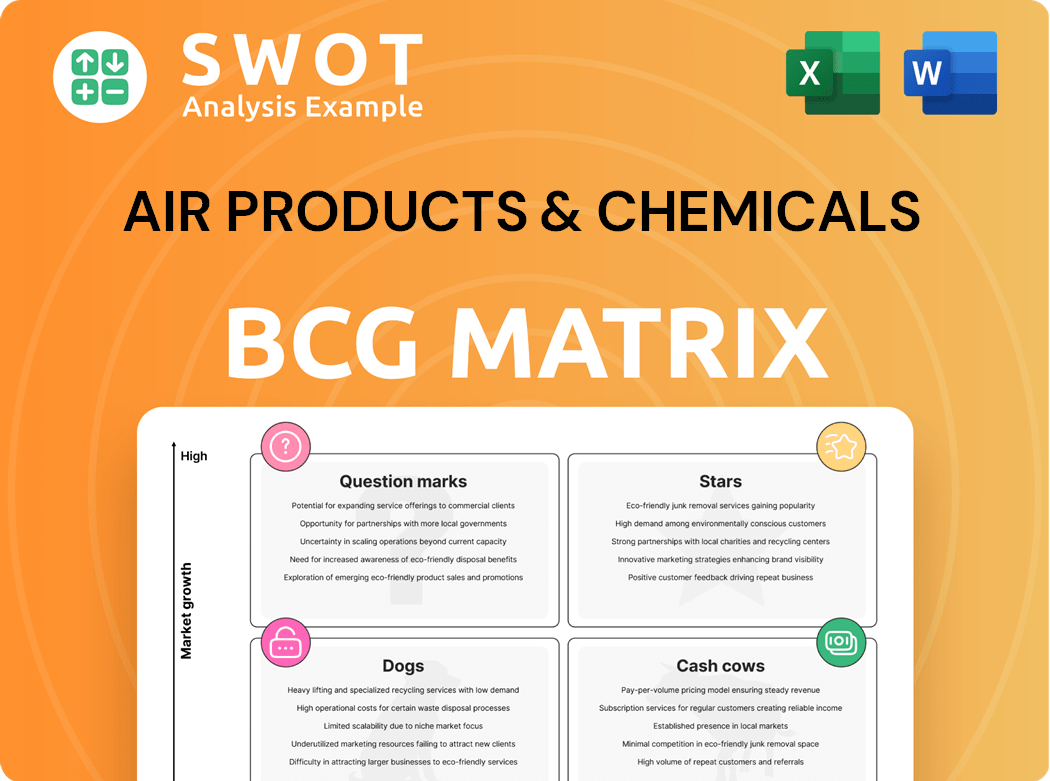

Air Products & Chemicals Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Products & Chemicals Bundle

What is included in the product

Analysis of Air Products' portfolio across the BCG matrix, suggesting investment, holding, or divestment strategies.

Printable summary optimized for A4 and mobile PDFs. Quickly share the strategic analysis.

Full Transparency, Always

Air Products & Chemicals BCG Matrix

The displayed Air Products & Chemicals BCG Matrix preview mirrors the complete report. You'll receive the identical document upon purchase, ready for strategic insights. It's fully formatted, no hidden content. Ready to download immediately!

BCG Matrix Template

Air Products & Chemicals' portfolio is a complex mix of gases and technologies. Our brief look reveals how these offerings compete for market share and resources. Understanding their position—Stars, Cash Cows, Dogs, or Question Marks—is key. This sneak peek shows just a fraction of the strategic landscape.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Air Products' clean hydrogen projects are a "Stars" component in its BCG matrix. The company is developing world-scale clean hydrogen projects, like the NEOM green hydrogen project. These projects aim to capitalize on the increasing demand for clean energy. Successful execution could significantly boost revenue and earnings; for example, in 2024, Air Products' sales reached $12.6 billion.

Air Products' industrial gas production, a key "Star" in its BCG matrix, shines brightly. The Americas and Europe see robust performance from atmospheric gases like oxygen and nitrogen, plus process gases. This segment significantly boosts the company's adjusted earnings per share (EPS). For instance, in fiscal year 2024, Air Products reported a 7% increase in adjusted EPS, showing its strength.

Air Products' sustainability initiatives are a strength, reducing CO2 emissions. The 'Third by '30' targets and renewable energy goals show environmental commitment. For instance, Air Products aims for a 33% reduction in carbon intensity by 2030. This is crucial for a positive brand image. The company's focus on sustainable solutions is also a key driver.

Expertise in Large-Scale Project Execution

Air Products excels in executing massive industrial gas projects. Their expertise covers engineering, construction, ownership, and operation of complex facilities. This capability, vital in the capital-intensive gas market, gives them an edge. For instance, in 2024, they secured a major project worth $500 million. This strategic advantage is crucial for their growth.

- Proven track record in large-scale industrial gas projects.

- Expertise in engineering, building, owning, and operating complex projects.

- Competitive advantage in the capital-intensive industrial gas market.

- Secured a $500 million project in 2024.

Global Distribution Network

Air Products' global distribution network, a "Star" in its BCG matrix, spans roughly 50 countries. This wide reach supports diverse industries and customer bases. Such extensive presence helps the company leverage emerging market growth and hedge against regional economic risks. In 2024, Air Products' international sales accounted for a significant portion of its revenue, reflecting its global footprint.

- Operations in about 50 countries.

- Serves a broad customer base across various sectors.

- Capitalizes on growth in emerging markets.

- Mitigates regional economic downturn risks.

Air Products' "Stars" include clean hydrogen, industrial gas production, sustainability initiatives, global project execution, and global distribution. Clean hydrogen projects, like NEOM, target the increasing clean energy demand, with sales reaching $12.6 billion in 2024. The industrial gas segment, boosted adjusted EPS by 7% in fiscal year 2024, with sustainable solutions reducing CO2 emissions. The company secured a $500 million project in 2024, supported by a global network in 50 countries.

| Aspect | Details | 2024 Data |

|---|---|---|

| Clean Hydrogen | World-scale projects | $12.6B Sales |

| Industrial Gas | Robust performance of atmospheric gases | 7% Adjusted EPS Increase |

| Sustainability | Carbon intensity reduction targets | Aim for 33% by 2030 |

| Global Projects | Expertise in complex project execution | $500M Project Secured |

| Global Reach | Operations in 50 countries | Significant International Sales |

Cash Cows

Air Products' merchant gases business, featuring oxygen, nitrogen, and argon, is a cash cow. These gases are crucial for sectors like refining and electronics. Consistent demand ensures a steady revenue stream, supporting the company's stability. In 2024, Air Products' sales were approximately $12.6 billion, demonstrating its strong market position.

Tonnage gases, supplied under long-term contracts, are a cash cow for Air Products & Chemicals. These agreements, involving on-site production, ensure steady revenue. In 2024, Air Products reported a significant portion of its revenue from these stable contracts. This predictability is key. The long-term nature ensures consistent cash flow.

Air Products' equipment sales, including turbomachinery and cryogenic containers, generate steady cash flow. This segment leverages the company's design and manufacturing expertise. The 2024 LNG business sale to Honeywell streamlined operations. In Q1 2024, the company reported $3.3 billion in sales. This strategic move enhanced focus on core competencies.

Cryogenic Technology

Air Products' cryogenic technology, crucial for air separation, is a key cash cow. This technology is vital for producing industrial gases, ensuring a steady revenue stream. Ongoing R&D investments maintain its competitive edge and support consistent cash generation. In 2024, Air Products' sales in its core industrial gases segment, which relies heavily on cryogenic tech, reached approximately $11 billion.

- High-Purity Gases: Essential for various industries.

- R&D Focus: Continuous innovation in cryogenic processes.

- Steady Revenue: Consistent demand and sales.

- Market Leadership: Strong position in industrial gas production.

Helium

Helium, a crucial industrial gas, is a cash cow for Air Products, generating consistent revenue. Air Products excels in helium storage and distribution, ensuring a reliable supply. Their global infrastructure supports efficient helium delivery worldwide. In 2024, the helium market was valued at approximately $5 billion, with Air Products holding a significant market share. This stable revenue stream solidifies its cash cow status.

- Market Value: Helium market at $5 billion in 2024.

- Business: Air Products is a key player in helium distribution.

- Global Reach: Company has worldwide helium supply network.

- Revenue: Helium sales provide a consistent income.

Air Products benefits from stable revenue streams due to its cash cows. Key areas include merchant gases, tonnage gases, and equipment sales. These segments provide consistent financial support for the company. Strong market positions and contracts boost predictability.

| Segment | Revenue (2024) | Notes |

|---|---|---|

| Merchant Gases | $12.6B | Oxygen, Nitrogen, Argon |

| Tonnage Gases | Significant Portion | Long-term Contracts |

| Equipment Sales | $3.3B (Q1 2024) | Turbomachinery, Cryogenic Containers |

Dogs

Air Products' exit from three U.S. projects, including the California SAF expansion, New York's green liquid hydrogen facility, and the Texas carbon monoxide project, signals underperformance. These cancellations, announced in early 2025, led to a pre-tax charge. The move streamlines the company's focus. In 2024, Air Products' revenue was approximately $12.7 billion.

Air Products divested its LNG business to Honeywell in mid-2024. This sale, though temporarily dilutive to earnings, likely targeted a lower-growth segment. The move allows focus on core industrial gases and clean hydrogen. This strategic shift aligns with long-term goals. The divestiture was valued at approximately $3.5 billion.

Air Products & Chemicals terminated its carbon monoxide project in Texas due to poor economics. The project's cancellation shows it wasn't financially sound. This aligns with the company's goal to boost shareholder value. In 2024, Air Products' total revenue was about $12.6 billion, reflecting strategic decisions.

Non-Strategic Joint Ventures

Non-strategic joint ventures for Air Products, classified as "Dogs," often diverge from its core strengths. These ventures may demand substantial investment but yield limited returns. A strategic review in 2024 could identify underperforming joint ventures. Divesting from these non-strategic ventures can bolster the company's financial health.

- Focus on core competencies.

- Investment without returns.

- Strategic review.

- Divesting can improve financial health.

Commoditized Product Lines

Certain Air Products & Chemicals product lines, such as bulk industrial gases, can be considered "Dogs" in a BCG matrix due to commoditization. These products experience intense competition and lower profit margins, impacting overall profitability. The company faces price pressures in these segments, making it challenging to sustain high returns. Air Products' 2024 financials reflect this, with some bulk gas sales showing modest growth compared to specialized gases. Focusing on higher-value gases would be a more effective strategy.

- Intense competition and lower profit margins.

- Products may lack differentiation.

- Reliance on commoditized offerings.

- Focus on specialized gases and applications.

Air Products & Chemicals' "Dogs" represent underperforming segments, like certain bulk industrial gases. These face intense competition and lower profit margins, affecting profitability. Strategic review of 2024 data may highlight non-strategic joint ventures as Dogs.

| Category | Characteristics | 2024 Impact |

|---|---|---|

| Bulk Industrial Gases | Commoditized, low margins | Modest growth vs. specialized gases |

| Non-Strategic Ventures | Low returns on investment | Potential divestment |

| Joint Ventures | Underperforming | Strategic review and potential exit |

Question Marks

Air Products' Louisiana Clean Energy Complex exemplifies a high-growth venture in blue ammonia. This involves substantial capital outlays and dependence on carbon capture. The blue ammonia market's future is still evolving, with its long-term success yet to be determined. In 2024, Air Products' revenue was approximately $12.7 billion, indicating the scale of its operations.

Although Air Products exited its Sustainable Aviation Fuel (SAF) project in California, the SAF market offers a long-term growth opportunity. The aviation industry's push to cut emissions fuels rising SAF demand. The global SAF market could reach $15.8 billion by 2028. Air Products may re-enter this market if economics and regulations improve.

Air Products & Chemicals' expansion into emerging markets like India and Southeast Asia represents a question mark in its BCG matrix. These regions present substantial growth potential, yet they are also laden with risks. For instance, infrastructure in these areas might be less advanced, and regulatory landscapes can be uncertain, fostering intense competition. Successful expansion demands meticulous strategic planning and flawless execution to seize opportunities while minimizing potential risks. In 2024, Air Products' revenue in Asia was $3.9 billion, reflecting the importance of this market, but also the challenges of operating there.

Specialty Gases

Air Products' specialty gases business aligns with the "Question Marks" quadrant in a BCG Matrix due to its high-growth potential but uncertain market share. Investing in these gases, crucial for electronics and healthcare, is a strategic move. These gases often offer higher profit margins, which can boost revenue. Successful ventures in this area differentiate Air Products.

- Specialty gases revenue grew, with a 2024 forecast of 2.5% to 3.5% from 2023.

- The electronics industry's demand for specialty gases is expected to increase by 6-8% in 2024.

- Air Products' margins for specialty gases are about 25% to 30%.

- R&D investments in specialty gases totaled $150 million in 2023.

Carbon Capture Technology

Air Products' carbon capture technology is a question mark in its BCG matrix. Continued investment is crucial for clean hydrogen projects, yet CCS technology is still developing. Widespread adoption faces technical and economic hurdles, impacting long-term success. For example, in 2024, the CCS market was valued at approximately $2.5 billion, with projections for significant growth. Overcoming these challenges is vital for low-carbon initiatives.

- Market Value: The CCS market was valued around $2.5 billion in 2024.

- Growth Potential: CCS adoption faces technical and economic challenges.

- Strategic Importance: CCS is key to Air Products' clean hydrogen projects.

- Challenges: Widespread adoption faces technical and economic hurdles.

Air Products faces uncertainties with carbon capture, specialty gases, and emerging markets like India. High-growth potential exists, but market share and profitability are not guaranteed. Investment in innovation and strategic market entry is crucial for long-term success. 2024 revenue shows both opportunities and risks.

| Aspect | Details | 2024 Data |

|---|---|---|

| Carbon Capture | Developing tech with adoption challenges. | Market valued at ~$2.5B. |

| Specialty Gases | High-growth, potential profit margins. | Revenue growth forecast 2.5%-3.5%. |

| Emerging Markets | High growth potential with risks. | Asia revenue: $3.9B. |

BCG Matrix Data Sources

This Air Products' BCG Matrix employs financial statements, industry analyses, and market intelligence for robust strategic assessments.