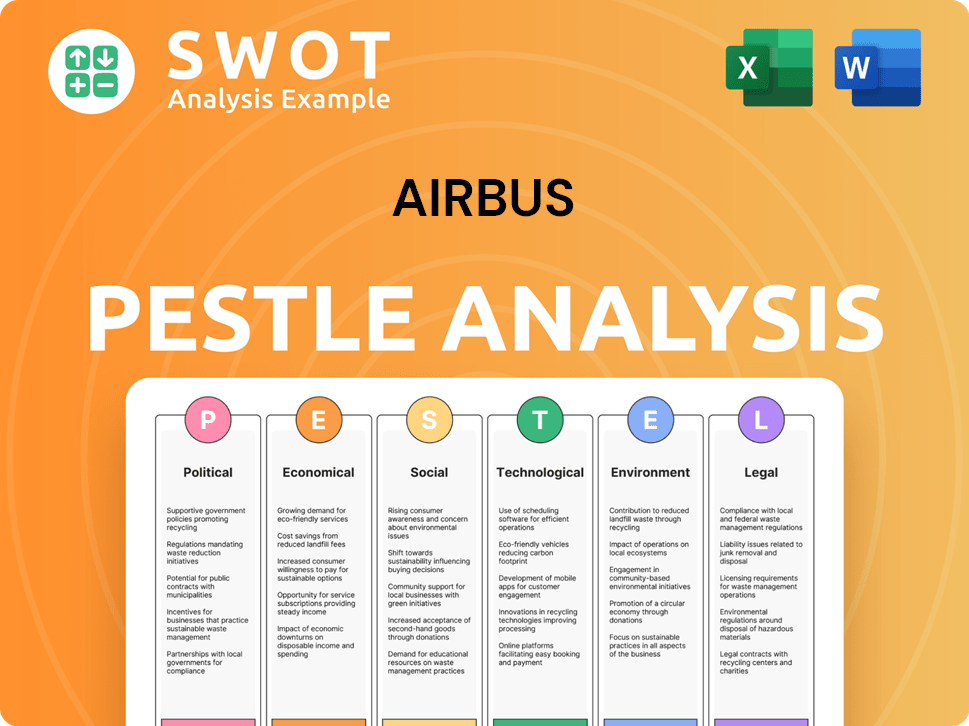

AIRBUS PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AIRBUS Bundle

What is included in the product

It explores external macro-environmental impacts on AIRBUS across Political, Economic, Social, Technological, Environmental, and Legal aspects.

A shareable summary, great for quick alignment on risks & opportunities.

What You See Is What You Get

AIRBUS PESTLE Analysis

The preview showcases the full AIRBUS PESTLE Analysis.

The file you see now is the one you will download after purchase.

It's fully formatted and structured for your immediate use.

This includes all content and sections.

What you're viewing is the final version!

PESTLE Analysis Template

Uncover how AIRBUS maneuvers complex external factors! Our detailed PESTLE analysis dissects crucial political, economic, social, technological, legal, and environmental influences. Gain insights to assess risks and opportunities impacting the aerospace giant. This analysis provides actionable intelligence for strategic planning, investments, or market research. Don't miss the full, in-depth report: download it now to unlock AIRBUS's strategic landscape!

Political factors

Government regulations heavily influence Airbus. Airworthiness directives, like those from EASA and FAA, mandate aircraft modifications. Trade policies, such as tariffs or sanctions, affect Airbus's global market access. Defense spending, crucial for military contracts, directly impacts Airbus's revenue. In 2024, Airbus secured significant defense contracts, highlighting this impact.

Airbus faces risks from international trade and tariffs. For example, in 2023, global trade in aerospace products was valued at over $1.6 trillion. Trade disputes can raise costs and disrupt supply chains. Airbus closely watches tariffs, especially from the U.S., a key market. In 2024, the EU and U.S. continue trade talks amid ongoing tensions.

Geopolitical stability significantly impacts Airbus. Conflicts can boost defense spending, benefiting its defense sector. Instability disrupts air travel, affecting commercial orders. For example, the Russia-Ukraine war continues to reshape European airspace. In 2024, defense contracts represented a notable portion of Airbus's revenue, around 20%. The conflict's effects on fuel costs and route planning also matter.

Government Support and Subsidies

Government support and subsidies significantly affect Airbus's operations. These interventions can boost research and development efforts, influencing technological advancements. Government financing also impacts investment decisions in new projects. For instance, in 2024, the French government allocated €1.5 billion to support the aerospace industry, including Airbus.

- 2024: French government allocated €1.5 billion to aerospace.

- Subsidies influence investment in new technologies.

- Government support boosts R&D efforts.

Political Stability in Key Markets

Airbus's success is closely tied to political stability in its main markets. Unstable regions can disrupt operations and shift regulations, affecting aircraft demand. Building strong government relationships is essential for Airbus's international business. Political risks impact Airbus's ability to secure contracts and manage supply chains. For example, in 2024, geopolitical tensions affected airline travel and aircraft orders.

- Political instability can lead to delays in aircraft deliveries and increased operational costs.

- Changes in trade policies can affect Airbus's access to key markets and components.

- Maintaining positive diplomatic relations is vital for securing government support and contracts.

Political factors significantly shape Airbus. Government regulations like airworthiness directives and trade policies such as tariffs heavily influence Airbus operations. Geopolitical stability, government support and subsidies have direct impact on Airbus, with €1.5 billion allocated by the French government in 2024 for the aerospace industry. Political relationships are vital to Airbus.

| Political Factor | Impact on Airbus | 2024/2025 Data |

|---|---|---|

| Regulations & Trade | Affects market access and costs | 2023 aerospace trade: $1.6T |

| Geopolitics | Influences defense contracts and travel | Defense revenue ~20% of Airbus total |

| Government Support | Boosts R&D and investment | France: €1.5B aerospace support |

Economic factors

Global economic growth significantly fuels demand for commercial aircraft. Rising disposable incomes, a result of economic expansion, boost air travel and the need for new planes. Passenger traffic recovery to pre-pandemic levels is positive for Airbus. In 2024, global air travel is expected to increase, supporting Airbus's sales. The International Air Transport Association (IATA) forecasts a strong rise in passenger numbers.

Airbus faces currency exchange rate risks, mainly between the Euro and USD. These shifts affect sales, expenses, and profits. For example, a strong USD makes Airbus planes pricier for U.S. buyers. In Q1 2024, the EUR/USD rate varied, influencing Airbus's financial results.

Airbus depends on a global supply chain, making it vulnerable to cost changes and disruptions. Raw material and component costs, alongside supply chain interruptions, affect production and expenses. Recent supply chain issues significantly challenge Airbus, impacting delivery timelines. For instance, in 2024, Airbus faced delays due to supply chain bottlenecks, increasing operational costs by 5%.

Fuel Prices

Fuel prices significantly impact airline operational costs, affecting profitability and aircraft demand. Rising fuel costs prompt airlines to seek fuel-efficient aircraft, creating opportunities for Airbus. In 2024, jet fuel prices averaged around $2.50 per gallon, impacting airline margins. Airbus's focus on fuel-efficient models, like the A320neo family, aligns with this trend. The IATA projects a 2024 fuel bill of $210 billion for airlines globally.

- Fuel prices directly affect operational costs.

- High prices increase demand for fuel-efficient aircraft.

- Airbus benefits from this demand with its newer models.

- Jet fuel prices averaged $2.50/gallon in 2024.

Interest Rates and Financing Availability

Interest rates and financing are critical for Airbus and its clients. Elevated interest rates increase borrowing costs for airlines, potentially reducing aircraft orders. For example, in early 2024, the European Central Bank maintained interest rates, but future hikes could affect airline financing. Airbus's R&D and production also depend on accessible financing.

- ECB's interest rate decisions directly impact Airbus.

- Higher rates could cool down aircraft orders.

- Financing supports Airbus's innovation and growth.

Economic factors strongly affect Airbus's operations. Global air travel recovery supports sales, with the IATA forecasting a strong rise in 2024. Currency fluctuations and supply chain issues, increasing operational costs, are risks. High interest rates might also impact financing.

| Factor | Impact | Data (2024) |

|---|---|---|

| Global Air Travel | Boosts Demand | Passenger numbers rose (IATA forecast) |

| Currency Exchange | Affects Costs & Prices | EUR/USD rates fluctuated, impacting results |

| Supply Chain | Raises Production Costs | Bottlenecks delayed deliveries (+5% costs) |

Sociological factors

Consumer preferences are shifting, affecting airline demands. Direct flights' popularity over connections influences aircraft needs. Airbus adjusts its offerings to meet these evolving demands. In 2024, direct flights accounted for 60% of all travel. Airbus's A321XLR caters to this trend, with over 500 orders by early 2025.

Public perception and trust significantly influence the aerospace industry. Safety concerns and environmental impact are key, affecting demand. Airbus must maintain a strong focus on both. In 2024, air travel saw a strong recovery, but environmental concerns remain. The industry's reputation directly impacts aircraft orders and profitability.

Airbus relies heavily on a skilled workforce for its operations. The aerospace sector demands specialized engineers and technicians. A 2024 report indicated that the industry faces a skills gap, potentially affecting production. Approximately 3.5 million aerospace professionals are employed globally in 2024, with ongoing recruitment challenges.

Demographic Shifts and Urbanization

Demographic shifts and rising urbanization, especially in emerging markets, fuel air travel demand. Airbus benefits as populations grow and cities expand, increasing air connectivity needs. For example, the Asia-Pacific region's air travel growth is projected at 5.3% annually through 2042. This urbanization trend drives demand for Airbus's aircraft.

- Asia-Pacific air travel growth: 5.3% annually (2024-2042).

- Urban population growth: significant in India and China.

- Airbus's order backlog: reflects demand from urbanized areas.

Corporate Social Responsibility Expectations

Societal expectations for corporate social responsibility (CSR) are increasing significantly. Airbus faces pressure to adopt ethical sourcing, fair labor practices, and community contributions. CSR efforts impact Airbus's reputation and stakeholder relationships. In 2024, stakeholder scrutiny of environmental and social governance (ESG) performance has intensified. This includes calls for greater transparency and accountability in supply chains.

- ESG-related investments reached $40.5 trillion globally in 2024.

- Airbus's recent CSR reports show a commitment to reducing carbon emissions and improving labor standards.

- Failure to meet CSR expectations can lead to reputational damage and financial penalties.

Airbus must meet growing societal demands for Corporate Social Responsibility (CSR). ESG-related investments totaled $40.5 trillion worldwide in 2024. The company's ethical practices and transparency are critical for reputation. Failing to meet these standards may cause financial losses.

| Factor | Details | Impact on Airbus |

|---|---|---|

| CSR Pressure | Increased calls for ethical sourcing and labor. | Reputational and financial impact. |

| ESG Investments | $40.5T invested in ESG by 2024. | Investor and stakeholder expectations. |

| Transparency | Greater demand for transparent practices. | Brand trust and market access. |

Technological factors

Continuous advancements in aircraft tech are vital. Airbus focuses on aerodynamics, engine efficiency, and advanced avionics. The company invests heavily in R&D. Airbus aims for more fuel-efficient and quieter aircraft. In 2024, Airbus delivered 735 aircraft.

The aviation industry is heavily investing in Sustainable Aviation Fuels (SAF) and alternative propulsion methods. Airbus is at the forefront, aiming to reduce air travel's environmental impact. In 2024, SAF use grew, with a projected rise in 2025. Electric and hydrogen-powered aircraft are also being developed for future regulations.

Digitalization and automation are key for Airbus. These technologies boost efficiency, cut costs, and improve quality. Airbus utilizes these in its facilities. For example, in 2024, Airbus invested €1.5 billion in digital transformation. Automation increased production by 15% in some areas.

Innovations in Materials Science

Airbus actively invests in materials science to boost aircraft efficiency. Lighter materials like composites reduce fuel consumption, aligning with environmental goals. This focus is crucial as air travel grows, with a projected 4.2% annual passenger increase through 2040. Airbus is exploring advanced alloys and polymers to enhance aircraft performance and safety. These innovations support the company's aim to reduce emissions by 50% by 2035.

- Airbus aims for a 50% emissions reduction by 2035.

- Passenger growth is projected at 4.2% annually through 2040.

- Composites and advanced alloys are key materials.

Progress in Space Technology

Airbus's space division benefits greatly from technological progress. Advancements in satellite technology, such as improved resolution and data transmission, directly enhance Airbus's offerings. The development of more efficient and reusable launch vehicles also reduces costs. Airbus's competitiveness is tied to these technological leaps. Airbus is actively involved in space exploration.

- Airbus's Space Systems revenue in 2023 was €2.3 billion.

- The global space economy is projected to reach $1 trillion by 2040.

- Airbus is involved in projects like the European Space Agency's (ESA) Juice mission.

Technological advancements drive Airbus’s strategy. R&D investment is key, with €1.5 billion in 2024 for digital transformation. Sustainable fuels and electric aircraft are pivotal for future emission targets. Airbus is pushing for innovative materials to enhance efficiency and safety.

| Area | Focus | Data (2024) |

|---|---|---|

| R&D Spending | Digital Transformation | €1.5B Investment |

| Sustainability | SAF Usage Growth | Projected rise in 2025 |

| Materials | Advanced Composites | Reduce fuel consumption |

Legal factors

Aviation safety regulations and aircraft certification are crucial for Airbus. The company must comply with strict standards from EASA and FAA to certify its aircraft. In 2024, EASA updated regulations impacting aircraft design. This can affect production and delivery schedules. For example, compliance costs can increase by 10% due to new safety features.

Airbus faces stringent environmental regulations. Noise, air quality, and carbon emissions standards are key. This pushes for sustainable tech investment. The EU's "Fit for 55" package aims to cut emissions. Airbus invested €1.2 billion in sustainable aviation fuel in 2024.

Airbus must navigate international sanctions and export controls, which limit sales to certain countries. These regulations are crucial for international trade compliance. For instance, sanctions related to the Russia-Ukraine war impacted Airbus's supply chains. Geopolitical shifts can trigger new restrictions; for example, in 2024, the EU extended sanctions against Russia, affecting aerospace exports.

Product Liability and Litigation

Airbus faces product liability risks due to its complex, high-value products. Litigation may arise from accidents or defects, impacting finances. Ensuring high quality and safety standards is critical to minimize legal exposure. In 2024, the aviation industry saw approximately $2.5 billion in product liability settlements. Airbus allocated around $300 million for potential litigation in its 2024 financial reports.

- Product liability claims can lead to substantial financial penalties.

- Stringent safety protocols are vital to reduce legal liabilities.

- The aviation sector's legal landscape is constantly evolving.

Labor Laws and Employment Regulations

Airbus must navigate diverse labor laws and employment regulations across its global operations, influencing HR practices. These laws dictate hiring, working conditions, and labor relations, crucial for operational compliance. Non-compliance can lead to legal issues and operational disruptions, impacting profitability. Staying current with evolving labor standards is a constant challenge.

- In 2024, Airbus employed approximately 134,000 people worldwide.

- Labor disputes can significantly affect production; for example, strikes in France or Germany could halt aircraft assembly.

- Compliance costs, including legal and administrative fees, can range from 2% to 5% of operational expenses, varying by country.

Airbus's legal environment includes safety regulations from bodies like EASA and FAA, influencing design and delivery. Environmental standards, particularly those targeting emissions, are also critical, requiring investments in sustainable aviation. The company faces risks tied to product liability, potentially impacting finances, with significant settlements in the aviation sector, totaling approximately $2.5 billion in 2024. Furthermore, labor laws and employment regulations across its global footprint also need careful navigation.

| Legal Area | Key Regulations/Risks | Financial Impact (2024/2025 est.) |

|---|---|---|

| Safety Regulations | EASA, FAA, Aircraft certification; Design Changes; Safety Features | Compliance Costs can increase by 10% |

| Environmental Regulations | EU's "Fit for 55", Emissions Standards, Sustainable Aviation Fuel | €1.2 billion in 2024 (SAF investments) |

| Product Liability | Accidents, Defects, Quality Standards, Litigation | Approx. $300 million (allocation for litigation) |

Environmental factors

Climate change significantly impacts the aviation industry, pushing for lower carbon emissions. Airbus faces pressure to create fuel-efficient planes and use sustainable aviation fuels (SAF). In 2024, SAF use grew, yet it's still a tiny fraction of total fuel. The EU's "Fit for 55" package demands emission cuts, influencing Airbus's strategies.

Noise pollution near airports poses a major environmental challenge. Aircraft noise regulations affect aircraft design and how they operate. Airbus focuses on creating quieter aircraft to reduce community impacts near airports. In 2024, the EU set noise limits for airports, impacting aircraft development. The global market for noise reduction technologies is valued at $6.2 billion as of 2025.

Airbus focuses on waste management and recycling throughout an aircraft's lifecycle. It aims to minimize its environmental impact. For example, in 2024, Airbus recycled approximately 90% of materials from retired aircraft. Airbus's commitment involves using sustainable materials and efficient processes.

Resource Scarcity and Material Sourcing

Airbus faces environmental challenges regarding raw materials for aircraft production. Sustainable sourcing and material availability are key concerns. The environmental impact of extraction and processing must be considered in its supply chain. This includes assessing carbon footprints and promoting circular economy principles. Airbus's 2023 sustainability report highlights these efforts.

- Airbus aims to increase the use of sustainable aviation fuels (SAF), targeting 10% SAF use by 2030.

- Airbus has invested in technologies for material recycling and reuse.

- The company is exploring alternative materials to reduce reliance on scarce resources.

Impact of Air Travel on Biodiversity and Ecosystems

The expansion of air travel significantly affects biodiversity and ecosystems. Airport construction leads to habitat loss and fragmentation, impacting wildlife. Aircraft emissions contribute to air pollution, harming sensitive ecosystems. Public perception increasingly demands sustainable aviation practices.

- Air travel accounted for approximately 2.5% of global CO2 emissions in 2024.

- Habitat loss due to airport expansion has increased by 15% in the last decade.

- Noise pollution from aircraft affects bird and mammal behavior.

Environmental factors challenge Airbus with climate change demands and sustainable fuel needs, with a goal of 10% SAF use by 2030. Noise and waste regulations, such as the EU’s 2024 noise limits, are influencing aircraft design. The company prioritizes sustainable material sourcing and waste recycling.

| Factor | Impact | Data |

|---|---|---|

| Climate Change | CO2 emissions, need for SAF | Air travel ~2.5% of global emissions (2024), 10% SAF target by 2030 |

| Noise Pollution | Airport restrictions | Global market for noise reduction $6.2B (2025) |

| Waste and Recycling | Sustainability practices | ~90% material recycling rate (2024) |

PESTLE Analysis Data Sources

Our analysis incorporates data from industry reports, government publications, economic indicators, and environmental organizations.