Afren PLC Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Afren PLC Bundle

What is included in the product

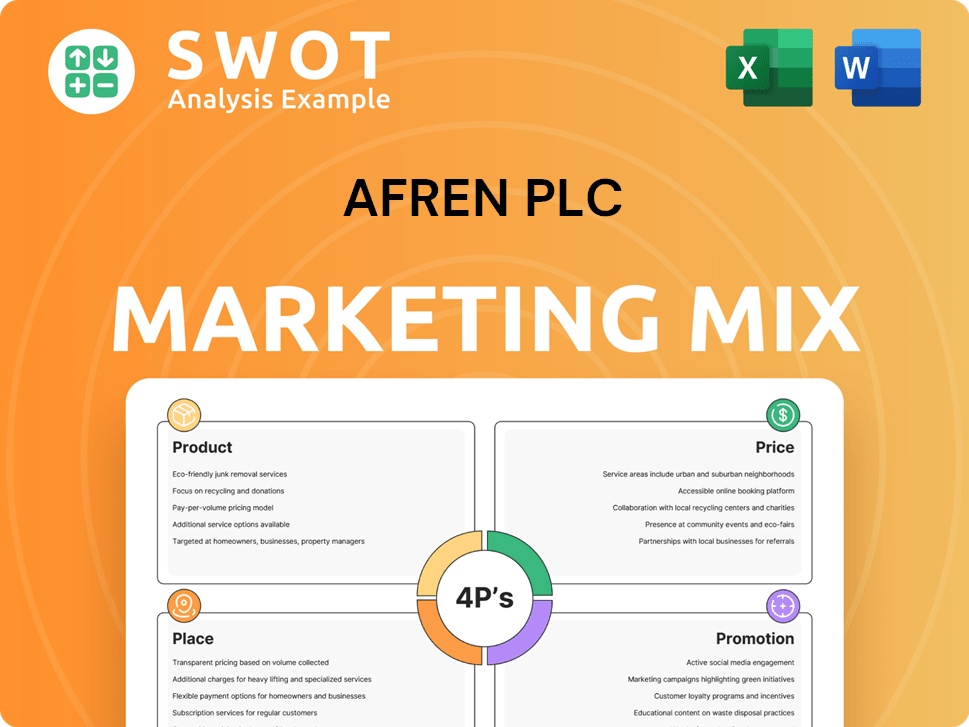

A detailed 4Ps analysis of Afren PLC, examining Product, Price, Place & Promotion strategies, and their practical implications.

Summarizes the 4Ps in a clean, structured format, aiding understanding and clear communication.

What You See Is What You Get

Afren PLC 4P's Marketing Mix Analysis

The preview shown is identical to the final Afren PLC 4P's Marketing Mix Analysis document you'll download instantly after purchase. This is not a sample; it’s the complete analysis. Access a ready-to-use, comprehensive file immediately.

4P's Marketing Mix Analysis Template

Discover Afren PLC's marketing blueprint: its product offerings, pricing, distribution, and promotional strategies. See how they crafted their market approach during its operation.

The preview only shows a glimpse. Access the full Marketing Mix analysis for detailed insights. You'll get real-world data and practical examples to apply.

This comprehensive analysis offers a deep dive into Afren's product positioning, pricing tactics, and promotional channels.

Uncover how Afren PLC strategically aligned its decisions to compete in its industry.

The complete 4Ps report delivers a clear breakdown. Perfect for business, academic and self-learning.

Get it now and learn!

Product

Afren PLC, an independent oil and gas exploration and production company, centered its product strategy on extracting hydrocarbons. Its primary product was crude oil and natural gas, sourced from West African assets, especially Nigeria. The company engaged in complex exploration, drilling, and production processes to deliver its core offering. In 2014, Afren's production reached 40,000 barrels of oil per day, highlighting its operational scale before its financial troubles.

Afren PLC's product centered on its asset portfolio of oil and gas properties. These assets were spread across West Africa and the Kurdistan region. The portfolio included exploration, development, and producing assets. In 2013, Afren's proved and probable reserves were 2P reserves of 268 million barrels of oil equivalent (MMboe).

Afren's product strategy hinged on partnerships and joint ventures. They teamed up with African entities to access assets and local know-how. This strategy was key to their operational success, ensuring product delivery. For example, in 2014, Afren had several joint ventures across Nigeria and Ghana. These partnerships were designed to share risks and resources.

Technical Expertise

Afren PLC's technical expertise, though not a physical product, was central to its value. Their proficiency in oil and gas exploration and production was a critical asset. This included field identification, assessment, and development capabilities. Success hinged on these core competencies, driving market performance.

- Afren's technical team had experience in diverse geological settings.

- They utilized advanced technologies for seismic surveys and drilling.

- Their expertise aimed to maximize oil and gas recovery rates.

Hydrocarbon Resources

Afren PLC's core product was its hydrocarbon resources, mainly oil and gas. These resources were extracted and refined for sale, directly influencing the company's financial health. The quality and volume of these reserves were critical to Afren's success in the market. Afren's production peaked in 2013, with about 40,000 barrels of oil equivalent per day, before declining due to various issues.

- Oil and gas extraction formed the basis of Afren’s operations.

- Reserve quality and quantity determined Afren's market value.

- Production volumes saw a significant decline post-2013.

Afren PLC's product primarily consisted of crude oil and natural gas, extracted from West African assets. Their asset portfolio included exploration, development, and production stages. Technical expertise, focused on efficient extraction, underpinned their value.

| Product | Details | Facts (2014) |

|---|---|---|

| Oil and Gas | Extraction and Sale | Production: 40,000 bpd. Reserves: 268 MMboe |

| Asset Base | West Africa, Kurdistan | Joint Ventures: Nigeria, Ghana. |

| Technical Expertise | Exploration, Production | Diverse geological settings. |

Place

Afren PLC heavily centered its 'place' strategy on West Africa, with Nigeria being a key area. This concentration allowed for focused resource allocation. In 2014, Nigeria accounted for a significant portion of Afren's oil production. For instance, in 2013, approximately 70% of Afren's production came from Nigeria.

Afren strategically spread its operations across West Africa, including Ghana, Cote d'Ivoire, Gabon, and the Republic of Congo, plus Iraqi Kurdistan. This multi-country presence aimed to tap into diverse oil reserves, mitigating risks associated with relying on a single location. By 2014, Afren's proved and probable reserves across these areas were substantial, though financial troubles later impacted operations.

Afren's 'place' strategy encompassed a mix of offshore and onshore assets. The Ebok field, offshore Nigeria, highlights their offshore presence. Afren's portfolio included onshore blocks in various regions, showcasing their diversified location strategy. In 2013, Afren's production was approximately 30,000 barrels of oil equivalent per day.

London Stock Exchange Listing

As a publicly listed entity, Afren PLC's shares were traded on the London Stock Exchange (LSE), which served as a primary 'place' within its marketing mix. This listing provided Afren access to a broad international investor base, enhancing its visibility and opportunities for capital raising. From January to December 2024, the LSE saw an average daily trading value of £6.3 billion. This enabled Afren to connect with a wide audience.

- LSE's total market capitalization in December 2024 was approximately £3.9 trillion.

- Afren's listing facilitated access to a global investor pool.

- Trading on the LSE provided liquidity for Afren's shares.

Local Offices and Operations

Afren's local offices and operational bases were critical for managing assets and activities in their operating countries. This physical presence was essential for conducting exploration, development, and production. These offices facilitated direct engagement with local stakeholders and governments. For example, in 2014, Afren's operations included significant activities in Nigeria and Ghana.

- Nigeria: Afren held interests in several oil blocks.

- Ghana: Afren's focus was on exploration and development.

- Local Presence: Offices were key for operational control.

Afren's "place" strategy concentrated operations in West Africa, particularly Nigeria, for focused resource deployment and significant oil production. This included an onshore and offshore presence. Strategic expansion included Ghana and the Republic of Congo for diversification and risk mitigation.

Afren PLC's London Stock Exchange listing (LSE) offered access to international investors. From January to December 2024, the LSE had an average daily trading value of £6.3 billion, enhancing market visibility and facilitating capital raising.

Local offices were important for asset management and government engagement. Afren had significant activities in Nigeria and Ghana. In 2024, Nigeria's oil production accounted for 1.6 million barrels per day.

| Aspect | Details |

|---|---|

| Primary Regions | West Africa, Nigeria |

| Stock Exchange | London Stock Exchange |

| 2024 Daily Trading Value (LSE) | £6.3 Billion |

Promotion

Investor communications were crucial for Afren. They regularly updated investors. For example, in 2013, Afren's investor relations team actively engaged with shareholders. This was to share operational updates and financial results. These communications aimed to boost investor confidence.

Afren likely utilized industry conferences to boost its profile. These events offered chances to showcase projects and expertise. Participation could attract partners and investors. For instance, in 2013, similar firms spent an average of $500,000 on conference marketing. This aimed to generate leads and strengthen industry relationships.

Afren PLC's public relations focused on managing its image. They aimed to highlight responsible operations and community partnerships. This included showcasing economic contributions in operational regions. Such efforts sought to build trust and mitigate reputational risks. Effective PR is crucial for companies like Afren.

Partnership Announcements

Afren PLC's partnership announcements were a promotional tactic. These announcements highlighted the company's expansion and strategic achievements. They aimed to attract investors and partners. For instance, Afren announced a joint venture in Nigeria in 2013. This increased investor confidence.

- Partnerships boosted Afren's image.

- Joint ventures signaled growth.

- Asset acquisitions showed strategic moves.

- These announcements aimed to attract collaborators.

Reporting on Discoveries and Production

Afren PLC heavily promoted successful exploration results and production milestones. These reports highlighted value creation and aimed to attract investment. Announcements of reserve upgrades were also key promotional tools.

- In 2014, Afren reported a 43% increase in proven and probable reserves in Nigeria.

- The company's production in 2013 reached 30,000 barrels of oil per day.

- Afren's share price performance was closely tied to its exploration success.

Afren used investor relations, including regular updates, to build confidence. They utilized industry conferences to showcase projects. PR efforts focused on managing the company's image and announcing partnerships for expansion.

| Promotion Tactic | Objective | Example |

|---|---|---|

| Investor Communication | Boost Confidence | 2013 Investor Relations |

| Industry Conferences | Attract Partners | $500K Avg. spend by peers |

| Public Relations | Manage Image | Community Partnerships |

Price

Afren's 'price' hinged on volatile global oil and gas prices. As a price taker, they faced international supply and demand pressures. In 2024, Brent crude averaged around $80/barrel. Global oil demand is projected to reach 104 million barrels per day by 2025. This market sets their revenue potential.

Afren's financial "price" considered debt and equity costs. Loan terms and interest rates, alongside share prices, reflected market risk assessment. In 2014, Afren faced significant debt, impacting its valuation. Equity offerings and share performance mirrored investor confidence, crucial for funding.

Operating costs were crucial for Afren, covering oil and gas extraction expenses. Exploration, development, and operational costs significantly impacted Afren's financial health. In 2014, Afren's operational expenses were substantial. These costs directly affected profitability, a key factor for investors.

Fiscal Regimes and Royalties

Afren's financial performance was significantly influenced by fiscal regimes and royalty payments in its operating countries. These government charges directly affected the netback price, which is the revenue Afren received after deducting production costs and royalties. For instance, royalty rates varied widely; in some regions, they could reach up to 20% of gross revenue. These costs were a crucial part of the expenses, impacting profitability.

- Royalty rates impacted the netback price.

- Government levies were a cost.

- Rates varied based on the region.

Perceived Value by Investors

The share price of Afren PLC directly mirrored investor perception of its worth. This perception was shaped by several factors, including Afren's oil reserves and production volumes. Growth prospects and the quality of its management team also played a crucial role. Market sentiment towards the oil and gas industry significantly impacted the valuation.

Afren's pricing strategies faced external oil price volatility. Debt costs and share performance further shaped pricing decisions. Operational costs significantly influenced profitability and financial viability.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Oil Prices | Revenue driver | Brent crude: ~$80/barrel (2024), Projected demand: 104M barrels/day (2025) |

| Debt Costs | Financial burden | High debt in 2014; Interest rates varied based on market risk |

| Operating Costs | Profitability Impact | Substantial expenses in 2014, directly influenced bottom line |

4P's Marketing Mix Analysis Data Sources

The Afren PLC 4P's analysis incorporates company filings, investor relations materials, industry reports, and news archives. We use a mix of public data.