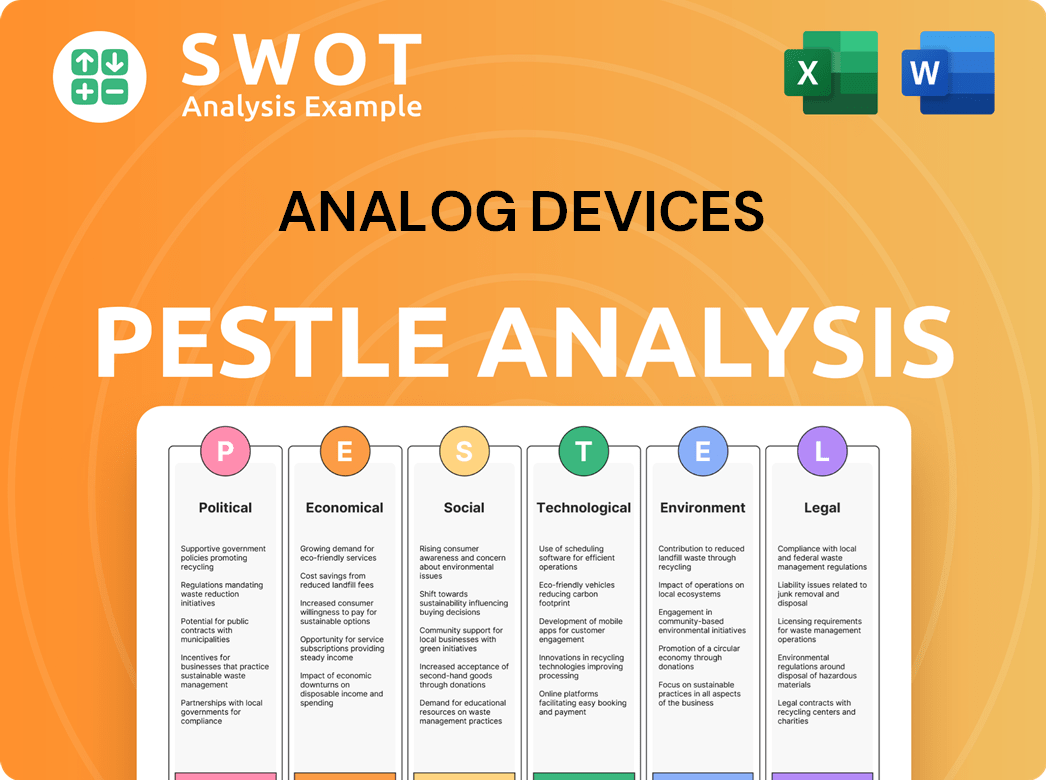

Analog Devices PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Analog Devices Bundle

What is included in the product

Examines external influences affecting Analog Devices through political, economic, etc., dimensions.

Provides concise insights for swift strategy sessions, ensuring impactful, streamlined team discussions.

Preview Before You Purchase

Analog Devices PESTLE Analysis

This preview shows the complete Analog Devices PESTLE analysis. It contains the same thorough research and insights. You'll receive the same document immediately after your purchase. The format and structure displayed will be identical. What you're seeing is the final version.

PESTLE Analysis Template

Navigate the complex landscape impacting Analog Devices with our expertly crafted PESTLE analysis. Uncover how political shifts, economic conditions, and tech advancements shape their future. Understand social trends, environmental factors, and legal regulations affecting ADI's trajectory. This detailed analysis equips you with actionable intelligence. Download the complete PESTLE analysis now and gain a competitive edge!

Political factors

Geopolitical tensions, especially the US-China trade war, highly affect semiconductor firms like Analog Devices. Restrictions on tech transfers and export controls disrupt supply chains. The US limits China's access to advanced tech, while China retaliates. In 2024, trade tensions caused a 5% decrease in global semiconductor sales.

Governments globally are boosting domestic semiconductor production for tech independence and supply chain stability. The U.S. CHIPS Act offers substantial financial aid, like the $52.7 billion earmarked for semiconductor manufacturing and research. Analog Devices could gain from these schemes, aiming to lessen reliance on overseas output and bolster local semiconductor sectors.

Strict export control regulations, particularly those enforced by the U.S. Department of Commerce, significantly impact Analog Devices. These rules restrict the export of advanced semiconductor items. In 2024, these regulations have been updated to include additional scrutiny on specific technologies. Compliance is crucial, with potential penalties for violations, including fines or export restrictions. As of early 2025, the landscape continues to evolve, requiring constant monitoring.

Political and Regulatory Uncertainty

The political landscape is rapidly changing, creating uncertainty. This affects trade deals, tariffs, and policies. These changes can impact Analog Devices' manufacturing and market access. The company needs to adapt to these shifts. For example, the U.S. imposed tariffs on certain goods in 2024, which could affect the company's supply chain.

- Trade policy changes can affect material costs.

- Regulatory shifts can create new market opportunities.

- Political instability may disrupt supply chains.

National Security Considerations

Governments worldwide now see semiconductors as vital to national security, prompting protective policies. These actions include heightened government scrutiny, limits on foreign investment, and a push for domestic production. These shifts directly impact Analog Devices' strategic choices. The CHIPS Act in the U.S. offers billions to boost domestic chip manufacturing.

- U.S. CHIPS Act allocates $52.7 billion for semiconductor manufacturing and research.

- EU Chips Act aims to double the EU's share of global chip production by 2030.

- China's focus on self-sufficiency is driving significant investment in its domestic semiconductor industry.

Political factors significantly affect Analog Devices' operations. Geopolitical tensions, especially US-China trade disputes, disrupt supply chains and limit market access. Governments globally boost domestic semiconductor production, providing financial aid and shaping industry strategies. Strict export controls, such as those from the U.S. Department of Commerce, impact the company's activities.

| Aspect | Impact | Example/Data (2024-2025) |

|---|---|---|

| Trade Wars | Disrupts supply chains, limits market access. | 5% decrease in global semiconductor sales in 2024 due to trade tensions. |

| Government Aid | Boosts domestic production, provides financial incentives. | U.S. CHIPS Act: $52.7B for semiconductor manufacturing and research. |

| Export Controls | Restricts tech exports, compliance essential. | Ongoing updates to export control regulations in early 2025. |

Economic factors

The semiconductor market's health is linked to global economics. Uncertainty, inflation, and rates affect device demand. Economic downturns hit spending and impact Analog Devices. In 2024, global chip sales may reach $588 billion, up from $527 billion in 2023, per WSTS.

The semiconductor industry is cyclical, impacting companies like Analog Devices. Downturns occurred in 2024, influenced by inventory corrections. However, there's guarded optimism for 2025's recovery, especially in areas like industrial and automotive markets. The World Semiconductor Trade Statistics projects a 13.1% growth in 2024 and 13.5% in 2025.

Analog Devices thrives in sectors like automotive, industrial, and communications. The automotive market, especially EV and autonomous vehicles, fuels demand. The 5G rollout and IoT expansion also drive growth. For example, in Q1 2024, ADI reported a 10% revenue increase in its industrial segment. These markets' health significantly impacts ADI's sales and future success.

Inflation and Cost Pressures

Inflation poses a significant challenge for Analog Devices, primarily through escalating costs across its supply chain. Rising prices of raw materials, such as silicon wafers and other components, directly impact production expenses. These cost pressures can squeeze profit margins if not managed effectively. The company must strategically adjust pricing or enhance operational efficiencies to mitigate these financial impacts. In Q1 2024, the U.S. inflation rate was around 3.5%.

- Increased input costs: Raw materials and components.

- Margin squeeze: Potential impact on profitability.

- Strategic response: Pricing adjustments and operational efficiencies.

- Economic context: Current inflation trends.

Currency Exchange Rates

As a global entity, Analog Devices faces currency exchange rate risks, impacting financial results. Fluctuations can affect reported revenue and expenses. Currency risk management is vital for profitability. For example, the USD/EUR exchange rate in early 2024 was approximately 1.08, affecting European sales translation.

- Currency fluctuations impact revenue and expenses.

- Risk management is crucial for profitability.

- USD/EUR rate in early 2024 was approx. 1.08.

Economic factors substantially influence Analog Devices. Global economic conditions, inflation rates, and currency exchange rates significantly affect financial results. The semiconductor industry is cyclical; it creates challenges but also opportunities for expansion. Understanding economic factors is essential for Analog Devices' performance and strategic decisions.

| Economic Factor | Impact | Data (2024/2025) |

|---|---|---|

| Semiconductor Market Growth | Affects demand and revenue | Projected growth of 13.1% (2024) and 13.5% (2025) |

| Inflation | Increases costs, impacts margins | Q1 2024 U.S. inflation: ~3.5% |

| Currency Exchange Rates | Influences reported financials | USD/EUR: ~1.08 in early 2024 |

Sociological factors

Societal embrace of new tech and changing consumer tastes fuel demand for ADI's ICs. Tech's growing role in everyday life, plus the need for smarter, connected goods, affect ADI's offerings and target markets. Consider the smart home market, projected to reach $174.6 billion in 2025, impacting ADI's product focus. Wearables are also key; the global market hit $81.5 billion in 2024, pushing ADI's tech development.

Analog Devices relies heavily on skilled engineers and technical experts. The availability of this talent pool is influenced by factors like demographics and interest in STEM fields. For example, the U.S. Bureau of Labor Statistics projects about 32,500 annual openings for electrical and electronics engineers, on average, over the decade. Attracting and retaining this workforce is thus critical for ADI's success.

Societal shifts, like the rise of remote work, drive demand for flexible tech. This impacts Analog Devices' products in communication and home electronics. In 2024, remote work increased by 15%, boosting demand. Analog Devices must adapt to these changing needs to stay competitive.

Social Responsibility and Ethical Considerations

Societal expectations for Analog Devices include ethical business practices and corporate social responsibility. This affects labor practices in the supply chain, product safety, and data privacy. Maintaining a positive reputation is crucial for stakeholder trust. In 2024, stakeholder pressure on ESG practices increased, with investors prioritizing ethical conduct.

- 2024 saw a 15% rise in ESG-focused investment.

- Analog Devices invests heavily in supply chain audits for ethical sourcing.

- Product safety regulations are constantly evolving.

Diversity and Inclusion

Societal focus on diversity and inclusion (D&I) heavily influences Analog Devices. It affects their hiring, culture, and public perception. Companies must embrace D&I to attract diverse talent and mirror their global customers. Analog Devices actively pursues these goals.

- In 2024, Analog Devices reported on its D&I progress.

- They have specific targets for boosting female representation in leadership roles.

- The company's commitment to D&I is part of its broader ESG strategy.

Societal trends significantly shape Analog Devices (ADI). Changing tech preferences, like smart home devices, drive demand, projected at $174.6B by 2025. ADI's ability to attract/retain skilled engineers and address remote work trends impacts its business.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Tech Demand | Fuels growth | Smart Home: $174.6B (2025 projection) |

| Workforce | Talent crucial | 32,500 EE openings (annual avg) |

| Remote Work | Boosts tech | Increased 15% |

Technological factors

Analog Devices (ADI) thrives on semiconductor innovation. They focus on analog, mixed-signal, and digital signal processing ICs. Research and development spending in 2024 was approximately $2.2 billion. This investment supports new materials like wide-bandgap semiconductors, crucial for future products. Staying ahead ensures ADI's competitive advantage.

The surge in AI and ML applications boosts demand for advanced semiconductors. Analog Devices' tech supports AI at the edge and in data centers. Generative AI speeds up design processes. In 2024, the AI chip market is valued at $86.93 billion, growing to $209.35 billion by 2029.

The Internet of Things (IoT) expansion significantly impacts Analog Devices. This growth, fueled by IoT devices in consumer, industrial, and automotive sectors, boosts demand for ADI's sensors and connectivity solutions. The IoT market's expansion offers a major opportunity for Analog Devices. In 2024, the global IoT market was valued at $250 billion, expected to reach $350 billion by 2025.

5G Network Deployment

The ongoing global deployment of 5G networks significantly impacts Analog Devices. This rollout demands sophisticated RF and mixed-signal components, which are ADI's specialty. Demand for faster data transfer and improved network capacity drives the need for ADI's high-performance solutions. This is a key growth area, with 5G infrastructure spending expected to reach $23.7 billion in 2024.

- 5G infrastructure spending is projected to hit $23.7B in 2024.

- ADI's communication segment is a key focus for growth.

- 5G enables faster data transfer and increased network capacity.

Edge Computing and Processing

Edge computing, processing data near its source, demands high-performance, efficient semiconductors. Analog Devices (ADI) targets the 'Intelligent Edge' with its tech, aligning with the trend and opening markets. ADI's revenue for fiscal year 2024 was $12.07 billion. This growth is supported by the increasing demand for edge computing solutions.

- ADI's focus on the 'Intelligent Edge' boosts market opportunities.

- The demand for efficient semiconductors is rising due to edge computing.

- ADI's fiscal year 2024 revenue reached $12.07 billion.

Technological factors critically shape Analog Devices' success. The company heavily invests in R&D, spending around $2.2 billion in 2024 to drive semiconductor innovation. Demand from AI, IoT, and 5G significantly impacts ADI's market prospects.

The growing markets for AI and IoT fuel demand for ADI's tech, alongside 5G. Edge computing also necessitates high-performance semiconductors, with ADI targeting the 'Intelligent Edge'. ADI's fiscal year 2024 revenue was $12.07 billion.

| Technology Trend | Impact on ADI | Data/Forecast |

|---|---|---|

| AI and ML | Increased demand for semiconductors | AI chip market valued $86.93B in 2024, $209.35B by 2029 |

| Internet of Things (IoT) | Boosts demand for sensors and connectivity solutions | Global IoT market valued $250B in 2024, $350B by 2025 |

| 5G Networks | Demand for RF & mixed-signal components | 5G infrastructure spending forecast at $23.7B in 2024 |

Legal factors

Analog Devices (ADI) faces rigorous export control regulations. These rules, like those from the U.S. government, affect where ADI can sell its products. In 2024, ADI reported $12.07 billion in revenue. Compliance programs are essential for ADI to navigate these legal hurdles effectively.

Analog Devices heavily relies on intellectual property protection to maintain its market edge. This involves patents, trademarks, and trade secrets to secure its R&D investments. The strength of legal frameworks globally, and the company's ability to enforce them, directly impacts its ability to protect its innovations. In 2024, ADI spent $1.6 billion on R&D, highlighting the importance of protecting these assets.

Analog Devices (ADI) must adhere to environmental laws. These cover manufacturing, waste, emissions, and hazardous substances. Non-compliance risks fines and legal issues. For example, in 2024, ADI allocated $20 million for environmental compliance. Sustainability initiatives are also legally driven.

Labor Laws and Employment Regulations

Analog Devices (ADI) faces significant legal hurdles regarding labor laws globally. ADI must adhere to wage, hour, and workplace safety regulations, varying by country, impacting operational costs. Non-compliance can lead to hefty fines and reputational damage, as seen in similar cases across the tech sector. For example, in 2024, the average cost of labor law violations for companies was up to $500,000.

- Wage and hour compliance is a major focus.

- Workplace safety regulations are crucial.

- Anti-discrimination laws are strictly enforced.

- Labor law compliance costs increase yearly.

Data Privacy and Security Regulations

Analog Devices faces stringent data privacy and security regulations globally. Compliance with GDPR and similar laws is critical, especially for software products handling sensitive customer data. These regulations impact data collection, storage, and usage, requiring robust security measures. Non-compliance risks hefty fines and reputational damage. In 2024, GDPR fines totaled over €400 million, highlighting the stakes.

- GDPR fines in 2024 exceeded €400 million.

- Compliance ensures customer trust and legal adherence.

- Regulations impact data handling across all operations.

Analog Devices must comply with strict legal export controls. This includes regulations from various governments that affect product sales, as evidenced by its $12.07 billion in revenue in 2024. Data privacy regulations, like GDPR, pose significant compliance challenges; GDPR fines in 2024 topped over €400 million. Labor laws also impact operations; in 2024, the average fine for violations was up to $500,000.

| Legal Aspect | Impact | Financial Consequence |

|---|---|---|

| Export Controls | Sales Restrictions | Variable |

| Data Privacy | Data Handling & Security | Up to €400M (GDPR Fines 2024) |

| Labor Laws | Operational Costs | Up to $500K (Average fines 2024) |

Environmental factors

Analog Devices is committed to environmental sustainability. They aim for carbon neutrality by 2030 and net-zero emissions by 2050. By 2025, they plan to use 100% renewable energy in their factories. This includes reducing greenhouse gas emissions. These efforts boost operational efficiency and show environmental responsibility.

Semiconductor manufacturing, like Analog Devices' operations, significantly relies on water. The company actively works to decrease water withdrawal intensity and boost water recycling across its sites. This commitment supports environmental sustainability. Water usage is also influenced by regulations and resource availability, making efficient management vital for ADI, especially with the industry's growth, where water-related operational costs and risks are increasing.

Waste management and recycling are crucial environmental factors for Analog Devices. The company focuses on proper waste management during manufacturing. Analog Devices aims to divert a significant portion of waste from landfills. In 2024, Analog Devices reported a waste diversion rate of 85% across its global operations, showcasing its commitment to sustainability. Effective waste reduction and recycling are vital for compliance and sustainability.

Climate Change and Extreme Weather Events

Climate change and extreme weather are key environmental factors for Analog Devices. Increased frequency of disasters threatens its global supply chain and manufacturing sites. Production and distribution may face disruptions due to these events. Building a resilient supply chain is crucial. For example, in 2024, extreme weather caused $250 billion in global economic losses.

- Supply chain disruptions may raise costs.

- Manufacturing facilities face operational challenges.

- Resilience strategies are vital for business continuity.

- Environmental risks demand proactive measures.

Energy Consumption and Efficiency

Energy consumption is a key environmental consideration for Analog Devices, especially in its manufacturing plants. The company actively pursues renewable energy adoption and energy efficiency to meet its sustainability targets. Such efforts can lead to considerable cost reductions in the long run.

- In 2024, Analog Devices reported a 10% increase in renewable energy use across its global operations.

- They have set a goal to reduce greenhouse gas emissions by 50% by 2030.

- Energy efficiency initiatives have already saved the company an estimated $5 million annually.

Analog Devices prioritizes environmental sustainability by aiming for carbon neutrality by 2030 and net-zero emissions by 2050, aiming for 100% renewable energy by 2025. The company's focus includes water conservation, waste management with an 85% diversion rate in 2024, and managing climate risks. Energy efficiency and the use of renewable energy sources are crucial for ADI's operations and cost savings.

| Environmental Factor | ADI's Actions | Impact |

|---|---|---|

| Carbon Emissions | Target: Net-Zero by 2050 | Reduced environmental footprint, cost savings |

| Water Usage | Water Recycling and Efficiency Programs | Decreased operational risks & expenses |

| Waste Management | 85% waste diversion rate (2024) | Improved compliance and cost savings |

PESTLE Analysis Data Sources

Analog Devices' PESTLE Analysis incorporates data from financial reports, market research, government regulations, and industry publications. This ensures accuracy.