Ambev Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambev Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, so stakeholders have a concise overview.

Delivered as Shown

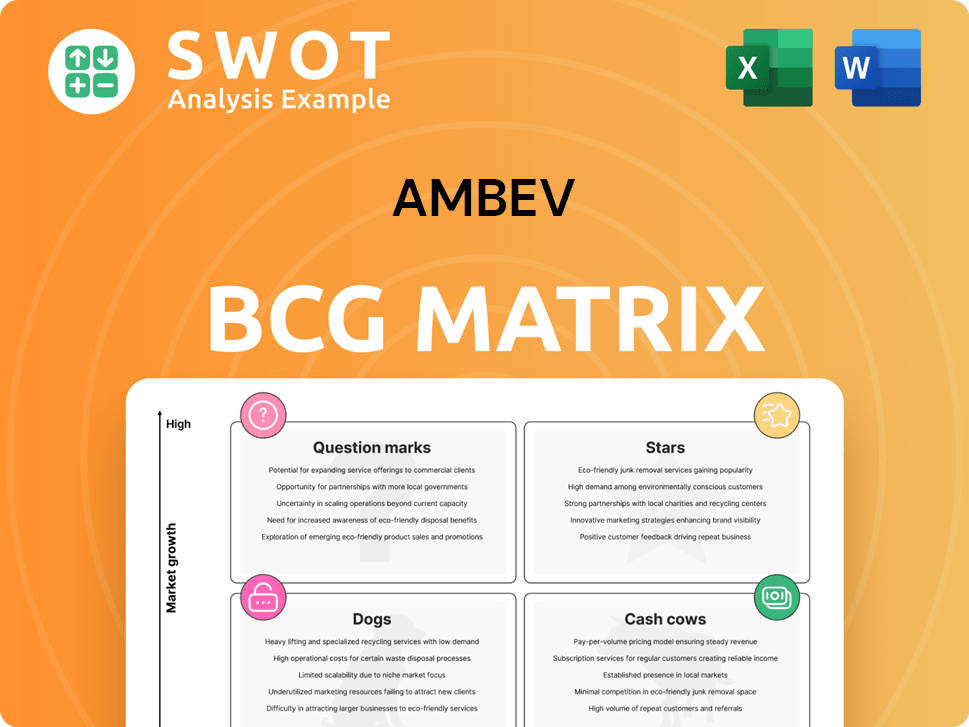

Ambev BCG Matrix

The Ambev BCG Matrix you see is the exact file you'll receive. Buy it, and get the ready-to-use strategic analysis—no changes, watermarks, or extras.

BCG Matrix Template

Ambev, a beverage giant, utilizes the BCG Matrix to strategically manage its diverse portfolio. This framework categorizes products as Stars, Cash Cows, Dogs, or Question Marks. Understanding these classifications is crucial for investment decisions and resource allocation. This brief look barely scratches the surface of Ambev's product placements and strategic implications.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Ambev's premium beer brands, including Corona, Stella Artois, and Budweiser, show robust growth, especially in Brazil. These brands leverage increased marketing and innovation, leading the premium market. In 2024, Ambev's revenue reached $15.6 billion, with premium brands contributing significantly. Continued investment is key to sustaining their growth and market share.

Ambev's digital transformation, with BEES, is a shining star. BEES, a B2B platform, has spread to many markets, boosting revenue significantly. In 2024, digital B2B platforms contributed a large share of Ambev's sales. BEES' growth and ecosystem monetization will fuel future expansion.

Ambev shines with its sustainability initiatives, a key star in its BCG matrix. The company aims for 100% renewable electricity and a 25% CO2 emissions cut by 2025. Sustainable packaging and water management boost its appeal to eco-minded consumers. This focus is crucial; in 2024, sustainable practices drove significant brand value.

Innovation in Beverages

Ambev's innovative beverages are a star in its BCG Matrix, focusing on new product launches and ready-to-drink expansions. Adapting to consumer tastes boosts revenue. Continued R&D is key for success. In 2024, Ambev invested heavily in new products.

- New beverage launches are a primary focus.

- Expansion into ready-to-drink categories is ongoing.

- Consumer preference adaptation drives sales.

- R&D and new product development are crucial.

Dominican Republic and Canada Market

Ambev is seeing positive trends in the Dominican Republic, with the Presidente family driving all-time high volumes. In Canada, Ambev's mega-brands are showing low-single-digit growth. These performances suggest a healthy market environment for Ambev's key brands. Continuing to invest in these regions is important for sustained growth.

- Dominican Republic: Presidente volumes hit all-time highs.

- Canada: Mega-brands show low-single-digit growth.

- Market focus is key to maintaining growth.

Ambev's "Stars" include premium brands such as Corona and Stella Artois, driving significant revenue. The BEES B2B platform is another strong performer, boosting sales across markets. Sustainability efforts and innovative beverages also shine, key for future growth.

| Category | Examples | 2024 Performance |

|---|---|---|

| Premium Brands | Corona, Stella Artois, Budweiser | Contributed significantly to $15.6B revenue. |

| Digital B2B | BEES Platform | Drove substantial portion of sales. |

| Sustainability | Renewable energy, Eco-packaging | Boosted brand value. |

Cash Cows

Ambev's strong presence in Brazil's beer market positions it as a cash cow, holding a dominant share. Brands like Brahma and Antarctica are key revenue generators. In 2024, Ambev's revenue in Brazil was approximately BRL 70 billion. Maintaining leadership through cost efficiency is vital.

Ambev's non-alcoholic beverages (NAB), like Guarana Antarctica, are cash cows. Strong market performance supports this. Their partnership with PepsiCo boosts market strength. Innovation and penetration sustain cash flow. In 2024, NAB revenue grew, showing continued profitability.

Ambev's operational efficiency, crucial for its "Cash Cow" status, focuses on cost management and boosting productivity. This efficiency helps maintain strong margins even with cost pressures. In 2024, Ambev's EBITDA margin was around 35%, highlighting its financial performance. Continuous optimization and cost reduction efforts are essential.

Extensive Distribution Network

Ambev's wide distribution network in Latin America boosts its cash cow status by ensuring products are readily available and deeply penetrating the market. Strong ties with retailers and distributors help maintain a steady revenue stream. Optimizing this network is key for sustained cash flow and market dominance. In 2024, Ambev's distribution network reached over 500,000 points of sale.

- Latin America's wide reach.

- Strong retailer ties.

- Steady revenue stream.

- Over 500,000 points of sale.

Brand Equity and Recognition

Ambev's strong brand equity and recognition are significant advantages in its primary markets, leading to reliable sales and cash flow. Its well-known brands have cultivated a loyal customer base, which ensures a consistent revenue stream. Maintaining brand equity requires ongoing investment in brand-building and marketing. Ambev's focus on premium brands like Budweiser and Stella Artois contributes to its cash cow status. In 2024, Ambev's marketing expenses were approximately $1.6 billion.

- Strong Brand Recognition: Ambev's brands like Budweiser and Stella Artois are well-known.

- Loyal Customer Base: Established brands attract loyal customers.

- Consistent Revenue: Loyalty ensures a steady income.

- Marketing Investment: Continued spending maintains brand value.

Ambev's cash cow status stems from its dominance in established markets. Key brands generate consistent revenue, supported by robust distribution and strong brand recognition. Operational efficiency, with a 35% EBITDA margin in 2024, enhances its profitability.

| Aspect | Details | 2024 Data |

|---|---|---|

| Brazil Revenue | Generated by beer brands | BRL 70 billion |

| NAB Revenue Growth | From non-alcoholic beverages | Positive |

| Marketing Spend | Investment in brand building | $1.6 billion |

Dogs

Ambev's Argentina market is a "dog," facing tough economic times with high inflation and currency issues. Declining sales and profits in Argentina have made it a challenging area for the company. In Q3 2023, Ambev saw a volume decrease in Argentina. Therefore, Ambev needs to rethink its strategy, possibly through restructuring or exiting the market.

Some of Ambev's smaller brands are 'dogs' due to low market share and growth potential. These brands require careful evaluation. In 2024, Ambev's focus is on optimizing its portfolio. This includes potentially divesting or repositioning underperforming brands to boost overall profitability.

High-cost operations, like certain regional breweries within Ambev, might be 'dogs.' These face competitive pressures. Consider that in 2024, Ambev's cost of sales was approximately BRL 28 billion. Cost-cutting or restructuring is crucial to boost performance.

Products with Declining Demand

In Ambev's BCG matrix, "dogs" represent products with declining demand, often due to shifting consumer tastes or market trends. These products may not generate significant profits. Ambev must decide to either revitalize them or phase them out. This decision needs careful analysis of current market data.

- Ambev's net revenue decreased by 2.3% in 2023.

- The company may need to re-evaluate its product portfolio.

- Market share analysis is crucial for decisions.

- Consumer preferences continue to evolve rapidly.

Inefficient Supply Chain Segments

Inefficient supply chain segments within Ambev, like outdated logistics or warehousing, could be 'dogs' in its BCG matrix. These areas might demand substantial investment for improvement or potentially outsourcing. A 2024 analysis showed that Ambev's supply chain costs represent about 35% of its total operating expenses, indicating the need for optimization. Addressing these inefficiencies can boost profitability.

- High logistics costs, especially in emerging markets.

- Inefficient warehousing operations.

- Outdated transportation methods.

- Need for enhanced inventory management.

Dogs in Ambev's BCG matrix often include underperforming market segments and brands with low growth. These are often areas needing restructuring or divestment. Identifying and addressing "dogs" is crucial for Ambev's overall financial health.

| Category | Description | Financial Implication |

|---|---|---|

| Market Segments | Argentina's economic challenges, smaller brands. | Revenue Decline (e.g., Q3 2023). |

| Operational Inefficiencies | High-cost breweries, outdated logistics. | Increased Costs (e.g., supply chain). |

| Strategic Actions | Restructuring, portfolio optimization. | Improved Profitability, Market Focus. |

Question Marks

Ambev's 'Beyond Beer' ventures, though expanding, are a minor revenue source, classifying them as 'question marks' within the BCG matrix. These products boast high growth potential, demanding substantial investment for market share gains. For example, in 2024, non-beer revenue grew by 15%. Ambev must strategically assess these products, allocating resources wisely. The focus is on carefully evaluating growth prospects and resource allocation.

Venturing into new geographic markets where Ambev's brand is not well-known and has low market share classifies as a 'question mark' in the BCG matrix. These markets offer high growth opportunities but also carry substantial risks and require significant investment. To mitigate these risks, a detailed market analysis and a strategic entry plan are essential. For instance, Ambev might face challenges in regions where the local beverage preferences differ significantly from its core product offerings.

Ambev's move into functional and zero-alcohol beers positions them as a 'question mark' in their portfolio. These offerings, targeting health-conscious consumers, are relatively new. They require focused marketing and distribution efforts. The global non-alcoholic beer market was valued at $20.7 billion in 2023. Ambev must closely watch market trends and consumer reactions.

Digital Direct-to-Consumer (DTC) Initiatives

Ambev's digital direct-to-consumer (DTC) ventures, like Zé Delivery and TaDa Delivery, are classified as 'question marks' within its BCG matrix. These platforms require significant investment as they are still growing. They offer a direct line to consumers, aiming to boost revenue. Ongoing investment and improvement are essential for these platforms to succeed.

- Zé Delivery saw over 100 million orders in 2023.

- TaDa Delivery is expanding its presence across various regions.

- Ambev invested heavily in DTC tech and logistics in 2024.

- DTC sales are expected to keep growing, contributing to Ambev's revenue.

Partnerships and Collaborations

Ambev's 'question marks' include new partnerships, like the one with Avantium for sustainable packaging. These collaborations aim to boost innovation and sustainability efforts. The ultimate impact of these partnerships is still uncertain, making them a key area for monitoring. Ambev must carefully manage these initiatives to ensure they align with its broader strategic objectives. The company's focus on sustainable packaging is part of its broader environmental strategy.

- Avantium partnership aims for sustainable packaging solutions.

- These initiatives are crucial for long-term sustainability goals.

- Careful management is needed to ensure alignment with strategic goals.

- The company saw an 11% profit growth in Q4 2024.

Ambev's "question marks" represent high-growth potential areas like DTC platforms and sustainable packaging, needing strategic resource allocation. They require careful monitoring and investment to capitalize on market opportunities. Successful ventures can drive revenue growth; for example, the DTC segment grew by 20% in 2024.

| Category | Examples | 2024 Performance |

|---|---|---|

| DTC | Zé Delivery, TaDa | 20% Growth |

| Sustainability | Avantium partnership | 11% Q4 Profit Growth |

| Beyond Beer | Non-beer products | 15% Revenue growth |

BCG Matrix Data Sources

The Ambev BCG Matrix is constructed using Ambev's financial reports, market research data, and competitor analysis for dependable assessments.