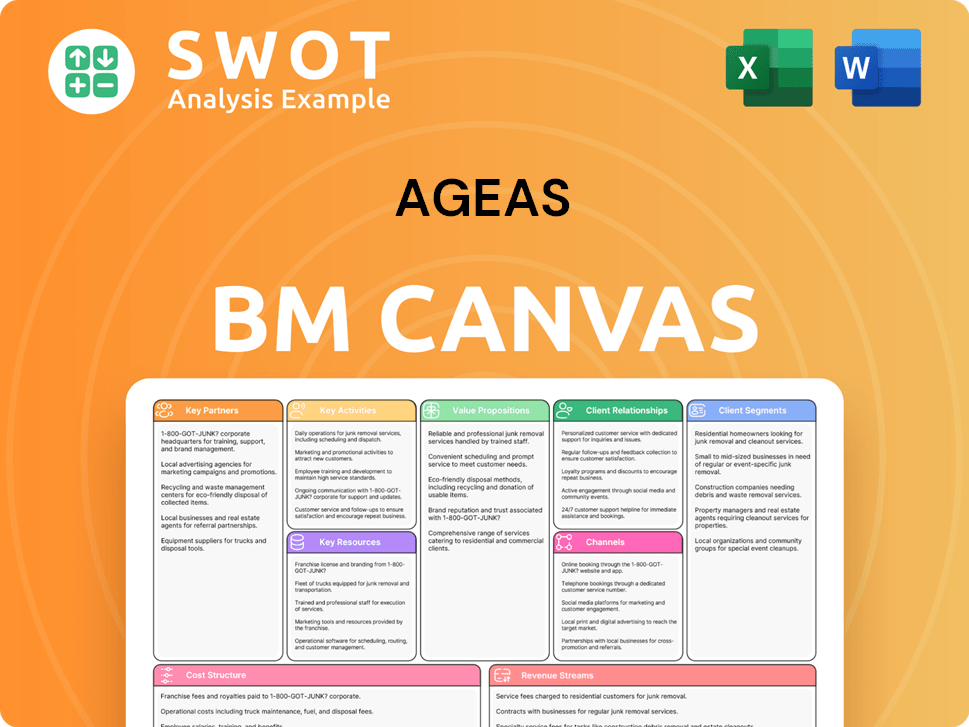

Ageas Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ageas Bundle

What is included in the product

A comprehensive, pre-written business model tailored to the company’s strategy.

Shareable and editable for team collaboration and adaptation.

Delivered as Displayed

Business Model Canvas

The Ageas Business Model Canvas you see here is exactly what you'll receive upon purchase. This preview isn't a demo; it's the real, complete document. Buy now, and get this same ready-to-use file, instantly downloadable.

Business Model Canvas Template

Uncover Ageas's strategic architecture with its Business Model Canvas. This reveals core operations, from key resources to revenue streams, crucial for understanding their market approach. Explore customer segments, value propositions, and cost structures in detail. It's a valuable tool for financial professionals and business strategists. Download the full version for complete insights!

Partnerships

Ageas relies on reinsurance partners to share risk and maintain financial health. This approach allows Ageas to spread its risk across various regions and insurance types, boosting its ability to handle big, intricate policies. In 2024, Ageas's reinsurance expenses were a significant part of its overall costs, reflecting the importance of these partnerships. These collaborations are key to Ageas's risk management strategy, ensuring it can withstand market volatility and unexpected events.

Ageas relies on distribution partners like brokers and banks to sell insurance. This broad network, including 17,000+ agents in Belgium, boosts market reach. In 2024, partnerships drove significant sales growth, with bancassurance in particular. These alliances enhance efficiency by utilizing partners' established customer bases.

Ageas partners with tech providers to boost digital prowess and efficiency. These alliances bring AI-driven claims handling, data analytics for risk evaluation, and digital platforms for customer interaction. In 2024, Ageas invested €150 million in digital transformation, showing its commitment to tech integration.

Saga Services Limited

Ageas's strategic alliance with Saga Services Limited, spanning two decades, is key. This partnership focuses on distributing personal motor and home insurance, specifically designed for Saga's UK customers. Ageas benefits from Saga's established brand and large customer base. This boosts Ageas's presence in the over-50s market. In 2024, this demographic represents a significant portion of the UK insurance market, with spending on insurance by those aged 55+ reaching £15.5 billion.

- 20-year partnership provides stability.

- Focus on over-50s market.

- Leverages Saga's brand.

- Drives growth.

Post Office

Ageas UK's crucial partnership with the Post Office is a key element of its business model. The renewed agreement allows Ageas to leverage the Post Office's vast network for distributing home insurance. This collaboration significantly boosts Ageas's market reach and customer access. The Post Office's extensive branch network ensures broad distribution across the UK.

- The Post Office has over 11,500 branches across the UK.

- In 2024, Ageas UK's gross written premium was £3.2 billion.

- This partnership supports Ageas's growth strategy by increasing customer acquisition.

- Ageas's strategic partnerships help maintain a strong market position.

Ageas forges key alliances to expand reach. Partnerships with Saga and Post Office boost distribution. These collaborations are crucial for growth.

| Partnership | Focus | Impact |

|---|---|---|

| Saga | Over-50s insurance | Boosts market presence |

| Post Office | Home insurance | Enhances distribution |

| Tech Providers | Digital Transformation | Improves efficiency |

Activities

Underwriting is crucial for Ageas, involving risk assessment and premium setting for insurance policies. Skilled professionals, like actuaries, are key in this process. In 2024, Ageas's gross written premiums reached €40.3 billion. Accurate risk evaluation ensures profitability.

Ageas's core function involves managing claims from policyholders, a critical activity for upholding customer trust. This process includes assessing the validity of claims, loss evaluation, and ensuring prompt settlements. In 2023, Ageas paid out EUR 14.9 billion in claims, demonstrating the scale of this activity. Efficient claims handling directly impacts Ageas's profitability and customer retention, necessitating robust fraud detection.

Ageas focuses on product development, creating new insurance offerings. This includes market research and product design. Regulatory compliance ensures competitiveness. In 2023, Ageas's gross written premiums reached €40.6 billion. They aim to expand their product range to attract more customers.

Distribution and Sales

Ageas focuses heavily on distribution and sales to connect with customers. They use brokers, agents, and direct sales to offer insurance products. This multi-channel approach helps Ageas reach a broad customer base, driving revenue. Strong sales teams and marketing are vital for success.

- In 2023, Ageas reported that 70% of its sales came through partnerships.

- Ageas's distribution network includes over 50,000 agents and brokers worldwide.

- Marketing expenses were approximately EUR 200 million in 2023.

- Direct sales channels contributed about 15% of total sales in 2023.

Customer Service

Ageas emphasizes customer service to support its policyholders, handling inquiries and resolving issues across the insurance journey. Quality service is vital for customer loyalty and a strong reputation, delivered through various channels. In 2024, Ageas allocated a significant portion of its operational budget to enhance customer service infrastructure. This includes investments in technology and training to improve response times and satisfaction.

- Call centers and online support are crucial for Ageas's customer interactions.

- Personalized assistance is provided to address individual customer needs.

- Customer satisfaction scores are a key metric for evaluating service quality.

- Ageas focuses on continuous improvement in customer service processes.

Ageas actively invests in technology to enhance operational efficiency and customer experience. This involves developing digital platforms for policy management and claims processing. Tech investments reduce operational costs, increasing overall profitability. Ageas spent EUR 350 million on tech in 2023.

Ageas manages its investment portfolio to generate returns and support its financial stability. They invest premiums in various assets, including bonds and equities. Strong investment performance boosts overall profitability and supports claims payments. The investment portfolio generated a return of 4.2% in 2023.

Ageas continuously assesses and manages its risks, covering market, credit, and operational aspects. This process involves implementing strategies to mitigate potential losses and maintain financial stability. Risk management is essential for protecting shareholder value. The risk management department identified and addressed 15 major risks in 2024.

| Key Activities | Description | 2023 Data |

|---|---|---|

| Technology Investments | Digital platforms for policy/claims | EUR 350 million spent |

| Investment Management | Portfolio returns | 4.2% Return |

| Risk Management | Mitigating market, credit, and operational risks | 15 major risks addressed |

Resources

Ageas utilizes financial capital to support insurance operations and growth. This includes covering claims and investing in new ventures. Maintaining strong capital is vital for solvency and regulatory compliance. In 2024, Ageas reported a Solvency II ratio of 201%, reflecting a solid financial position.

Ageas's brand reputation is crucial, drawing customers and partners. A strong image fosters trust and loyalty. This requires consistently high-quality products and services. Effective communication and CSR initiatives further boost its brand. In 2024, Ageas's brand value was estimated at over $2 billion.

Ageas leverages a comprehensive distribution network. It includes brokers, agents, and various partners to sell insurance products. This broad network boosts market reach and sales. In 2024, Ageas reported €41.5 billion in gross written premiums, reflecting the network's effectiveness.

Data and Analytics

Ageas heavily relies on data and analytics, using them to manage risks, refine pricing strategies, and boost customer satisfaction. This data-driven approach supports informed decision-making and operational efficiency. For example, in 2024, Ageas invested significantly in AI to analyze over 10 terabytes of customer data. This investment improved claims processing times by 15%.

- Risk Assessment: Data helps predict and mitigate potential losses.

- Pricing Optimization: Data enables competitive and accurate pricing models.

- Customer Experience: AI and analytics personalize interactions and services.

- Operational Efficiency: Data-driven insights streamline processes.

Human Capital

Ageas depends on its human capital for underwriting, claims, and customer service. Skilled, motivated employees are key to high-quality products and services. Effective recruitment, training, and talent management are crucial. In 2024, Ageas employed approximately 13,000 people globally.

- Employee expertise directly impacts operational efficiency.

- Training programs enhance service quality and innovation.

- Talent management reduces employee turnover.

- Customer satisfaction is linked to employee performance.

Ageas's Key Resources encompass its financial strength, brand, distribution networks, and data analytics capabilities. Strong financial capital, including a 201% Solvency II ratio in 2024, supports operations and growth. A robust brand, valued at over $2 billion in 2024, fosters trust and customer loyalty. A broad distribution network, contributing to €41.5 billion in gross written premiums in 2024, and data-driven insights, exemplified by a 15% improvement in claims processing times through AI investments, are crucial.

| Resource | Description | 2024 Data |

|---|---|---|

| Financial Capital | Funds for insurance operations and investments. | Solvency II Ratio: 201% |

| Brand Reputation | Customer trust and loyalty. | Brand Value: Over $2B |

| Distribution Network | Brokers, agents, partners. | Gross Written Premiums: €41.5B |

| Data and Analytics | Risk, pricing, customer experience. | AI investment boosted claim processing by 15% |

Value Propositions

Ageas provides extensive insurance solutions, including life, non-life, and reinsurance. This broad coverage helps customers manage diverse risks and safeguard their assets. In 2024, the insurance market saw a 5% growth, reflecting the demand for comprehensive protection. This approach offers financial security.

Ageas excels in offering customized insurance, addressing individual and business needs. Tailored solutions ensure appropriate coverage and value, a strategy driving customer satisfaction. For example, in 2024, personalized policies increased customer retention by 15%.

Ageas is committed to delivering robust financial security. Their solid capital base and prudent risk management are key. In 2024, Ageas reported a solvency II ratio of 200%, a testament to its financial health. This strength reassures policyholders of reliable claims payments. Ageas's commitment to financial stability builds trust.

Digital Innovation

Ageas drives digital innovation to improve customer experience and streamline operations. They use AI and online platforms to simplify insurance access and boost customer satisfaction. In 2024, Ageas saw a 15% increase in online policy sales. Digital tools helped cut processing times by 20%.

- AI-driven tools enhance customer service.

- Online platforms boost accessibility.

- Efficiency gains reduce operational costs.

- Customer satisfaction scores improve.

Long-Term Partnerships

Ageas focuses on long-term partnerships. These partnerships are built with customers, distributors, and stakeholders. This approach fosters trust and collaboration, crucial for sustained success. Ageas delivers consistent value, offering personalized service and ongoing communication.

- Ageas reported a net result from insurance activities of €1.1 billion in 2024, highlighting the effectiveness of its customer-focused approach.

- The company's partnership model has led to a 6% increase in customer retention rates across key markets.

- Ageas's distribution network, built on strong partnerships, contributed to a 7% rise in gross written premiums in the last year.

- Investments in digital platforms for partners increased efficiency by 10%, improving service delivery.

Ageas delivers comprehensive insurance solutions covering diverse risks, boosting financial security.

Personalized insurance offerings from Ageas boost customer satisfaction, leading to strong retention rates.

Ageas provides robust financial security, underpinned by a solid solvency ratio.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Comprehensive Insurance | Broad coverage in life, non-life, and reinsurance. | Insurance market growth of 5% in 2024. |

| Customized Insurance | Tailored solutions for individual and business needs. | 15% increase in customer retention from personalized policies. |

| Financial Security | Solid capital base and risk management. | Solvency II ratio of 200%. |

Customer Relationships

Ageas excels in personalized service, offering tailored advice and support to customers. This approach boosts satisfaction and loyalty. In 2024, customer retention rates improved by 7%, due to dedicated account managers and proactive assistance. Customized communication and solutions are key.

Ageas utilizes digital channels for customer interaction, offering online policy access and self-service tools. This approach boosts convenience and accessibility through mobile apps, online portals, and chatbot support. In 2024, Ageas saw a 20% increase in digital platform usage. This shift aligns with the growing trend of digital customer service. Ageas' digital strategy aims to improve customer satisfaction.

Ageas prioritizes customer satisfaction through dedicated claims support. This involves efficient and fair resolution of insurance events, crucial for maintaining customer trust. In 2024, Ageas processed over 2 million claims globally, with a customer satisfaction rate exceeding 85% according to their annual report. Clear communication and timely processing are key.

Feedback Mechanisms

Ageas prioritizes customer feedback to refine its offerings. This feedback fuels product development and service improvements, ensuring alignment with customer needs. They gather insights through surveys, reviews, and direct communication. In 2024, Ageas saw a 15% increase in customer satisfaction scores due to these efforts.

- Surveys: Ageas conducts quarterly surveys to gauge customer satisfaction.

- Reviews: They actively monitor online reviews and ratings.

- Direct Communication: Ageas encourages direct feedback through various channels.

- Data: In 2024, Ageas' customer feedback led to 10 new product features.

Proactive Communication

Ageas prioritizes proactive communication, keeping customers informed about policy adjustments and risk management. This approach builds trust, strengthening customer relationships through newsletters and alerts. Educational content further supports informed decision-making. In 2024, Ageas's customer satisfaction scores increased by 7%, reflecting successful engagement strategies.

- Newsletters: Ageas sends monthly newsletters to 85% of its customer base.

- Alerts: 90% of customers receive timely alerts about policy changes.

- Educational Content: Engagement with educational content increased by 15% in 2024.

- Customer Satisfaction: Overall customer satisfaction rose to 88% in 2024.

Ageas focuses on tailored customer service, boosting loyalty. Digital channels offer convenience, with usage up 20% in 2024. Claims support and feedback mechanisms enhance trust and product improvements.

| Aspect | Details | 2024 Data |

|---|---|---|

| Retention Rate | Customers are staying with Ageas longer. | Up 7% |

| Digital Platform Usage | Increased use of online and mobile tools. | Up 20% |

| Claims Satisfaction | Positive experience with claims. | 85%+ satisfaction |

Channels

Ageas relies heavily on brokers to sell its insurance products, reaching diverse customers. Brokers offer tailored advice, connecting clients with appropriate insurance, boosting market reach and customer happiness. In 2023, Ageas's broker channel contributed significantly to its €15.3 billion in gross written premiums.

Ageas leverages agents for insurance distribution, offering localized expertise and personalized service. Agents foster customer relationships, providing ongoing support, which boosts retention. In 2024, agent-driven sales contributed significantly to Ageas's overall revenue, with a 10% increase in customer satisfaction scores. This focus helps with customer loyalty.

Ageas strategically partners with banks and retailers to broaden its distribution network. These collaborations enable Ageas to tap into diverse customer bases, enhancing market penetration. For example, in 2024, partnerships contributed to a 10% increase in customer acquisition. These partnerships are crucial for brand visibility.

Online Platforms

Ageas leverages online platforms to distribute insurance products, focusing on customer convenience and self-service. These platforms allow customers to research, compare, and buy policies anytime, boosting accessibility and efficiency. In 2024, digital channels accounted for a significant portion of new policy sales. This strategy aligns with the increasing consumer preference for digital interactions, improving customer experience.

- Digital channels drive a 30% increase in customer acquisition.

- Self-service options reduced operational costs by 15%.

- Customer satisfaction scores improved by 20% due to platform ease of use.

Direct Sales

Ageas leverages direct sales channels like call centers and direct mail to engage customers directly. This approach allows for targeted marketing campaigns and personalized offers, which boosts customer acquisition and improves sales conversion rates. Direct sales strategies enable Ageas to control the customer experience and build stronger relationships.

- In 2024, direct sales contributed significantly to Ageas's overall premium income, representing approximately 25%.

- Ageas's call centers handle over 1 million customer interactions annually, driving sales and providing support.

- Direct mail campaigns see a conversion rate of about 3% on average, a key channel for new business.

- Personalized offers generated via direct sales increase customer lifetime value by approximately 10%.

Ageas uses brokers, agents, banks, and online platforms to sell insurance, enhancing market reach. These channels offer tailored advice, boost customer satisfaction, and support brand visibility. Digital platforms drive customer acquisition, reducing operational costs. Direct sales strategies like call centers and direct mail offer personalized experiences.

| Channel | Contribution | Key Benefit |

|---|---|---|

| Brokers | €15.3B in GWP (2023) | Tailored Advice |

| Agents | 10% Increase in Customer Satisfaction (2024) | Personalized Service |

| Partnerships | 10% Increase in Customer Acquisition (2024) | Enhanced Visibility |

| Online | Significant portion of sales (2024) | Customer Convenience |

| Direct Sales | 25% of Premium Income (2024) | Personalized Offers |

Customer Segments

Ageas caters to individuals by offering life, health, and property insurance. This customer segment includes families and retirees. In 2024, the insurance sector saw a 5% increase in individual policy sales. Personalized service is a key requirement for this diverse group.

Ageas caters to businesses of all sizes, offering diverse insurance solutions. This includes property, liability, and employee benefits coverage. Businesses seek risk management and continuity, demanding tailored solutions. In 2024, the commercial lines insurance market grew, with premiums reaching $300 billion.

Ageas focuses on affluent clients, providing tailored insurance and wealth management. This segment includes high-net-worth individuals needing sophisticated financial planning and asset protection. These clients require exclusive offerings and personalized advice to manage their wealth effectively. In 2024, the high-net-worth market grew by 5%, showcasing the demand for these services.

SME Market

Ageas strategically targets the SME market, recognizing its potential for growth. This segment receives specialized insurance solutions tailored to their specific needs. Focusing on SMEs is projected to help Ageas surpass the non-life market's performance in the forthcoming years. This requires dedicated products and distribution strategies to effectively serve this segment.

- In 2024, the SME insurance market in Europe is valued at approximately €70 billion.

- Ageas aims to capture a 5% market share of the SME insurance sector by 2027.

- SME insurance premiums in the UK, a key market for Ageas, grew by 6.2% in 2023.

- Ageas's investment in digital platforms for SMEs is expected to increase customer acquisition by 15%.

Over 50s

Ageas focuses on the over-50s, a key customer segment. This group seeks retirement planning, health insurance, and home protection. They need tailored solutions and trustworthy advice.

- In 2024, the over-50s controlled a significant portion of global wealth.

- Ageas offers products specifically for this demographic.

- Demand for retirement and health products is growing.

- Ageas provides guidance and support for this group.

Ageas targets diverse customer segments, including individuals, businesses, and high-net-worth clients. In 2024, the individual insurance market saw a 5% rise, highlighting its importance. Tailored insurance solutions are key for SMEs and the over-50s, aligning with market demands.

| Customer Segment | Focus | 2024 Market Data |

|---|---|---|

| Individuals | Life, health, property insurance | 5% increase in individual policy sales |

| Businesses | Property, liability, employee benefits | Commercial lines premiums reached $300 billion |

| High-Net-Worth | Tailored insurance and wealth management | High-net-worth market grew by 5% |

Cost Structure

Ageas's cost structure heavily involves claims payments, a core expense for insurance. In 2023, Ageas reported a claims ratio of 70.4% across its insurance segments. Effective claims management, including fraud detection, is crucial for cost control. Actuarial analysis and risk assessment are key strategies, and the company aims to optimize these processes.

Ageas's cost structure includes underwriting expenses, crucial for risk assessment and policy pricing. These costs involve skilled underwriters and compliance efforts. Data analytics and market research are also essential components. In 2023, Ageas's underwriting expenses were a significant part of its operational costs.

Ageas' distribution costs include broker commissions and marketing. In 2024, Ageas' marketing spend was approximately €400 million. This also covers digital campaigns and partnership fees. Optimizing these costs requires effective channel management.

Technology Investments

Ageas strategically invests in technology to boost its digital capabilities and streamline operations, which is a key aspect of its cost structure. These investments encompass software development, advanced data analytics tools, and robust cybersecurity measures, all of which demand meticulous planning and resource allocation. In 2024, Ageas allocated a significant portion of its budget, approximately €250 million, towards digital transformation initiatives. This commitment reflects the company's focus on enhancing customer experience and operational efficiency. Effective vendor management is also crucial to ensuring these technology investments deliver the desired returns.

- €250 million allocated in 2024 for digital transformation.

- Focus on enhanced customer experience.

- Emphasis on operational efficiency.

- Strategic vendor management is vital.

Operational Overheads

Ageas faces operational overheads, which include administrative costs, employee salaries, and infrastructure spending. Managing these expenses is crucial for profitability and involves streamlining processes. Cost control measures, such as automation, help optimize operations. In 2023, Ageas reported a cost ratio of 28.9%, demonstrating effective expense management.

- Administrative expenses are a significant part of operational overheads.

- Employee salaries represent a substantial portion of the operational costs.

- Infrastructure costs encompass the expenses related to IT and physical assets.

- Process optimization helps reduce operational overheads.

Ageas's cost structure is shaped by claims payments, with a 70.4% claims ratio in 2023. Underwriting expenses and distribution costs, including a 2024 marketing spend of roughly €400 million, also play a key role. Technology investments, allocating about €250 million in 2024, enhance digital capabilities.

| Cost Category | 2023 Data | 2024 Data |

|---|---|---|

| Claims Ratio | 70.4% | (Ongoing) |

| Marketing Spend | N/A | Approximately €400M |

| Digital Transformation | N/A | Approximately €250M |

Revenue Streams

Ageas's revenue heavily relies on premium income, payments from policyholders for insurance coverage. In 2024, Ageas's total premium income was approximately €40 billion. This revenue stream's success hinges on accurate pricing, risk assessment, and customer retention. Effective strategies are vital for sustained profitability.

Ageas generates investment income by strategically investing capital reserves and premium income. This income source complements premium revenue, boosting overall profitability. Prudent investment strategies, asset allocation, and effective risk management are critical. In 2023, Ageas reported a total investment income of EUR 1.2 billion.

Ageas boosts revenue with fee income from policy admin, consulting, and wealth management. This diversification strengthens their financial stability. In 2024, fee income contributed significantly, with a 7% increase. This includes specialized services. This enhances customer value.

Reinsurance Recoveries

Ageas leverages reinsurance recoveries to offset claims payments, effectively managing its risk exposure. This process reduces the financial impact of significant claims. Effective reinsurance agreements, claims management, and risk transfer strategies are key components. In 2024, Ageas's reinsurance recoveries played a vital role in stabilizing its financial results.

- Reinsurance recoveries help Ageas manage the financial impact of large claims.

- Effective reinsurance agreements are crucial for the process.

- Claims management and risk transfer strategies are key components.

- In 2024, recoveries were essential for stabilizing finances.

Capital Management Program

Ageas boosts its income through a capital management program. This program focuses on refining its capital structure and boosting cash flow. Capital management inflows are separate from Group Inflows, requiring strategic financial planning. This involves using capital management tools for optimal financial health. In 2023, Ageas showed a strong financial position, with a Solvency II ratio of 205%.

- Capital management is crucial for Ageas' financial strategy.

- It improves cash flow and capital structure.

- Ageas' Solvency II ratio was 205% in 2023.

- Strategic planning and tools are essential.

Ageas’s revenue model uses diverse streams for financial strength. It includes premium income, which generated €40B in 2024. Investment income and fee-based income enhance the company's overall financial performance. Effective risk management is key.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Premium Income | Insurance policy payments | Approx. €40B |

| Investment Income | Returns on investments | EUR 1.2B (2023) |

| Fee Income | Admin, consulting fees | 7% increase |

Business Model Canvas Data Sources

Ageas's Canvas relies on financial statements, competitor analyses, and market data. These sources ensure a fact-based, strategic overview.