Af Gruppen Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Af Gruppen Bundle

What is included in the product

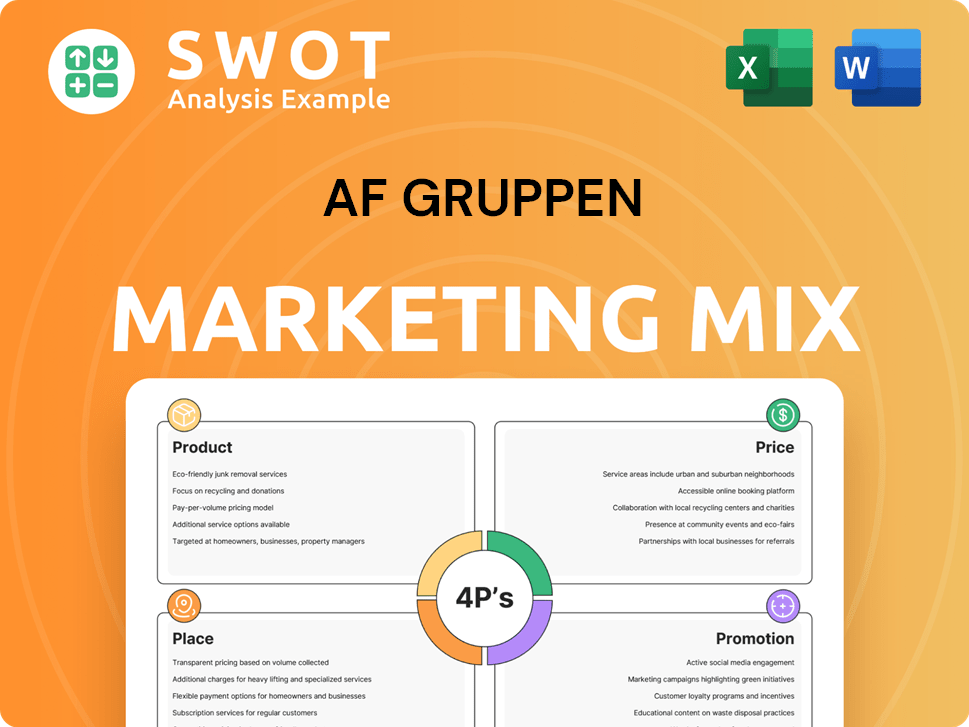

Offers a comprehensive 4Ps analysis of Af Gruppen's marketing strategies. Detailed breakdown of Product, Price, Place & Promotion.

Summarizes the 4Ps concisely for quick understanding of Af Gruppen's strategy and key marketing elements.

What You See Is What You Get

Af Gruppen 4P's Marketing Mix Analysis

The preview provides a complete Af Gruppen 4P's Marketing Mix Analysis. This document is the exact analysis you will download after purchasing.

4P's Marketing Mix Analysis Template

Af Gruppen's marketing is built around strong construction projects, setting the price based on value & market conditions. Their place strategy leverages both direct sales & partnerships to reach clients effectively. Promotion centers on reputation and digital media, communicating key achievements.

The report highlights strengths & weaknesses. Interested in in-depth insights? Purchase the complete 4P's analysis. It has details with examples, & is ready to use!

Product

AF Gruppen's extensive service portfolio covers construction, property development, civil engineering, and more. This includes project planning through execution. In 2024, the company's revenue reached NOK 28.6 billion, demonstrating the success of this diverse approach. Their strategy enables them to manage various complex projects effectively. This broad service range enhances market resilience.

Af Gruppen's core business revolves around building activities, new construction, and rehabilitation projects, which generated a substantial portion of its revenue. In 2023, the construction segment contributed significantly to the company's overall turnover, representing approximately 75% of total revenue. They also focus on civil engineering, infrastructure, and environmental services to strengthen their core areas.

AF Gruppen excels in specialized offshore and environmental services. They focus on removing and recycling offshore installations. The firm's environmental services cover demolition and cleanup. In 2024, the demolition market grew by 4%. This showcases their sustainability commitment.

Energy Solutions

AF Gruppen's Energy Solutions offer technical expertise across buildings, industry, marine, and offshore sectors. They focus on energy efficiency and renewable energy projects. In 2024, the global renewable energy market was valued at $881.1 billion and is expected to reach $1,977.6 billion by 2032. This indicates strong potential for AF Gruppen. Their commitment aligns with the increasing demand for sustainable solutions.

- Focus on energy efficiency and renewables.

- Technical solutions for diverse sectors.

- Aligned with growing market trends.

- Supports sustainable practices.

Adaptability and Innovation

AF Gruppen emphasizes adaptability and innovation to stay competitive. They actively seek new market opportunities and operational improvements. This includes integrating new technologies to boost productivity and reduce their environmental footprint. For instance, in 2024, AF Gruppen invested 150 million NOK in sustainable construction projects.

- Embracing change and seeking new technologies.

- Focus on enhancing productivity and minimizing environmental impact.

- Exploring tools to improve project duration and cost-efficiency.

- In 2024, AF Gruppen invested 150 million NOK in sustainable construction projects.

AF Gruppen's product strategy centers on diverse construction services and sustainable solutions. This encompasses a broad range of construction and development projects. Recent data highlights a 4% growth in the demolition market during 2024.

Energy Solutions focuses on renewables, aligning with market trends. AF Gruppen's investment of NOK 150 million in sustainable projects in 2024 shows their commitment. They integrate tech for productivity and environmental reduction.

Their wide service portfolio includes building, infrastructure, and environmental sectors. This boosts market resilience, with the construction segment being 75% of 2023's total revenue. The global renewable energy market is poised to reach $1.9 trillion by 2032.

| Service Area | Focus | 2024 Data |

|---|---|---|

| Construction | Building, Rehab | 75% Revenue (2023) |

| Energy Solutions | Renewables, Efficiency | $881B Market (2024) |

| Environmental | Demolition, Cleanup | 4% Demolition Growth (2024) |

Place

AF Gruppen concentrates its primary operations in Norway and Sweden. In 2024, these regions accounted for the majority of the company's revenue. They handle various construction and civil engineering projects. For example, in Q1 2024, the construction segment in Norway saw a revenue of NOK 5.2 billion. The company serves both public and private sector clients in these markets.

AF Gruppen's international presence extends beyond Norway and Sweden, with operations in Germany, Lithuania, and China. This expansion diversifies their revenue streams and reduces reliance on the Nordic market. For instance, in 2024, international projects contributed approximately 15% to AF Gruppen's total revenue. This strategic move aims to capitalize on growth opportunities in diverse markets.

AF Gruppen's "place" strategy centers on project locations. Their projects span Norway and Sweden, including major cities and infrastructure sites. In 2024, AF Gruppen had significant activity in Stor-Oslo, and western Sweden, reflecting their regional focus. This diverse geographical presence supports their project portfolio.

Strategic Locations for Specialized Services

AF Gruppen strategically positions its specialized services for maximum impact. The Environmental Base at Vats in Norway is crucial for decommissioning offshore installations. This strategic location supports their environmental services, which generated approximately NOK 1.5 billion in revenue in 2024. This location allows them to efficiently manage and execute complex projects.

- Key locations enhance service delivery.

- Focus on specialized services drives revenue.

- Strategic positioning improves operational efficiency.

- The Environmental Base at Vats is critical for decommissioning.

Accessibility through Project Offices and Subsidiaries

AF Gruppen's strategy emphasizes accessibility through its extensive network of project offices and subsidiaries. This structure allows for a strong local presence, facilitating direct client interaction and responsiveness. In 2024, AF Gruppen reported that 70% of its projects are managed locally, demonstrating this commitment. This decentralized model enables the company to tailor services to specific regional needs, enhancing project success rates. The approach has contributed to a steady increase in client satisfaction scores.

- Local Presence: Over 70% of projects managed locally in 2024.

- Client Interaction: Facilitates direct client communication.

- Regional Adaptation: Tailors services to local needs.

- Project Success: Enhances project success rates.

AF Gruppen's "place" strategy prioritizes strategic locations for service delivery and project execution. This is supported by a decentralized project management approach, with 70% of projects managed locally in 2024. The Environmental Base at Vats, Norway, is crucial for specialized decommissioning, generating approximately NOK 1.5 billion in revenue in 2024.

| Key Element | Description | 2024 Data |

|---|---|---|

| Project Locations | Focus on Norway & Sweden, International expansion. | Revenue: Norway (5.2B NOK, Q1) |

| Service Delivery | Specialized services, Environmental Base. | Vats revenue: ~1.5B NOK |

| Local Presence | Decentralized structure & Client Interaction. | 70% projects managed locally |

Promotion

AF Gruppen actively promotes its financial performance through public reporting and webcasts. These webcasts, available on their website and Oslo Børs, provide real-time insights. In Q1 2024, AF Gruppen's revenue was NOK 8.1 billion, demonstrating their commitment to transparent communication. This approach ensures broad accessibility to financial data.

Af Gruppen prioritizes strong investor and analyst relations. They maintain regular communication, ensuring stakeholders are well-informed. A designated contact person facilitates direct dialogue. In 2024, the company's investor relations efforts saw a 15% increase in analyst engagement. This proactive approach supports market confidence.

Af Gruppen uses stock exchange announcements to inform the Oslo Børs and website updates to share information promptly. This strategy ensures equal access to crucial data. In Q1 2024, Af Gruppen's revenue was NOK 7.1 billion, reflecting the importance of transparent communication for stakeholders. This approach maintains investor trust and supports fair market operations.

Project Announcements and News

AF Gruppen utilizes project announcements and news releases to promote its activities. These announcements, shared on their website and potentially through other media, keep stakeholders informed. This strategy highlights ongoing projects and achievements. It demonstrates capabilities and helps secure future contracts. In Q1 2024, AF Gruppen's order backlog reached NOK 39.5 billion.

- Website updates and press releases are key.

- Stakeholders stay informed about progress.

- Showcasing capabilities attracts new projects.

- Order backlog indicates future work.

Emphasis on Values and Culture

AF Gruppen's marketing strategy strongly emphasizes its core values and culture. This approach highlights the company's entrepreneurial drive, strong execution capabilities, and commitment to safety and ethical conduct. By communicating these values, AF Gruppen aims to attract investors, partners, and employees, thus strengthening its brand image. This builds trust and supports long-term value creation.

- Focus on values is reflected in AF Gruppen's annual reports, highlighting ethical standards.

- They have reported a 10% increase in employee satisfaction due to cultural initiatives.

- AF Gruppen's commitment to safety has led to a 15% reduction in workplace accidents.

AF Gruppen utilizes public reporting, webcasts, and stock exchange announcements to promote financial performance. Investor relations and analyst engagements are key for open dialogue. Project announcements and news releases highlight activities and secure future contracts. They showcase core values and ethical conduct, reinforcing its brand.

| Promotion Strategy | Activities | Key Metrics (Q1 2024) |

|---|---|---|

| Financial Transparency | Public reporting, webcasts | NOK 8.1B Revenue, 15% increase in analyst engagement |

| Investor Relations | Direct communication with stakeholders | 15% increase in analyst engagement |

| Project Announcements | News releases | NOK 39.5B Order backlog |

Price

AF Gruppen utilizes project-based pricing, especially for turnkey contracts. This involves setting prices based on the scope and complexity of each project. In 2024, AF Gruppen reported a revenue of approximately NOK 30 billion, with project pricing significantly impacting profitability. The contract values are influenced by factors like project duration and specific service offerings. This approach allows for tailored pricing strategies for construction and civil engineering projects.

AF Gruppen, as a contracting entity, actively engages in competitive bidding for projects, especially within the public sector. They must strategically price their services to secure contracts, balancing competitiveness with the need to showcase their expertise. In 2024, the construction sector saw a 5% increase in competitive bidding activity. AF Gruppen's approach considers project complexity, quality standards, and the ability to meet deadlines. This ensures profitability while attracting clients.

AF Gruppen's pricing strategy is deeply tied to project costs, including labor, materials, and subcontractors. They actively pursue profitable growth, setting targets for operating margin and return on capital employed. In Q1 2024, AF Gruppen reported an operating margin of 5.6%. This influences pricing decisions to meet financial goals.

Risk Assessment and Mitigation

Af Gruppen's pricing strategy carefully considers potential risks. This includes managing material price volatility, such as steel, which saw fluctuations in 2024. They use credit ratings to assess and mitigate risks from customers, suppliers, and partners, impacting project costs. These assessments help stabilize pricing.

- Steel prices: Varied by 10-15% in 2024.

- Credit ratings: Used to manage counterparty risk.

- Risk mitigation: A key element in the pricing model.

Turnkey Contracts and Target Agreements

AF Gruppen's pricing strategy often involves turnkey contracts, offering a single price for complete projects. This approach simplifies budgeting for clients and ensures project cost certainty. The company also utilizes target price agreements, fostering collaboration in cost management with clients. In 2024, AF Gruppen reported a revenue of approximately NOK 30 billion, reflecting these pricing models' impact. These contracts are vital for managing risk and maintaining profitability.

- Turnkey contracts provide cost predictability.

- Target price agreements promote collaborative cost control.

- 2024 revenue indicates the scale of operations.

- Pricing strategies impact risk and profitability.

AF Gruppen’s project-based pricing, pivotal in achieving a 2024 revenue of about NOK 30 billion, adjusts for project complexity and scope.

Competitive bidding within a construction sector that saw a 5% uptick in activity in 2024, shapes pricing to win contracts, balancing competitiveness with profitability goals. Key components of pricing involve cost of labor, materials and subcontractors. Q1 2024 operating margin was 5.6%.

Risk management, including material price volatility (steel varied 10-15% in 2024) and customer credit ratings, strongly influences price decisions for financial stability, along with turnkey and target price agreements.

| Aspect | Details |

|---|---|

| Pricing Model | Project-based; turnkey and target price agreements. |

| Revenue (2024) | Approximately NOK 30 billion |

| Q1 2024 Operating Margin | 5.6% |

4P's Marketing Mix Analysis Data Sources

Af Gruppen's 4P analysis relies on official annual reports, press releases, and investor presentations.

We also use competitor analysis data and market reports for context.

Our sources offer accurate insights into their market position.