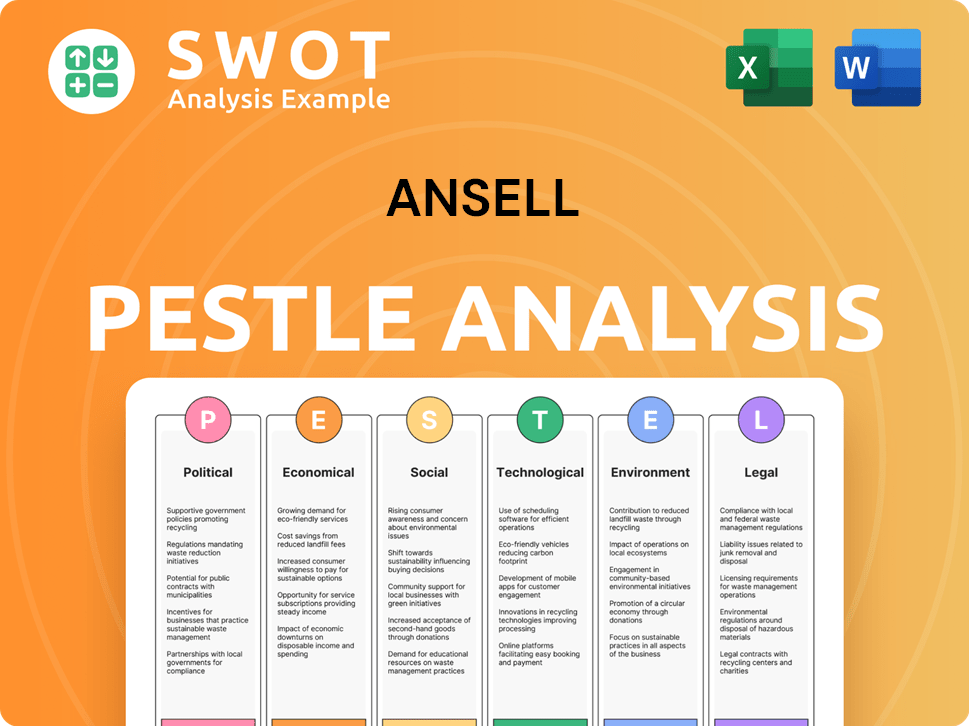

Ansell PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ansell Bundle

What is included in the product

Evaluates Ansell's external factors through Political, Economic, etc. dimensions for a complete market perspective.

A comprehensive version, it streamlines strategy discussions, reducing time and effort.

Same Document Delivered

Ansell PESTLE Analysis

See the complete Ansell PESTLE analysis. What you’re previewing here is the actual file—fully formatted and professionally structured. This means the document’s layout is exactly as you'll get it. All the analysis is ready, so there is no extra work. Purchase, download, and utilize it right away.

PESTLE Analysis Template

Uncover Ansell's strategic landscape with our PESTLE Analysis.

Explore how external factors shape the company's future. Understand political, economic, social, technological, legal, and environmental impacts.

Our analysis delivers expert insights for investors and strategists.

Gain a competitive edge with actionable intelligence on Ansell.

Download the full version to make informed decisions today.

Political factors

Ansell's global presence across 55+ countries makes it vulnerable to geopolitical risks. Political instability, such as the ongoing conflicts, can disrupt supply chains. Trade wars and sanctions pose further challenges, potentially impacting operations and profitability. For example, in fiscal year 2024, Ansell reported $2.0 billion in sales in the Americas, highlighting their exposure to political and economic shifts in the region.

Ansell's operations span globally, exposing it to diverse political landscapes. Changes in government, like new trade agreements, directly influence costs. For example, fluctuating tariffs impact material sourcing and product pricing. In 2024, trade tensions increased, affecting supply chains. Regulatory shifts, such as environmental standards, also drive operational adjustments.

Changes in trade pacts and new tariffs significantly affect Ansell. For instance, a 10% tariff on latex from Malaysia could raise production costs. In 2024, Ansell reported $2.1 billion in sales from the Asia-Pacific region. This highlights the impact of trade policies on its global operations. Ansell’s profitability is directly linked to global trade dynamics.

Political Stability in Manufacturing Locations

Ansell's manufacturing locations, such as Malaysia, Sri Lanka, and Thailand, are subject to political dynamics. These regions' political stability directly affects Ansell's production and supply chain. For instance, political unrest could disrupt operations and increase costs. In 2024, Malaysia's political stability index was at 0.7, while Sri Lanka's stood at 0.6. Thailand's index was 0.75, indicating a moderate level of stability.

- Political stability influences manufacturing efficiency.

- Unstable regions can lead to supply chain disruptions.

- Political risks can impact operational costs.

- Ansell closely monitors political climates in its operating countries.

Government Healthcare Policies and Spending

Government healthcare policies and spending significantly affect Ansell's business, particularly its healthcare product demand. Changes in procurement strategies, like those seen during the COVID-19 pandemic, directly impact Ansell's sales of gloves and protective equipment. Public health initiatives and government investments in healthcare infrastructure also play a crucial role. For instance, the U.S. government's healthcare spending reached approximately $4.6 trillion in 2023.

- U.S. healthcare spending accounted for 17.7% of the GDP in 2023.

- Ansell's revenue in the healthcare segment was approximately $1.9 billion in 2023.

- Government contracts represent a significant portion of Ansell's sales, especially during health crises.

Ansell's global operations face political hurdles like trade wars and sanctions that can disrupt supply chains. Trade policies greatly affect its operational costs. For instance, political instability could disrupt production and increase costs. The Asia-Pacific region generated $2.1 billion in sales for Ansell in 2024.

| Political Factor | Impact on Ansell | Financial Implication (2024) |

|---|---|---|

| Trade Agreements | Influences material sourcing, product pricing. | Sales in the Americas: $2.0B. |

| Political Stability | Affects production and supply chains. | Asia-Pacific Sales: $2.1B. |

| Government Healthcare Policies | Impacts healthcare product demand. | U.S. Healthcare Spending: $4.6T (2023). |

Economic factors

Ansell faces inflation, impacting raw materials, goods from suppliers, and labor costs. In 2024, the U.S. inflation rate was around 3.1%, impacting various sectors. Ansell must manage these costs to protect its profit margins. The company's strategies will be crucial in 2025.

Ansell, with its global presence, faces currency exchange rate risks. In FY24, currency fluctuations affected reported revenue. For instance, a 1% adverse movement in exchange rates could impact operating profit. Understanding these impacts is crucial for financial planning and forecasting.

Global economic conditions significantly affect Ansell. Economic activity levels directly impact demand, especially in industrial and healthcare sectors. Downturns in major markets like the US and Europe, which account for a substantial portion of Ansell's revenue, can lead to reduced sales. For instance, a 2024/2025 forecast predicts a 2-3% growth slowdown in the global healthcare sector, potentially affecting Ansell's sales. Inflation and interest rate hikes in key regions like Australia, where Ansell has significant operations, will likely influence consumer behavior.

Raw Material Price Fluctuations

Ansell faces challenges from raw material price swings, impacting production costs and pricing strategies. Rubber, synthetic fibers, and polymers are key components, and their prices are subject to market dynamics. For instance, in 2024, natural rubber prices saw fluctuations, influenced by supply chain disruptions and demand shifts. This volatility necessitates careful inventory management and hedging strategies.

- Natural rubber prices fluctuated in 2024, affecting Ansell's cost of goods sold.

- Supply chain disruptions and demand changes are primary drivers of these price swings.

- Ansell must employ effective inventory management and hedging.

Interest Rates

Interest rates are a key economic factor for Ansell, impacting both borrowing costs and investment returns. As of December 2024, Ansell's interest rate on borrowings stood at 5.0% p.a., influencing its financial planning. Fluctuations in rates affect the company's ability to invest in growth and manage its debt effectively. Changes in global interest rate environments, such as those influenced by the Federal Reserve or European Central Bank, directly impact Ansell's financial strategy.

- December 2024: Ansell's borrowing rate at 5.0% p.a.

- Interest rates impact investment decisions.

- Global rate changes affect financial strategy.

Ansell is managing inflation, with the U.S. rate at about 3.1% in 2024, impacting costs. Currency fluctuations remain a key risk, as a 1% shift could impact profit, necessitating careful forecasting. Economic downturns and interest rates are key factors.

| Economic Factor | Impact on Ansell | Data/Statistics (2024/2025) |

|---|---|---|

| Inflation | Increases costs of raw materials | US Inflation: ~3.1% (2024), impacting raw material costs. |

| Exchange Rates | Affects reported revenue and profits | A 1% adverse movement could affect operating profit |

| Interest Rates | Impacts borrowing costs and investment | Ansell's borrowing rate 5.0% (Dec. 2024). |

Sociological factors

Growing safety awareness boosts demand for Ansell's products. Stricter standards impact manufacturing, construction, and chemical sectors. The global industrial safety market is valued at $75 billion in 2024, growing at 6% annually. Ansell's sales rose 4.6% in fiscal year 2024, highlighting the trend. Increased safety regulations drive this growth.

The healthcare sector's emphasis on hygiene and infection control is growing, particularly after recent global health events. This trend significantly drives the demand for medical and single-use gloves. The global market for medical gloves is projected to reach $10.8 billion by 2025, according to a 2024 report. This increase highlights the importance of hygiene practices.

An aging global population significantly boosts healthcare demands, directly impacting the need for medical supplies. The global elderly population (65+) is projected to hit 1.6 billion by 2050. This demographic shift fuels increased healthcare utilization. In 2024, the global medical gloves market reached $8.2 billion.

Changing Consumer Preferences and Lifestyles

Consumer preferences are shifting, with a rising focus on health, wellness, and safety, which directly impacts Ansell's product demand. This trend is evident in the increased sales of medical gloves and protective gear. Ansell's innovations in areas like chemical protection also respond to evolving safety standards. The company's ability to adapt to these changing preferences is crucial for sustained market success.

- Ansell's revenue from healthcare increased by 8.6% in the first half of fiscal year 2024.

- The global personal protective equipment market is projected to reach $70.4 billion by 2025.

Labor Rights and Supply Chain Scrutiny

Increased focus on labor rights and ethical sourcing significantly impacts Ansell, a company reliant on global supply chains. As a member of the Responsible Glove Alliance, Ansell faces heightened expectations to ensure fair labor practices. This involves detailed audits and certifications to verify ethical sourcing, which can influence operational costs and consumer perception. The ethical sourcing market is projected to reach $13.9 billion by 2025.

- Ansell's membership in the Responsible Glove Alliance underscores its commitment to ethical sourcing.

- The ethical sourcing market is expected to reach $13.9 billion by 2025.

- Compliance with labor standards can affect operational costs.

Safety awareness influences Ansell's market demand. Hygiene practices are important. Increased healthcare drives demand. Consumer focus boosts health and wellness. Ethical sourcing impacts Ansell.

| Factor | Impact | Data |

|---|---|---|

| Safety | Increased demand | PPE market to $70.4B by 2025 |

| Healthcare | Higher need | Gloves market at $10.8B by 2025 |

| Ethics | Cost & perception | Ethical sourcing at $13.9B by 2025 |

Technological factors

Ongoing advancements in material science drive innovation in protective gear. Ansell benefits by creating gloves and clothing with superior durability and comfort. For instance, in 2024, Ansell invested $50 million in R&D, focusing on new materials. This investment led to a 15% increase in sales for advanced protection products. These products offer better protection levels, as shown by a 20% reduction in reported workplace injuries in 2024.

Smart PPE is evolving, with technologies like smart gloves gaining traction. These gloves use sensors to track grip and movement, enhancing worker safety. Ansell is investing in wearable tech integration. The global smart PPE market is projected to reach $9.8 billion by 2027, growing at a CAGR of 8.2% from 2020.

Technological advancements in manufacturing are vital for Ansell. They boost efficiency, cut costs, and improve product quality. Ansell invests heavily in R&D for both product design and manufacturing. In fiscal year 2024, Ansell's R&D spending was $85.5 million, reflecting its commitment to innovation.

Digitalization and Automation

Digitalization and automation are reshaping industries, impacting Ansell's protective equipment needs. Integrated safety solutions are becoming more crucial, as seen in the rise of smart factories. The global industrial automation market is projected to reach $396.2 billion by 2025. This creates opportunities for Ansell to offer advanced, connected safety products.

- Smart factories are expected to grow by 10% annually.

- The adoption of digital safety platforms is increasing by 15% yearly.

- Ansell's investments in digital solutions increased by 8% in 2024.

- The demand for automated safety systems is up by 12% in 2024.

E-commerce and Digital Sales Channels

E-commerce and digital sales are crucial for Ansell. They must invest in online channels and digital marketing. In 2024, global e-commerce grew by 14%. Ansell's digital sales strategies need to adapt quickly. This includes optimizing websites and using social media.

- E-commerce sales grew by 14% globally in 2024.

- Ansell needs strong online presence.

- Digital marketing is key for Ansell.

Technological factors significantly shape Ansell's operations and market position. Innovations in materials, such as Ansell's $50M R&D investment in 2024, enhance product performance and safety, reflected in a 20% reduction in workplace injuries. Digitalization and automation drive demand for integrated safety solutions within a market projected at $396.2 billion by 2025. Furthermore, Ansell must capitalize on e-commerce growth, as global sales rose by 14% in 2024.

| Factor | Impact on Ansell | Data/Statistics (2024) |

|---|---|---|

| Material Science Advancements | Enhanced product durability, comfort | $50M R&D investment; 20% injury reduction |

| Smart PPE Growth | Integration of wearable tech, sensor tech | Smart PPE market expected at $9.8B by 2027 |

| Digitalization & Automation | Need for integrated safety products | Industrial Automation market: $396.2B (2025) |

| E-commerce Expansion | Focus on online channels, marketing | 14% growth in global e-commerce |

Legal factors

Stringent workplace safety regulations, like OSHA's, significantly influence Ansell. These regulations mandate PPE, boosting demand for Ansell's gloves. In 2024, OSHA's focus on enforcement led to over $100 million in penalties, highlighting compliance importance. This drives Ansell's market.

Healthcare regulations significantly affect Ansell. These rules dictate medical device standards, including gloves. Compliance is crucial for product development, manufacturing, and distribution. Ansell's medical segment must adhere to these standards to maintain market access. In 2024, the global medical gloves market was valued at approximately $7.8 billion.

Ansell faces legal hurdles from environmental regulations across its global operations. Compliance includes managing manufacturing, waste, and chemicals. The EU's Ecodesign for Sustainable Products Regulation adds complexity. Companies failing to comply risk significant penalties. Ansell's 2024 sustainability report highlights environmental initiatives.

Product Liability Laws

Ansell faces product liability laws, potentially leading to lawsuits if products are defective or cause harm. High product quality and safety compliance are crucial for mitigating legal risks. In 2024, product liability insurance costs for medical device companies, like Ansell, increased by 10-15%. Ansell needs to ensure its products meet stringent safety standards to avoid costly litigation and maintain consumer trust.

- Product liability lawsuits can significantly impact financial performance.

- Compliance with global safety regulations is essential.

- Regular product testing and quality control are vital.

- Insurance coverage is necessary but expensive.

Import and Export Controls and Tariffs

Changes in import and export controls, alongside tariffs, directly affect Ansell's global operations. These legal restrictions can limit the flow of goods and raw materials across borders, potentially increasing costs and disrupting supply chains. For example, in 2024, the U.S. imposed tariffs on certain medical gloves, a key Ansell product, impacting their pricing. These trade barriers could lead to higher production expenses or necessitate changes in sourcing strategies. Ansell closely monitors these legal factors to adapt its business practices and maintain profitability.

- In 2024, the U.S. imposed tariffs on certain medical gloves.

- Trade barriers can lead to higher production expenses.

- Ansell closely monitors these legal factors.

Ansell is subject to product liability lawsuits which impacts its finances and operational efficiency. Compliance with safety regulations, such as OSHA, and environmental rules is critical for maintaining market access and minimizing risk exposure. Trade controls, tariffs, and import-export rules shape global supply chains, requiring ongoing monitoring and adaptation.

| Legal Area | Impact on Ansell | 2024/2025 Data |

|---|---|---|

| Product Liability | Lawsuits from defective products. | Insurance costs for medical devices rose by 10-15%. |

| Safety Regulations | Requires PPE, driving market demand. | OSHA imposed over $100 million in penalties. |

| Trade | Tariffs and import controls. | U.S. tariffs on medical gloves in 2024. |

Environmental factors

Growing global awareness of environmental issues and customer/investor demand for sustainable products are pivotal. Ansell faces pressure to reduce its environmental impact. Ansell's 'Ansell Earth' strategy sets sustainability targets. In 2024, Ansell reported a 15% reduction in Scope 1 and 2 emissions. This focus affects product development and supply chain decisions.

The environmental impact of disposable gloves is a major issue, especially in healthcare and food processing. These industries heavily rely on gloves, generating significant waste. Ansell faces increasing pressure to offer sustainable alternatives. For example, the global medical gloves market was valued at $8.97 billion in 2023.

Climate change presents significant risks to Ansell, potentially disrupting operations and supply chains due to extreme weather. Resource scarcity, driven by climate change, could also impact Ansell's access to essential materials. Ansell aims for net-zero emissions by 2050, demonstrating a commitment to mitigating climate-related risks. In 2024, Ansell invested $10 million in sustainable practices, aligning with its environmental goals.

Responsible Sourcing of Raw Materials

Ansell's PESTLE analysis should consider environmental factors like responsible sourcing. This involves ensuring raw materials, such as natural rubber, are sourced sustainably, addressing deforestation and social impacts. Certifications like the Forest Stewardship Council (FSC) are crucial for verifying responsible sourcing practices. The global market for sustainable rubber is projected to reach $3.5 billion by 2027.

- Deforestation and land-use change are significant environmental concerns.

- Social impacts include fair labor practices and community engagement.

- FSC certification ensures timber comes from responsibly managed forests.

- Sustainable sourcing enhances brand reputation and reduces risks.

Packaging Sustainability

Packaging sustainability is increasingly crucial. Ansell aims for fully recyclable, reusable, or compostable packaging by 2026. This aligns with rising consumer and regulatory pressures. The global sustainable packaging market is projected to reach $436.9 billion by 2027.

- Ansell is investing in eco-friendly materials.

- They are reducing packaging waste.

- This approach enhances brand image.

- It also mitigates environmental risks.

Ansell navigates growing environmental demands, including reducing its footprint and offering sustainable products. The company actively works towards net-zero emissions by 2050, illustrated by its $10 million investment in 2024. This involves sustainable sourcing, and aiming for eco-friendly packaging by 2026.

| Environmental Factor | Ansell's Action | Relevant Data (2024/2025) |

|---|---|---|

| Emissions | Reduce Scope 1 & 2 emissions | 15% reduction in 2024; Net-zero target by 2050 |

| Sustainable Packaging | Implement recyclable packaging | Target for fully sustainable packaging by 2026; Global market expected to reach $436.9B by 2027. |

| Sustainable Sourcing | Ensure responsibly sourced raw materials | Sustainable rubber market is projected to reach $3.5B by 2027. |

PESTLE Analysis Data Sources

The Ansell PESTLE Analysis draws from governmental data, market reports, and industry publications. We source data from reputable economic and environmental institutions.