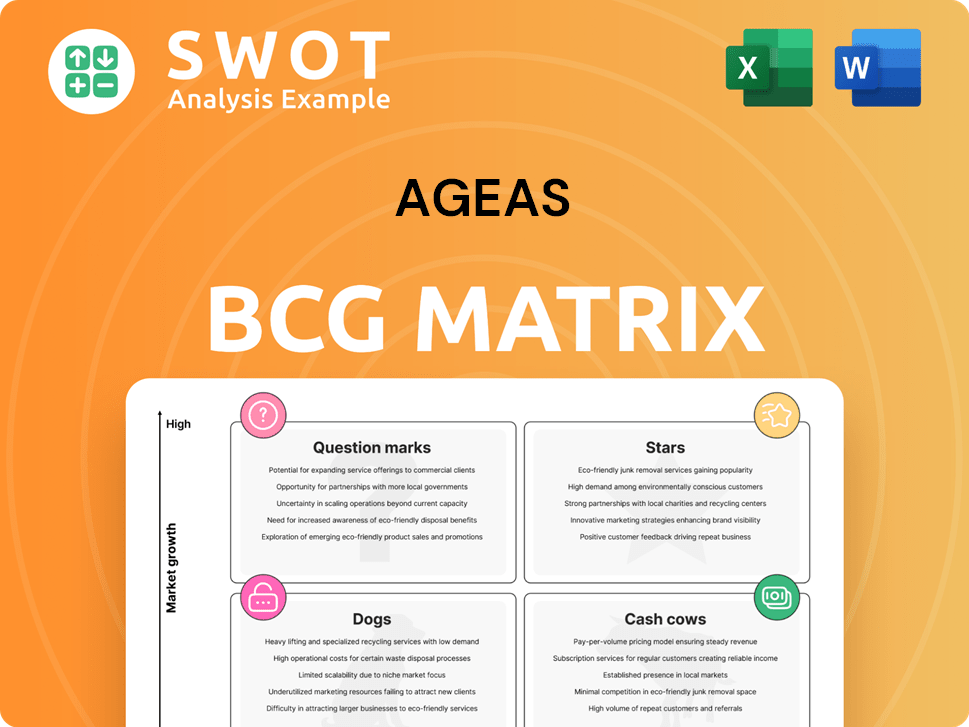

Ageas Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ageas Bundle

What is included in the product

Analysis of Ageas' business units using BCG, suggesting investment, holding, or divesting.

Easily switch color palettes for brand alignment, avoiding lengthy redesigns.

Delivered as Shown

Ageas BCG Matrix

The BCG Matrix preview is identical to the document you'll receive. Get the complete, ready-to-use Ageas-focused report, designed for immediate strategic application post-purchase.

BCG Matrix Template

Explore Ageas' product portfolio through a strategic lens! This overview hints at market positioning, but what about the full picture? Discover the Stars, Cash Cows, Dogs, and Question Marks within their offerings. Uncover where Ageas excels and where they need to reassess.

The full BCG Matrix offers data-driven recommendations and a roadmap for smarter decisions. Get instant access for a strategic edge.

Stars

Ageas UK has demonstrated strong growth in the UK personal lines market. This success is fueled by strategic decisions, leading to profitable expansion. The segment thrives on broker distribution, technical expertise, and technological advancements. In 2024, Ageas UK's gross written premiums increased, reflecting market gains. This growth highlights their ability to adapt and succeed.

Ageas Re, a star in the BCG matrix, has shown strong expansion. Its book of business grew by 29% during the 1 January 2024 renewal campaign. This segment is a key growth driver due to its financial success and diversification.

Ageas strategically partners in Asia, focusing on high-growth markets. A key alliance involves China Taiping Insurance Company. In 2024, Ageas boosted its stake in Taiping Pension to 10%. These partnerships diversify the group and tap into expanding insurance sectors, driving performance. For example, in the first half of 2024, Ageas's net profit rose to €630 million.

Data and AI initiatives

Ageas is heavily investing in data and AI. They're using it to improve underwriting, pricing, and customer service. This tech focus boosts efficiency and personalizes customer experiences. For instance, Ageas saw a 15% reduction in claims processing time in 2024 due to AI.

- Data-driven underwriting improvements.

- AI-enhanced customer service.

- Claims processing efficiency gains.

- Competitive market positioning.

Acquisition of esure (pending regulatory approval)

The acquisition of esure is a strategic move for Ageas, aiming to bolster its UK presence. This acquisition, slated for completion in the latter half of 2025, will position Ageas as the third-largest player in the UK personal lines market. Ageas projects substantial top-line growth by 2028, driven by expanded customer reach and diversified distribution. This strategic expansion aligns with Ageas's focus on growth and market consolidation.

- Acquisition expected in H2 2025.

- Creates third-largest UK personal lines platform.

- Aims for significant top-line growth by 2028.

- Diversifies distribution and customer base.

Stars in Ageas’s BCG matrix, like Ageas Re, show strong growth potential. Ageas Re saw its book of business surge by 29% in 2024, showcasing its financial prowess. Strategic partnerships and investments also fuel this growth.

| Segment | Performance Metric (2024) | Strategic Focus |

|---|---|---|

| Ageas Re | Book of Business Growth: +29% | Expansion & Diversification |

| Asia Partnerships | Taiping Pension Stake: +10% | High-Growth Markets |

| Ageas UK | Gross Written Premiums: Increased | Broker Distribution |

Cash Cows

Ageas maintains a strong leadership position in the Belgian life insurance market, holding a significant market share. This dominance translates into a steady stream of revenue and robust cash flow. In 2024, Ageas Belgium's net profit reached EUR 402 million. The anticipated uptick in interest rates is poised to improve margins for Ageas' guaranteed business.

Ageas is a "Cash Cow" in the BCG Matrix due to its strong presence in the Belgian non-life insurance market. The company's robust market share and operational efficiency generate steady cash flows. In 2024, Ageas's non-life business in Belgium saw a combined ratio of approximately 93%, showcasing profitability. This segment provides predictable income, supporting other business ventures.

Ageas focuses on long-term partnerships, boosting distribution and market reach. These collaborations create a stable revenue base. In 2024, Ageas operates in multiple countries. The company's strategy includes subsidiaries and key distributors.

Saga partnership in the UK

Ageas's 20-year UK partnership with Saga, focusing on motor and home insurance for the over-50s, is a strategic move. This collaboration, leveraging Saga's established brand, aims for a stable revenue stream. The Affinity Partnership's operational readiness is targeted for Q4 2025. This partnership is expected to generate significant returns.

- Partnership duration: 20 years, providing long-term stability.

- Target market: Over-50s, a demographic with specific insurance needs.

- Operational Readiness Date: Q4 2025, marking the partnership's launch.

- Revenue stream: Stable, leveraging Saga's strong brand and customer base.

Strong operating performance in Portugal

Ageas holds a powerful position in Portugal, securing the second spot in life insurance and third in non-life insurance markets. Portugal's Life inflows saw a strong rebound in 2024, growing by 53% at a constant scope, signaling recovery. This business unit showcases solid operational results, significantly supporting Ageas's cash cow status. The market maturity and efficient operations in Portugal contribute to consistent profitability.

- Ageas ranks second in life and third in non-life insurance in Portugal.

- Life inflows in Portugal increased by 53% in 2024.

- The Portuguese market is mature and operationally efficient.

Ageas's "Cash Cow" status is bolstered by its strong market positions and operational efficiency. These segments generate consistent cash flows, fueling further investments. In 2024, Ageas Belgium's net profit was EUR 402 million. These stable profits contribute to Ageas's financial health.

| Market Segment | 2024 Performance | Key Factor |

|---|---|---|

| Belgium Non-Life | Combined Ratio: ~93% | Operational Efficiency |

| Portugal Life Inflows | +53% growth | Market Recovery |

| Ageas Belgium Net Profit | EUR 402 million | Steady Revenue |

Dogs

Ageas' exit from UK commercial lines in 2022, including the sale to AXA, highlights underperformance. These lines likely struggled with low growth and market share. This strategic shift allowed Ageas UK to focus on personal lines. In 2024, Ageas's focus remains on core markets, optimizing its portfolio.

In the Ageas BCG Matrix, "dogs" represent insurance products with low market share in a slow-growth market. These might be outdated offerings like certain legacy life insurance policies. Turning around these products demands substantial investment. For example, in 2024, some traditional life insurance products saw a market share decline of about 5%.

Ageas's presence in volatile markets, like some in Asia, can be categorized as 'dogs' in its BCG Matrix due to low returns and economic instability. China's market, facing a low-interest-rate environment, is a key example. This environment impacts Beijing's accounting standards. In 2024, Ageas anticipates a slowdown in its Asian markets due to these economic headwinds.

Legacy IT systems before transformation

Before Ageas's tech overhaul, legacy IT systems could be classified as "dogs" in a BCG matrix, consuming resources without yielding significant returns. These systems hampered agility and competitiveness, typical of low-growth, low-market-share business units. Ageas UK's digital transformation has since generated benefits, indicating a shift away from this status. For example, Ageas UK has been able to generate “£6m in terms of benefit to the to the business”.

- Inefficient Legacy Systems

- Hindered Agility

- Costly Maintenance

- Digital Transformation Benefits

Products facing regulatory headwinds

Insurance products hit by tough regulations, leading to higher costs and lower profits, could be considered 'dogs' in the BCG matrix. These products might struggle to survive long-term due to regulatory changes. For example, in 2024, compliance costs for financial services rose by an estimated 15%, impacting profitability. Personal lines brokers face key concerns around regulation and customer retention.

- Compliance costs for financial services increased by 15% in 2024.

- Regulatory changes can make products unsustainable.

- Retention is a key concern for personal lines brokers.

In the Ageas BCG Matrix, "dogs" are insurance products with low market share in slow-growth markets. These products face challenges like regulatory hurdles, outdated tech, and economic instability. By 2024, underperforming products, such as legacy life insurance policies, have market share declines, highlighting the need for strategic shifts. Ageas aims to cut underperforming units.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Share Decline | Legacy Life Insurance | Approx. 5% drop |

| Compliance Cost Increase | Financial Services | Estimated 15% rise |

| Strategic Focus | Ageas's Core Markets | Optimizing portfolio |

Question Marks

Ageas is expanding into the Small and Medium Enterprise (SME) market, a sector with substantial growth potential. This expansion requires considerable investment to capture market share. The company aims to surpass the non-life market's performance. Ageas's strategy involves encouraging market adoption of its products, aiming for rapid market share growth to avoid becoming a "dog". In 2024, the SME insurance market in Europe is valued at approximately €80 billion.

New digital insurance products, like those at Ageas, fit the question mark category in the BCG Matrix, needing significant investment. These innovative products aim to meet evolving customer demands and utilize new tech. Success hinges on effective marketing and development, as customer adoption is crucial. For example, in 2024, digital insurance premiums grew by 15% globally, indicating market potential.

Ageas Re's push into new reinsurance areas, like Credit & Surety by 2025, positions it as a question mark. These ventures promise growth but demand strategic investment. Since 2023, Ageas Re has expanded globally, writing third-party premiums in over 50 countries. In 2024, Ageas Re's gross written premiums increased to €1.1 billion, marking a significant growth phase.

Investments in AI-driven customer segmentation

Ageas is venturing into AI-driven customer segmentation, a "question mark" in its BCG Matrix. This approach aims to revolutionize market strategy. By leveraging AI, Ageas intends to transform data into personalized customer journeys. Success hinges on effective implementation. AI-driven initiatives have the potential to significantly improve customer engagement.

- In 2024, the AI market for customer segmentation is projected to reach $2.5 billion globally.

- Companies using AI for personalization see a 20% increase in customer satisfaction.

- Successful AI implementation can boost customer lifetime value by 15%.

- Data breaches related to AI-driven segmentation have increased by 10% in the last year.

New savings products in specific markets (e.g., Portugal)

New savings products, such as those introduced in Portugal, are currently classified as question marks within the Ageas BCG matrix. These products are in the initial stages of growth, and their future success is uncertain. For instance, Ageas saw growth driven by new savings products in Portugal.

To transition from a question mark to a star, these products must demonstrate strong, sustained performance. They need to attract a substantial customer base and generate significant revenue. Inflows from Türkiye almost doubled due to progress across all business lines.

The future of these savings products hinges on their ability to capture and retain market share effectively. Ageas's strategy involves careful monitoring and strategic adjustments to optimize the growth potential of these offerings. The company's performance in 2024 will be crucial in determining the future of these products.

- Question mark represents products with low market share in a high-growth market.

- New savings products in Portugal show initial growth.

- These products need sustained performance to become stars.

- Inflows from Türkiye almost doubled in 2024.

Question marks in the Ageas BCG matrix are products with low market share in high-growth markets, needing significant investment. New savings products in Portugal and digital insurance offerings exemplify this category. For these products to succeed, strong, sustained performance is essential to transition them into stars.

| Aspect | Details | 2024 Data |

|---|---|---|

| Digital Insurance Growth | Market Expansion | 15% premium growth globally |

| AI Customer Segmentation | Market Value | $2.5B market projected |

| Ageas Re Growth | Gross Written Premiums | €1.1B |

BCG Matrix Data Sources

Ageas's BCG Matrix uses financial statements, market analysis, and expert assessments to provide a data-driven strategic view.