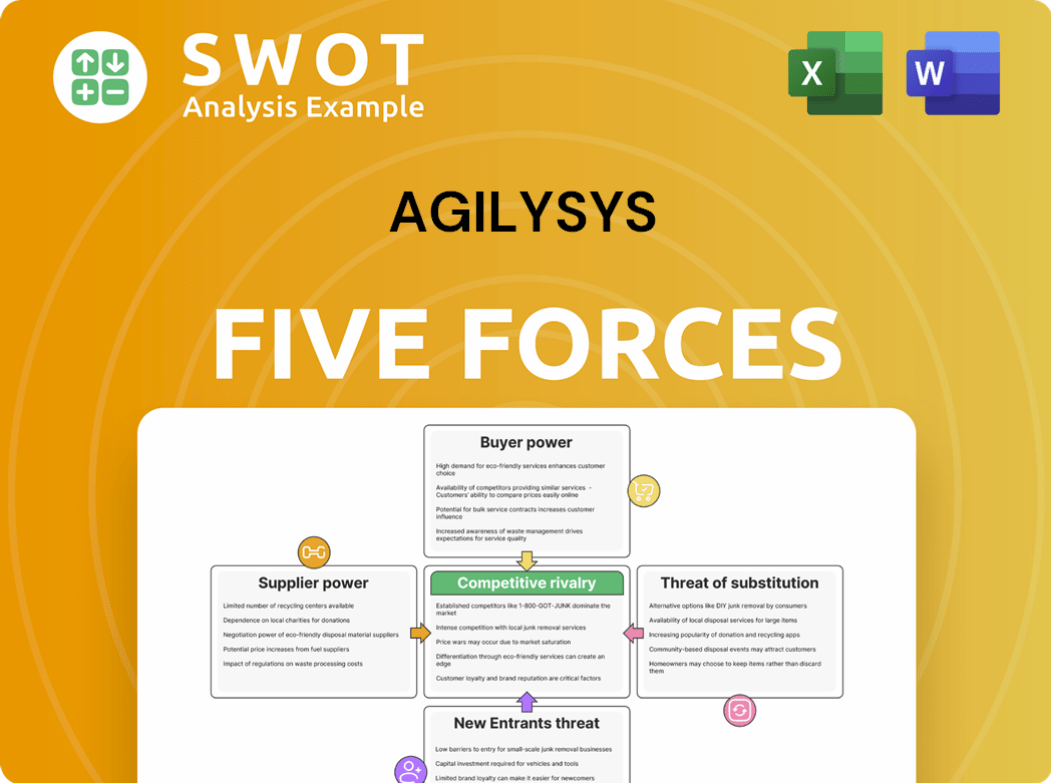

Agilysys Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Agilysys Bundle

What is included in the product

Analyzes Agilysys' position, highlighting competition, customer impact, and entry barriers.

Understand competitive pressure fast with color-coded ratings—perfect for fast strategic analysis.

Same Document Delivered

Agilysys Porter's Five Forces Analysis

This preview demonstrates the complete Agilysys Porter's Five Forces analysis you'll receive. The document presented mirrors the final, downloadable version. Expect a fully formatted, ready-to-use report upon purchase. You'll gain immediate access to this exact analysis file. No alterations or revisions will be needed.

Porter's Five Forces Analysis Template

Agilysys operates within a dynamic competitive landscape, where supplier power, particularly concerning specialized hardware and software, plays a significant role. Buyer power, influenced by diverse customer needs, also shapes market dynamics. The threat of new entrants, given the industry's evolving technology, remains moderate. Substitute products, such as cloud-based solutions, present a competitive consideration. Finally, competitive rivalry within the hospitality tech sector is intense.

Ready to move beyond the basics? Get a full strategic breakdown of Agilysys’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The hospitality software sector features a concentrated supplier base, granting providers considerable influence. Agilysys depends on key technology suppliers, impacting its operations. The enterprise software market for hospitality was valued at $16.3 billion in 2023, highlighting the industry's scale.

Agilysys depends on suppliers for hardware, creating a dependency. The supply chain involves key tech component providers. This reliance gives suppliers bargaining power. For 2024, consider supply chain disruptions, potentially impacting costs. Analyze supplier concentration to understand vulnerability.

High switching costs significantly bolster supplier power, particularly for integrated systems. Implementing systems like PMS and POS entails intricate data migration and comprehensive staff training, which can be quite expensive. The financial burden of shifting to a new software platform can range from $100,000 to $500,000, not accounting for operational disruptions. This substantial investment and potential for operational setbacks cement the supplier's strong position in the market.

Proprietary Technology Advantage

Suppliers with proprietary technology hold significant bargaining power. Agilysys, for example, offers unique products like rGuest, integrating POS with mobile and cloud features. This gives Agilysys an edge. This reduces customer alternatives, boosting supplier influence.

- Agilysys's rGuest platform integrates POS, mobile, and cloud capabilities, a proprietary advantage.

- Limited customer alternatives increase supplier power.

- In 2024, Agilysys reported strong recurring revenue growth, reflecting the value of its proprietary solutions.

Software Market Concentration

The enterprise software market for hospitality technology, where Agilysys operates, exhibits a concentrated structure. The top three suppliers in 2024 command a substantial market share, indicating considerable bargaining power. This concentration allows these major players to influence pricing and terms significantly. The remaining market is fragmented, which further strengthens the position of the dominant suppliers.

- Market concentration enhances supplier leverage.

- Top suppliers can dictate terms.

- Fragmented competition weakens buyer power.

- Agilysys faces supplier-driven challenges.

Agilysys faces strong supplier bargaining power due to market concentration and proprietary technology. High switching costs, ranging from $100,000 to $500,000, lock in customers. In 2024, the top suppliers held significant market share, influencing pricing.

| Factor | Impact | Example |

|---|---|---|

| Concentrated Supplier Base | Increased Leverage | Top 3 suppliers dominate market |

| High Switching Costs | Reduced Buyer Power | Software implementation expenses |

| Proprietary Tech | Enhanced Supplier Control | Agilysys's rGuest platform |

Customers Bargaining Power

Enterprise customers of Agilysys Porter, like those in hospitality, demand specific software features. They have significant bargaining power due to their rigorous selection criteria. A 2024 study showed 70% seek integrated cloud solutions. Scalability is also key; 60% want platforms that grow with them.

The enterprise software market is experiencing price compression, increasing price negotiations. Customers frequently seek price reductions and compare offers from various vendors. This price sensitivity significantly boosts customers' bargaining power. For instance, in 2024, average contract discounts in the software sector reached 12-15%. This trend underscores the strong customer influence.

Long-term contracts highlight strong customer-vendor ties, increasing customer power. Agilysys's contracts often span several years, with high renewal rates. These contracts, coupled with complex service level agreements, strengthen customer influence. As of 2024, the renewal rate for Agilysys's contracts is around 85%, showing customer loyalty and bargaining strength.

Cloud-Based Alternatives

Customers of Agilysys Porter have increasing bargaining power due to readily available cloud-based alternatives. The global cloud computing market reached over $670 billion in 2024, with hospitality software solutions experiencing significant annual growth. This expansion provides customers with numerous options, lessening their reliance on any single vendor. Agilysys directly competes with these cloud-based solutions, which offer similar functionalities, intensifying the pressure to remain competitive.

- Cloud computing market reached over $670 billion in 2024.

- Hospitality software solutions are growing annually.

- Customers have multiple choices, reducing vendor dependence.

Customization Demands

Customers' ability to dictate terms increases due to demands for customizable software architectures. A substantial portion of enterprise clients, about 60% in 2024, prioritize software customization. This preference allows them to negotiate more favorable terms. It gives these customers greater control over the final product and its pricing.

- 60% of enterprise customers prioritize software customization.

- Customization demands increase negotiation power.

Agilysys's customers, especially in hospitality, wield strong bargaining power. They demand specific features and seek cloud-based solutions, increasing their negotiating leverage. Price compression in the enterprise software market, with discounts reaching 12-15% in 2024, further enhances this power.

Long-term contracts, like Agilysys's, and a wide array of cloud alternatives intensify customer influence. With the cloud computing market exceeding $670 billion in 2024, customers have multiple choices, reducing vendor dependence. Customization demands, prioritized by about 60% of enterprise clients, also give them greater control over terms.

| Factor | Impact | 2024 Data |

|---|---|---|

| Cloud Market | Increased Options | $670B+ market |

| Price Pressure | Higher Negotiation Power | 12-15% discounts |

| Customization | Control over Terms | 60% prioritize |

Rivalry Among Competitors

Agilysys faces fierce competition in the hospitality and retail management software sector. Giants such as Oracle and Microsoft compete alongside specialized firms. This crowded market demands constant innovation and significant financial investment. For instance, Oracle's 2024 revenue in cloud services was over $15 billion. This rivalry affects pricing and market share.

High technological innovation intensifies competition. Agilysys, like its rivals, needs fast software development and R&D. Staying ahead requires constant innovation; for example, in 2024, R&D spending in the tech sector was about 7% of revenue.

Agilysys heavily invests in R&D to stay ahead. In 2024, the company allocated a considerable portion of its revenue to R&D. This commitment is evident in its portfolio of active software patents. Such investments allow Agilysys to differentiate its products, bolstering its market position.

Differentiation Focus

Agilysys thrives on differentiation, focusing on niche markets like hospitality with specialized tech. They excel in cloud-based software integration, setting them apart from rivals. This strategy has helped Agilysys maintain a competitive edge, even in a crowded tech landscape. In 2024, Agilysys's revenue reached $250 million, reflecting successful differentiation.

- Specialized hospitality technology platforms.

- Cloud-based software integration.

- Competitive edge in the market.

- 2024 revenue of $250 million.

Market Share Dynamics

Agilysys contends with fierce competition in hospitality software, battling for market share. While Agilysys has seen revenue growth, market share has fluctuated. For example, in 2024, Agilysys reported revenues of approximately $270 million, while Oracle's hospitality revenue far surpasses this. This highlights the intense rivalry.

- Oracle's hospitality revenue dwarfs Agilysys'.

- Market share battles are common.

- Agilysys revenue was about $270M in 2024.

Competition in Agilysys's market is intense. Oracle's cloud services generated over $15B in 2024. Agilysys competes by focusing on specialized tech. Their 2024 revenue reached about $270 million.

| Company | 2024 Revenue (approx.) | Market Focus |

|---|---|---|

| Agilysys | $270M | Hospitality, Retail |

| Oracle | $15B+ (Cloud Services) | Diverse, including Hospitality |

| Tech Sector R&D | ~7% of Revenue | Overall Industry |

SSubstitutes Threaten

Cloud-based solutions pose a significant threat to Agilysys. The global cloud computing market is booming; it was valued at $670.6 billion in 2024. Hospitality software is a key growth area. Agilysys directly competes with cloud-based alternatives. These alternatives offer similar services at potentially lower costs.

Open-source platforms pose a substantial substitute threat. Many businesses leverage open-source software. These platforms provide flexibility and cost savings, potentially drawing customers away from Agilysys. In 2024, 79% of enterprises used open-source software, increasing adoption across industries. This trend highlights the growing importance of competitive pricing and open solutions.

Some major hotel chains opt to develop their property management systems internally, creating in-house solutions. This strategy presents a direct threat to companies like Agilysys, as these internal systems act as substitutes for commercial software. In 2024, the trend of in-house development grew, with an estimated 15% of large hotel groups choosing this path. This approach allows for greater control over customization and data management, reducing dependency on external vendors.

Modular Software Platforms

Modular software platforms pose a threat to Agilysys Porter due to their ability to substitute integrated solutions. These platforms offer flexibility, allowing customers to choose specific functionalities from various vendors. This modular approach can lead to significant cost savings and customization advantages. The market for modular solutions is growing, with projections indicating increased adoption across various industries. For example, the global modular software market was valued at $62.5 billion in 2023.

- Cost Reduction: Modular solutions often provide cost savings compared to comprehensive suites, potentially impacting Agilysys' pricing strategy.

- Customization: The ability to tailor software to specific needs is a key advantage of modular platforms, attracting customers seeking personalized solutions.

- Market Growth: The expanding modular software market presents a significant challenge for integrated solution providers like Agilysys.

Evolving Technology

Emerging technologies and evolving guest expectations pose a significant threat to Agilysys. The hospitality industry is rapidly adopting new technologies to enhance guest experiences and operational efficiency. Companies that fail to adapt risk substitution by more innovative solutions, potentially impacting market share. For instance, the global hospitality technology market was valued at $30.7 billion in 2023.

- Self-service kiosks and mobile apps are becoming standard, reducing the need for traditional POS systems.

- Cloud-based solutions offer flexibility and cost-effectiveness compared to on-premise systems.

- Guests now expect personalized experiences driven by data analytics and AI.

- Competition from tech giants entering the hospitality space.

Substitutes significantly challenge Agilysys by offering alternatives like cloud solutions, valued at $670.6B in 2024. Open-source software, used by 79% of enterprises in 2024, and in-house systems pose further threats. Modular platforms and emerging tech also compete, changing the landscape.

| Substitute Type | Impact on Agilysys | 2024 Data/Example |

|---|---|---|

| Cloud Solutions | Cost, Flexibility | $670.6B Cloud Market |

| Open-Source | Cost, Customization | 79% Enterprise Usage |

| In-House Systems | Customization | 15% Hotel adoption |

Entrants Threaten

High initial investment requirements create a significant barrier for new entrants in the hospitality software market. Developing robust solutions like Agilysys's requires considerable capital. New companies face substantial costs in research and development, infrastructure, and marketing. For instance, in 2024, R&D spending in the software industry averaged 17% of revenue, highlighting the financial commitment needed.

Technological expertise barriers significantly hinder new entrants. The hospitality tech sector demands specialized knowledge of software and hardware. Newcomers need developers, engineers, and experts. Entry costs are high due to the need for advanced tech and skilled personnel. For instance, Agilysys's R&D spending in 2024 was about $30 million.

Regulatory compliance presents a significant hurdle for new entrants in the hospitality sector. The industry faces a web of regulations, encompassing data privacy and security standards that can be intricate. Companies, like Agilysys, must allocate resources to navigate these requirements. For instance, in 2024, the average cost of compliance for small to medium-sized businesses in the hospitality industry rose by 15%.

Intellectual Property Protection

Intellectual property protection is a key barrier for new entrants. Agilysys benefits from active patents, creating hurdles for potential competitors. These patents safeguard existing solutions from immediate replication. In 2024, strong IP helped tech companies maintain market share. This protection is crucial in a competitive landscape.

- Patents provide legal barriers against imitation.

- Agilysys's patents protect its unique offerings.

- IP reduces the threat of new competitors.

- Strong IP boosts market competitiveness.

Established Brand Loyalty

Established brand loyalty presents a significant hurdle for new entrants. Companies like Agilysys, as of 2024, often enjoy strong customer relationships. This loyalty stems from trust and satisfaction with existing products or services.

Newcomers must work to overcome this loyalty to gain market share. This can involve offering significantly superior value or introducing groundbreaking innovations to entice customers.

The challenge is considerable, as loyal customers are less likely to switch. Agilysys's strong customer retention rates, reported in 2024, highlight this barrier.

Overcoming brand loyalty requires a strategic approach. It includes targeted marketing and compelling value propositions to attract and retain customers.

Successful entry depends on a clear understanding of customer needs and a commitment to providing superior offerings.

- Customer loyalty can be a significant barrier for new entrants in the market.

- Incumbents often have established relationships, making it hard to attract customers.

- New companies must provide greater value or innovation to compete effectively.

- Agilysys's customer retention rates show the impact of brand loyalty.

Threat of new entrants in the hospitality software market faces multiple hurdles. High upfront costs, like R&D, present a significant challenge. Brand loyalty and intellectual property further raise barriers.

| Barrier | Impact | Example (2024 Data) |

|---|---|---|

| High Initial Investment | Requires substantial capital for R&D and infrastructure. | Software industry R&D spending: 17% of revenue. |

| Technological Expertise | Demands specialized software and hardware knowledge. | Agilysys R&D spending: ~$30M. |

| Brand Loyalty | Established customer relationships hinder new entrants. | Agilysys customer retention rates: High. |

Porter's Five Forces Analysis Data Sources

The Porter's Five Forces analysis relies on SEC filings, industry reports, competitor financials, and market analysis data.