AIRBUS Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIRBUS Bundle

What is included in the product

Tailored analysis for Airbus product portfolio, mapping each unit to BCG Matrix quadrants.

One-page, clear overview enables quick analysis and strategic decision-making for each business unit.

Preview = Final Product

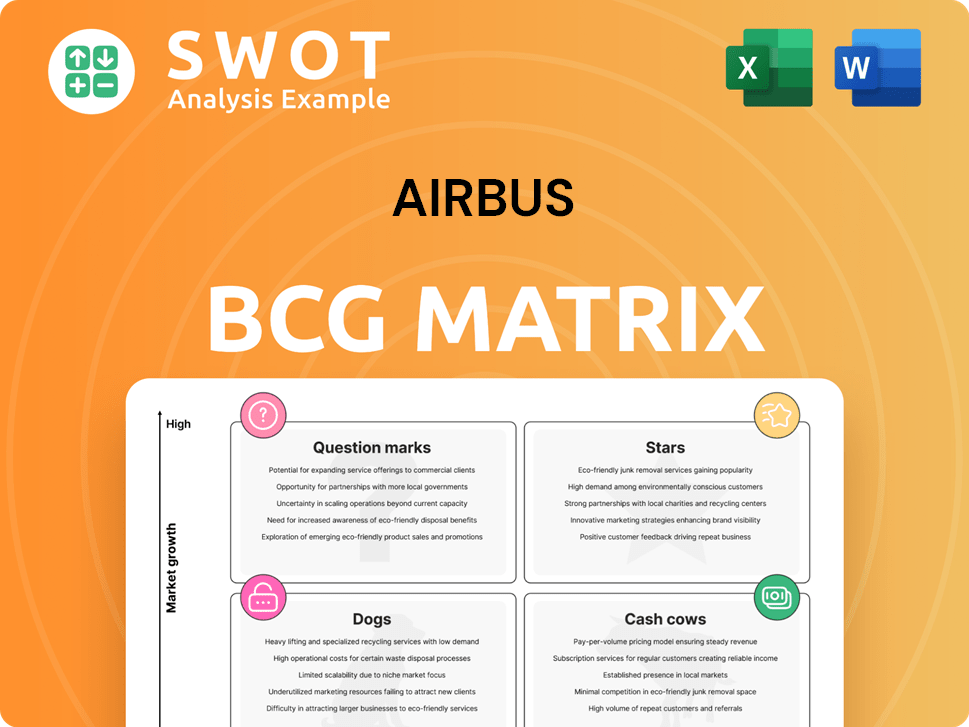

AIRBUS BCG Matrix

This is the full AIRBUS BCG Matrix you'll receive. The preview displays the complete document; download it and start your strategic assessment right away.

BCG Matrix Template

Airbus's BCG Matrix highlights product portfolio dynamics. Stars shine with high growth & market share. Cash Cows generate profits. Question Marks need strategic focus. Dogs face challenges.

This preview offers a glimpse into Airbus's strategic landscape. Purchase the full BCG Matrix for detailed quadrant placements and actionable insights to guide your investment decisions.

Stars

The A320 family, especially the A321neo, is a "Star" in the Airbus BCG matrix, dominating the narrow-body market. The A321neo's efficiency and reliability drive high demand. Airbus aims for a 75 aircraft monthly production rate by 2027. In 2024, Airbus delivered over 500 A320 family aircraft.

The A350 family shows robust growth, attracting new and repeat orders. As the largest passenger aircraft, the A350-1000 is poised for continued success. Airbus aims to produce 12 A350s monthly by 2028. In 2024, Airbus delivered over 50 A350s, demonstrating strong market confidence and demand.

Airbus Helicopters is a "Star" in the BCG matrix, showcasing strong performance. In 2024, the division saw increased orders and deliveries. Demand remains robust, with a book-to-bill ratio exceeding 1. The civil market benefits from energy sector recovery and air medical demand.

Defense and Space Sector

Airbus's Defence and Space sector is a "Star" within the BCG matrix, showing robust order intake, especially in Air Power. This includes the German Federal Police's order for 38 H225 helicopters, highlighting the division's strong market position. Airbus is actively adapting this sector to thrive in the current environment, aiming to capitalize on growing demand. The focus is on enhancing competitiveness and meeting customer needs effectively.

- Strong order intake driven by Air Power and military aircraft demand.

- German Federal Police ordered 38 H225 helicopters.

- Airbus is transforming the division to ensure competitiveness.

- Focus on meeting civil and military customer needs.

Innovation and Technology

Airbus is aggressively pursuing innovation, especially in sustainable aviation. They are investing heavily in technologies like sustainable aviation fuel (SAF) and hybrid-electric propulsion to reduce emissions. Their focus includes designing new aircraft architectures and improving aerodynamics. This positions Airbus strongly in the future of air travel.

- Airbus invested €3.9 billion in R&D in 2023, showing a commitment to innovation.

- SAF is projected to account for 50% of Airbus's fuel needs by 2035.

- Airbus's goal is to have a zero-emission aircraft by 2035.

- Aerodynamic improvements aim to reduce fuel consumption by up to 20%.

Airbus Defence and Space thrives as a "Star." It benefits from strong Air Power orders. The German Federal Police ordered 38 H225 helicopters. Airbus is adapting the sector to boost competitiveness and meet both civil and military demands.

| Metric | 2024 Performance | Strategic Focus |

|---|---|---|

| Order Intake | Robust, especially in Air Power | Enhancing competitiveness |

| Key Orders | 38 H225 helicopters (German Police) | Meeting Customer Needs |

| Strategic Goal | Adapting to the current environment | Capitalizing on demand |

Cash Cows

The Airbus A330 is a cash cow within the BCG matrix. It holds a significant market share in the wide-body aircraft sector. In 2024, the A330 family saw over 100 deliveries. The A330 generates consistent revenue from passenger and cargo operations. Its established presence ensures steady cash flow, even with slower market growth.

The A320ceo family, while aging, is a cash cow for Airbus. It still generates revenue from its large fleet and maintenance needs. Its reliability ensures a steady income stream. In 2024, the A320 family, including the ceo, delivered 400+ aircraft. The A320 family is classified as a 'Star' in the BCG matrix.

The A400M Atlas, a military transporter, has become operational with over 130 aircraft in service. The fleet has accumulated more than 200,000 flight hours. This aircraft supports national sovereignty and European strategic autonomy.

MRO (Maintenance, Repair, and Overhaul) Services

Airbus's Maintenance, Repair, and Overhaul (MRO) services are a cash cow, ensuring a steady income from its vast fleet. The consistent need for aircraft upkeep guarantees a reliable revenue stream for Airbus. The MRO market in the region is projected to reach $42.3 billion, growing at a CAGR of 1.7% over the next two decades. Services are crucial for managing growing demand and boosting fleet performance.

- Stable Revenue: MRO provides a dependable income source.

- Market Growth: The MRO market is expanding.

- Demand Drivers: High demand for maintenance services.

- Fleet Efficiency: Services improve fleet performance.

Space Equipment

Airbus' Space Equipment division, a cash cow, benefits from its established market position and consistent revenue streams. Airbus is a leading player in the European space sector, emphasizing technological advancements and industrial development. The company is committed to advancing space commercialization, focusing on sustainability and efficiency. Airbus actively seeks innovative ideas for space-related hardware, processes, and business models.

- Airbus' Space Systems revenues in 2023 were €2.4 billion.

- Airbus invested €864 million in space research and development in 2023.

- Airbus has a backlog of over €8 billion in space orders.

Airbus's cash cows, like the A330 and A320ceo, generate consistent revenue. Their established presence secures steady cash flow despite slower growth. MRO services also act as cash cows. The Space Equipment division's revenues were €2.4 billion in 2023.

| Category | Description | 2024 Data |

|---|---|---|

| A330 Deliveries | Wide-body aircraft | 100+ |

| A320 Family Deliveries | ceo and newer models | 400+ |

| MRO Market | Projected growth in region | $42.3 billion (CAGR 1.7%) |

Dogs

The Airbus A380, now discontinued, is a "dog" in the BCG matrix. Production ended in 2021 due to low demand and high costs. Its minimal market share and operational expenses strain Airbus's resources. The A380's struggles reflect broader challenges in the airline industry, including the shift towards more fuel-efficient aircraft.

The A321 MPA, a militarized A321XLR, addresses French Navy needs, focusing on anti-submarine and anti-surface warfare. It is designed to replace the Atlantique 2 MPAs by 2030-2040. The A321 MPA offers long-range and high maneuverability, even at low altitudes. Airbus aims to deliver advanced capabilities, potentially impacting naval aviation strategies significantly.

Hypersonic and supersonic jets promise to reshape air travel, potentially cutting flight times significantly. Boom Supersonic aims to launch aircraft that could reduce travel durations. The global supersonic jet market was valued at $1.1 billion in 2024, projected to reach $3.9 billion by 2032. Noise and fuel efficiency remain key challenges for widespread adoption.

A220

The Airbus A220 is positioned as a "Dog" in the BCG matrix, indicating low market share in a slow-growth market. Airbus delivered 65 A220s by the end of November 2024, a 12% increase compared to 2023, but still around six aircraft per month. The company aims to boost production to 14 aircraft monthly by 2026, focusing on ramping up output in Mirabel and Mobile during 2025.

- Position: "Dog" in the BCG Matrix.

- 2024 Deliveries: 65 aircraft by November.

- Production Rate: Approximately six aircraft per month.

- Future Goal: Increase production to 14 aircraft monthly by 2026.

Zero Emission Aviation

Airbus's ZEROe project, launched in 2020, aims to revolutionize aviation with hydrogen-powered flight. They've been exploring hydrogen combustion and fuel cells. At a recent summit, updates on this project were shared, outlining future steps. Airbus is investing heavily in this technology, hoping to launch hydrogen-powered aircraft by 2035.

- Project ZEROe launched in 2020.

- Focus on hydrogen combustion and fuel cells.

- Target is to introduce hydrogen-powered aircraft by 2035.

- Airbus is heavily investing in this technology.

The Airbus A220 is categorized as a "Dog," indicating low market share in a slow-growth market. By November 2024, 65 A220s were delivered, maintaining a monthly production of roughly six aircraft. Airbus plans to boost production to 14 aircraft monthly by 2026, with a focus on output in Mirabel and Mobile.

| Metric | Value (2024) | Goal (2026) |

|---|---|---|

| Deliveries (by November) | 65 aircraft | N/A |

| Monthly Production | ~6 aircraft | 14 aircraft |

| Market Position | Dog | N/A |

Question Marks

The A321XLR, a new Airbus variant, is set to launch in the second quarter of 2025. It targets the high-growth, long-range single-aisle market. This aircraft faces success hurdles dependent on performance and reliability. Airbus delivered 735 aircraft in 2023; the A321XLR is key to future growth.

CityAirbus NextGen, Airbus's eVTOL, targets urban air mobility. The market is emerging, offering Star potential. Airbus aims to commercialize the technology. In 2024, Airbus delivered 735 commercial aircraft, up from 661 in 2023. The A350's success supports future ventures.

Airbus's Space-Based Connectivity is a question mark in its BCG matrix. The market is developing, and China's fleet is expanding. This growth drives demand for new aircraft. Orders are fueled by strong public services and commercial segments.

Sustainable Aviation

Sustainable aviation is a key focus for aircraft manufacturers like Airbus, influencing areas from manufacturing to pilot training and fuel efficiency. Airbus and Boeing both have substantial production backlogs, but recent performance differs significantly. In 2024, Airbus secured 826 net orders compared to Boeing's 377, highlighting a strong market position.

- Airbus's 2024 net orders were more than double Boeing's.

- Boeing faced 173 order cancellations for the B737 in 2024.

- Sustainable practices are reshaping the aviation industry.

- Airbus is leading in new aircraft orders.

Advanced Materials and Additive Manufacturing

Advanced materials and additive manufacturing are positioned as "Question Marks" in Airbus's BCG matrix, indicating high market growth potential but uncertain market share. Airbus is investing in these areas, with AI and automation playing a key role in aerospace manufacturing. For example, AI-powered predictive maintenance is reducing aircraft downtime. Military aerospace advancements focus on stealth technologies and AI-powered combat drones.

- AI and automation are significantly impacting aerospace, flight operations, and air traffic management.

- AI-powered predictive maintenance is reducing aircraft downtime.

- Military aerospace advancements focus on stealth technologies and AI-powered combat drones.

- Airbus is investing in these areas, with AI and automation playing a key role in manufacturing.

Question Marks in Airbus’s BCG matrix include Space-Based Connectivity, advanced materials, and additive manufacturing.

These areas show high market growth but uncertain share, requiring strategic investment. Airbus's focus on AI and automation is key for future developments. In 2024, Airbus saw 826 net orders, highlighting its strong position.

| Category | Description | Status |

|---|---|---|

| Space-Based Connectivity | Emerging market, expanding fleets | Question Mark |

| Advanced Materials/Additive Manufacturing | High growth, uncertain share, AI focus | Question Mark |

| 2024 Net Orders | Airbus vs. Boeing | Airbus: 826, Boeing: 377 |

BCG Matrix Data Sources

The AIRBUS BCG Matrix leverages diverse sources. This includes company financials, market analysis, industry reports, and competitive data for a robust assessment.