Agilysys Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agilysys Bundle

What is included in the product

Tailored analysis for Agilysys' product portfolio with investment and divestment recommendations.

Printable summary optimized for A4 and mobile PDFs, ensuring easy sharing and review.

What You’re Viewing Is Included

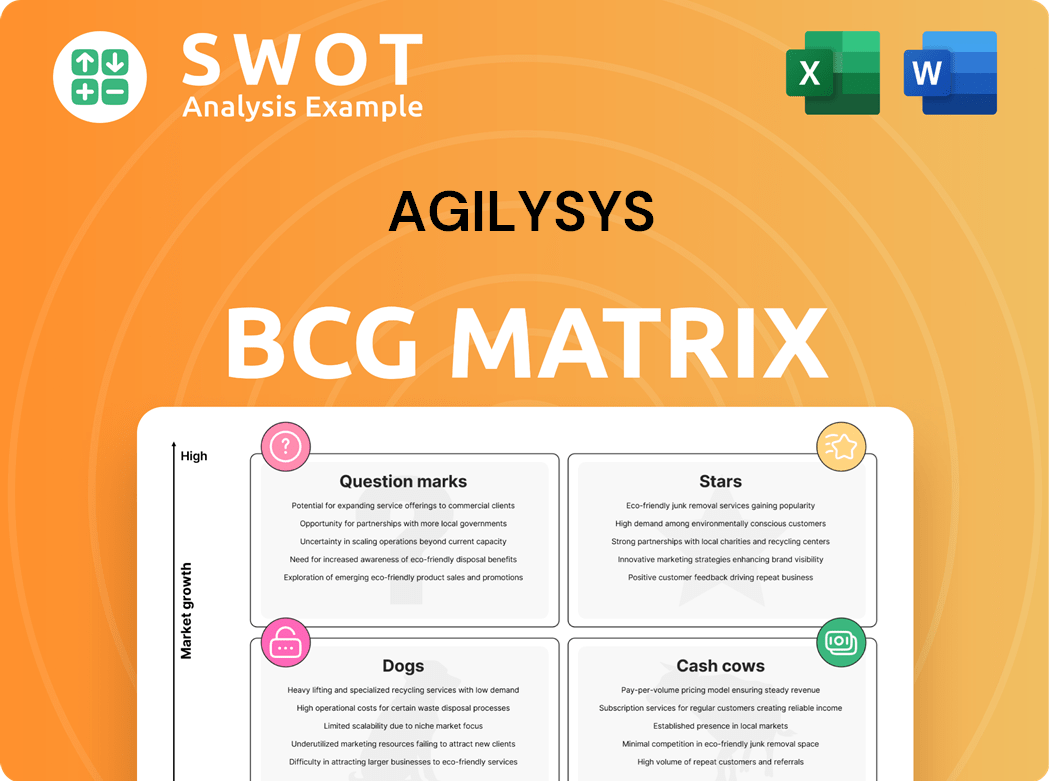

Agilysys BCG Matrix

The Agilysys BCG Matrix preview is the same report you'll receive after purchase. This comprehensive document, with data and insights, is ready for immediate implementation within your business strategies.

BCG Matrix Template

Agilysys's product portfolio, analyzed through a BCG Matrix, reveals key insights into its market positioning. This snapshot highlights the relative market share and growth potential of its offerings.

Discover which products are market leaders (Stars) and which require strategic attention (Dogs or Question Marks). The matrix provides a visual representation of its business units.

Understand resource allocation and growth strategies at a glance. Gain a clear picture of its current standing in the market.

Dive deeper into Agilysys’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Agilysys's subscription revenue is a 'star' in its BCG Matrix. In Q3 Fiscal 2025, it showed a 45.1% year-over-year increase. This growth highlights strong demand for their subscription services within the hospitality sector. This positions subscription revenue as a key driver for the company.

The Book4Time integration is a 'star' for Agilysys. This acquisition has broadened the customer base and product range. It's boosting subscription revenue. Agilysys saw a 17% increase in total revenue in fiscal year 2024, with subscription revenue being a key driver.

Agilysys excels with its cloud-native solutions, a 'star' in its BCG Matrix. Its hospitality-focused software boosts Return on Experience (ROE), making interactions profitable. In 2024, cloud revenue grew, reflecting market success. This positions Agilysys strongly.

Property Management Systems (PMS)

Agilysys' Property Management Systems (PMS) shine as a 'star' in its portfolio. These systems are integral for managing hotel operations and guest data. They boost efficiency and enhance the guest experience, driving revenue growth. In 2024, the hospitality industry saw a 6.5% rise in PMS adoption.

- Essential for hotel operations.

- Enhances guest experiences.

- Drives revenue growth.

- Adoption saw a 6.5% rise in 2024.

Point-of-Sale (POS) Solutions

Agilysys' POS solutions, like IG Fly, are 'stars', enhancing customer satisfaction through seamless transactions. They offer integrated payment solutions, speeding up service. Innovation is ongoing, with new mobile ordering and payment options. The POS segment is vital for hospitality.

- In 2024, the global POS terminal market was valued at approximately $100 billion.

- Agilysys' revenue in fiscal year 2024 was $238.9 million, with a significant portion from POS solutions.

- IG Fly is a mobile ordering and payment solution launched in 2024.

Agilysys' stars are its high-growth, high-share business units. These include subscription revenue, fueled by a 45.1% YoY increase in Q3 FY2025. POS solutions and PMS also shine, essential for hospitality.

| Component | Description | 2024 Data |

|---|---|---|

| Subscription Revenue | Key growth driver | Up 17% YoY |

| POS Solutions | Enhance customer satisfaction | Global market ~$100B |

| PMS | Hotel operation systems | Adoption up 6.5% |

Cash Cows

Agilysys' maintenance services are a cash cow, providing steady revenue. These services ensure software operates smoothly and offer client support. In 2024, recurring revenue streams like these were vital. Agilysys reported consistent cash flow from maintenance contracts, with minimal reinvestment needed.

Agilysys benefits from enduring customer relationships in hospitality, a sector it has served for years. These relationships provide a steady income stream, crucial for financial stability. In 2024, Agilysys reported a 15% increase in recurring revenue, showcasing the value of these ties. This translates into predictable revenue, underpinning its 'cash cow' status.

Agilysys dominates the hospitality software space. They serve diverse clients like hotels and casinos. This solid market presence fuels consistent revenue, making them a 'cash cow'. In 2024, Agilysys reported revenue of $287.1 million.

Inventory and Procurement (I&P) Systems

Agilysys' Inventory and Procurement (I&P) systems are vital for hospitality clients, helping them manage food and beverage inventory, streamline procurement, and cut expenses. These systems are crucial for generating consistent revenue for Agilysys, solidifying their status as a 'cash cow'. In 2024, the I&P segment contributed significantly to Agilysys' recurring revenue stream, showing its stability.

- I&P systems help optimize inventory management, reducing waste and improving efficiency.

- Procurement processes are streamlined, leading to cost savings for clients.

- The consistent revenue from I&P systems makes them a 'cash cow' for Agilysys.

- This segment provides a stable financial foundation for the company.

Professional Services

Professional services remain a substantial part of Agilysys' revenue, even after the conclusion of a major project. These services are crucial, assisting clients in implementing and tailoring Agilysys' software. This segment acts as a cash cow, steadily contributing to the company's financial stability. In Q3 2024, professional services brought in $23.2 million.

- Significant Revenue Source

- Customer Implementation Support

- Consistent Financial Contribution

- $23.2M in Q3 2024

Agilysys' cash cows are marked by recurring revenue streams and established market positions. Maintenance services and enduring client relationships provide stable income. In 2024, Agilysys' revenue reached $287.1 million. Inventory and Procurement systems also act as cash cows, and in Q3 2024, professional services brought in $23.2 million.

| Cash Cow Element | Description | 2024 Data |

|---|---|---|

| Maintenance Services | Recurring revenue, client support | Consistent cash flow |

| Client Relationships | Steady income, hospitality focus | 15% increase in recurring revenue |

| Market Presence | Dominance in hospitality software | $287.1 million revenue |

| I&P Systems | Inventory management, procurement | Significant recurring revenue |

| Professional Services | Implementation, customization | $23.2 million in Q3 2024 |

Dogs

Agilysys experienced a decline in one-time product revenue, especially in managed food services, during its modernization phase. This downturn affected the company's financial results, causing a decrease in its total revenue guidance for 2024. Specifically, the company's Q1 2024 product revenue decreased by 19% year-over-year. This situation indicates low growth. This makes the one-time product revenue a 'dog' in the BCG Matrix.

Agilysys' hardware revenue struggles persist, affecting product revenue negatively. This situation indicates that hardware offerings may lack competitiveness compared to software solutions. For instance, in Q2 2024, product revenue, which includes hardware, decreased, reflecting these challenges. This underperformance aligns with the 'dog' classification in the BCG Matrix, indicating low market share in a slow-growth industry.

Agilysys faces POS sales challenges, especially in managed food services. These issues have hurt revenue and profitability. The POS segment is deemed a 'dog'. In Q1 2024, Agilysys reported a decline in POS revenue.

Traditional Revenue Models

Traditional revenue models in hospitality, like Revenue Per Available Room (RevPAR), are becoming obsolete. Agilysys recognizes this, labeling these models as "dogs" in its BCG matrix. RevPAR's limitations restrict revenue growth in today's market. The industry increasingly focuses on metrics like Revenue Per Available Guest (RevPAG) to capture more revenue.

- RevPAR's focus on room revenue ignores other revenue streams.

- RevPAG considers all guest spending, offering a broader view.

- In 2024, RevPAG is up 15% in certain markets.

- Agilysys's shift to RevPAG aligns with industry trends.

Siloed Technology

The hospitality sector's fragmented tech poses a significant risk. Agilysys's current systems, if not integrated, struggle to create a smooth operational flow. This siloed tech environment can be deemed a 'dog' in the BCG matrix, limiting efficiency and guest experience. A unified platform is crucial to enhance personalization and streamline operations.

- In 2024, 60% of hospitality businesses cited technology integration as a major challenge.

- Inefficient systems can lead to a 15% loss in operational productivity.

- Unified systems can boost guest satisfaction scores by up to 20%.

- Agilysys needs to address this tech fragmentation to stay competitive.

Dogs represent business units with low market share and low growth. Agilysys' one-time product revenue, hardware offerings, and POS sales are "dogs". These areas, including traditional models, show limited potential.

| Category | Description | 2024 Data |

|---|---|---|

| Product Revenue | Decline in one-time sales | Q1 2024 product revenue decreased by 19% year-over-year |

| Hardware Revenue | Struggles in hardware offerings | Q2 2024 product revenue decrease |

| POS Sales | Challenges in POS segment | Q1 2024 decline in POS revenue |

Question Marks

Agilysys' guestsense.ai, an embedded AI, boosts revenue and efficiency in PMS and POS systems. The hospitality AI market, valued at $1.2 billion in 2023, is projected to reach $5.3 billion by 2028. Despite high growth potential, guestsense.ai's market share is currently low, positioning it as a 'question mark' in the BCG matrix. This reflects the industry's shift towards AI-driven solutions.

Agilysys's IG Fly mobile POS is a 'question mark' in the BCG matrix due to its recent market entry. It offers on-the-go order, payment, and printing capabilities, aiming to enhance customer service. However, its current low market share reflects its nascent stage. Agilysys reported a 10% revenue growth in fiscal year 2024, with mobile POS contributing a small fraction.

The Agilysys Guest App, a mobile-first initiative, aims to boost guest experiences and uncover upsell chances. Despite promising guest engagement and revenue growth, its low market presence currently classifies it as a 'question mark' in Agilysys' BCG Matrix. For example, in Q3 2024, the app saw a user base increase of 15%, but overall revenue contribution remained minimal. The app's success hinges on quicker adoption and market penetration.

RevStream Analytics

RevStream Analytics, acquired via the Book4Time deal, represents a 'question mark' in Agilysys's BCG matrix due to its recent integration and evolving market presence. This tool offers sophisticated enterprise performance analysis for multi-location spas, potentially boosting revenue and streamlining operations. However, its current market share is still low, indicating a need for strategic growth. The company's 2024 revenue was $280.9 million, demonstrating a growth of 10.7% year-over-year.

- Book4Time acquisition enhanced Agilysys's spa analytics capabilities.

- Low market share signifies growth opportunities, requiring focused investment.

- The tool's features aim to optimize revenue and operational efficiency.

- Agilysys's 2024 financial performance shows solid, but potential for higher growth.

Digital Transformation Initiatives

Agilysys is actively involved in digital transformation initiatives, assisting hospitality businesses in modernizing their operations. These initiatives, while promising substantial growth, currently hold a relatively low market share. Consequently, within the BCG matrix, these endeavors are classified as "question marks," indicating a need for strategic investment and development. This is because the hospitality industry is rapidly evolving, with digital solutions becoming increasingly crucial for competitiveness.

- Agilysys focuses on helping hospitality businesses with digital transformation.

- These initiatives have high growth potential.

- They currently have a low market share.

- Therefore, they are categorized as 'question marks' in the BCG matrix.

Question marks in Agilysys' BCG matrix represent ventures with low market share but high growth potential. These include AI, mobile POS, and digital transformation initiatives. In 2024, Agilysys focused on boosting adoption and market penetration, seeking strategic investments. Agilysys's 2024 revenue reached $280.9 million.

| Initiative | Market Share | Growth Potential |

|---|---|---|

| guestsense.ai | Low | High (AI hospitality market projected to $5.3B by 2028) |

| IG Fly Mobile POS | Nascent | High |

| Guest App | Low | High (15% user base growth in Q3 2024) |

BCG Matrix Data Sources

The Agilysys BCG Matrix leverages financial reports, market trends, industry studies, and expert opinions for accurate analysis.