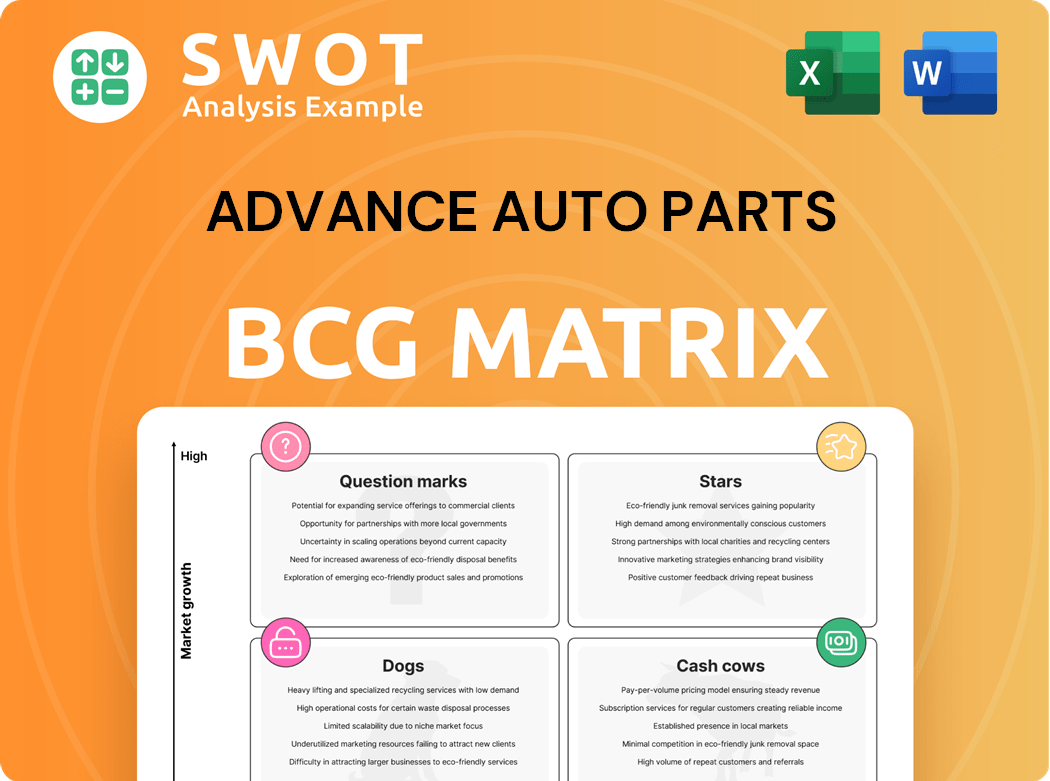

Strategic analysis using the BCG Matrix to optimize Advance Auto Parts' portfolio.

Visualizes Advance Auto Parts' portfolio, enabling strategic decisions for profit growth and resource allocation.

What You See Is What You Get

Advance Auto Parts BCG Matrix

The BCG Matrix you see now is the complete document you'll receive after purchase, including the Advance Auto Parts analysis. This is the final, ready-to-use report—no hidden content or alterations. Download instantly and use it immediately.

BCG Matrix Template

Advance Auto Parts' BCG Matrix offers a snapshot of its product portfolio. It categorizes offerings into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This analysis helps understand resource allocation priorities for the company. See which products drive the most revenue and which ones need strategic attention. The full BCG Matrix report gives detailed insights, quadrant placement, and strategic recommendations. Purchase the full version now for complete competitive clarity.

Stars

Advance Auto Parts is strategically expanding its market hub network, which are larger stores designed to boost parts availability and same-day delivery. These hubs, stocking 75,000-85,000 SKUs, have driven above-target comparable sales growth. By mid-2027, the company aims to operate 60 market hubs. This initiative is vital for enhancing same-day parts availability, thus supporting future sales growth. The company's comparable sales increased by 3.7% in Q1 2024.

Advance Auto Parts strategically positions itself with over 75% of its stores securing either the #1 or #2 market position. This substantial market presence creates a robust base for future growth initiatives. Dominating specific markets allows for efficient resource allocation, driving higher returns. In 2024, Advance Auto Parts reported a revenue of approximately $11.3 billion, reflecting its strong market positioning.

Advance Auto Parts caters to both professional installers and DIY customers, creating a diversified revenue stream. The blended-box strategy targets both groups. In 2024, DIY sales accounted for a significant portion, about 30%, of total revenue. This approach broadens market reach, reducing reliance on one customer segment.

Enhanced Vendor Relationships

Advance Auto Parts' strong vendor relationships are a key strength, especially as a Star in the BCG Matrix. These partnerships have led to better product costs and promotional pricing. Such improvements are projected to boost gross margins in 2025. This is crucial, considering that in 2024, gross profit was $6.8 billion.

- Improved product costs and promotional pricing.

- Expected gross margin improvements in 2025.

- Vendor relationships lead to cost savings.

- Benefits both the company and customers.

Strategic Initiatives

Advance Auto Parts is actively implementing a strategic plan centered on enhancing merchandising, optimizing its supply chain, and streamlining store operations. These strategic initiatives are crucial for improving overall business performance and fostering consistent, profitable growth. The plan is specifically designed to tackle key operational challenges and set the stage for sustainable growth in the long term. The company's net sales were $11.3 billion in 2023.

- Merchandising excellence focuses on offering the right products at competitive prices.

- Supply chain optimization aims to improve efficiency and reduce costs.

- Store operations improvements include better customer service and store layouts.

- The strategic plan is expected to generate positive financial results.

As a Star in the BCG Matrix, Advance Auto Parts leverages its vendor relationships, like those with major suppliers, to improve product costs and promotional pricing. These partnerships are vital, especially as the company aims for gross margin improvements in 2025. The company's gross profit was $6.8 billion in 2024, reflecting the importance of these vendor relationships.

| Metric | Data |

|---|---|

| 2024 Gross Profit | $6.8 Billion |

| Anticipated Improvement | Gross Margins in 2025 |

| Strategic Aim | Enhanced Vendor Relations |

Cash Cows

Advance Auto Parts, a recognized name in auto parts, enjoys strong brand recognition. This familiarity supports a steady customer base and dependable sales. The brand's strength helps retain its market share and draw in new clients. In 2024, Advance Auto Parts reported net sales of approximately $11.3 billion.

Advance Auto Parts boasts a vast network, with roughly 4,800 stores across North America. This expansive presence, including locations in the U.S., Canada, and Puerto Rico, ensures broad market coverage. The large network directly translates into convenient access for customers seeking auto parts and services. In 2024, this accessibility contributed to the company's ability to maintain a strong market position.

Advance Auto Parts' DIY segment, focusing on automotive parts and accessories, is a cash cow. In 2023, the DIY market in the U.S. generated approximately $40 billion in sales, highlighting its significance. The company's value-added services, like advice, help retain customers. This segment provides a reliable revenue stream, with DIY maintaining a stable market share.

Focus on Customer Service

Advance Auto Parts prioritizes customer service, fostering loyalty and repeat business. This focus is crucial for maintaining its market position as a Cash Cow. Excellent service drives positive word-of-mouth, attracting new customers. In 2024, customer satisfaction scores continue to be a key performance indicator. This strategy helps stabilize revenue streams.

- Customer satisfaction scores are a key performance indicator.

- Focus on customer service leads to repeat business.

- Positive word-of-mouth referrals attract new customers.

- This strategy helps stabilize revenue streams.

Core Retail Improvements

Advance Auto Parts is concentrating on enhancing its core retail operations to boost productivity and shareholder value. This involves standardizing store procedures and improving labor efficiency. Such improvements aim to streamline operations and increase profitability. In 2024, they invested in technology to improve these areas.

- Standardization of store operations.

- Improved labor productivity.

- Focus on core retail fundamentals.

- Increased efficiency and profitability.

Advance Auto Parts' DIY segment is a "Cash Cow", generating consistent revenue. It benefits from a large store network, enhancing customer access. Customer service focus boosts customer loyalty and referrals, driving sales.

| Aspect | Details | 2024 Data |

|---|---|---|

| Revenue Stream | DIY sales | $40B (U.S. DIY market) |

| Market Presence | Store Network | ~4,800 stores |

| Customer Focus | Service & Loyalty | Key performance indicator. |

Dogs

Advance Auto Parts is actively closing underperforming stores, including over 500 corporate locations and 200 independent stores. These closures, reflecting strategic adjustments, help streamline operations. By shutting down unprofitable stores, the company aims to reduce financial losses. In 2024, this strategy is crucial for improving overall financial performance.

Advance Auto Parts faced challenges in 2024, with net sales of $9.1 billion, a 1.2% decrease from 2023. Comparable store sales also fell by 0.7%. This decline signals the need for strategic adjustments. Addressing these sales issues is vital for the company's future.

Advance Auto Parts faced a tough year. The company's 2024 operating loss reached $713.3 million, or (7.8)% of net sales. Such losses signal significant financial strain. Addressing these losses is crucial for the company's recovery. Focus on improving profitability is essential.

High SG&A Expenses

Advance Auto Parts' "Dogs" status, as defined by the BCG matrix, is significantly impacted by high SG&A expenses. For the full year of 2024, SG&A expenses reached $4.1 billion, representing 45.3% of net sales. High SG&A expenses can indeed eat into profits, making it harder for the company to perform well financially. Effective management of these costs is crucial for enhancing Advance Auto Parts' financial health.

- SG&A Costs: $4.1 Billion (2024)

- Percentage of Sales: 45.3% (2024)

- Impact: Erodes profitability

- Action: Needs better management

Negative Free Cash Flow

Advance Auto Parts' expects negative free cash flow in 2025. This means the company is using more cash than it's generating. A negative free cash flow, projected between $25 million and $85 million, can signal financial strain. Improving this is key for financial health.

- Free cash flow issues can hinder investments.

- Negative cash flow might affect dividend payments.

- The company's debt levels need close monitoring.

- Management must focus on cost control.

Advance Auto Parts' "Dogs" status highlights significant financial challenges in 2024. High SG&A expenses, reaching $4.1 billion, erode profitability, demanding better cost management. The company anticipates negative free cash flow in 2025. This financial strain underscores the need for strategic improvements.

| Metric | 2024 Data | Impact |

|---|---|---|

| SG&A Expenses | $4.1B | Erodes profits |

| Net Sales Decline | -1.2% | Signals issues |

| Operating Loss | $713.3M | Financial strain |

Question Marks

The automotive aftermarket is shifting towards e-commerce, a question mark for Advance Auto Parts. To capture this market, investment in their e-commerce platform is essential. In 2024, online sales in the auto parts industry grew, highlighting the need to enhance their digital presence. This is crucial for expanding their customer base and maintaining competitiveness. For instance, in 2024, online sales represent a significant portion of the overall market.

Advance Auto Parts can boost growth by exploring new product categories. This includes parts for electric vehicles (EVs), capitalizing on their growing popularity. The rising demand for EV parts and maintenance tools presents a lucrative opportunity. Diversifying offerings could attract new customers and boost revenue. In 2024, EV sales continue to rise, with projections showing substantial growth in the coming years.

Expanding into new markets is a growth strategy for Advance Auto Parts. Targeting underserved areas can increase sales and market share. Strategic expansion helps diversify revenue. In 2024, AAP's net sales were around $11.3 billion. This expansion could boost these figures.

Innovative Service Offerings

Advance Auto Parts, as a Question Mark in the BCG matrix, can benefit from innovative service offerings. Developing mobile repair services or subscription-based maintenance plans could attract new customers. These services provide added convenience and value. Differentiating the company from competitors is possible through service innovation. 2024 data shows that the demand for mobile auto services increased by 15%.

- Mobile repair services can capture a growing market share.

- Subscription plans ensure recurring revenue streams.

- Innovation enhances customer loyalty and satisfaction.

- Service differentiation supports competitive advantage.

Strategic Partnerships

Strategic partnerships are a key aspect of Advance Auto Parts' strategy, potentially offering significant growth opportunities. Collaborating with repair shops, fleet operators, and technology providers can expand the company's reach and market penetration. These partnerships can unlock new markets and resources, boosting overall performance. Such collaborations can also lead to improved customer service and innovative solutions.

- In 2024, partnerships are vital for growth in the competitive automotive market.

- Strategic alliances can improve supply chain efficiencies.

- Collaborations can boost access to new technologies.

- Partnerships may lead to increased brand visibility.

Advance Auto Parts can overcome its "Question Mark" status by forming strategic partnerships. In 2024, collaborations are essential for growth in the competitive automotive market. Partnerships boost supply chain efficiencies and access to new technologies. These alliances can increase brand visibility and market reach.

| Strategy | Benefit | 2024 Data |

|---|---|---|

| Partner with Repair Shops | Expanded Market Reach | Independent shops control 60% of repair market. |

| Fleet Operator Alliances | Improved Supply Chain | Fleet market projected to grow 8% annually. |

| Tech Provider Collaboration | Tech Integration | Telematics market grew 12% in 2024. |

BCG Matrix Data Sources

This Advance Auto Parts BCG Matrix uses financial data, market research, and sales figures for detailed category analysis.