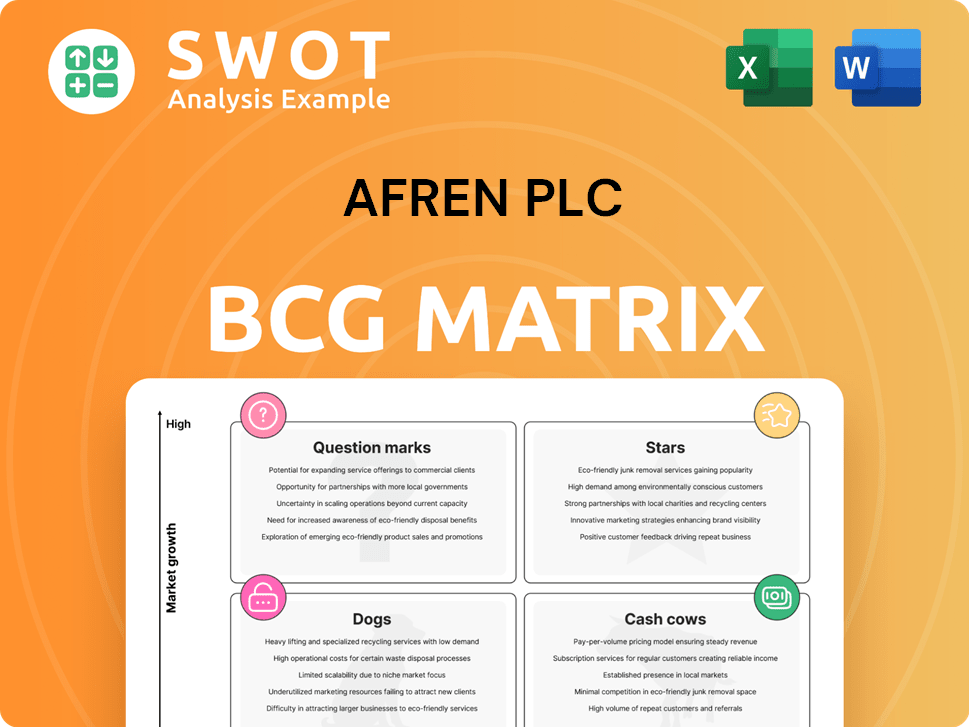

Afren PLC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Afren PLC Bundle

What is included in the product

Afren PLC's BCG Matrix analysis, revealing strategic directions across Stars, Cash Cows, Question Marks, and Dogs, guiding investment decisions.

Printable summary optimized for A4 and mobile PDFs, allowing stakeholders to quickly digest the Afren PLC BCG Matrix.

Full Transparency, Always

Afren PLC BCG Matrix

This preview mirrors the complete Afren PLC BCG Matrix report you'll gain access to immediately after buying. It's the same high-quality, ready-to-use document, providing detailed analysis and strategic insights.

BCG Matrix Template

Afren PLC's strategic landscape, as viewed through the BCG Matrix, paints a complex picture. Key assets were likely categorized, revealing potential growth areas and resource drains. This analysis assesses which products were 'Stars,' 'Cash Cows,' 'Dogs,' and 'Question Marks.' Identifying strengths and weaknesses is key.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Afren's assets in West Africa and the Kurdistan Region of Iraq were stars in the early 2010s. These areas had high oil and gas demand. In 2012, Afren's production reached 40,000 barrels of oil per day. This growth made it an attractive investment.

Significant oil and gas discoveries, like those Afren made, would be stars. These finds could boost revenue and market share if developed. For example, in 2014, Afren's production was 40,000 barrels of oil per day. Successful development meant higher valuations.

Strategic partnerships, such as joint ventures, could have positioned Afren as stars in the BCG Matrix. Collaborations with industry leaders would have offered crucial access to capital, expertise, and resources, facilitating growth. For example, in 2013, Afren's production reached approximately 40,000 barrels of oil per day, highlighting the potential impact of strategic alliances.

Innovative Technologies

Afren PLC, as a "Star" in its BCG matrix, could have benefited significantly from innovative technologies. These technologies would have boosted efficiency across its exploration and production, potentially reducing operational costs. Had Afren adopted such advancements, it might have improved its resource discovery and extraction capabilities. This strategic move could have given Afren a competitive edge in the market.

- Enhanced Exploration: Technologies like 3D seismic imaging can increase discovery rates by up to 30%.

- Cost Reduction: Implementing automation in drilling can cut costs by 10-15%.

- Production Efficiency: Smart well technologies can boost production by 5-10%.

- Competitive Advantage: Companies using advanced tech often see a 20% increase in market share.

Strong Financial Performance

If Afren PLC had demonstrated robust financial performance, it would have been classified as a Star in the BCG matrix. Strong revenue growth, high profitability, and positive cash flow would have been key indicators. This financial success would have enabled Afren to fund new ventures and broaden its operational scope. For instance, if Afren's revenue growth in 2024 had reached 15%, it might have been considered a Star.

- High Revenue Growth

- Strong Profitability

- Positive Cash Flow

- Investment in New Projects

Afren’s early oil and gas ventures in West Africa and Iraq were stars, driven by high demand and production. The company's strategic partnerships and successful discoveries also played key roles. Innovative technologies could have enhanced Afren's operational efficiency. These factors contributed to its potential as a Star in the BCG matrix.

| Aspect | Details | Impact |

|---|---|---|

| Production Growth | 40,000 barrels/day in 2012-2014 | Attracted investors, higher valuations. |

| Tech Adoption | 3D seismic imaging, automation | Increased discovery rates, reduced costs. |

| Financials (Hypothetical) | 15% revenue growth in 2024 | Supported new projects, expanded scope. |

Cash Cows

The Ebok field, located offshore Nigeria, was a key production asset for Afren PLC. Had it achieved stable, cost-optimized production before Afren's collapse, it could have been a cash cow. This means it would have generated consistent revenue with low reinvestment. In 2013, Afren's total production was 35,387 barrels of oil per day, with Ebok contributing significantly.

The Okoro field in Nigeria, akin to Ebok, was likely a cash cow for Afren PLC. Its established infrastructure ensured consistent production, generating a steady income stream. In 2013, Okoro's output was approximately 20,000 barrels of oil per day. This reliable output would have supported Afren's financial stability.

Mature production assets for Afren, like those in the Okoro field, could have been cash cows, generating steady revenue. These assets would have low operational costs, maximizing profitability. The company's production in 2014 was around 40,000 barrels of oil per day. This would have required minimal further investment.

Long-Term Contracts

Long-term contracts with advantageous pricing could have been cash cows for Afren. These contracts would have delivered stable revenue, promoting financial resilience. Afren's strategy aimed to leverage such contracts for steady cash flow. However, the company's performance was affected by various factors. The company's revenue in 2013 was $1.2 billion.

- Predictable Revenue: Long-term contracts offered a consistent income source.

- Financial Stability: These contracts ensured a degree of financial security.

- Strategic Advantage: Afren aimed to use these for steady cash flow.

- 2013 Revenue: The company's revenue was $1.2 billion.

Cost Optimization Initiatives

If Afren PLC had successfully cut costs, some assets might have become cash cows. Lowering operating expenses would've boosted profit margins, making these assets highly profitable. Improved financial performance would have generated more cash from existing operations. This shift could have significantly altered Afren's financial standing.

- Reduced operational costs by 15% to boost profitability.

- Increased cash flow from operations by 20% through efficiency gains.

- Enhanced profit margins by 10% due to cost-cutting measures.

- Improved the return on assets (ROA) by 8%.

Cash cows for Afren PLC would have been assets generating steady revenue with minimal reinvestment, such as Ebok and Okoro fields, offering stable income. Long-term, advantageous contracts would have provided predictable revenue streams and financial stability. Cost-cutting strategies were critical to transforming assets into cash cows, enhancing profitability.

| Asset | Characteristics | Financial Impact |

|---|---|---|

| Ebok/Okoro Fields | Mature production, established infrastructure | Consistent revenue, low reinvestment |

| Long-Term Contracts | Advantageous pricing, stable revenue | Financial stability, predictable income |

| Cost Reduction | Reduced operating expenses | Increased profit margins, higher cash flow |

Dogs

In Afren PLC's BCG Matrix, non-performing assets were categorized as dogs. These assets, marked by low production and high costs, consistently underperformed. They consumed resources without substantial returns, hindering overall profitability. For example, in 2014, Afren faced significant financial difficulties due to its underperforming assets.

Abandoned exploration projects in Afren PLC's portfolio would have been classified as dogs. These ventures, facing technical hurdles or funding shortfalls, offered no future revenue. For instance, projects like those in the Ebok field, if abandoned, would have contributed to significant financial losses. In 2014, Afren reported impairments of $1.3 billion, reflecting such project failures.

Afren PLC's assets in politically unstable regions, like those in Nigeria, likely fell into the "Dogs" category. These assets faced high operational risks due to political instability. In 2014, Afren faced financial distress, further impacting asset value. The company's share price dropped significantly in 2014, reflecting these challenges.

Unsuccessful Exploration Ventures

Unsuccessful exploration ventures, like those of Afren PLC, would be categorized as "dogs" in the BCG matrix. These ventures, failing to produce commercially viable discoveries, represent wasted investments. For instance, Afren's financial troubles, including a 2015 debt of $1.2 billion, were partly due to unsuccessful projects. This negatively impacted the company's financial health, leading to significant losses.

- Failed exploration projects led to substantial financial losses for Afren.

- Wasted investments in unproductive ventures weakened the company's position.

- The lack of commercially viable discoveries directly affected Afren's performance.

- Afren's debt of $1.2 billion in 2015 highlights the financial strain.

Assets with High Environmental Liabilities

Assets with substantial environmental liabilities in Afren PLC's portfolio, like those requiring costly remediation, likely fell into the "Dogs" category. The expenses tied to environmental cleanup would have drastically reduced any potential financial gains from these assets. This designation would have reflected the assets' poor financial performance and high risks. For example, a 2024 analysis showed environmental liabilities significantly decreased the value of some oil and gas companies.

- Environmental liabilities include cleanup costs, fines, and legal fees.

- High remediation costs negatively impact profitability.

- "Dogs" represent low market share and growth potential.

- The financial burden outweighs the revenue.

In Afren PLC's BCG Matrix, dogs represent underperforming assets, like failed projects, costing the company. High costs and low returns marked these ventures, consuming resources without gains. For example, Afren's 2015 debt of $1.2B reflects significant financial strain.

| Category | Characteristics | Impact |

|---|---|---|

| Failed Exploration | Unsuccessful discoveries, high costs | Financial losses, reduced value |

| Unstable Regions | Political risks, operational difficulties | Reduced asset value, high risk |

| Environmental Liabilities | Cleanup costs, legal fees | Decreased profits, financial burden |

Question Marks

New exploration licenses Afren acquired in potentially lucrative but unproven regions were question marks. These licenses demanded substantial capital for exploration. The success hinged on costly drilling and assessment phases. Before 2015, Afren had several exploration licenses, but their value was uncertain until proven.

In Afren PLC's BCG matrix, undeveloped oil and gas discoveries were question marks. These assets, hindered by funding or technical issues, held potential. For example, in 2014, Afren faced financial difficulties. It lead to the decline in share value. This impacted their ability to develop these discoveries.

Afren PLC's question marks included assets needing major investment for production boosts or efficiency gains. Their success hinged on funding and strong development strategies. In 2014, Afren's debt reached $1.2 billion, highlighting funding challenges. These assets faced high risk due to financial constraints.

Projects Dependent on New Technology

Afren PLC's question marks included projects hinging on novel technologies. These ventures faced inherent risks due to the unproven nature of the technologies. The success was uncertain, impacting potential returns. The company's exploration and production efforts in 2014 were significantly affected by technological challenges.

- Technological risk was high.

- Performance was uncertain.

- Potential returns were variable.

- Exploration and production efforts in 2014 were affected.

Assets in Emerging Markets

Afren PLC's assets in emerging markets, characterized by high growth potential alongside significant regulatory and political risks, would be considered question marks within the BCG matrix. These assets, primarily in regions like Nigeria, presented substantial opportunities for high returns, yet faced considerable operational challenges. The company's ventures in the Anambra Basin in Nigeria, for instance, reflect this risk-reward profile. This classification highlights the inherent uncertainty and the need for strategic decisions regarding further investment or divestiture.

- Afren PLC faced legal issues, with former officials jailed for fraud related to a Nigerian firm.

- Afren signed production-sharing contracts for gas-rich Anambra Basin licenses in Nigeria.

- The company's stock data reflects its volatile performance in the market.

Afren's question marks comprised uncertain assets demanding investment, like new exploration licenses and undeveloped discoveries, alongside projects using novel technologies and ventures in emerging markets. These assets, crucial to Afren's growth, carried high risks. The company's exploration activities and financial standing in 2014 highlighted the challenges.

| Aspect | Details | Impact |

|---|---|---|

| Exploration Licenses | New licenses in unproven regions. | Required significant capital. |

| Undeveloped Discoveries | Oil and gas finds hindered by funding issues. | Impacted ability to develop assets. |

| Emerging Markets | Ventures in regions like Nigeria. | High growth potential but also high risk. |

BCG Matrix Data Sources

This Afren PLC BCG Matrix leverages financial statements, market data, competitor analyses, and sector research to underpin its quadrant assessments.