Advance Auto Parts Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Advance Auto Parts Bundle

What is included in the product

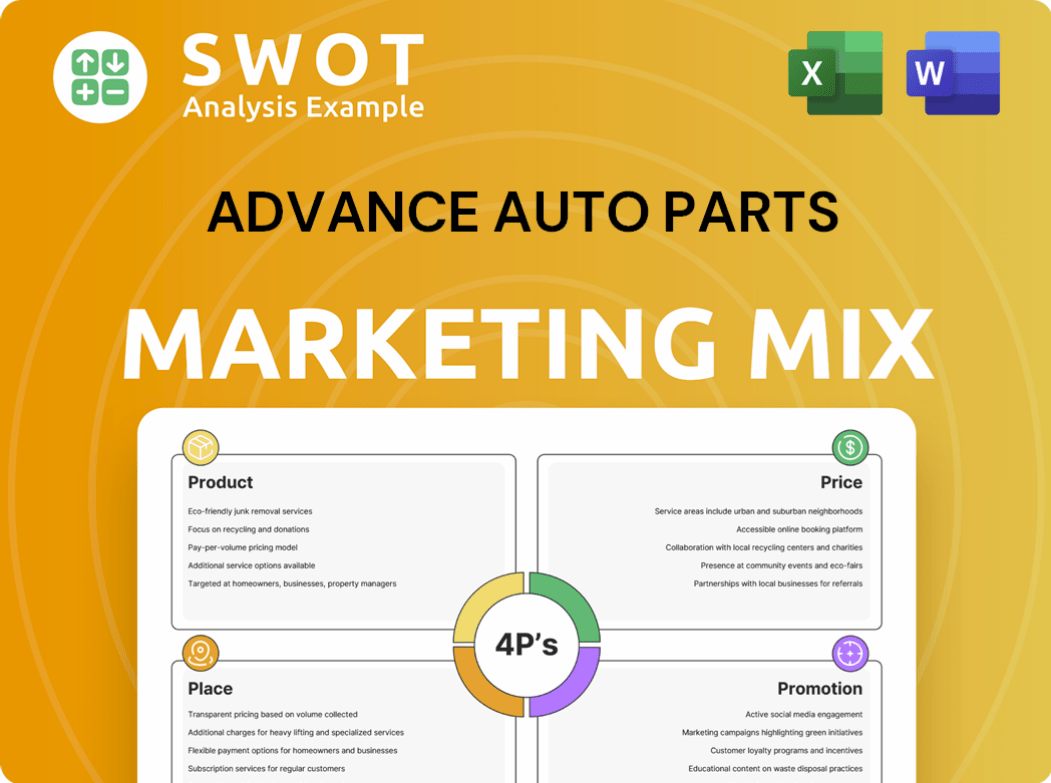

Analyzes Advance Auto Parts' marketing mix (4Ps) through detailed product, price, place & promotion strategies.

Summarizes the 4Ps in a structured format that's easy to understand for streamlined strategy communication.

Same Document Delivered

Advance Auto Parts 4P's Marketing Mix Analysis

The preview is a complete look at the Advance Auto Parts 4P's Marketing Mix Analysis. The document you're seeing now is exactly what you'll receive immediately after purchase. There are no changes or variations to expect. Get instant access to this fully ready and completed analysis.

4P's Marketing Mix Analysis Template

Advance Auto Parts strategically offers a wide range of products, from essential car parts to accessories. Their pricing strategy includes competitive pricing and various promotions. They utilize a broad distribution network with physical stores and online platforms. Effective promotional tactics, like targeted advertising, build brand awareness. The 4P's come together for market impact. The full analysis provides a deep dive into their success.

Product

Advance Auto Parts boasts an extensive inventory. As of 2024, it features around 391,000 different parts and accessories. This vast selection covers a wide range of vehicle types. It ensures they can meet diverse customer needs effectively.

Advance Auto Parts offers a wide selection of aftermarket and OEM components. This includes parts for over 130 vehicle makes and models, catering to diverse customer needs. In Q1 2024, aftermarket sales represented a significant portion of revenue. The dual strategy helps capture a broader market segment.

Advance Auto Parts distinguishes itself by providing specialized tools and equipment alongside basic auto parts. This includes diagnostic tools, catering to customers performing advanced repairs. This boosts sales, with tools and equipment contributing significantly to revenue, approximately $1.2 billion in 2024. Offering these resources enhances customer self-service capabilities.

Catering to DIY and Professional Customers

Advance Auto Parts caters to both DIY customers and professional installers, offering tailored parts and services. This dual approach allows them to capture a broader market share. In 2024, the company reported that approximately 40% of its sales came from professional customers. This strategy ensures they meet the diverse needs and skill levels within the automotive market.

- DIY customers often seek cost-effective solutions.

- Professional installers prioritize speed and reliability.

- Advance Auto Parts stocks a wide range of products.

- They also provide services like battery testing.

Focus on Parts Availability and Quality

Advance Auto Parts prioritizes parts availability and quality, vital for customer satisfaction and operational efficiency. They enhance their merchandise mix, focusing on late-model and import parts to meet diverse customer needs. This strategy is crucial, especially given the automotive industry's evolving demands. As of Q1 2024, Advance Auto Parts reported a gross profit margin of 40.6%, indicating effective inventory management and product quality control.

- Parts Availability: Ensures customers find what they need when they need it.

- Quality Focus: Maintains customer trust and reduces returns.

- Merchandise Mix: Adapts to new vehicle technologies.

- Financial Impact: Directly affects profitability and market share.

Advance Auto Parts excels in product selection, carrying nearly 391,000 items. They target both DIYers and professionals, enhancing market reach. They focus on part availability and quality. Their inventory strategies aim at capturing varied customer needs and trends.

| Aspect | Details | 2024 Data |

|---|---|---|

| Inventory Size | Vast range of parts | Approximately 391,000 parts and accessories |

| Customer Segmentation | Targeting DIY & Professionals | Approx. 40% sales from pro customers |

| Profitability | Inventory effectiveness and product quality | Gross profit margin: 40.6% (Q1 2024) |

Place

Advance Auto Parts boasts an expansive retail network. In late 2024, they managed nearly 4,800 corporate stores. This extensive presence provides easy access for customers. They also support over 900 independently owned locations. This widespread reach is key to their market strategy.

Advance Auto Parts is streamlining its store network. The company plans to close approximately 90-120 underperforming stores by mid-2025. This strategic move aims to boost profitability. The focus is on core markets for better efficiency. This optimization aligns with broader industry trends.

Advance Auto Parts is expanding its network with larger 'market hub' locations. These hubs offer a wider selection of products, boosting parts availability. They enable rapid fulfillment, including same-day delivery. In Q1 2024, the company reported opening several new hubs. This strategy aims to enhance customer service and streamline logistics.

Consolidation of Distribution Centers

Advance Auto Parts is streamlining its distribution network. They are creating a single, unified system to boost efficiency and cut costs. The plan involves fewer, larger facilities by late 2026. This should improve inventory and service.

- Reduced operational costs.

- Improved inventory management.

- Enhanced delivery times.

Growing Online Presence and Fulfillment Options

Advance Auto Parts has significantly expanded its online presence to complement its physical stores. E-commerce sales are a key focus, with free shipping offers on eligible orders. They also provide convenient options like buy online, pickup in-store (BOPIS), often ready in 30 minutes.

- Online sales growth reported at 10% in 2024.

- BOPIS orders account for roughly 15% of total online sales.

- Investments in digital infrastructure are projected to increase by 8% in 2025.

Advance Auto Parts' Place strategy centers on an extensive network, comprising nearly 4,800 corporate stores and over 900 independently owned locations by the end of 2024, facilitating widespread customer access. Strategic store closures, around 90-120 underperforming stores by mid-2025, and the expansion of larger 'market hub' locations aim to enhance profitability and customer service. The optimization includes streamlining the distribution network to boost efficiency and cut costs, with fewer, larger facilities planned by late 2026.

| Aspect | Details |

|---|---|

| Corporate Stores (Late 2024) | Approx. 4,800 |

| Independent Locations (Late 2024) | Approx. 900+ |

| Planned Store Closures (Mid-2025) | 90-120 |

| E-commerce Sales Growth (2024) | 10% |

Promotion

Advance Auto Parts tailors its marketing to DIY and professional clients. They're streamlining promotions for a stronger impact. In Q1 2024, marketing spend was $133.8 million. This strategy aims to boost customer engagement and sales. The focus is on fewer, more impactful campaigns.

Advance Auto Parts runs customer loyalty programs, notably Speed Perks, to boost repeat purchases and customer bonds. These programs boost customer retention rates. In 2024, loyalty program members accounted for a significant portion of sales. They organize events and interactive experiences to attract customers. These efforts aim to raise awareness and grow membership within their loyalty initiatives.

Advance Auto Parts utilizes online marketing, including affiliate programs. These programs enable marketers to direct customers to their e-commerce site. In 2024, the company's digital sales grew, reflecting the effectiveness of these strategies. Commissions are earned on qualifying sales. This approach boosts online visibility and drives sales.

Advertising and Media Strategy

Advance Auto Parts' advertising and media strategy focuses on communicating value to boost brand awareness. This is vital in the crowded automotive aftermarket. In 2024, the company spent approximately $200 million on advertising. These efforts include TV commercials, digital ads, and partnerships.

- 2024 Advertising Spend: Roughly $200 million.

- Media Channels: TV, digital, social media, and partnerships.

- Goal: Increase brand awareness and drive sales.

In-Store Service and Team Member Training

Advance Auto Parts focuses promotion on in-store service and team member training. This strategy enhances customer experience and differentiates the brand. Investing in employee knowledge is crucial for providing expert service. Improved service can lead to increased customer loyalty and sales. In Q1 2024, Advance Auto Parts reported a slight increase in customer satisfaction scores, reflecting the impact of these initiatives.

- Customer satisfaction scores improved.

- Employee training programs are ongoing.

- Focus on knowledgeable service.

- Enhancing the in-store experience.

Advance Auto Parts emphasizes promotional efforts through targeted campaigns and customer engagement. The company invested approximately $200 million in advertising during 2024 to increase brand awareness and sales. Customer loyalty programs and employee training enhance the overall shopping experience.

| Promotion Strategy | Key Activities | Impact in 2024 |

|---|---|---|

| Advertising | TV commercials, digital ads, partnerships. | Roughly $200M spent, focused on awareness. |

| Customer Loyalty | Speed Perks program, interactive events. | Significant portion of sales from members. |

| In-Store Experience | Service, employee training, and expert knowledge. | Improved customer satisfaction scores in Q1 2024. |

Price

Advance Auto Parts uses competitive pricing to stay appealing in the auto parts market. Their prices are set to match the value customers see, fitting their market position. In Q1 2024, they reported a 0.7% increase in comparable store sales, showing pricing effectiveness. They constantly review prices, adapting to market changes for optimal sales.

Advance Auto Parts focuses on pricing and promotions to boost gross margins. Strategic pricing investments have positively affected profitability. In Q1 2024, gross profit was $1.7 billion, with a gross margin of 42.3%. This reflects effective pricing strategies. The company aims to optimize pricing for higher profitability in 2024/2025.

External factors significantly impact Advance Auto Parts' pricing. Commodity input inflation and import tariffs are key considerations. The company may adjust prices to offset these rising costs, as seen in 2023 when supply chain issues led to price hikes. For instance, in Q3 2023, gross profit decreased due to increased product costs. This is a direct result of external pressures. These adjustments help maintain profitability, even amidst economic challenges.

Pricing for Different Customer Segments

Advance Auto Parts tailors its pricing to cater to distinct customer segments. DIY customers, who make up a significant portion of the market, might encounter promotional pricing and discounts to encourage purchases. Professional installers, on the other hand, could benefit from volume-based discounts or specialized pricing structures. This approach helps maximize profitability across diverse customer needs.

- DIY customers often seek competitive prices and sales.

- Professional installers may prioritize bulk discounts.

- Advance Auto Parts' Q1 2024 gross profit was $1.53 billion.

- Pricing strategies support different customer purchasing behaviors.

Impact of Pricing on Profitability

Advance Auto Parts' pricing strategies are crucial for their profitability and operating margins. Effective pricing directly influences financial performance and strategic goals. In 2024, the company's ability to manage pricing reflected in its financial results. Pricing decisions impact revenue and cost management.

- Gross profit margin in Q1 2024 was 40.4%.

- Operating income in Q1 2024 was $166.7 million.

- Net sales decreased by 0.4% in Q1 2024.

Advance Auto Parts uses competitive pricing and strategic promotions to stay appealing in the auto parts market. They constantly review and adjust prices to match value. In Q1 2024, gross profit was $1.7B with 42.3% gross margin, demonstrating effectiveness. Pricing impacts both revenue and cost management.

| Metric | Q1 2024 | Change from Prior Year |

|---|---|---|

| Gross Profit | $1.7B | -0.7% |

| Gross Margin | 42.3% | -0.5% |

| Net Sales | $3.54B | -0.4% |

4P's Marketing Mix Analysis Data Sources

The 4P's analysis is built with info from official company sources, competitor benchmarks, and market reports. Public filings, brand sites, and investor communications are key.