Akebia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akebia Bundle

What is included in the product

Highlights which units to invest in, hold, or divest

Printable summary optimized for A4 and mobile PDFs.

Full Transparency, Always

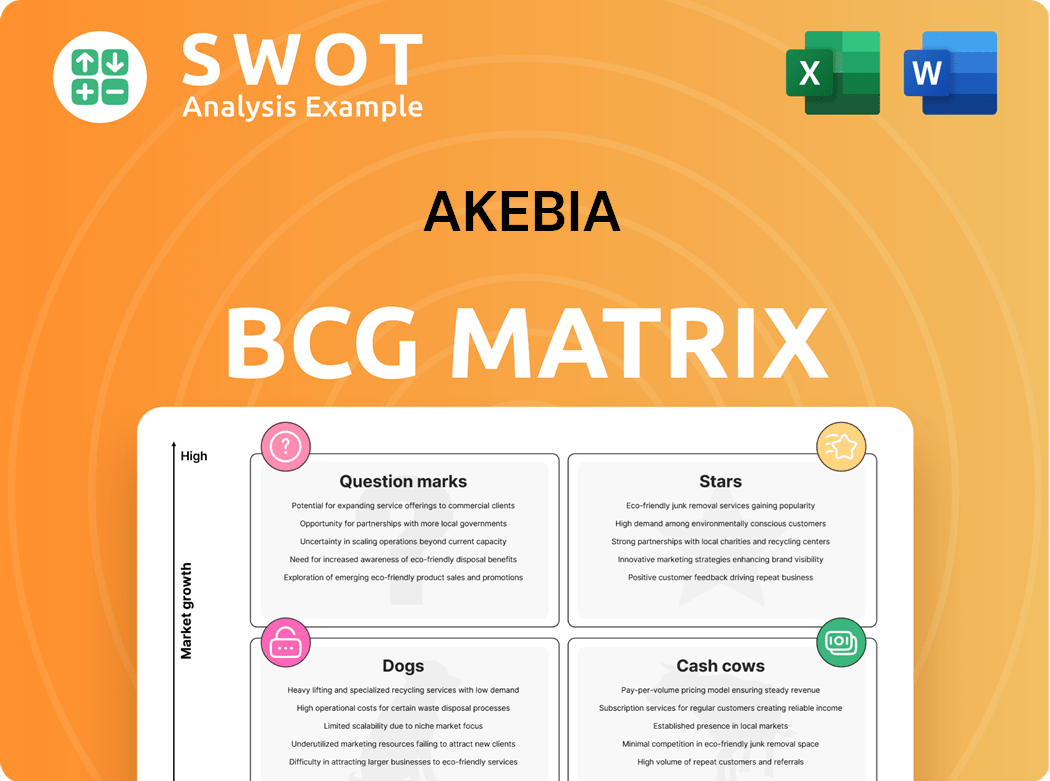

Akebia BCG Matrix

The BCG Matrix displayed is the actual document you'll receive after purchase, reflecting Akebia's strategic insights. This is a fully functional report, designed for professional application. Download the full, ready-to-use file instantly after buying.

BCG Matrix Template

Akebia's BCG Matrix reveals its product portfolio's competitive landscape. Discover which products shine as Stars, and which are Cash Cows. Identify the Dogs and Question Marks demanding strategic attention. This overview scratches the surface of its market positioning. Purchase the full BCG Matrix for in-depth quadrant analysis and actionable strategies for informed decisions.

Stars

Vafseo, approved by the FDA in March 2024, is a promising product for anemia in dialysis patients. The drug's early launch metrics are strong, with contracts covering almost all U.S. dialysis patients. Initial prescriber uptake is also encouraging, suggesting market acceptance. Akebia projects $10-11 million in Vafseo revenue for Q1 2025, signaling growth.

Vafseo's future hinges on the VALOR trial, targeting non-dialysis CKD patients. FDA approval following a successful Phase 3 trial, slated for H2 2025, could broaden Vafseo's label. This expansion could unlock substantial revenue growth, with peak sales estimates potentially reaching $1 billion annually.

The CHMP's positive recommendation for XOANACYL, known as Auryxia in the U.S., in Europe, hints at possible revenue growth. The European Commission's decision is expected by June 2025, with approval appearing likely based on the CHMP's stance. Averoa, a renal therapies expert, will handle marketing. In 2024, Auryxia's U.S. net sales were roughly $150 million.

VOICE Collaborative Clinical Trial

The VOICE trial, a key component of Akebia's strategy, is evaluating Vafseo's impact on mortality and hospitalization rates. With over 50% enrollment, the trial's progress is promising. Positive outcomes could significantly boost Vafseo's market position. This trial is crucial for Akebia's future.

- VOICE trial assesses Vafseo's mortality and hospitalization effects.

- Over half of the target patients have been enrolled.

- Positive results could drive Vafseo's adoption.

- The trial is a key part of Akebia's strategy.

Analyst Ratings and Price Targets

Analyst ratings for Akebia are generally positive, with a consensus leaning towards a "Buy" recommendation. Price targets set by analysts are notably higher than the current market price, reflecting optimism. For example, one recent price target is $13.64, suggesting a substantial increase. This positive outlook is largely due to confidence in Akebia's strategy and the potential of Vafseo.

- Consensus Rating: Buy

- Price Target: $13.64 (612.27% increase)

- Confidence: Strategic Initiatives and Vafseo

Akebia's "Stars," like Vafseo, show high growth potential and market share. Vafseo, launched in 2024, quickly secured contracts for dialysis patients. Positive analyst ratings with high price targets reflect the market's strong belief in the company's growth potential, particularly Vafseo's trajectory.

| Product | 2024 Revenue (USD) | Strategic Element |

|---|---|---|

| Vafseo | $0 (launch year) | Rapid Market Adoption |

| Auryxia (XOANACYL) | $150M (U.S.) | EU Approval (Q2 2025) |

| Akebia Stock (Price Target) | $13.64 (612.27% increase) | Analyst Confidence |

Cash Cows

Auryxia, despite facing revenue declines, remains a significant revenue generator for Akebia. In Q4 2024, Auryxia's net product revenues reached $44.4 million. Akebia is strategically contracting with dialysis organizations to maintain Auryxia's accessibility. The inclusion of Auryxia in bundled payments for dialysis services supports its continued market presence.

Akebia's commercial supply contracts for Vafseo, covering nearly all U.S. dialysis patients, are a significant strength. These contracts ensure a solid revenue stream, crucial for Vafseo's market access. In 2024, these agreements will be pivotal for sustained financial stability. The company's contracts cover dialysis organizations caring for almost 100% of U.S. patients.

Akebia's partnership with Medice for Vafseo's European launch is a strategic move, offering revenue diversification. Medice launched Vafseo in several European countries in 2024, boosting Akebia's international presence. This collaboration allows expansion without substantial direct investment. The partnership is expected to contribute positively to Akebia's financial performance.

TDAPA Reimbursement

Vafseo's TDAPA status is crucial. CMS's TDAPA designation ensures reimbursement, boosting adoption. Level II HCPCS code simplifies billing for Medicare patients. This support is vital for commercial success.

- Vafseo's 2024 U.S. net product revenue reached $41.7 million.

- TDAPA designation provides additional payment for Vafseo, helping dialysis centers.

- The HCPCS code allows for streamlined billing processes.

- Reimbursement support is essential for market penetration.

Strategic Partnerships

Akebia Therapeutics strategically leverages partnerships to bolster its cash flow. They collaborate to broaden their product range and market footprint. Akebia's deal with Cyclerion Therapeutics for praliciguat is a prime example. This agreement, including manufacturing control, is vital for revenue.

- Partnerships can generate royalties or upfront payments, improving financial stability.

- The Cyclerion agreement amendment highlights Akebia's control over crucial aspects.

- Strategic alliances help Akebia navigate the complex biotech landscape.

- These moves are essential for growth and sustaining financial health.

Cash Cows are revenue-generating products with established market share. In Akebia's case, Auryxia and Vafseo are prime examples, generating consistent revenue. Vafseo's 2024 U.S. net product revenue reached $41.7 million, demonstrating its financial stability.

| Product | 2024 Revenue (USD Millions) | Status |

|---|---|---|

| Auryxia | 44.4 | Cash Cow |

| Vafseo (U.S.) | 41.7 | Cash Cow |

| Partnerships | Royalties/Payments | Cash Flow Booster |

Dogs

Auryxia's net revenues dipped in Q4 and FY2024 due to lower sales volume. This signifies potential market challenges or growing competition. In 2024, Auryxia's net product revenue was $131.7 million, down from $155.2 million in 2023. Akebia must strategize to counter this revenue decrease.

Akebia's "Dogs" status is highlighted by escalating net losses. Q4 2024 saw a net loss of $22.8M, contrasting with $0.6M income in Q4 2023. For 2024, the loss reached $69.4M, up from $51.9M in 2023. Such losses threaten the company's financial health; profitability improvements are critical.

Akebia's financial health is closely tied to Vafseo's performance. A shortfall in Vafseo's revenue, projected at $450 million by 2027, could hurt Akebia. In 2024, the company must diversify its income sources to lessen this risk. Explore partnerships to reduce reliance on a single drug.

Potential Regulatory Hurdles

Akebia, categorized as a "Dog" in the BCG matrix, confronts regulatory challenges that could slow down its progress. Delays in approvals or expanded label indications could limit Akebia's market opportunities. The company must actively address these risks to stay on track. In 2024, the FDA issued several Complete Response Letters, pointing out regulatory concerns.

- Complete Response Letters from the FDA in 2024.

- Potential delays in product launches.

- Impact on revenue projections.

- Need for proactive regulatory strategies.

Financial Instability

Akebia, classified as a "Dog" in the BCG matrix, grapples with financial instability. Intellectual property disputes cast a shadow, and securing capital at favorable terms presents a significant hurdle. This financial strain impedes growth and pipeline development, crucial for its survival. Akebia's market capitalization as of late 2024 was under $200 million, reflecting investor concerns.

- IP Disputes: Ongoing legal battles increase financial uncertainty.

- Capital Constraints: Difficulty in securing funding at advantageous rates.

- Market Capitalization: Under $200 million as of December 2024, signals risk.

- Pipeline Development: Funding is essential for drug development.

Akebia's "Dogs" status is marked by significant financial instability and recurring net losses.

In 2024, the company's net loss grew to $69.4 million, raising concerns about its financial viability.

Facing IP disputes and capitalization struggles, Akebia's market cap fell below $200 million by late 2024, hindering growth.

| Financial Metric | 2023 | 2024 |

|---|---|---|

| Net Loss ($M) | 51.9 | 69.4 |

| Market Cap ($M) | ~250 | <200 |

| Auryxia Net Revenue ($M) | 155.2 | 131.7 |

Question Marks

Expanding Vafseo to non-dialysis CKD patients is a high-growth, high-risk move for Akebia. The VALOR trial's results are critical, as they will determine Vafseo's efficacy and safety. Akebia must invest significantly in the Phase 3 trial. In 2024, Akebia's R&D spending was $158.6 million.

The anemia treatment market is indeed competitive, featuring established pharmaceutical giants and the looming threat of generic competitors. To succeed, Akebia must highlight the unique benefits of Vafseo and Auryxia. A robust marketing strategy is crucial for Akebia to effectively compete and maintain its market position. The global anemia treatment market was valued at USD 18.2 billion in 2024.

The Committee for Medicinal Products for Human Use (CHMP) recommended XOANACYL approval in Europe. The European Commission (EC) makes the final decision, which could impact Akebia's revenue. Failure to get EC approval poses a risk, requiring close monitoring of the regulatory landscape. In 2024, Akebia's revenue was $26.8 million.

Relying on Partnerships

Akebia's reliance on partnerships, particularly for Vafseo's commercialization in Europe, is a key aspect of its BCG Matrix positioning. This strategy introduces an element of risk since success hinges on the partner's effectiveness. Effective partnership management is crucial for Akebia. According to the Q3 2024 report, Akebia's collaboration with Vifor Pharma is critical for Vafseo's European launch.

- Partnership risk is a primary concern for Akebia's European market entry.

- Vifor Pharma's performance significantly impacts Vafseo's success.

- Akebia must ensure alignment with its partners.

Future Strategic Transactions

Akebia is actively pursuing strategic transactions to bolster its financial health. These moves may include licensing deals, partnerships, or acquisitions, aiming to boost revenue. The outcomes of these transactions remain uncertain. Akebia must carefully assess each opportunity. The company anticipates revenue from current agreements.

- Strategic transactions could involve licensing agreements, collaborations, or acquisitions.

- The success of these transactions is uncertain.

- Akebia needs to carefully evaluate potential opportunities.

- The company anticipates generating revenue from its collaboration and supply agreements.

Question Marks represent high-growth, high-risk ventures like expanding Vafseo to non-dialysis CKD patients. Akebia's success hinges on positive trial results and effective market strategies. The company faces uncertainties in regulatory approvals, partnerships, and strategic transactions. In 2024, R&D costs were $158.6 million, while revenue was $26.8 million.

| Aspect | Details | Impact |

|---|---|---|

| Vafseo Expansion | Non-dialysis CKD trials | High Risk/High Growth |

| Regulatory | EC approval for XOANACYL | Revenue Impact |

| Partnerships | Vifor Pharma (Europe) | Success Dependence |

BCG Matrix Data Sources

Akebia's BCG Matrix is built using company financials, market share analyses, and growth forecasts from industry experts.