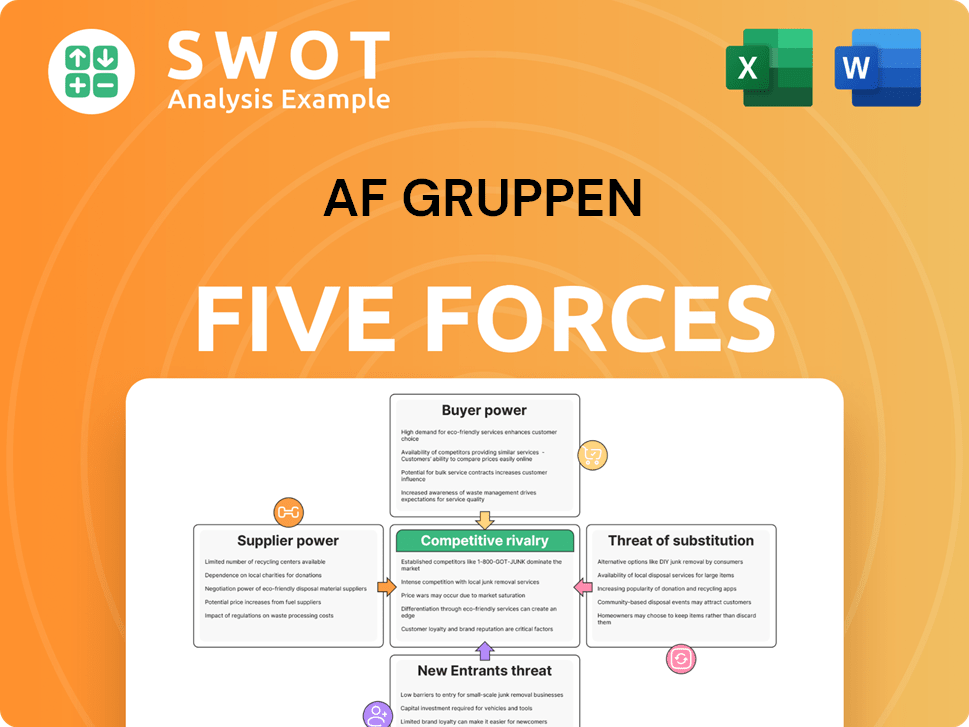

Af Gruppen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Af Gruppen Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Customize pressure levels based on new data, market trends, or regulations.

Full Version Awaits

Af Gruppen Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Af Gruppen. The document you see is the same expertly crafted analysis you will receive immediately after purchase. It includes a thorough examination of industry dynamics, competitive forces, and strategic implications. Download the fully formatted document and use it instantly. This is the complete analysis; no extras or alterations are needed.

Porter's Five Forces Analysis Template

Af Gruppen faces a complex competitive landscape. The bargaining power of suppliers and buyers influences its profitability. The threat of new entrants and substitute products adds further pressure. Competition among existing rivals is also significant. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Af Gruppen’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly impacts AF Gruppen's operational costs. When few suppliers control crucial resources, they gain pricing power. For example, in 2024, construction material prices fluctuated, affecting project budgets. High concentration forces AF Gruppen to accept less favorable terms.

High switching costs significantly boost supplier power. If AF Gruppen finds it expensive to change suppliers, those suppliers gain leverage. This can happen with specialized equipment or long-term contracts. For example, construction firms often have long-term agreements. In 2024, the average contract length in the construction sector was around 1.5 years. This dependence strengthens supplier influence.

Suppliers with unique offerings hold more power. If AF Gruppen relies on specialized materials or services unavailable elsewhere, suppliers can increase prices. For example, in 2024, construction material costs rose, impacting project budgets. This rise highlights supplier influence on profitability. Higher input costs directly affect AF Gruppen's project margins.

Forward integration potential

Suppliers can exert power by considering forward integration, potentially entering construction or related fields. If suppliers possess the necessary resources and expertise, they can directly compete with AF Gruppen, boosting their leverage. This threat can pressure AF Gruppen to accept less favorable terms to maintain access to essential supplies. For instance, a concrete supplier could establish its own construction services. In 2024, the construction materials market saw significant price fluctuations, impacting supplier bargaining power.

- Supplier forward integration reduces AF Gruppen's control.

- Competition is a key factor, like the 2024 cement market.

- Suppliers with more resources have stronger positions.

- Threats can lead to less favorable terms.

Impact on quality

The quality of inputs directly impacts AF Gruppen's project outcomes, making supplier bargaining power crucial. Critical suppliers, such as those providing specialized equipment or essential services, can exert significant influence. AF Gruppen must ensure high-quality inputs to maintain its reputation and project success. In 2024, AF Gruppen's focus on sustainable construction increased reliance on suppliers with green certifications, impacting supplier negotiations.

- High-quality inputs are essential for project success and client satisfaction.

- Specialized suppliers hold more power due to the unique nature of their offerings.

- AF Gruppen's commitment to sustainability influences supplier selection and negotiation.

- Failure to secure quality inputs can lead to project delays and cost overruns.

Supplier power affects AF Gruppen's costs. High supplier concentration increases prices; 2024 material costs rose. Specialized suppliers with unique offerings have more leverage. Forward integration threatens AF Gruppen.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Concentration | Higher costs | Material prices up 5-10% |

| Switching Costs | Supplier leverage | Avg. contract: 1.5 years |

| Uniqueness | Price increases | Specialized equipment costs up |

| Forward Integration | Reduced control | Concrete market volatility |

Customers Bargaining Power

Customer concentration significantly impacts AF Gruppen's pricing and profitability. If a handful of major clients generate a large portion of their revenue, those clients wield considerable negotiating leverage. For instance, major contracts with the Norwegian Public Roads Administration, a key AF Gruppen customer, can dictate terms. Any decrease in project pricing by 5% can significantly impact the company's margins.

Low switching costs amplify customer power. Customers can easily shift to alternative providers, increasing their negotiating strength with AF Gruppen. This is particularly relevant for projects with standard specifications. For example, in 2024, the construction industry saw a 4.5% increase in firms. This offers clients more choices and bargaining power.

Customer price sensitivity significantly influences their bargaining power. Highly price-sensitive customers aggressively negotiate to find the lowest prices, potentially squeezing AF Gruppen's profit margins. In 2024, the construction industry saw intense price competition. For instance, the average profit margin in the Norwegian construction sector was around 5%, highlighting the impact of price sensitivity.

Information availability

Enhanced customer knowledge boosts their negotiating power. Customers with cost details and market comparisons can negotiate better, potentially impacting Af Gruppen's margins. Transparency in pricing and project specifics enables clients to seek higher value. Increased information access, driven by digital platforms, amplifies this effect. For instance, in 2024, the construction industry saw a 15% rise in online bidding platforms usage, increasing price comparisons.

- Increased online bidding platform usage.

- Higher customer access to cost information.

- More transparent pricing models.

- Greater customer demand for value.

Backward integration potential

Customers' bargaining power rises if they can integrate backward, potentially handling construction themselves. This threat is especially potent with large entities capable of self-performing projects. AF Gruppen faces pressure to offer favorable terms from such customers. In 2024, the construction industry saw a shift, with some clients internalizing project elements. This strategy impacts pricing and project scope negotiations.

- Backward integration allows customers to bypass AF Gruppen, increasing their leverage.

- Large organizations, like governmental bodies or major corporations, have the resources to consider this.

- Competitive pricing and terms become crucial for AF Gruppen to secure contracts.

- The trend of clients managing aspects of projects in-house intensified in 2024.

AF Gruppen faces customer bargaining power challenges. Key clients like the Norwegian Public Roads Administration influence pricing. Price sensitivity and readily available alternatives amplify customer leverage. In 2024, the construction sector's average profit margin was approximately 5% due to price pressures.

| Factor | Impact | 2024 Data |

|---|---|---|

| Customer Concentration | High concentration boosts power | Key contracts dictate terms |

| Switching Costs | Low costs increase power | 4.5% rise in construction firms |

| Price Sensitivity | High sensitivity increases power | 5% average profit margin |

Rivalry Among Competitors

High industry concentration often means less rivalry among firms. The construction and industrial services sectors in Norway and Sweden show moderate competition. A fragmented market with many firms boosts rivalry, potentially sparking price wars. In 2024, the Norwegian construction sector saw increased competition, affecting profit margins, with several large firms reporting lower earnings due to intense bidding.

Slow industry growth can significantly intensify competitive rivalry. In mature markets, like some of those AF Gruppen operates in, limited growth means companies must fight harder for each new project or contract. This heightened competition can lead to price wars or increased marketing spending. AF Gruppen's financial results for 2024 reflect this pressure, with revenue growth of only 3% in a challenging market.

Low product differentiation heightens competitive rivalry. If Af Gruppen's services are seen as similar, price becomes key. This intensifies competition, squeezing profit margins. Specialized services or superior project management can set them apart. In 2024, the construction industry saw a 5% profit margin dip due to price wars.

Exit barriers

High exit barriers significantly amplify competitive rivalry within an industry. Firms with substantial investments in specialized assets or bound by long-term contracts find it challenging to leave the market, even amid financial losses. This situation can lead to overcapacity and heightened competition, as companies persist despite unprofitability. For instance, in the construction industry, the high costs associated with liquidating specialized equipment and the commitments tied to ongoing projects can keep companies in the market, intensifying competition. In 2024, the construction sector saw a 5% increase in bankruptcies due to these pressures.

- Specialized Assets: High investment in specific equipment and facilities.

- Long-Term Contracts: Commitments that make it difficult to cease operations.

- Overcapacity: More supply than demand, intensifying competition.

- Unprofitability: Firms remain in the market despite losses.

Number of competitors

A high number of competitors significantly increases competitive rivalry. AF Gruppen operates in Norway and Sweden, where many construction and industrial service providers exist. This intense competition pressures AF Gruppen to maintain a strong market position. They must focus on innovation and operational efficiency to secure projects and contracts.

- Norway's construction industry saw approximately 3,700 active companies in 2024.

- Sweden's construction sector also features thousands of competitors.

- AF Gruppen's 2024 revenue was around NOK 30 billion.

- Increased competition can lead to lower profit margins.

Competitive rivalry in AF Gruppen's markets is significantly influenced by industry concentration and market growth. High numbers of competitors and low product differentiation intensify price wars. High exit barriers and the presence of specialized assets further fuel competition. The construction sector's 2024 profit margin dipped by 5% due to intense competition.

| Factor | Impact on AF Gruppen | 2024 Data |

|---|---|---|

| Market Concentration | Moderate to high, affecting rivalry | Norway: ~3,700 construction companies |

| Market Growth | Slow growth intensifies competition | AF Gruppen: 3% revenue growth |

| Product Differentiation | Low differentiation leads to price focus | Construction sector profit margin: -5% |

SSubstitutes Threaten

The threat of substitutes for AF Gruppen is moderate, affecting its pricing power. Substitute services, like modular construction, offer similar functionality. In 2024, the modular construction market grew, posing a challenge. AF Gruppen must innovate to stay competitive. This requires focusing on efficiency and value.

Low switching costs amplify the threat from substitutes in AF Gruppen's market. If clients can readily choose alternatives, AF Gruppen's pricing flexibility diminishes. This dynamic is especially crucial for projects where alternatives are easily accessible. In 2024, the construction industry saw increased competition, highlighting the importance of maintaining competitive advantages. This is influenced by project specifics and client needs.

The price-performance ratio of substitutes significantly impacts their appeal. If alternatives provide similar results at a reduced cost, they become a major threat. For instance, in 2024, the average cost of construction materials increased by about 5%. AF Gruppen needs to prove its superior value to keep clients, possibly through innovation or efficiency. Consider the rise of prefabricated construction, which could offer lower costs and faster project completion.

Technological advancements

Technological advancements pose a significant threat to AF Gruppen by potentially introducing substitutes. Innovations like 3D printing and new construction materials could disrupt conventional practices. AF Gruppen must monitor these developments closely. In 2024, the construction industry saw a 15% increase in the adoption of digital tools, including those that could lead to substitutes.

- 3D printing in construction gained traction, with the global market projected to reach $5.5 billion by 2027.

- Advanced materials, such as self-healing concrete, are emerging, offering alternatives to traditional materials.

- AF Gruppen needs to invest in R&D to understand and adapt to these emerging technologies.

- The company's ability to innovate will determine its competitiveness against potential substitutes.

Customer preferences

Changing customer preferences significantly influence the threat of substitutes for AF Gruppen. If clients lean towards prefabricated or green building solutions, traditional construction methods become less appealing. AF Gruppen must evolve its services to match these shifts in demand to stay competitive. In 2024, the sustainable construction market grew by 10%, showing this trend. Understanding and proactively adapting to these evolving needs is vital for AF Gruppen's sustained relevance.

- 2024 saw a 10% rise in the sustainable construction market.

- Customer preference shifts increase the substitute threat.

- AF Gruppen needs to adapt to new construction methods.

- Understanding customer needs is crucial for survival.

The threat of substitutes for AF Gruppen is heightened by technological advancements and evolving customer preferences. Modular construction and 3D printing are emerging alternatives. In 2024, the adoption of digital tools in construction rose, and the sustainable construction market grew by 10%. AF Gruppen needs to adapt.

| Factor | Impact | 2024 Data |

|---|---|---|

| Tech Advancements | Increased threat | 15% increase in digital tool adoption |

| Customer Preferences | Shift toward substitutes | 10% growth in sustainable market |

| Key Substitute | Modular construction | Market growth |

Entrants Threaten

High barriers to entry significantly protect Af Gruppen from new competitors. The construction industry demands substantial capital, with equipment costs often exceeding several million Norwegian kroner. Regulatory compliance adds further complexity; for instance, new construction firms must adhere to stringent safety and environmental standards.

Specialized expertise is another critical barrier, considering the need for skilled labor and project management capabilities. In 2024, the Norwegian construction sector saw approximately 20% of projects delayed due to labor shortages, highlighting the importance of established workforce access. This setup makes it harder for new entrants to compete directly.

Economies of scale pose a significant barrier for new entrants. AF Gruppen, as an established player, benefits from cost advantages in procurement and operations. New firms find it hard to match these efficiencies. For instance, in 2024, AF Gruppen's revenues reached approximately NOK 30 billion, showcasing operational scale benefits.

Strong brand recognition provides a significant advantage to existing companies. AF Gruppen's reputation and established brand make it hard for newcomers to capture market share. In 2024, AF Gruppen's revenue reached approximately NOK 30 billion, reflecting its strong market position. Building trust and credibility requires considerable time and investment.

Government regulations

Stringent government regulations pose a significant threat to new entrants in the construction industry, potentially increasing barriers to entry. Compliance with environmental standards, safety protocols, and building codes demands substantial financial investment and specialized knowledge, which can be a deterrent. For instance, in Norway, where Af Gruppen operates, new construction projects must adhere to the Norwegian Building Regulations (TEK17), which are updated regularly, necessitating ongoing adaptation and investment. Successfully navigating these complex regulations is crucial for any new firm aiming to compete.

- TEK17 compliance requires detailed documentation and adherence to strict energy efficiency standards.

- Environmental regulations, such as those related to waste management and emissions, add to compliance costs.

- Safety regulations, enforced by Arbeidstilsynet (the Norwegian Labour Inspection Authority), require significant investment in worker safety.

- The cost of obtaining necessary permits and licenses can be substantial, acting as a barrier.

Access to distribution channels

New entrants to the construction industry, like AF Gruppen, face significant hurdles in accessing distribution channels. Established firms usually have strong relationships with suppliers and customers, making it difficult for newcomers to secure projects. AF Gruppen, with its long-standing presence, benefits from these established networks. Limited access to crucial channels can significantly impede new entrants’ ability to compete effectively.

- AF Gruppen's revenue in Q1 2024 was NOK 8.2 billion.

- The company has a strong presence in Norway and Sweden.

- New entrants struggle to match the existing supply chain efficiency.

The threat of new entrants to AF Gruppen is low due to significant barriers. High capital needs, complex regulations like TEK17, and the demand for specialized expertise protect the company. Established brand recognition and strong distribution channels, such as AF Gruppen's Q1 2024 revenue of NOK 8.2 billion, further limit new competition.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High initial investment in equipment, technology, and labor. | Significant hurdle; requires substantial financial backing. |

| Regulatory Compliance | Adherence to safety, environmental, and building codes (TEK17). | Increases costs, delays, and the need for specialized knowledge. |

| Economies of Scale | Established players benefit from lower procurement and operational costs. | Makes it difficult for newcomers to compete on price. |

Porter's Five Forces Analysis Data Sources

The Af Gruppen analysis is based on financial statements, market reports, industry databases, and news sources to evaluate each competitive force.