Ansell Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ansell Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Simplified visualization, providing an instant snapshot of portfolio strengths and weaknesses.

Full Transparency, Always

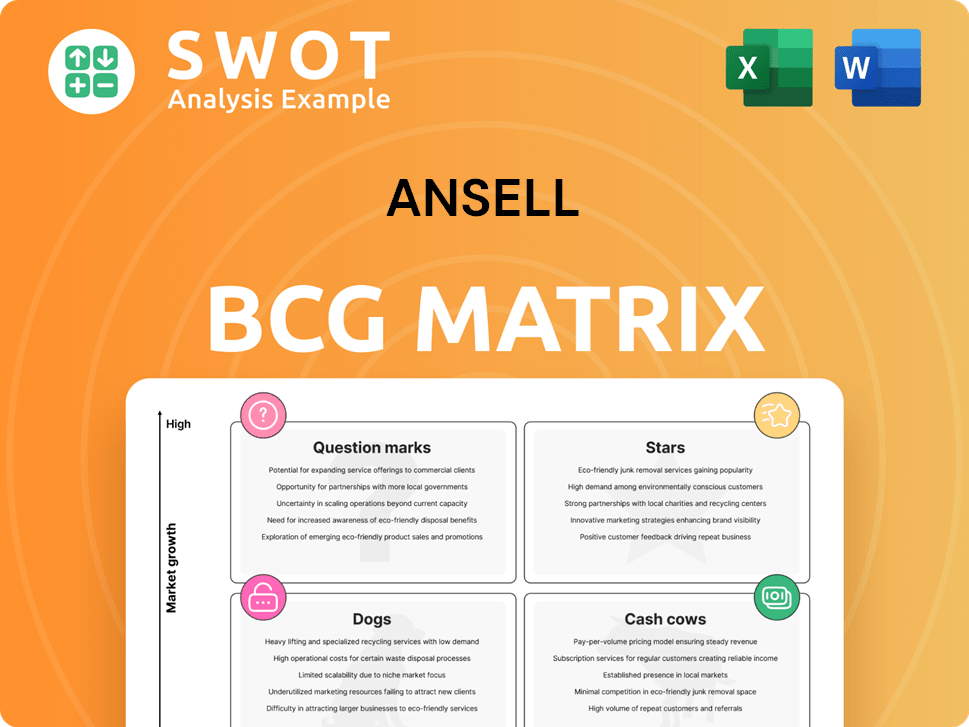

Ansell BCG Matrix

The Ansell BCG Matrix preview is identical to the document you'll receive. After purchasing, you'll have immediate access to a ready-to-use, fully formatted report, perfect for strategic planning. No hidden content or watermarks—just a professionally designed matrix. The complete file is optimized for clarity and business applications.

BCG Matrix Template

Ansell's BCG Matrix unveils the strategic positioning of its diverse product lines. We see some products shining as Stars, others steadily milking as Cash Cows. Question Marks face uncertainty, while Dogs may need reevaluation.

This preview offers a glimpse into Ansell's market dynamics, but true strategic clarity awaits. Dive deeper into the complete BCG Matrix to gain a comprehensive understanding of Ansell's product portfolio and make informed investment decisions.

Stars

Ansell's Healthcare segment is a Star in the BCG Matrix. Sales surged 16.3% in the first half of FY25. This boost comes from recovering customer restocking and fulfilling deferred surgical orders. Increased demand for gloves and safety devices also drives growth.

Ansell's Industrial segment is a "Star" in its BCG Matrix, showing robust growth. Sales surged by 8.1% in the first half of FY25, a clear indicator of its strong market position. This growth is fueled by both mechanical and chemical divisions. Demand for hand and body protection solutions is a key driver.

Ansell's acquisition of Kimberly-Clark's KCPPE, now KBU, boosted growth substantially. KBU accounted for about two-thirds of Ansell's EBIT growth in the first half of FY25. The integration is on track, aiming for completion by the end of FY25. This strategic move strengthens Ansell's position in the personal protective equipment market.

New Product Innovation

Ansell's commitment to new product innovation is evident in its recent launches. The HyFlex Ultra-Lightweight Cut Protection Series and AlphaTec 53-002 and 53-003 gloves are prime examples. These innovations are fueling sales growth across Healthcare and Industrial segments. This strategic focus ensures a competitive edge.

- New products boosted Ansell's revenue by 4.2% in fiscal year 2024.

- The Industrial segment saw a 6.5% increase due to innovation.

- Healthcare segment also benefited, with a 3.8% rise in sales.

Emerging Markets

Ansell is strategically focused on high-growth emerging markets. The company saw organic constant currency sales increase by 9.4% in the first half of FY25, demonstrating strong performance. Ansell is actively investing in these regions to meet the increasing demand for personal protective equipment. This approach allows Ansell to broaden its customer base and strengthen its revenue diversity.

- FY24 sales in emerging markets contributed significantly to overall revenue growth.

- Investments include expanding distribution networks and local manufacturing capabilities.

- Focus on markets like China, India, and Brazil.

- Ansell aims to capitalize on long-term growth trends in these areas.

Ansell's "Stars" demonstrate strong performance. Both Healthcare and Industrial segments show significant sales growth, with Healthcare up 16.3% and Industrial up 8.1% in the first half of FY25. New product launches contributed substantially, and emerging markets are key growth drivers.

| Segment | Sales Growth (H1 FY25) | Key Drivers |

|---|---|---|

| Healthcare | 16.3% | Customer restocking, new products |

| Industrial | 8.1% | Mechanical & chemical divisions, innovation |

| Emerging Markets | 9.4% (organic) | Increased demand, strategic investments |

Cash Cows

Surgical gloves represent a mature product with a high market share for Ansell. These gloves are crucial for infection control, driving consistent demand. Ansell's brand assures steady cash flow. In 2024, the global surgical gloves market was valued at $5.8 billion. Ansell holds a significant share.

Examination gloves represent a mature product line for Ansell, holding a solid market position. These gloves are essential in healthcare and industry for protection. Their consistent demand and broad customer base ensure a steady cash flow. Ansell's revenue from gloves was approximately $800 million in 2024, demonstrating their financial stability.

HyFlex gloves, favored for comfort and dexterity, lead in industrial hand protection. They're popular across industries. Ansell's innovation keeps them competitive. Ansell reported $1.9 billion in sales for FY24, with a steady cash flow from products like HyFlex. The industrial segment, where HyFlex thrives, contributed significantly to this figure.

AlphaTec Gloves

AlphaTec gloves, a key product within Ansell's industrial segment, act as cash cows. These gloves provide chemical protection, safeguarding workers from hazardous substances. Their specialized nature ensures consistent demand and higher profit margins, making them a reliable revenue source. For instance, in 2024, the industrial segment, which includes AlphaTec, contributed significantly to Ansell's overall revenue, demonstrating its cash-generating capability.

- AlphaTec gloves protect workers from chemicals.

- They have steady demand and high profit margins.

- The industrial segment is a major revenue source.

- Ansell's 2024 performance highlights this.

TouchNTuff Gloves

TouchNTuff gloves, made by Ansell, are a cash cow in the BCG matrix, providing consistent revenue. They are popular across industries for splash protection and comfort. Ansell's 2024 revenue was approximately $1.9 billion, with gloves contributing significantly. The steady demand ensures stable cash flow.

- Market: Gloves are widely used in healthcare, manufacturing, and laboratories.

- Revenue: Ansell generated about $1.9B in revenue during 2024.

- Stability: Steady demand and broad application ensure consistent sales.

- Protection: TouchNTuff offers reliable protection against splashes.

Surgical gloves generate stable revenue for Ansell due to high market share and consistent demand in healthcare.

Examination gloves, with a strong market position, provide steady cash flow for Ansell across healthcare and industry sectors.

HyFlex gloves lead in industrial hand protection, driving stable cash flow from diverse sectors, contributing significantly to Ansell’s $1.9B in FY24 sales.

AlphaTec gloves offer chemical protection, leading to consistent demand and higher margins, supporting Ansell's industrial segment.

TouchNTuff gloves are a reliable revenue source, with steady demand and protection, contributing significantly to Ansell's 2024 performance.

| Product | Market Share | Revenue Source |

|---|---|---|

| Surgical Gloves | High | Healthcare |

| Examination Gloves | Solid | Healthcare, Industry |

| HyFlex Gloves | Leading | Industrial |

| AlphaTec Gloves | Specialized | Industrial |

| TouchNTuff Gloves | Consistent | Healthcare, Industry |

Dogs

Ansell exited the retail household gloves sector. This move was part of its Accelerated Productivity Investment Program. The decision highlighted the low growth and profitability of this segment. Focusing on higher-growth areas became the new strategy. In 2024, Ansell's focus is on its medical and industrial segments.

Ansell plans to exit commoditized chemical protection by fiscal 2025. This segment struggles with fierce competition and low profitability. In 2024, these products represented a small portion of Ansell's revenue. The focus shifts to higher-margin, specialized offerings. This strategic move aims to boost overall profitability.

Low-end mechanical gloves, a segment with minimal differentiation, often resemble "dogs" in the Ansell BCG matrix. Competition is fierce from cheaper options, squeezing profit margins. Ansell's 2024 strategy emphasizes high-performance, branded gloves. This shift aims for profitability, focusing on innovation over commodity products.

Basic Protective Clothing

Basic protective clothing, like simple coveralls, often sees low profit margins and intense competition, fitting the Dogs quadrant. These items offer little differentiation, making it tough to stand out. Ansell, for example, aims to move away from these commodity-like products. In 2024, Ansell's focus is on high-performance, specialized protective gear.

- Low margins characterize these products.

- Strong competition erodes profitability.

- Ansell prioritizes innovation over basic items.

- Focus is on advanced protective solutions.

Outdated Product Lines

Outdated product lines at Ansell, which haven't seen updates for years, often fall into the "Dogs" category of the BCG Matrix. These products struggle against newer, more advanced alternatives. Ansell's strategy must involve either investing in innovation or phasing out these underperforming lines to maintain competitiveness. For instance, in 2024, Ansell's revenue from older product lines showed a 5% decrease, signaling the need for strategic adjustments.

- Outdated products face performance and feature gaps.

- Ansell must choose between innovation and discontinuation.

- Older product lines saw a 5% revenue decrease in 2024.

- Strategic changes are crucial for competitiveness.

In Ansell's BCG Matrix, "Dogs" signify low-growth, low-share products. These face tough competition and thin margins. Ansell aims to exit or revamp these, focusing on profitable sectors.

| Characteristic | Impact | Ansell's Response (2024) |

|---|---|---|

| Low Profitability | Strained financial returns | Focus on higher-margin, specialized products |

| Intense Competition | Erosion of market share | Exit from commoditized offerings |

| Outdated Products | Revenue decrease by 5% (2024) | Innovation or discontinuation strategies |

Question Marks

The Kimtech and KleenGuard expansion into North America and Europe positions them as question marks in Ansell's BCG matrix. These brands, acquired in 2023, offer growth potential. However, Ansell needs to invest. Ansell's revenue increased 7.5% in FY2024. Increased market share is the goal.

Ansell's RightCycle Program, addressing PPE waste, is in its early stages, indicating high growth potential. This program taps into growing environmental awareness, a key market trend. Ansell should aggressively promote RightCycle to attract eco-conscious clients and boost market share. The global PPE market was valued at $70.4 billion in 2024, offering a significant opportunity.

APEX, Ansell's cleanroom service, is a Question Mark in the BCG Matrix. It's a new service, so market acceptance is still unclear. This niche offering needs to prove its worth to customers. Ansell's 2024 revenue was $2.1 billion, showing potential for APEX to grow.

Advanced Anti-Cut Gloves

Advanced anti-cut gloves, crucial in high-risk industries, are a "Question Mark" for Ansell's BCG Matrix. These gloves, using materials like Dyneema and Kevlar, are becoming increasingly important. Ansell's investment in R&D is key to capitalizing on this trend and maintaining a competitive advantage in the safety glove market. The global cut-resistant gloves market was valued at USD 1.2 billion in 2023.

- Market Growth: The cut-resistant gloves market is projected to reach USD 1.8 billion by 2028.

- Material Innovation: Dyneema and Kevlar are leading materials for cut resistance.

- Competitive Landscape: Ansell faces competition from companies like Honeywell and 3M.

- R&D Investment: Crucial for product differentiation and market share.

AI-Powered Safety Solutions

Ansell's AI-powered safety solutions represent a question mark in the BCG Matrix. This integrated system combines wearable pods and glove sensors with AI analysis, signaling a novel approach to workplace safety. To drive adoption, Ansell must prove the effectiveness and value of this technology. The company is projecting growth, with a focus on innovation.

- Ansell projects growth in FY25.

- The company's focus is on innovation.

- This technology aims to revolutionize workplace safety.

Ansell views AI-powered safety solutions as question marks in its BCG matrix due to their novel approach and need for market validation. This technology integrates wearable devices, glove sensors, and AI analysis, representing a major shift in workplace safety. Ansell must demonstrate the value of this integrated system to drive adoption and prove its effectiveness.

| Metric | Value | Year |

|---|---|---|

| Projected Growth FY25 | Focus on Innovation | 2025 |

| Target Market | Workplace Safety | 2024 |

| Technology | AI-Powered | 2024 |

BCG Matrix Data Sources

Ansell's BCG Matrix leverages market share, financial results, and competitive landscape data from public filings and industry reports. It uses market size growth information to generate business insights.