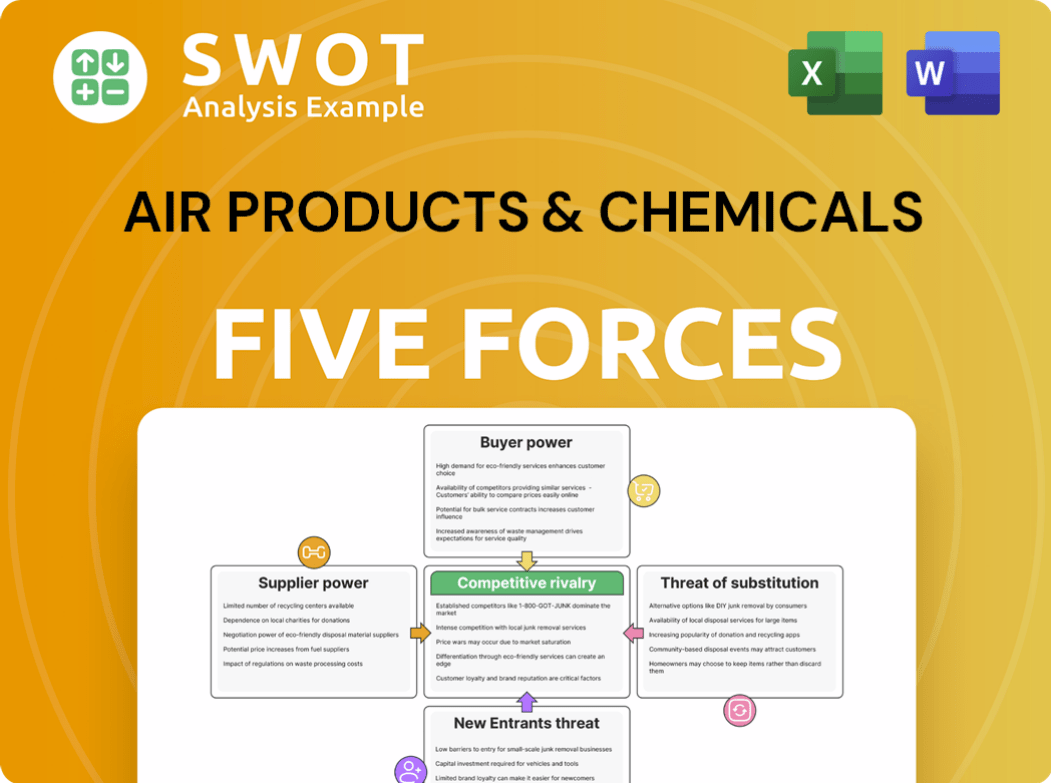

Air Products & Chemicals Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Air Products & Chemicals Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Easily visualize competitive intensity with a dynamic bubble chart, spotting potential risks quickly.

Same Document Delivered

Air Products & Chemicals Porter's Five Forces Analysis

This preview presents the complete Air Products & Chemicals Porter's Five Forces analysis. You'll receive this exact, professionally written document immediately after purchase.

Porter's Five Forces Analysis Template

Air Products & Chemicals faces moderate rivalry, driven by competition among industrial gas companies. Buyer power is concentrated among large industrial customers, potentially pressuring margins. Supplier power is moderate, with some specialized gas sources. The threat of new entrants is limited by high capital costs and regulatory hurdles. Substitutes, such as alternative energy sources, pose a growing, but manageable, threat.

This preview is just the beginning. Dive into a complete, consultant-grade breakdown of Air Products & Chemicals’s industry competitiveness—ready for immediate use.

Suppliers Bargaining Power

The industrial gas equipment sector is highly concentrated, with about 5-7 major global suppliers. This includes giants like Linde plc, Air Liquide S.A., and Chart Industries, Inc. This limited supplier base gives these companies significant leverage. In 2024, Air Products faced increased costs due to supplier price hikes.

Air Products & Chemicals faces high supplier bargaining power due to the significant capital investments required for industrial gas production equipment. Manufacturing facilities require investments from $50 million to $250 million. For instance, cryogenic air separation units can cost $75-120 million. This financial commitment creates a strong reliance on current suppliers.

Air Products & Chemicals' profitability is influenced by its raw material dependency. The company uses natural gas, with costs fluctuating. In 2024, natural gas prices ranged from $3.50 to $4.25 per MMBtu. Major suppliers like ExxonMobil, Chevron, Shell, and BP hold considerable pricing power. This dependence on suppliers impacts Air Products' costs and financial performance.

Technological Capabilities

Air Products & Chemicals leverages its technological capabilities to counter supplier power. The company allocates $350-400 million annually to research and development, focusing on advanced separation technologies. This investment aims to reduce dependency on specific suppliers and enhance operational efficiency. These technological advancements provide Air Products with more control and flexibility in its supply chain. This is a core strategy to maintain competitive advantage in the industrial gas market.

- Annual R&D Spending: $350-400 million.

- Focus: Advanced separation technologies and process improvements.

- Goal: Reduce supplier dependency and improve efficiency.

- Impact: Increased control and flexibility in the supply chain.

Long-Term Contracts

Air Products & Chemicals significantly lessens supplier power through long-term contracts, ensuring stable pricing and supply continuity. These contracts are a strategic shield against volatile market swings, securing access to vital resources. Effective management of supplier relationships through these agreements is crucial for maintaining cost competitiveness, as seen in the 2024 financial reports. For instance, the company's consistent profitability in 2024 reflects its ability to negotiate favorable terms.

- Long-term contracts help stabilize costs.

- They guarantee a steady supply of essential materials.

- Strategic supplier management boosts cost-effectiveness.

- 2024 reports show positive financial results due to these strategies.

Air Products & Chemicals faces substantial supplier bargaining power, especially from a few large equipment and raw material providers. High capital investments and dependence on natural gas, priced between $3.50 and $4.25 per MMBtu in 2024, bolster supplier influence. However, Air Products mitigates this through R&D ($350-400 million annually) and long-term contracts.

| Factor | Description | Impact |

|---|---|---|

| Equipment Suppliers | Concentrated market with few major players. | Increased costs and supply chain vulnerabilities. |

| Raw Materials | Reliance on natural gas (2024: $3.50-$4.25/MMBtu). | Exposure to price volatility from major suppliers. |

| Mitigation | R&D ($350-400M), long-term contracts. | Enhanced control and cost stability. |

Customers Bargaining Power

Air Products boasts a broad customer base of roughly 2.5 million clients spanning manufacturing, healthcare, and tech. This diversification is key. In 2024, no single customer accounted for over 10% of sales. This spread minimizes vulnerability to any one sector's downturn, ensuring stability.

Air Products & Chemicals faces moderate customer concentration, with its top 10 customers generating 35.6% of its revenue in 2024. This reliance highlights the importance of maintaining strong relationships with these key accounts. The customer base is diverse, but this concentration requires careful management. Strong relationships are crucial for sustained financial performance.

Air Products & Chemicals benefits from long-term contracts with customers. These contracts, with an average duration of 7.3 years, lock in revenue. This strategy reduces the risk of customers switching to competitors. Contractual agreements are central to Air Products' customer relationships, ensuring stability.

Switching Costs

Switching costs significantly impact Air Products' customer bargaining power. Industrial gases are deeply integrated into manufacturing processes. Industries like semiconductors and healthcare depend heavily on specific gas supplies, making it costly to switch. This dependency reduces buyer power, protecting Air Products.

- Air Products' sales in fiscal year 2024 reached $12.6 billion.

- The company's long-term contracts and integrated supply systems create high switching costs for customers.

- Air Products' focus on long-term contracts with major industrial players strengthens its position.

Customization and Value-Added Services

Air Products & Chemicals excels in offering tailored solutions and value-added services, thereby increasing customer dependence and limiting their price negotiation leverage. These services include on-site production facilities, expert application knowledge, and dedicated technical support. This comprehensive approach reinforces customer relationships, effectively diminishing buyer power. In 2024, the company's strategic focus has been on expanding these services, which is evident in their contract renewals and project wins.

- On-site production generates a significant portion of Air Products' revenue, reducing customer bargaining power.

- Application expertise and technical support deepen customer reliance on Air Products' specialized knowledge.

- Customized solutions lock in customers through tailored offerings.

- The company's focus on long-term contracts further reduces customer negotiation opportunities.

Air Products faces moderate customer concentration, with top 10 clients generating 35.6% of 2024 revenue, despite a broad base. Long-term contracts, averaging 7.3 years, and high switching costs bolster its position. Tailored solutions and value-added services further reduce buyer power.

| Aspect | Details | Impact |

|---|---|---|

| Customer Concentration | Top 10 customers: 35.6% of 2024 revenue | Moderate impact, managed via relationships |

| Contract Duration | Average 7.3 years | Reduces customer bargaining power |

| Switching Costs | High due to integrated processes | Decreased buyer power |

Rivalry Among Competitors

Air Products encounters fierce competition in the industrial gas sector, primarily from Linde and Air Liquide. These rivals battle on multiple fronts, including cost, technological innovation, and global reach. This high level of competition can squeeze profit margins. Air Products' sales in 2023 were $12.6 billion, showing the scale of the market rivalry.

Air Products & Chemicals possesses a substantial global market share in the industrial gases sector, currently around 16.3%. However, it contends with robust competition from larger entities like Linde plc, which boasts a larger market capitalization. The need to continually innovate and invest strategically is crucial for Air Products to retain and increase its market share. These efforts are vital in a competitive landscape where market dynamics are ever-changing. Air Products' strategic focus on cost-efficiency and innovation helped it achieve $12.6 billion in sales in fiscal year 2023.

Air Products & Chemicals significantly invests in research and development, allocating $422 million in 2023. This substantial investment represents 3.7% of their revenue. Such commitment to innovation is vital for maintaining a competitive edge. R&D efforts drive technological advancements and new product development.

Industry Consolidation

The industrial gases market is marked by consolidation, a trend that intensified in 2023, with an annual growth of 4.2%. This consolidation, driven by mergers and acquisitions, creates larger competitors, intensifying rivalry. Air Products & Chemicals, and its peers, must adapt to these shifts to remain competitive.

- 2023 saw a 4.2% annual growth in the industrial gases market, reflecting ongoing consolidation.

- Mergers and acquisitions are key drivers of this consolidation.

- Consolidation leads to larger, more competitive rivals.

- Adaptation is crucial for maintaining competitiveness.

Global Presence

Air Products' global footprint, reaching over 50 countries, is a significant strength. This extensive reach allows them to serve multinational clients efficiently. However, rivals like Linde and Air Liquide also boast broad international networks, creating fierce competition worldwide. The industrial gas market's global nature intensifies rivalry across regions.

- Air Products' sales outside the U.S. represented 44% of total sales in fiscal year 2024.

- Linde operates in over 100 countries, reflecting its vast global presence.

- Air Liquide has a presence in 75 countries.

- The global industrial gases market was valued at approximately $120 billion in 2024.

Air Products faces intense rivalry, especially from Linde and Air Liquide, who compete on costs, tech, and global presence. R&D spending, like Air Products’ $422 million in 2023, fuels the competition. Market consolidation further intensifies competition.

| Metric | Air Products | Competitors |

|---|---|---|

| 2023 Revenue | $12.6B | Linde: $33B, Air Liquide: $30B |

| R&D Spending (2023) | $422M (3.7% of revenue) | Varies |

| Global Presence | 50+ countries | Linde: 100+, Air Liquide: 75 |

SSubstitutes Threaten

Air Products & Chemicals faces a low threat from substitutes due to the essential nature of industrial gases. These gases are indispensable in sectors like semiconductors and healthcare, with few direct alternatives. Their critical role in manufacturing processes reduces the likelihood of substitution. For example, in 2024, the global industrial gases market was valued at approximately $110 billion, highlighting the demand for these products.

Green hydrogen production poses a substitution threat to Air Products. The global green hydrogen market is forecasted to hit $72 billion by 2030. This could displace traditional industrial gases in some uses. Air Products must monitor and invest in green tech.

The threat of substitutes is increasing, especially with renewable energy integration. Solar and wind power are becoming more prevalent, challenging traditional gas consumption. Battery storage technology is also reducing gas-based power generation. In 2024, renewable energy accounted for around 25% of global electricity generation. Adapting to this shift is key for Air Products & Chemicals' long-term relevance.

Advanced Purification Technologies

Air Products & Chemicals actively invests in advanced gas purification and recycling technologies, aiming to boost operational efficiency and reduce expenses. These technological advancements bolster the value of industrial gases, making them more competitive against substitutes. Continuous innovation in purification technologies is key to maintaining this edge. For example, in 2024, Air Products allocated a significant portion of its R&D budget to enhance gas purification methods. This strategic investment is intended to boost market competitiveness.

- Air Products' R&D expenditure on purification technologies in 2024 amounted to $150 million.

- The company aims to reduce production costs by 10% through these advanced technologies by 2026.

- Enhanced purification increases the purity of industrial gases, improving their performance in applications like electronics manufacturing.

- Air Products' focus on efficiency helps to withstand the threat from alternative products or methods.

Alternative Energy Impact

The threat of substitutes is significant for Air Products due to the rise of alternative energy. The renewable energy sector is projected to decrease traditional gas consumption by 7.5% yearly until 2030. This shift requires Air Products to diversify its services and invest in renewable energy solutions to stay competitive. Diversification helps reduce dependency on conventional industrial gases, lessening the impact of substitution.

- Air Products' revenue in 2024 was approximately $12.7 billion.

- The company invested $4.5 billion in growth projects in 2024.

- Renewable energy investments are a key part of Air Products' strategy.

- Alternative energy projects are expanding globally.

The threat of substitutes for Air Products & Chemicals is moderate. Green hydrogen and renewable energy are emerging alternatives, potentially impacting traditional gas consumption.

Air Products invests in technologies to stay competitive. R&D spending on purification reached $150 million in 2024.

Diversification into renewable solutions is crucial. Revenue was $12.7 billion and growth investments were $4.5 billion in 2024.

| Substitution Factor | Impact | 2024 Data |

|---|---|---|

| Green Hydrogen Market | Growing Threat | Forecasted $72B by 2030 |

| Renewable Energy | Decreasing Gas Demand | 25% of Global Electricity |

| R&D on Purification | Mitigating Risk | $150M Investment |

Entrants Threaten

The industrial gas sector demands substantial initial capital, serving as a significant deterrent to new entrants. Air Products, for instance, allocated $1.4 billion for capital expenditures in fiscal year 2023. This extensive financial commitment is necessary for establishing essential infrastructure. Consequently, the high capital expenditure acts as a considerable barrier, limiting the likelihood of new competitors entering the market.

Producing and distributing industrial gases demands significant technological expertise, a barrier for new entrants. Air Products invests substantially in R&D. In 2024, R&D spending was approximately $200 million. Lack of tech capabilities is a major hurdle for new competitors, limiting their market access.

Air Products & Chemicals benefits from established customer relationships, a significant barrier to new entrants. These relationships, built on trust and reliability, offer customized solutions, giving Air Products a competitive edge. It takes considerable time and effort for newcomers to build such strong customer bonds. For instance, in 2024, Air Products' sales to long-term contract customers represented a substantial portion of their revenue, highlighting the value of these relationships. This customer loyalty is a key factor in their market position.

Economies of Scale

Air Products & Chemicals, as an established player, enjoys substantial economies of scale, allowing for cost advantages in production and distribution. New entrants face challenges in matching these efficiencies, creating a significant barrier. The ability to spread fixed costs over a large production volume is a key advantage. Scale advantages are crucial in the industrial gas market.

- Air Products' revenue in fiscal year 2024 was approximately $12.7 billion, showcasing their scale.

- New entrants may struggle to compete with established distribution networks.

- The cost to build a comparable plant is a significant entry barrier.

- Air Products' global presence enhances economies of scale.

Regulatory Compliance

Regulatory compliance poses a significant threat to new entrants in the industrial gas industry. Stringent regulations govern safety, storage, and transportation, increasing the complexity and cost of market entry. These requirements, which are constantly updated, demand substantial investment in infrastructure and expertise. The need to meet these standards creates a considerable barrier.

- Compliance costs can be substantial, including investments in specialized equipment and personnel training.

- Regulatory changes require continuous monitoring and adaptation, increasing operational overhead.

- Non-compliance can result in severe penalties, including fines and operational shutdowns.

- Meeting these regulatory hurdles can delay market entry and increase initial capital expenditures.

New entrants face high capital costs, such as Air Products' $1.4B cap ex in 2023. Technical expertise and R&D spending, with ~$200M in 2024, create barriers. Established customer relationships and economies of scale, with $12.7B revenue in 2024, further limit entry.

| Barrier | Description | Impact |

|---|---|---|

| Capital Expenditure | High initial investment in infrastructure | Limits new entrants. |

| Technical Expertise | Requires advanced knowledge and R&D | Raises market entry hurdles. |

| Economies of Scale | Established players have cost advantages | Difficult for new entrants to match. |

Porter's Five Forces Analysis Data Sources

Our analysis utilizes data from company reports, industry publications, and market research to evaluate competitive forces affecting Air Products & Chemicals.