American Eagle Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Eagle Bundle

What is included in the product

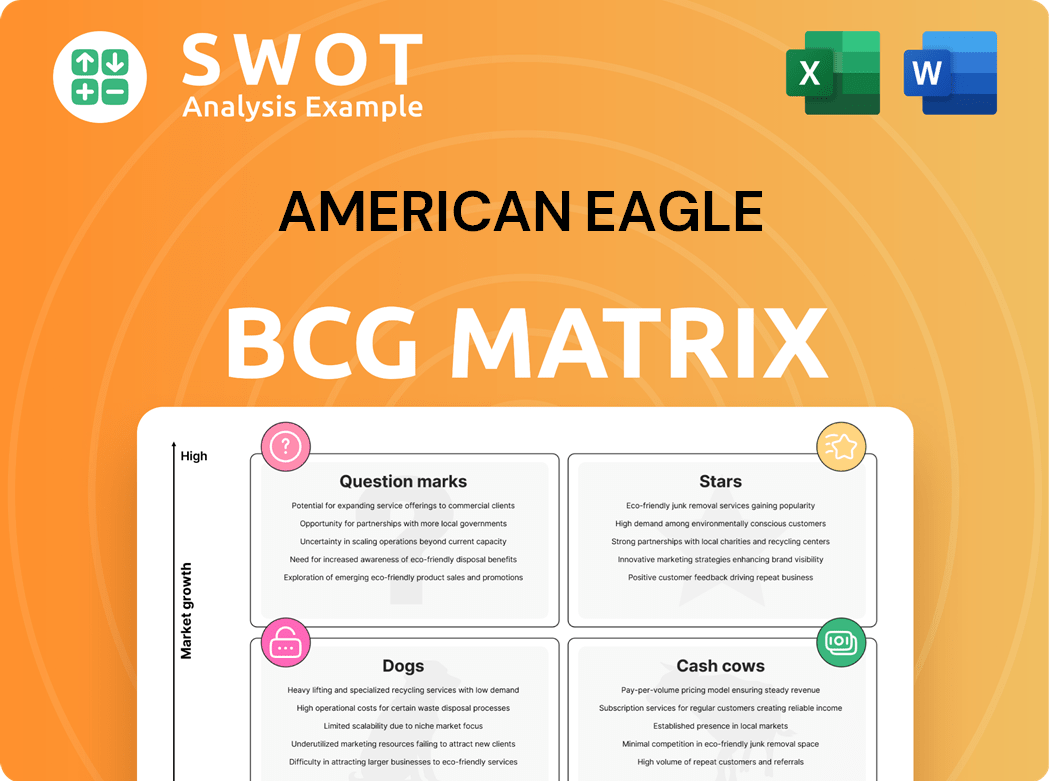

BCG Matrix analysis of American Eagle, with product portfolio breakdowns.

One-page overview placing each business unit in a quadrant

What You See Is What You Get

American Eagle BCG Matrix

The displayed preview is the complete American Eagle BCG Matrix you will download after purchase. It's a fully editable, strategic analysis tool, ready for immediate application in your business planning.

BCG Matrix Template

American Eagle's product portfolio is a dynamic mix. This sneak peek highlights its potential "Stars" and "Cash Cows." Identifying which products hold dominant market share is key to understanding its strategy. A complete BCG Matrix provides deeper analysis into its "Dogs" and "Question Marks."

Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Aerie, as a Star in American Eagle's BCG matrix, shows robust performance. In 2024, Aerie's revenue exceeded $1.7 billion, reflecting its market leadership. Comparable sales grew by 5%, highlighting strong growth potential. Continuous investment in Aerie is vital for expansion and innovation. This supports its strategy to keep high growth and market share.

American Eagle's denim segment shines as a 'Star' in its BCG Matrix. In 2024, denim sales experienced mid-single-digit growth, solidifying its role. This core product boosts overall revenue. Innovation and adapting to trends are key to maintaining its strong market position. American Eagle's denim success is a vital part of its financial story.

American Eagle's digital sales are soaring, a key driver of revenue. E-commerce and mobile shopping are central to this success. They've engaged Gen Z with social media, like TikTok. In 2024, digital sales grew, proving the strategy's impact. Omnichannel investments are vital for continued growth.

Powering Profitable Growth Plan

American Eagle's 'Powering Profitable Growth' initiative is a 'Star' in the BCG Matrix. The plan targets significant operating income expansion, aiming for mid-to-high teens annually, while growing revenue by 3-5% each year over the next three years. This strategy concentrates on boosting American Eagle and Aerie brands, exploring new categories, and accelerating activewear sales. For instance, Aerie's revenue grew by 10% in Q3 2024, showing strong performance.

- Operating income expansion targets mid-to-high teens annually.

- Revenue growth expected to be 3-5% per year.

- Focus on American Eagle, Aerie, and activewear.

- Aerie's Q3 2024 revenue saw a 10% increase.

Strategic Partnerships

American Eagle's strategic partnerships, like the pilot AI gift finder on WhatsApp, position it as a 'Star' in the BCG Matrix. This initiative directly targets Gen Z, a crucial demographic. The focus on tech-driven customer experiences enhances engagement and streamlines shopping. For example, in 2024, American Eagle's digital sales increased by 10%.

- Gen Z focus drives growth.

- Tech integration enhances customer experience.

- Partnerships expand reach.

- Digital sales show success.

American Eagle's Stars demonstrate strong performance and strategic growth. Key areas like Aerie, denim, and digital sales drive revenue. The "Powering Profitable Growth" initiative supports these segments, targeting significant operating income expansion. Strategic partnerships, particularly with tech integration, enhance customer experience and growth.

| Segment | 2024 Performance Highlights | Strategic Initiatives |

|---|---|---|

| Aerie | Revenue exceeding $1.7B; Comparable sales up 5%. | Continuous investment and expansion. |

| Denim | Mid-single-digit growth. | Innovation and trend adaptation. |

| Digital Sales | Digital sales grew 10% in 2024. | Omnichannel investments and Gen Z engagement. |

| "Powering Profitable Growth" | Operating income expansion targets mid-to-high teens annually. | Focus on AE, Aerie, and activewear. |

| Strategic Partnerships | Digital sales growth; AI gift finder. | Tech-driven customer experiences. |

Cash Cows

American Eagle, a "Cash Cow" in the BCG Matrix, generates substantial revenue. In 2024, the brand contributed significantly to overall sales, with comparable sales growth. Its established customer base and brand recognition provide a solid foundation. The focus is on maintaining market share and operational efficiency to maximize profitability. In the first quarter of 2024, American Eagle's revenue reached $1.09 billion.

American Eagle's Real Rewards loyalty program is a cash cow, fueling consistent revenue. In 2024, loyalty members drive significant sales. These programs boost repeat purchases. The program provides valuable customer data, aiding in targeted marketing.

American Eagle Outfitters (AEO) excels in omnichannel presence, blending online and physical stores. This integration boosts customer convenience and sales. AEO's BOPIS options enhance efficiency. In Q3 2023, digital sales were 31% of total revenue.

Denim Market Share

American Eagle Outfitters holds a solid position in the denim market, a key "Cash Cow" for the brand. Denim's consistent demand provides a stable revenue source, crucial for financial health. In 2024, American Eagle's denim sales are expected to contribute significantly to its overall revenue. Maintaining this share involves smart strategies.

- Targeted marketing to sustain customer loyalty.

- Operational efficiencies to cut costs.

- Inventory management to reduce waste.

Back-to-School Season

American Eagle's back-to-school season is a cash cow, consistently generating substantial revenue due to its appeal to the 15-25 age group. This predictable sales increase enables strategic inventory management and marketing efforts. Efficient operations and strong brand recognition are key to capitalizing on this peak season's profitability. In 2024, American Eagle's sales data indicated a significant boost during the back-to-school period, reflecting its cash cow status.

- Strong Revenue: Back-to-school drives significant sales.

- Target Demographic: Focuses on the 15-25 age group.

- Strategic Advantage: Enables inventory and marketing optimization.

- Profitability: Relies on operational efficiency and brand strength.

American Eagle's "Cash Cow" status is evident in its strong financial performance, especially in its denim sales and loyalty programs. In 2024, its denim sales and loyalty programs contributed to overall revenue growth, illustrating its solid market position. Key strategies include maintaining market share and operational efficiency, as shown by its impressive Q1 2024 revenue of $1.09 billion.

| Aspect | Details | Financial Impact |

|---|---|---|

| Denim Sales | Consistent demand | Revenue Stability |

| Real Rewards | Loyalty program | Boosts sales |

| Back-to-School | Seasonal Sales | Strategic advantage |

Dogs

American Eagle is strategically closing underperforming mall-based stores. These stores face high operating costs and lower sales, impacting profitability. In 2024, mall traffic declined by 7%, prompting store closures. This reallocation aims to boost returns.

If Unsubscribed, an American Eagle brand, underperforms, it might be a 'Dog' in the BCG Matrix. This suggests low market share and slow growth. In 2023, American Eagle's revenue was $5.07 billion. Strategic options could include restructuring or selling the brand. The goal is to improve overall portfolio performance.

If Todd Snyder, part of American Eagle, underperforms in growth and market share, it could be a 'Dog'. This might mean it struggles to connect with customers or fit with other brands. In 2024, AEO's revenue was about $5.1 billion. The brand's future needs a close look.

Certain Accessories

Certain accessories within American Eagle's product range could be considered Dogs in its BCG Matrix, especially those with low demand. These underperforming items might include specific jewelry or shoe lines. They often consume valuable inventory space and resources without significant returns. Reassessing or discontinuing these accessories can boost profitability. For instance, in 2024, American Eagle reported a decrease in sales of certain accessories.

- Low sales volume.

- High inventory costs.

- Limited customer interest.

- Potential for discontinuation.

International Expansion (Specific Markets)

If American Eagle Outfitters' (AEO) international ventures aren't performing, they become Dogs. This could be due to tough local competition or economic issues. AEO needs to reassess these markets to decide whether to stay or leave. In 2024, AEO's international net sales were $876 million.

- Market challenges can significantly impact financial performance.

- AEO must evaluate its international strategies regularly.

- Poorly performing markets may require restructuring or exiting.

- In 2024, AEO's international revenue represented 25% of total revenue.

Dogs within American Eagle's portfolio typically show low market share and slow growth, requiring strategic adjustments. These might include underperforming brands or product lines. In 2024, certain categories faced sales declines, urging reassessment. The aim is to boost overall profitability by addressing these.

| Characteristics | Examples | Strategic Implications |

|---|---|---|

| Low market share, slow growth | Unsubscribed, underperforming accessories | Restructure, sell, or discontinue |

| High costs, low sales | Underperforming mall stores, select international ventures | Close stores, reassess market strategies |

| Impact on profitability | Inventory issues, reduced revenue | Focus on core brands, improve efficiency |

Question Marks

OFFL/NE by Aerie, the activewear sub-brand, currently has a smaller market share. American Eagle is investing in marketing and product development to grow OFFL/NE. In 2024, American Eagle reported its net revenue increased 7% to $1.28 billion. To become a 'Star', OFFL/NE needs substantial market expansion.

International expansion offers American Eagle Outfitters (AEO) significant growth prospects, but also introduces complexities. In 2024, AEO strategically targeted markets like the Middle East and Asia. These expansions necessitate substantial investment, including approximately $100 million in capital expenditures for international store openings. Success hinges on adapting to diverse consumer behaviors and tailoring product offerings, as seen in AEO's 2024 focus on localized marketing campaigns.

New product lines for American Eagle often start as 'Question Marks.' These require investments in product development and marketing. Success hinges on consumer feedback and market adoption. In 2024, American Eagle's focus on new categories like activewear shows this. Their revenue in Q3 2024 was $1.28 billion, but new lines' profitability is yet to be fully proven.

AI-Driven Inventory Management

American Eagle Outfitters (AEO) is still assessing its AI-driven inventory management's long-term impact. Continuous improvement and investment are crucial for optimizing the system. The goal is to boost inventory efficiency and reduce costs. AEO’s 2023 inventory decreased by 13% year-over-year, showing initial success.

- 2023 inventory decreased by 13%

- Ongoing evaluation of AI effectiveness

- Focus on optimizing inventory efficiency

- Investment in AI system refinement is key

Men's Fashion Expansion

Expanding men's fashion within American Eagle aligns with a 'Question Mark' in a BCG matrix. This strategy involves significant investments in design, marketing, and targeted campaigns. Success hinges on understanding and adapting to evolving men's fashion trends to capture market share. The goal is to grow within a potentially high-growth market.

- Men's apparel sales in the US reached approximately $87 billion in 2024.

- American Eagle's men's category growth rate in 2024 was around 5%.

- Marketing spend will be crucial for capturing the men's demographic.

- The men's fashion market is projected to keep growing.

Question Marks represent new ventures, like emerging product lines and market expansions, within American Eagle's BCG matrix. These initiatives require considerable investment to develop products, market them, and establish a market presence.

The success of Question Marks depends significantly on consumer acceptance, market adaptation, and the brand's ability to capture market share. In 2024, American Eagle invested heavily in growing its men’s apparel and new product categories.

This involves evaluating the long-term potential of new product lines. The focus is on careful monitoring of sales data and adjusting strategies as the market evolves, aiming to transform these into 'Stars' or profitable ventures.

| Category | 2024 Investment (Approx.) | Strategic Focus |

|---|---|---|

| OFFL/NE (Aerie) | Marketing & Product Development | Expand Activewear Market Share |

| International Expansion | $100M Capital Expenditures | Targeting Middle East, Asia |

| Men's Fashion | Marketing Campaigns & Design | Capturing a Growing Market |

BCG Matrix Data Sources

The American Eagle BCG Matrix is built using financial statements, market analysis, sales data, and competitor insights for dependable evaluation.