Akebia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Akebia Bundle

What is included in the product

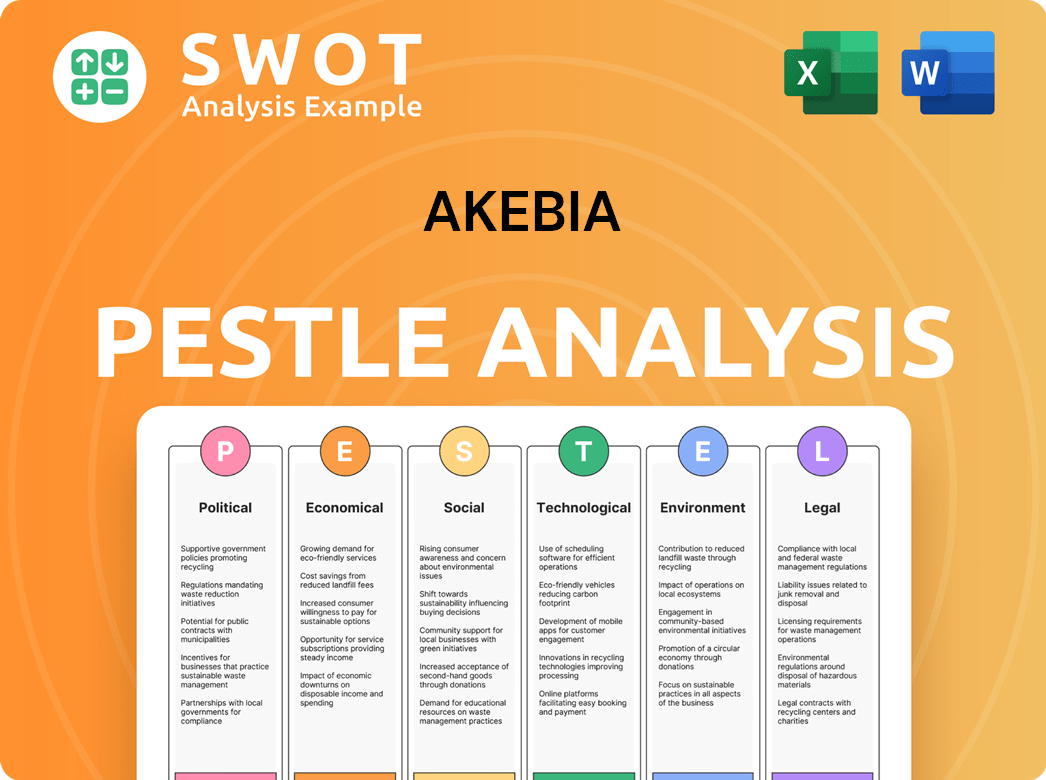

This Akebia PESTLE analysis offers actionable insights on external factors: Political, Economic, etc. for strategic planning.

Helps quickly pinpoint potential areas of weakness and opportunity.

Full Version Awaits

Akebia PESTLE Analysis

This Akebia PESTLE analysis preview shows the final product.

It's the exact document you'll receive instantly after purchase.

The formatting and content shown here will be downloaded.

Get this professional and structured analysis today.

Enjoy working with this ready-to-use file!

PESTLE Analysis Template

Uncover the external forces shaping Akebia's future with our PESTLE analysis. Explore how political and economic factors influence their success, as well as social, technological, legal, and environmental impacts. Understand key trends, assess risks, and identify opportunities within the pharmaceutical market. Equip yourself with actionable intelligence and make informed decisions. Download the full PESTLE analysis today and gain a strategic advantage!

Political factors

Changes in government healthcare policies and reimbursement rates are crucial for Akebia. The Centers for Medicare & Medicaid Services (CMS) plans to include oral-only products in bundled payments by 2025. This impacts how dialysis facilities are reimbursed. Federal discussions about postponing the change introduce uncertainty. For example, in Q1 2024, Auryxia's net product revenue was $81.5 million.

The pharmaceutical industry faces a dynamic regulatory environment. Akebia must comply with FDA regulations, including recent approvals. The FDA approved Vafseo in March 2024. Import regulations and manufacturing standards also present challenges.

Geopolitical events and political stability greatly influence biopharma. Trade policies can disrupt supply chains. Global market uncertainty affects sourcing and sales strategies. For instance, in 2024, political shifts influenced 15% of supply chain disruptions. This highlights the importance of monitoring political risks.

Government Funding for Kidney Disease Research

Government funding significantly influences kidney disease research, potentially driving innovation in treatments. Initiatives focusing on early detection and slowing disease progression could support Akebia's goals. In 2024, the National Institutes of Health (NIH) allocated approximately $700 million towards kidney disease research, illustrating the government's commitment. Such investments can create opportunities for companies like Akebia.

- NIH allocated roughly $700 million in 2024 for kidney disease research.

- Government initiatives aim for early disease detection and slowed progression.

Patient Access Advocacy

Patient access advocacy significantly impacts Akebia's market. Groups such as the National Kidney Foundation push for affordable access to kidney disease treatments. This advocacy can influence political decisions and payer policies. These actions directly affect Akebia's market position and revenue streams.

- In 2024, the National Kidney Foundation advocated for increased access to innovative therapies.

- The American Society of Nephrology supports policies promoting patient affordability.

- These groups' efforts can shift the political landscape for drug pricing.

Political shifts profoundly impact Akebia. Policy changes like those from CMS on reimbursement rates are critical; 2025 bundled payment plans may alter revenue. Regulatory approvals, such as the FDA's 2024 nod for Vafseo, reflect the dynamic pharmaceutical environment.

| Political Factor | Impact | 2024/2025 Data |

|---|---|---|

| Healthcare Policies | Reimbursement changes; market access | Q1 2024 Auryxia revenue: $81.5M |

| Regulatory Approvals | Drug sales & compliance; investor trust | Vafseo approval (March 2024) |

| Government Funding | R&D support; innovation | NIH allocated ~$700M for kidney research (2024) |

Economic factors

Healthcare spending levels and reimbursement rates significantly impact Akebia's financial performance. In 2024, U.S. healthcare spending reached approximately $4.8 trillion, with projections indicating continued growth. Reimbursement rates for kidney disease treatments, like those Akebia offers, are vital; changes can affect profitability. Factors such as insurance coverage and government payment models directly influence patient access and Akebia's revenue streams.

The global renal failure treatment market is large and expanding. It's fueled by rising chronic kidney disease rates and an aging population. This market is expected to reach $140 billion by 2030. Akebia can capitalize on this growth. This represents a considerable economic opportunity.

The biopharmaceutical market is highly competitive, particularly in kidney disease treatments. Existing therapies and new drug classes challenge Akebia's market share. Pricing pressure is a significant factor, potentially impacting profitability. In 2024, generic competition could further squeeze margins, affecting Akebia's financial performance. Sales forecasts must account for these competitive dynamics.

Investment Trends in Biotechnology

Investment trends significantly impact Akebia's funding prospects. Healthcare biotech funding has grown, but clinical-stage assets are favored. In 2024, venture capital investment in biotech reached $25 billion. Public offerings also play a key role.

- Venture capital investments in biotech in 2024: $25 billion.

- Focus on clinical-stage assets impacts funding availability.

Manufacturing and Supply Chain Costs

Manufacturing and supply chain expenses are critical economic factors for Akebia. Geopolitical instability, inflation, and material shortages directly influence production costs and profitability. These factors can lead to increased operational expenditures. For example, in 2024, pharmaceutical manufacturing costs rose by 6-8% due to these issues.

- Inflation's Impact: Affects raw material and labor costs.

- Supply Chain Disruptions: Can lead to production delays.

- Geopolitical Risks: Increase uncertainty.

- Cost Management: Crucial for maintaining profit margins.

Healthcare spending and reimbursement models, influencing Akebia's revenues, are significant. The global renal treatment market, poised for growth, offers a large opportunity. Rising costs, from inflation to supply chain woes, can squeeze margins; careful financial planning is crucial.

| Economic Factor | Impact | 2024 Data/Forecast |

|---|---|---|

| Healthcare Spending | Influences Revenue | U.S. healthcare spending $4.8T |

| Renal Market Growth | Expansion Opportunity | Expected to reach $140B by 2030 |

| Manufacturing Costs | Affects Profitability | Pharmaceutical costs rose 6-8% |

Sociological factors

The rising incidence of chronic kidney disease (CKD) worldwide is a critical sociological factor for Akebia. CKD affects millions, with global prevalence estimated to be 10-16%, creating a substantial need for treatments. This patient growth, expected to reach 738 million by 2035, fuels demand for innovative therapies.

The global population is aging, with a significant rise in those aged 65 and over, projected to reach 16% by 2050. This demographic shift is directly linked to increased kidney disease incidence. Older adults are more susceptible to renal function decline, expanding the target patient pool for Akebia's treatments. The prevalence of chronic kidney disease (CKD) is expected to grow, creating more opportunities for Akebia.

Patient awareness and education are vital for managing kidney disease. This impacts demand for treatments like Akebia's. Globally, chronic kidney disease affects roughly 10% of the population. Early diagnosis and patient education can significantly improve patient outcomes and potentially increase the use of Akebia's products. Successful patient engagement strategies may boost market penetration.

Access to Healthcare and Treatment Disparities

Sociological factors play a crucial role in healthcare access. Socioeconomic status and geographic location impact patient access to treatments. Ensuring equitable kidney care is vital for underserved populations. This impacts companies like Akebia, which focuses on kidney disease treatments. Disparities in access can affect drug adoption and market reach.

- In 2024, disparities in kidney care access persist, with significant differences in treatment rates based on race and income.

- Geographic location also affects access, with rural areas often lacking specialized kidney care facilities.

- The Centers for Medicare & Medicaid Services (CMS) initiatives aim to address these disparities, but challenges remain.

Quality of Life for Kidney Disease Patients

Akebia's focus on improving the quality of life for kidney disease patients is critical. The burden of treatment, like dialysis, significantly impacts patient well-being. Innovative therapies are needed to provide convenience and better outcomes for patients. The company's efforts directly address these challenges, aiming to enhance patient experiences. This is particularly relevant given the rising prevalence of kidney disease.

- Over 37 million adults in the U.S. currently have chronic kidney disease (2024 data).

- Dialysis patients often face a reduced quality of life due to treatment demands (2024 studies).

- Akebia's therapies aim to reduce the need for frequent dialysis.

- Improved outcomes can lead to better patient satisfaction and adherence (2025 projections).

Social factors influence Akebia’s market through disease prevalence, impacting treatment demand. In 2024, CKD affects 37M US adults, with global prevalence at 10-16%. Patient access and education are crucial. Socioeconomic and geographic disparities influence treatment rates.

| Factor | Impact | 2024 Data/Projections |

|---|---|---|

| CKD Prevalence | Drives treatment demand | 37M US adults (2024) |

| Access to Care | Affects market reach | Disparities persist in treatment rates (2024) |

| Patient Awareness | Influences product adoption | Early diagnosis improves outcomes (2024) |

Technological factors

Akebia's work in HIF biology is fueled by ongoing research advancements. Breakthroughs in understanding HIF's role in anemia and kidney disease could lead to better treatments. For example, the global anemia therapeutics market is projected to reach $22.8 billion by 2029. This growth is driven by innovation. This research is crucial for Akebia's future.

Technological advancements are crucial for Akebia. New treatments like SGLT2 inhibitors and GLP-1 receptor agonists are emerging. These compete and offer new solutions for kidney disease. The global kidney disease treatment market is projected to reach $146.6 billion by 2029. Akebia's therapies must evolve to stay competitive.

Technological advancements in drug delivery and manufacturing are pivotal. Continuous manufacturing and single-use systems can boost efficiency. These innovations potentially reduce costs and improve drug accessibility for Akebia. In 2024, the global market for continuous manufacturing reached $1.2 billion. It's projected to hit $2.5 billion by 2029.

Application of AI and Data Analytics in R&D and Operations

Akebia can benefit from the growing integration of AI and data analytics in the pharmaceutical sector. This includes using AI for drug discovery and optimizing clinical trials. These technologies can streamline Akebia's supply chain. For example, AI could reduce R&D costs by up to 30%.

- AI-driven drug discovery is projected to reach $4 billion by 2025.

- Data analytics can cut clinical trial times by 20%.

- Supply chain optimization can reduce operational costs by 15%.

Telehealth and Remote Patient Monitoring

Telehealth and remote patient monitoring are transforming chronic disease management, including kidney disease. These tech advancements enhance patient care and data collection. The telehealth market is projected to reach $64.1 billion by 2025. This growth is driven by improved accessibility and efficiency.

- Telehealth market projected to hit $64.1B by 2025.

- Remote monitoring improves patient outcomes.

Akebia needs to adapt to new competitors like SGLT2 inhibitors; the kidney disease market will reach $146.6 billion by 2029. Efficient manufacturing using technologies like continuous manufacturing can cut costs; the market for it was $1.2 billion in 2024 and is projected to hit $2.5 billion by 2029. Integrating AI and data analytics, along with telehealth solutions, is vital for innovation and patient care. AI in drug discovery is expected to hit $4 billion by 2025.

| Technological Aspect | Impact on Akebia | Market Data/Forecast |

|---|---|---|

| Drug Development Tech | New Treatment Development | AI drug discovery at $4B by 2025 |

| Manufacturing Advancements | Efficiency, Cost Reduction | Continuous manufacturing hit $1.2B (2024), $2.5B (2029) |

| Digital Health Integration | Improved patient care, Data Collection | Telehealth Market: $64.1B by 2025 |

Legal factors

Akebia's success hinges on securing regulatory approvals, primarily from the FDA, for its drug products. These pathways are complex and time-consuming, demanding rigorous adherence to legal standards. For instance, in 2024, the FDA issued complete response letters to several drug applications, highlighting the challenges. Effective legal strategies are essential to navigate these hurdles, which include addressing complete response letters and engaging in dispute resolution to avoid delays.

Patent protection is crucial for Akebia to safeguard its innovations and market share. Legal battles, like those concerning Akebia's phosphate binder, highlight the importance of robust IP. These challenges can affect revenue streams; for instance, patent expirations led to a 23% drop in sales for some drugs. Maintaining and defending patents is critical for long-term financial health.

Akebia Therapeutics must adhere to healthcare laws covering pricing, marketing, and patient data. Compliance is critical for its business. Regulatory changes can increase compliance costs and impact how Akebia operates. For example, the FDA's stance on drug approvals can affect Akebia's pipeline. Changes in reimbursement policies by payers like Medicare (which spent $1.67 billion on chronic kidney disease drugs in 2024) also pose risks.

Product Liability and Litigation

Akebia Therapeutics, as a biopharmaceutical company, is exposed to significant legal factors concerning product liability and potential litigation. These risks involve drug safety, effectiveness, and possible side effects, which could result in lawsuits and regulatory actions. The pharmaceutical industry's litigation expenses have been substantial. For instance, in 2024, major pharmaceutical companies faced billions in settlements and legal fees.

- Product liability lawsuits can lead to significant financial burdens.

- Regulatory actions, like FDA investigations, can halt or restrict product sales.

- The outcome of such litigation can severely impact Akebia's financial performance.

- Compliance with evolving regulations demands continuous investment.

Corporate Governance and Securities Law

Akebia Therapeutics, as a public entity, is strictly governed by corporate governance rules and securities legislation. This encompasses precise financial reporting, disclosure protocols, and investor engagement strategies. Compliance is crucial, as evidenced by the SEC's 2024 enforcement actions, which saw penalties averaging $2.5 million per violation. Non-compliance can lead to significant financial and reputational harm.

- SEC enforcement actions in 2024 averaged $2.5M per violation.

- Sarbanes-Oxley Act (SOX) compliance is a key focus.

- Investor relations must adhere to Regulation FD.

Akebia must obtain FDA approvals; recent rejections pose challenges. Patent protection fights are crucial, affecting drug sales (23% drop cited). Strict healthcare laws impact pricing, marketing, patient data; Medicare spent $1.67B on chronic kidney drugs in 2024.

| Legal Factor | Impact | Example |

|---|---|---|

| Regulatory Approval | Delays & Rejections | FDA Complete Response Letters |

| Patent Litigation | Revenue Impact | Patent Expirations (23% Sales Drop) |

| Healthcare Laws | Increased Costs | Medicare Spending ($1.67B, 2024) |

Environmental factors

Manufacturing biopharmaceuticals like Akebia's products involves environmental considerations. Energy use, water consumption, and waste are key impacts. In 2024, the biopharma sector saw rising scrutiny on its environmental footprint. Companies are increasingly adopting sustainable practices.

Akebia Therapeutics faces environmental scrutiny regarding waste management. Proper disposal of pharmaceutical waste, including hazardous materials, is crucial. Compliance with environmental regulations is vital to prevent contamination. The global pharmaceutical waste management market was valued at $8.9 billion in 2023, projected to reach $13.2 billion by 2028. Akebia must invest in sustainable practices.

Biopharmaceutical manufacturing, including Akebia's operations, relies heavily on water, especially for purified water production. Water scarcity is a growing global issue. According to the World Resources Institute, 25 countries face extremely high water stress. This necessitates water conservation measures to mitigate environmental impact and ensure sustainable operations.

Energy Consumption and Greenhouse Gas Emissions

Akebia Therapeutics' operations, including research and manufacturing, consume energy, leading to greenhouse gas emissions. The biopharmaceutical industry, including Akebia, is under increasing scrutiny to minimize its environmental impact. Companies are exploring renewable energy sources and sustainable practices to reduce their carbon footprint. Regulatory bodies and investors are also pushing for greater environmental responsibility.

- In 2024, the pharmaceutical industry's carbon footprint was estimated at 55 million metric tons of CO2e.

- The shift towards sustainable practices could potentially reduce operational costs by 10-15% in the long term.

- Companies are setting targets to reduce emissions by 30-40% by 2030.

Supply Chain Sustainability

Supply chain sustainability is crucial, considering the environmental impact from raw material sourcing to product transport. Akebia can enhance its environmental profile by developing sustainable supply chains. The pharmaceutical industry is under pressure to reduce its carbon footprint. In 2024, the global pharmaceutical supply chain emitted approximately 55 million metric tons of CO2 equivalent.

- Reduce emissions through green logistics.

- Source materials from sustainable suppliers.

- Implement waste reduction strategies.

Akebia Therapeutics navigates environmental challenges tied to waste management, water usage, and energy consumption. The biopharma industry is under scrutiny, and the shift towards sustainability is growing, driven by regulation and investor pressure.

Key areas include reducing emissions through sustainable practices, particularly the supply chain which emitted 55 million metric tons of CO2e in 2024.

By embracing renewable energy and cutting waste, Akebia can potentially reduce its operational costs. By 2030 companies are setting reduction emission targets by 30-40%.

| Environmental Factor | Impact Area | 2024-2025 Data/Trends |

|---|---|---|

| Waste Management | Pharmaceutical Waste | Global mkt $8.9B (2023) to $13.2B (2028) |

| Water Usage | Manufacturing | Water stress in 25 countries; needs conservation |

| Energy & Emissions | GHG Emissions | Industry's carbon footprint at 55 million metric tons CO2e |

PESTLE Analysis Data Sources

Our Akebia PESTLE analysis is rooted in government reports, financial data, and pharmaceutical industry publications.