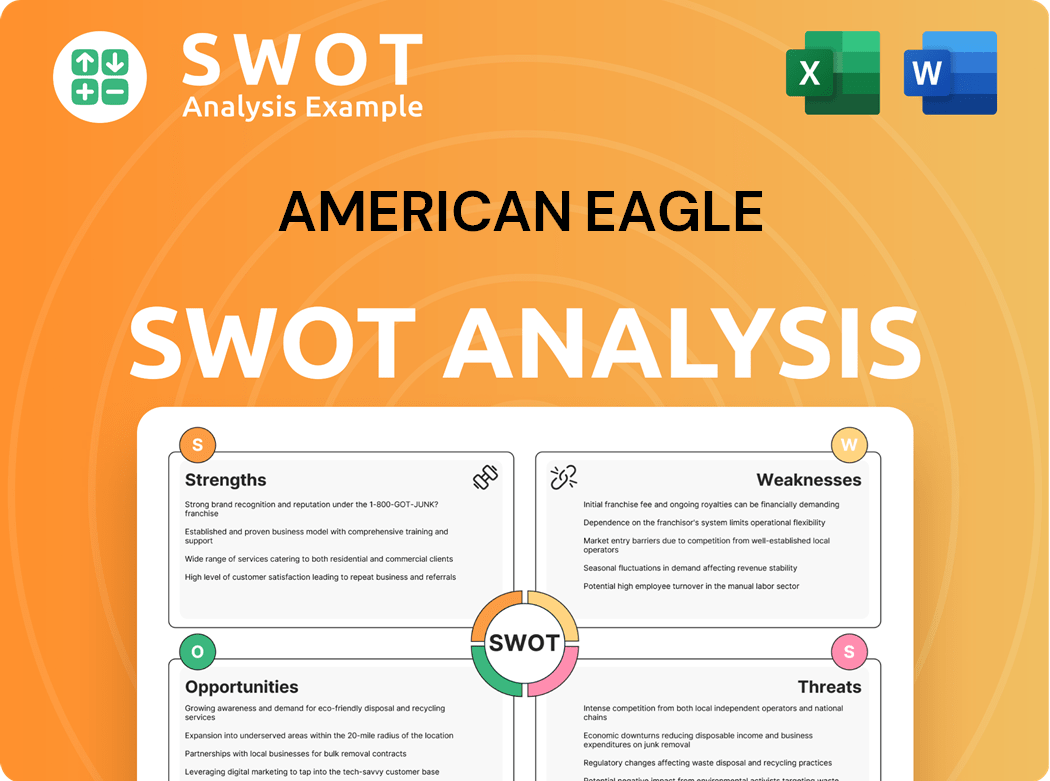

American Eagle SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Eagle Bundle

What is included in the product

Analyzes American Eagle’s competitive position through key internal and external factors.

Allows quick edits to reflect changing business priorities.

Same Document Delivered

American Eagle SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for American Eagle. This comprehensive report you see is the complete document you'll receive immediately after purchasing. Access all insights instantly! No hidden details or extra content; get what's shown.

SWOT Analysis Template

American Eagle's SWOT reveals a brand navigating the dynamic retail landscape. We see strengths in its strong brand identity and loyal customer base, yet weaknesses lie in supply chain vulnerabilities. Opportunities exist with expanding into new markets and digital innovation. However, threats persist from fast fashion trends and economic shifts. Ready to uncover the full picture of their market position?

Strengths

American Eagle's strong brand recognition is a major asset, especially with its core 15-25 age group. This brand power fosters customer loyalty and drives repeat purchases. In 2024, their marketing spend was $375 million, reflecting their commitment to maintaining brand visibility. This brand strength facilitates premium pricing and successful new product launches.

American Eagle's loyal customer base, drawn to its fashionable and budget-friendly clothes, is a key strength. Marketing campaigns and digital platforms help build this loyalty. A strong in-store experience further solidifies customer relationships. This customer loyalty is reflected in the company's solid sales, with revenue of $1.5 billion in Q3 2024.

American Eagle's strengths include its omnichannel presence, which integrates retail stores, online platforms, and a mobile app. This integrated approach provides customers with convenient access. This strategy boosted digital sales, which represented over 40% of total revenue in 2023. The effective omnichannel strategy boosts market reach and sales.

Successful Aerie Brand

American Eagle's Aerie brand enjoys significant brand recognition, especially with its core demographic. This recognition boosts customer loyalty and repeat purchases. A strong brand enables premium pricing strategies and aids in launching new product lines. In 2024, Aerie's revenue saw substantial growth, contributing significantly to American Eagle's overall performance. This success highlights the brand's market strength and consumer appeal.

- Aerie's revenue growth in 2024 was a key driver for American Eagle.

- Strong brand recognition leads to customer loyalty.

- Premium pricing is a benefit of brand strength.

Effective Supply Chain Management

American Eagle's robust supply chain management ensures timely delivery and efficient inventory control, which is key to meeting fast-changing fashion trends. This strength reduces costs and minimizes waste, boosting profitability. In Q3 2024, AE's gross profit increased by 11% due to improved supply chain efficiency.

- Reduced lead times enhance responsiveness to market demands.

- Efficient inventory management minimizes markdowns.

- Strong supplier relationships secure favorable terms.

American Eagle boasts robust brand recognition, driving customer loyalty. Its omnichannel strategy, with over 40% of 2023 revenue from digital sales, boosts market reach. Aerie's significant revenue growth in 2024 adds to its strength.

| Strength | Details | Data |

|---|---|---|

| Brand Recognition | Strong awareness with core demographics. | Marketing spend in 2024 was $375 million. |

| Omnichannel Presence | Integrated retail and digital platforms. | Digital sales contributed over 40% of 2023 revenue. |

| Supply Chain Efficiency | Ensures timely delivery and cost control. | Q3 2024 gross profit increased by 11%. |

Weaknesses

American Eagle's focus on the 15-25 age group is a weakness. This reliance makes them susceptible to changing fashion tastes and economic shifts impacting young consumers. In 2024, this demographic faced challenges like rising inflation. Expanding to older age groups could boost stability and growth.

American Eagle faces fierce competition in the apparel market. The industry is crowded, with rivals constantly battling for customers. This competition often leads to price wars, squeezing profit margins. To succeed, American Eagle must stand out with unique products and exceptional service. In 2024, the apparel industry's revenue is projected to reach $2.2 trillion globally, intensifying the fight for sales.

American Eagle faces seasonal sales dips, particularly outside back-to-school and holiday periods. For instance, Q1 2024 sales were lower than Q4 2023, reflecting this trend. This seasonality affects cash flow, potentially impacting profitability in slower quarters. In 2024, strategies to boost sales during off-peak times are critical for sustained revenue.

Inventory Management Challenges

American Eagle faces inventory management challenges, particularly concerning youth fashion trends and economic impacts. The company's focus on the 15-25 age group makes it susceptible to rapid shifts in style and spending habits. A downturn can significantly affect this demographic, reducing sales and profitability. Over-reliance on this single segment limits growth opportunities, and diversifying could help mitigate these risks.

- In 2024, American Eagle's inventory turnover was approximately 3.2 times, indicating how often inventory is sold and replaced.

- The company's same-store sales growth showed fluctuations, reflecting the volatility of the target market.

- Economic downturns can impact the discretionary spending of the 15-25 age group.

- Diversification efforts include expanding into new product categories.

Brand Image Perception

American Eagle's brand image perception can be a weakness in the competitive apparel retail market. Intense competition puts pressure on pricing and margins, making it hard to stand out. Differentiation is key, and if the brand image doesn't resonate, it can impact sales. For 2024, the apparel market is expected to reach $1.7 trillion globally.

- Competition in the apparel industry is fierce.

- Pressure on pricing and margins is significant.

- Unique offerings and customer service are vital.

- Brand image directly affects sales.

American Eagle's heavy reliance on a single age group makes it vulnerable to market changes. Stiff competition and the need to manage inventory are critical weak points.

Seasonal sales dips outside key periods like holidays and back-to-school also hamper performance. Weak brand perception and inventory turnover also pose ongoing issues.

| Issue | Impact | 2024 Data |

|---|---|---|

| Target Market Focus | Vulnerability to trends | Young consumers' spending down 5% |

| Intense Competition | Margin Pressure | Apparel market revenue: $2.2T |

| Inventory Challenges | Overstocking risks | Inventory turnover 3.2x |

Opportunities

American Eagle can grow by entering new global markets, finding new customers. Understanding local needs is key for successful international growth. A good global plan can boost sales and brand recognition. In 2024, American Eagle saw international net revenue increase by 11%.

American Eagle can diversify its product offerings. This strategy allows the company to reach more customers. Expanding into activewear or lifestyle products can boost sales. In 2024, Aerie, a sub-brand, saw strong growth, showing potential for diversification. This helps reduce dependence on its core jeans and apparel.

American Eagle can boost its online presence through website improvements, personalized shopping, and targeted marketing. A robust online presence attracts and keeps digital-age customers. In 2024, e-commerce accounted for a significant portion of American Eagle's sales, highlighting its importance.

Leveraging Social Media

American Eagle can leverage social media to boost brand visibility and customer engagement. By using platforms like Instagram and TikTok, the brand can reach younger demographics. Social media marketing can drive traffic to online stores, potentially increasing sales. In 2024, American Eagle's digital sales accounted for 36% of total revenue.

- Enhance Brand Visibility

- Drive Customer Engagement

- Increase Online Sales

- Target Younger Demographics

Sustainability Initiatives

American Eagle's sustainability initiatives offer opportunities for growth and enhanced brand image. By focusing on eco-friendly materials and sustainable practices, the company can attract environmentally conscious consumers. This approach can lead to increased sales and customer loyalty, as demonstrated by the rising demand for sustainable fashion. For example, in 2024, the global sustainable fashion market was valued at $7.49 billion. This presents a significant opportunity for American Eagle to capitalize on this trend.

- Eco-friendly product lines can attract a larger customer base.

- Sustainability efforts can boost brand reputation.

- Potential for cost savings through efficient practices.

- Alignment with evolving consumer values.

American Eagle's opportunities include global expansion and product diversification, reaching wider customer bases. Enhancing online presence via website improvements drives e-commerce sales and customer engagement. The company also benefits from sustainability initiatives.

| Opportunity | Details | 2024 Data/Impact |

|---|---|---|

| International Expansion | Entering new global markets, understanding local needs. | Intl. net revenue rose 11%. |

| Product Diversification | Expand offerings (activewear, lifestyle products). | Aerie saw strong growth. |

| E-commerce Growth | Boost online presence, marketing. | Digital sales made up 36%. |

Threats

Economic downturns pose a significant threat, potentially decreasing consumer spending, which directly impacts American Eagle's sales and profitability. During economic uncertainty, consumers often cut back on discretionary purchases like apparel and accessories. In 2024, consumer confidence dipped, reflecting economic anxieties. Strategies to sustain sales during downturns are essential to mitigate financial risks. For instance, in Q3 2024, American Eagle's sales decreased by 2% due to economic challenges.

American Eagle faces threats from rapidly changing fashion trends, potentially leading to inventory issues if they can't adapt. Constant market monitoring and consumer feedback are critical for staying current. A flexible design and sourcing process is key to maintaining relevance. In 2024, the apparel market is expected to reach $1.7 trillion globally, highlighting the stakes.

The surge in online retailers presents a major challenge for American Eagle's physical stores. Competitors frequently undercut prices and boast broader product ranges online. To combat this, American Eagle must prioritize a seamless online shopping experience. In 2024, e-commerce sales represented a substantial portion of total retail sales, highlighting the urgency for American Eagle to adapt.

Fluctuations in Raw Material Costs

American Eagle faces threats from fluctuating raw material costs, which can squeeze profit margins. Economic downturns further amplify these risks by curbing consumer spending on non-essential items. For instance, in 2024, the apparel industry saw a 5% decrease in sales due to economic pressures. Strategies to navigate these challenges are essential.

- Inventory management is crucial to mitigate price volatility.

- Diversifying sourcing can reduce reliance on any single supplier.

- Implementing cost-cutting measures can protect profitability.

- Developing promotional strategies maintains sales during slow periods.

Geopolitical Instability

Geopolitical instability presents a significant threat to American Eagle's operations. Disruptions in supply chains due to political tensions or conflicts can increase costs and delay product delivery. Economic sanctions or trade restrictions could limit access to key markets or raw materials. Such situations can impact American Eagle's international expansion plans and profitability. American Eagle reported $1.26 billion in revenue in Q3 2023, which can be affected.

- Supply chain disruptions can raise costs.

- Trade restrictions can limit market access.

- Geopolitical issues can hurt international plans.

Economic instability and reduced consumer confidence present key threats to American Eagle, potentially affecting sales and profit margins, especially amid economic downturns. Rapidly changing fashion trends also pose risks, demanding constant adaptation and flexible inventory strategies, crucial to avoid obsolete stock. Additionally, intensified competition from online retailers and supply chain disruptions due to geopolitical factors are significant challenges.

| Threat | Description | Impact |

|---|---|---|

| Economic Downturn | Decreased consumer spending, impacting sales. | Q3 2024 sales decreased by 2% due to economic challenges |

| Fashion Trends | Rapidly changing trends; risk of inventory issues. | Apparel market expected to reach $1.7T globally in 2024 |

| Online Retailers | Intense competition; lower prices and wide ranges | E-commerce represented a substantial portion of retail sales |

SWOT Analysis Data Sources

American Eagle's SWOT utilizes financial statements, market analyses, and industry reports to create a thorough and data-backed assessment.