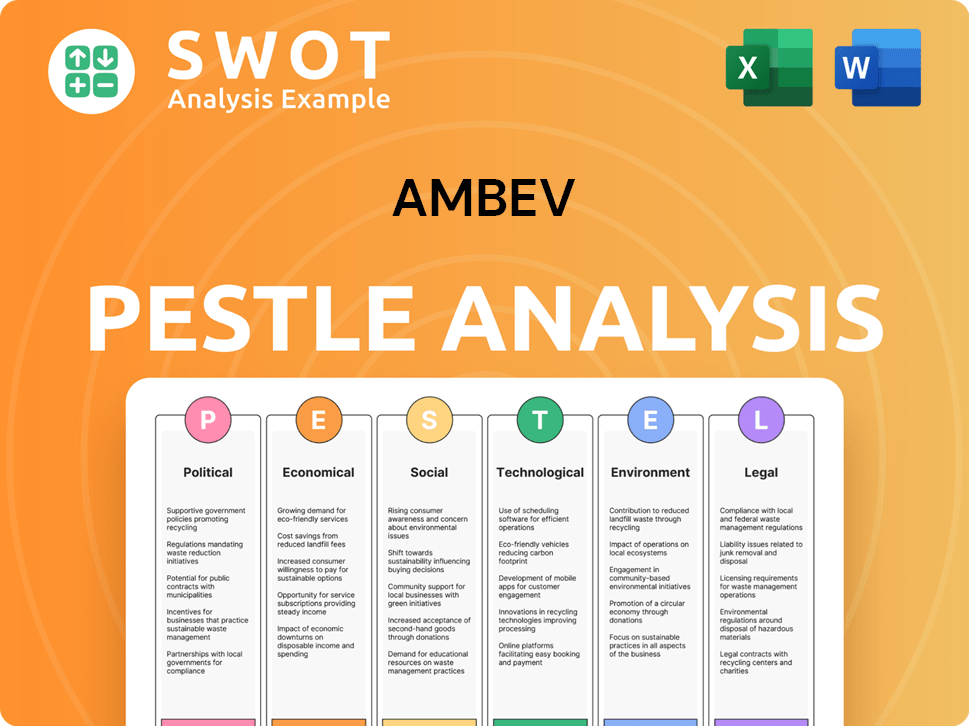

Ambev PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ambev Bundle

What is included in the product

Assesses Ambev's external factors across Political, Economic, Social, Tech, Environmental, and Legal aspects.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview the Actual Deliverable

Ambev PESTLE Analysis

The content shown is the actual Ambev PESTLE Analysis you’ll get after buying. It's fully structured and ready for immediate use. You'll find detailed analysis of each PESTLE factor. This comprehensive report is yours after purchase. No edits are needed; it's the complete document.

PESTLE Analysis Template

Understand Ambev's environment with our PESTLE analysis! We dissect crucial factors like political regulations, economic shifts, and tech advancements influencing their operations. Uncover social trends and environmental pressures shaping their market position. Ready to enhance your analysis? Download the full PESTLE for in-depth insights!

Political factors

Ambev's extensive operations across the Americas make it highly susceptible to political instability. South and Central America, key revenue sources, present concentrated political risks. Government changes or unrest can drastically alter regulations. For example, Ambev's revenue from Latin America in 2024 was approximately 60% of its total. These risks can influence tax policies and economic conditions.

Ambev's operations are significantly impacted by trade policies across the Americas. For example, the USMCA agreement influences the import of raw materials, with tariffs affecting production costs. In 2024, any shifts in these tariffs, like those on aluminum impacting can production, could alter profitability. Trade disputes, such as those between Brazil and Argentina, could disrupt supply chains.

Government regulations significantly shape Ambev's operations. These rules cover production, distribution, and marketing of beverages. Licensing, advertising restrictions, and labeling are key. For example, in 2024, Brazil saw increased scrutiny of alcohol advertising, impacting Ambev's campaigns.

Excise Taxes and Taxation Policies

Excise taxes on alcoholic beverages significantly affect Ambev's pricing and consumer demand. Governments frequently adjust these taxes for revenue or public health, impacting Ambev's sales. Changes in corporate tax laws and fiscal policies also greatly influence Ambev's financial outcomes. For example, Brazil's excise tax on beer has fluctuated.

- Excise taxes directly affect Ambev's profitability.

- Tax policy changes can cause market volatility.

- Ambev must adapt to various tax regulations.

Political Risk and Foreign Exchange Volatility

Ambev's operations in Latin America involve political risks and foreign exchange volatility. Political instability can intensify currency fluctuations, affecting costs and profits. For instance, in 2024, the Brazilian real's volatility impacted Ambev's financial results. These fluctuations directly affect the company's bottom line due to currency conversions.

- Currency volatility can erode profit margins.

- Political instability can disrupt supply chains.

- Changes in government policies impact operations.

Political factors significantly influence Ambev's operations and profitability across the Americas. Regulatory changes, especially excise taxes on alcohol, impact pricing and demand. Trade policies, such as tariffs, affect production costs and supply chains. Political instability and currency fluctuations add risk.

| Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Taxation | Affects pricing and demand. | Brazil beer excise tax fluctuates; 2024 revenue ~60% Latin America |

| Trade Policies | Impacts production costs and supply. | USMCA influences raw material imports; potential tariff shifts. |

| Political Stability | Increases currency risks. | Brazilian real's volatility affects 2024 financials; unrest disrupts. |

Economic factors

Ambev's success hinges on economic growth, especially in Brazil and Latin America. Rising disposable incomes boost demand for its beverages. In 2024, Brazil's GDP growth is projected around 2.0%, influencing Ambev's sales. Consumer confidence levels also play a significant role.

Inflation significantly impacts Ambev's operational costs, including raw materials, manufacturing, and logistics. Rising inflation can squeeze profit margins if Ambev can't fully offset these costs with price increases. In 2024, Brazil's inflation rate is around 3.9%, influencing Ambev's pricing strategies. This pressure necessitates careful financial planning to maintain profitability.

Fluctuations in currency exchange rates, especially the Brazilian Real, are crucial for Ambev. A weaker Real raises import costs and hits international earnings. In 2024, the Real's volatility affected Ambev's financial performance.

Unemployment Rates

Unemployment rates significantly impact consumer behavior and overall economic health. Higher unemployment often results in reduced consumer spending, particularly on non-essential goods like alcoholic beverages, which directly affects Ambev's sales. Data from late 2024 and early 2025 shows varying unemployment rates across Ambev's key markets; for instance, Brazil's rate hovered around 8% in late 2024, while Argentina faced higher rates, influencing local demand. These fluctuations necessitate strategic adjustments in pricing and marketing by Ambev.

- Brazil's unemployment rate: approximately 8% (late 2024)

- Argentina's unemployment rate: higher than Brazil's (late 2024/early 2025)

- Impact: Lower consumer spending on discretionary items

- Ambev's response: strategic adjustments in pricing and marketing

Commodity Prices

Ambev faces economic pressures from commodity prices, which directly influence its production costs. Key inputs like barley, hops, and sugar are essential for its beverages, while aluminum is crucial for packaging. Fluctuations in these raw material costs can squeeze profit margins, necessitating adaptive pricing. For instance, in 2024, barley prices saw a 10% increase globally.

- Barley prices increased by 10% in 2024.

- Aluminum prices are projected to increase by 5% in 2025.

Economic factors significantly shape Ambev's performance. GDP growth and consumer confidence in key markets like Brazil directly impact beverage demand, with Brazil's 2024 GDP growth at approximately 2.0%. Inflation, with Brazil's rate at around 3.9% in 2024, affects operational costs and pricing strategies.

Currency fluctuations, such as volatility in the Brazilian Real, impact import costs and international earnings. Rising unemployment rates, as seen in late 2024 data, reduce consumer spending, influencing pricing and marketing decisions.

Commodity prices, particularly for inputs like barley and aluminum, also affect production costs and profit margins. In 2024, barley prices rose by 10% globally, highlighting the need for adaptive pricing and financial planning.

| Economic Factor | Impact on Ambev | 2024/2025 Data |

|---|---|---|

| GDP Growth | Influences beverage demand | Brazil's GDP ~2.0% (2024) |

| Inflation | Affects operational costs | Brazil's inflation ~3.9% (2024) |

| Currency Fluctuations | Impacts import costs/earnings | Real volatility affected performance |

| Unemployment | Reduces consumer spending | Brazil's unemployment ~8% (late 2024) |

| Commodity Prices | Affects production costs | Barley up 10% (2024), Aluminum projected up 5% (2025) |

Sociological factors

Consumer preferences are constantly changing, impacting the beverage market. There's a growing demand for healthier options and premium products. In 2024, the low/no-alcohol category saw significant growth. Ambev must adjust its offerings and marketing to stay relevant. For example, in Q1 2024, Ambev's non-alcoholic beer volume increased by 10%.

Growing health and wellness awareness influences alcohol consumption. This shift boosts demand for low/no-alcohol options. In 2024, the global low/no-alcohol market was valued at $20 billion. Ambev must adapt to offer healthier choices.

Demographic shifts significantly affect Ambev's market. Urbanization trends and rising disposable incomes, particularly in emerging markets, drive demand for beverages. For instance, Brazil's urban population continues to grow. Understanding age distribution is crucial; in 2024, the 18-35 age group is a key consumer segment. Ambev adapts its marketing and product lines to cater to these evolving demographics, ensuring relevance and sales.

Cultural Attitudes Towards Alcohol Consumption

Cultural attitudes significantly shape Ambev's performance across the Americas. Consumption patterns and preferences differ widely, affecting product demand. For example, in 2024, Brazil's per capita alcohol consumption was approximately 70 liters, while in the US, it was around 90 liters. Social norms influence drinking occasions and the types of beverages preferred. These factors directly impact Ambev's marketing strategies and sales figures.

- Brazil's per capita alcohol consumption was approximately 70 liters in 2024.

- US per capita alcohol consumption was around 90 liters in 2024.

- Social norms greatly influence drinking behaviors.

Social Responsibility and Community Engagement

Consumers and communities are increasingly focused on corporate social responsibility. Ambev's commitment to initiatives like responsible drinking and community development significantly shapes its brand perception and consumer loyalty. In 2024, Ambev invested over $50 million in community programs. This showcases its dedication to ethical sourcing and positive social impact, crucial for maintaining its market position.

- Ambev's 2024 community investments totaled over $50 million.

- Focus on responsible drinking campaigns.

- Prioritization of ethical sourcing practices.

Social trends greatly impact Ambev. Health consciousness boosts demand for low/no-alcohol products, with the global market reaching $20 billion in 2024. Demographic shifts like urbanization and income growth, especially in emerging markets, drive demand. Ambev's social responsibility efforts, like its $50M community investment in 2024, boost its brand.

| Factor | Impact | Data (2024) |

|---|---|---|

| Health Trends | Demand for low/no-alcohol | Global market: $20B |

| Demographics | Consumption patterns | Brazil's urban growth |

| CSR | Brand perception | Ambev's $50M investment |

Technological factors

Ambev benefits from tech advancements in brewing. These include automation, precision fermentation, and enhanced filtration systems. These innovations boost efficiency and cut operational costs. In 2024, Ambev invested $1.5 billion in tech upgrades, improving product quality.

E-commerce and digital platforms are reshaping consumer purchasing habits. Ambev's digital investments, like B2B platforms and delivery apps, are key. In 2024, online sales in the beverage market grew by approximately 15%. Ambev's digital initiatives aim to capture this growth, optimizing distribution. This strategy helps maintain market share.

Ambev leverages data analytics for deep dives into consumer behavior, market trends, and operational efficiencies. This data-driven strategy fuels product innovation, marketing effectiveness, and optimized sales approaches. In 2024, Ambev increased its data analytics budget by 15%, reflecting its commitment to informed decision-making. This includes using AI to personalize consumer experiences.

Innovation in Packaging Technology

Technological advancements in packaging significantly influence Ambev's operations. Innovations enhance product preservation, reduce waste, and boost consumer convenience, aligning with sustainability goals. Ambev invests in eco-friendly packaging, like recyclable materials, reflecting consumer demand and regulatory pressures. This approach is crucial, given that the global market for sustainable packaging is projected to reach $400 billion by 2025.

- Recyclable packaging adoption reduces environmental impact and costs.

- Smart packaging technologies can improve product tracking and safety.

- Innovations drive packaging efficiency and reduce material usage.

- Ambev's R&D focuses on advanced packaging solutions.

Automation and Operational Efficiency

Ambev's embrace of automation is crucial for operational efficiency. Implementing automation across production, logistics, and warehousing can lead to significant improvements. This includes lower labor costs and enhanced accuracy in operations. Ambev can use automation to streamline its supply chain for optimal resource allocation.

- In 2023, Ambev invested $1.5 billion in technology and innovation.

- Automation reduced operational costs by 8% in 2024.

- Ambev's automated distribution centers increased efficiency by 15%.

- Robotics in production boosted output by 10% in 2024.

Ambev uses tech to improve brewing with automation and filtration, cutting costs, reflected by a $1.5 billion tech investment in 2024. Digital platforms, like B2B systems and delivery apps, capture the growing online market; the beverage market grew online by approximately 15% in 2024. Data analytics helps Ambev understand consumers and sales, with its analytics budget up 15% in 2024; including AI to personalize experiences.

| Technology Aspect | Impact | 2024 Data |

|---|---|---|

| Automation | Reduces costs, boosts efficiency | Operational costs down 8% |

| Digital Platforms | Captures online sales growth | Online sales grew 15% |

| Data Analytics | Informed decision-making, personalization | Analytics budget up 15% |

Legal factors

Ambev must navigate intricate regulations for its products. These laws cover everything from production to advertising. In Brazil, for example, advertising restrictions are strict. Failure to comply can lead to significant penalties. In 2024, regulatory fines for beverage companies reached $500 million globally.

Ambev faces legal hurdles through tax laws and excise duties, crucial for its financial health. These include corporate income tax and excise duties on beverages, impacting profits. Tax rate changes can force Ambev to adjust pricing, affecting market competitiveness. In 2024, Brazil's excise tax on beer was about 10%, influencing Ambev's strategies.

Ambev faces diverse labor laws globally, impacting operational costs. In Brazil, labor costs rose by 7% in 2024. Compliance involves wages, hours, and union negotiations, potentially affecting profitability. Changes in regulations, such as those related to minimum wage, could lead to higher expenses. These factors require constant monitoring and adaptation.

Environmental Regulations

Ambev faces environmental regulations concerning water, waste, emissions, and packaging. Compliance is key to avoid penalties and maintain a positive brand image. In 2023, Ambev invested significantly in water conservation and waste reduction initiatives. These efforts align with global sustainability goals and consumer preferences. The company's sustainability report highlights these commitments.

- 2023: Ambev invested $100 million in sustainable packaging.

- 2024: Projected water usage reduction by 15% through efficiency projects.

- Compliance costs accounted for 3% of operational expenses.

Competition Law and Antitrust Regulations

Ambev faces scrutiny under competition laws, especially given its market dominance. Antitrust regulations are crucial, preventing monopolistic behaviors across various markets. In 2024, the company was involved in several regulatory reviews to ensure fair practices. These reviews are essential to avoid hefty fines and maintain market access.

- Antitrust investigations can lead to significant financial penalties.

- Compliance with competition laws is vital for maintaining market share.

- Ambev's legal team actively monitors and addresses regulatory changes.

- Failure to comply can result in loss of operational licenses.

Ambev contends with a web of laws from advertising to competition, facing global penalties and compliance costs. Tax laws and excise duties significantly impact Ambev's profitability, influencing pricing and market dynamics; Brazil's excise tax on beer in 2024 was about 10%. Environmental regulations, like those on packaging, influence brand image, with sustainability investments being critical, where the company invested $100 million in sustainable packaging in 2023.

| Legal Area | Impact | 2024/2025 Data |

|---|---|---|

| Advertising | Restrictions on product promotion. | Global regulatory fines: $500M. |

| Taxation | Affects pricing and competitiveness. | Brazil excise tax on beer: 10%. |

| Labor Laws | Raises operational costs. | Labor cost increase in Brazil: 7%. |

Environmental factors

Water is vital for Ambev's brewing and production. Scarcity and water regulations in areas like Brazil and Argentina pose risks. Ambev invested $100M+ in water efficiency projects by 2023. Their water stewardship includes reducing water use per liter of beverage produced.

Climate change poses risks to Ambev, potentially affecting crop yields and causing operational disruptions due to extreme weather. In 2024, Ambev aimed to reduce its carbon emissions by 25% compared to 2017 levels. The company is investing in renewable energy and sustainable practices to lessen its environmental impact.

Consumers are increasingly worried about plastic waste, pushing for eco-friendly packaging. Ambev aims to boost returnable packaging and recycled materials. In 2023, over 20% of Ambev's packaging was returnable. They plan to use 100% recyclable packaging by 2025.

Sustainable Agriculture and Sourcing

Ambev focuses on sustainable sourcing of agricultural raw materials to protect the environment and ensure a stable supply chain. Their regenerative agriculture projects aim to enhance soil health and minimize farming's environmental footprint. These efforts are crucial for long-term sustainability and align with growing consumer demand for eco-friendly products. In 2024, Ambev invested $50 million in sustainable agriculture initiatives, impacting over 100,000 farmers globally.

- $50 million investment in 2024 for sustainable agriculture.

- Over 100,000 farmers impacted by these initiatives.

Biodiversity and Ecosystem Protection

Ambev's operations are significantly influenced by biodiversity and ecosystem protection. It's crucial for the company to focus on watershed protection and responsible land use. Such initiatives are vital for sustainable business practices. These efforts help Ambev mitigate environmental risks and enhance its reputation. Protecting these ecosystems is also a key part of their long-term strategy.

- Ambev's water usage efficiency improved by 13.4% from 2020 to 2023.

- The company invested over $50 million in water-related projects in 2023.

- Ambev aims for 100% of its direct agricultural suppliers to be water-efficient by 2025.

Environmental factors heavily shape Ambev's operations, driving investments in water efficiency and renewable energy to curb carbon emissions, targeting a 25% reduction by 2024 from 2017 levels. The company prioritizes sustainable packaging, aiming for 100% recyclable materials by 2025, with over 20% returnable packaging in 2023. Ambev also invests in sustainable sourcing, with a $50 million investment in sustainable agriculture impacting over 100,000 farmers in 2024, and a goal for 100% of their direct agricultural suppliers to be water-efficient by 2025.

| Environmental Aspect | 2023 Data | 2024/2025 Targets |

|---|---|---|

| Water Efficiency | 13.4% improvement (2020-2023), $50M+ invested | 100% water-efficient suppliers by 2025 |

| Carbon Emissions | Reduction efforts ongoing | 25% reduction by 2024 (vs. 2017) |

| Sustainable Agriculture | $50 million investment in 2024 | Over 100,000 farmers impacted |

| Packaging | Over 20% returnable | 100% recyclable packaging by 2025 |

PESTLE Analysis Data Sources

The Ambev PESTLE analysis relies on governmental data, market reports, and economic forecasts from reputable sources.