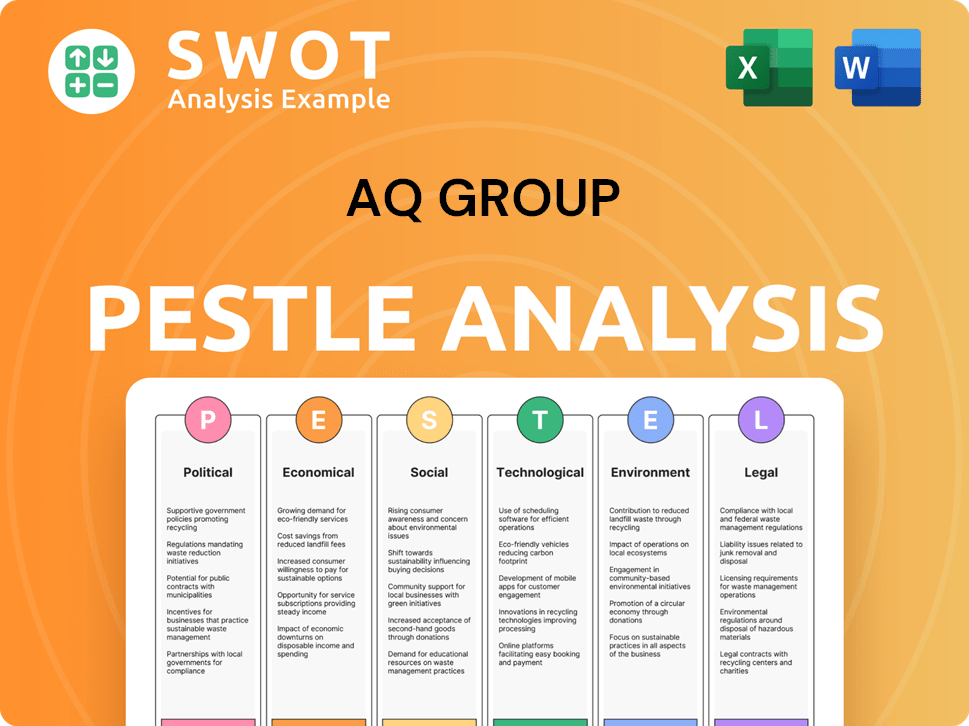

AQ Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AQ Group Bundle

What is included in the product

AQ Group's PESTLE dissects external macro-factors impacting their strategy.

AQ Group's PESTLE provides concise external factors, aiding risk and market positioning discussions.

Same Document Delivered

AQ Group PESTLE Analysis

See the comprehensive AQ Group PESTLE Analysis preview? This is it. The same well-structured and detailed document will be yours after purchase. All content and formatting shown is what you'll get. Get immediate access to the finished analysis! Download now.

PESTLE Analysis Template

Explore the forces shaping AQ Group’s destiny with our PESTLE analysis. Uncover how political, economic, social, technological, legal, and environmental factors impact their strategy. Identify risks and opportunities before your competitors do. Strengthen your market intelligence with key insights. Download the full analysis to gain a competitive edge!

Political factors

Government regulations and industrial policies are critical for AQ Group. For instance, changes in environmental regulations could affect its electric power operations. Recent data shows that the electric vehicle market is expected to grow significantly by 2025, influenced by government incentives and policies. Trade policies, like tariffs, can impact the cost of raw materials and finished goods. AQ Group must monitor these factors for strategic planning.

AQ Group's broad international footprint exposes it to geopolitical risks. Instability can disrupt supply chains and market access. For example, the Russia-Ukraine war impacted numerous multinational corporations, with over 1,000 companies curtailing operations in Russia by early 2024. Adapting to these shifts is vital. Monitoring geopolitical events is essential for maintaining business continuity and investor confidence.

Trade agreements and tariffs significantly affect AQ Group. For example, in 2024, tariffs on steel impacted production costs. Changes in trade policies can lead to price adjustments. This affects competitiveness and manufacturing locations. In 2025, monitoring these shifts is crucial.

Political Stability in Operating Countries

Political stability is crucial for AQ Group's global operations. Unstable political climates in countries with manufacturing or customer bases pose risks. These include operational disruptions and changes in the business environment. Recent data highlights the impact of political instability; for example, in 2024, countries with high political instability saw a 15% decrease in foreign investment.

- Operational disruptions may lead to supply chain issues.

- Changes in government could impact trade policies.

- Investment risks increase due to political uncertainty.

- Geopolitical events can affect currency exchange rates.

Government Support for Key Sectors

Government backing for key sectors like electric vehicles (EVs) and renewable energy is a major plus for AQ Group. Initiatives such as subsidies and infrastructure investments boost demand for AQ's offerings. For example, the U.S. government's Inflation Reduction Act allocates billions to clean energy. This supports the growth of the EV market, benefiting AQ Group.

- U.S. Inflation Reduction Act: Funds clean energy.

- EU Green Deal: Promotes renewables and EVs.

- China's 14th Five-Year Plan: Focuses on green tech.

- India's PLI Scheme: Supports manufacturing.

AQ Group faces impacts from government regulations, particularly concerning its EV and renewable energy sectors, with policies like the U.S. Inflation Reduction Act. Trade policies, including tariffs, can change production costs and competitiveness; for example, a 10% steel tariff increase. Political stability, vital for global operations, sees unstable regions showing a 15% investment decrease.

| Factor | Impact | Example (2024/2025) |

|---|---|---|

| Government Policy | Affects EV/Renewable Demand | U.S. IRA, EU Green Deal, China's 14th Plan |

| Trade Tariffs | Changes Production Costs | 10% steel tariff, impacting pricing |

| Political Instability | Reduces Investment | 15% drop in foreign investment |

Economic factors

Global economic growth significantly impacts AQ Group. In 2024, the World Bank projects global growth at 2.6%, increasing to 2.7% in 2025. Key industrial sector performance affects demand for AQ Group's products. Economic downturns, as seen in the 2023 slowdown, can reduce orders, affecting profitability. The automotive and aerospace sectors' health is critical.

Persistent inflation poses a risk, potentially increasing AQ Group's operational costs. For example, the U.S. inflation rate was 3.5% as of March 2024. Rising interest rates, like the Federal Reserve's current range, can impact borrowing costs. This affects both AQ Group's investment decisions and customer spending. Higher rates can also reduce project viability and overall profitability.

Geopolitical tensions and extreme weather events contribute to supply chain disruptions, increasing the volatility of material and component costs. AQ Group's global supply chain makes it vulnerable to these fluctuations. For example, the Baltic Dry Index, a measure of shipping costs, saw a 15% increase in Q1 2024. These disruptions can impact production costs and delivery times.

Currency Exchange Rates

As a global manufacturer, AQ Group faces currency exchange rate impacts. These rates affect production costs, export competitiveness, and international revenue. For example, the EUR/SEK rate, crucial for AQ Group, saw fluctuations in 2024. In Q1 2024, the EUR/SEK rate averaged around 11.30, impacting profitability.

- EUR/SEK rate impacted AQ Group's profitability in 2024.

- Currency fluctuations affect the cost of raw materials.

- Export competitiveness can be significantly impacted by rates.

- International revenue is directly exposed to currency risk.

Investment Levels in Industrial Sectors

Investment levels in sectors like electric power and electric vehicles are crucial for AQ Group. Higher investments boost demand for their products and services. For example, global EV investment is projected to reach $600 billion by 2025. This growth directly impacts AQ Group's potential revenue.

- EV market growth is expected to increase by 20% in 2024.

- Investments in renewable energy are up 15% year-over-year.

- AQ Group's revenue from these sectors could rise by 10-15%.

Economic growth forecasts impact AQ Group; the World Bank projects 2.7% growth in 2025. Inflation, like the 3.5% U.S. rate in March 2024, can increase costs. Currency fluctuations, such as EUR/SEK averaging 11.30 in Q1 2024, affect profitability and export competitiveness.

| Economic Factor | Impact | 2024/2025 Data |

|---|---|---|

| Global Growth | Demand & Revenue | 2.6% (2024), 2.7% (2025) - World Bank |

| Inflation | Cost of Operations | U.S. 3.5% (Mar 2024) |

| Currency Fluctuations | Profitability, Competitiveness | EUR/SEK ~11.30 (Q1 2024) |

Sociological factors

Workforce availability and skills are crucial. AQ Group's operations depend on skilled labor. Labor costs and availability are influenced by demographics and education. In 2024, skilled labor shortages affected 30% of businesses globally.

Consumer demand for sustainable products is on the rise, impacting AQ Group's operations. This trend encourages the creation of energy-efficient, eco-friendly products. For instance, in 2024, the market for green products grew by 15% globally. This presents opportunities for AQ Group to innovate. The shift aligns with consumer preferences and regulatory pressures.

Societal views on manufacturing, which encompasses AQ Group's activities, significantly shape its image. Public perception of industrial practices influences AQ Group's ability to recruit skilled workers, with 2024 data showing talent shortages in manufacturing. Community relations are vital; for example, 70% of consumers prefer brands supporting local economies. Negative attitudes can hinder growth.

Health and Safety Standards

Health and safety standards are increasingly important, affecting AQ Group's operations and expenses. Keeping up with changing safety rules and protecting employees is vital. In 2024, workplace injuries cost businesses billions. Compliance boosts employee morale and productivity. Proper safety measures also reduce legal liabilities.

- Workplace injuries cost US businesses over $170 billion annually (2024).

- Companies with strong safety programs see up to a 20% increase in productivity.

- Non-compliance can lead to fines, potentially costing millions.

- Employee well-being directly impacts operational efficiency by up to 15%.

Demographic Shifts

Demographic shifts significantly impact AQ Group's operations. Aging populations in key markets like Europe (with 21.1% aged 65+) and North America (16.8%) affect demand for healthcare and retirement-related products. These changes also influence workforce composition and skill availability. Adapting to these shifts is crucial for sustainable growth.

- Europe's elderly population is projected to reach 30% by 2050.

- North America's aging population is increasing healthcare spending.

- These shifts require AQ Group to tailor products and services.

- Workforce planning is essential for AQ Group.

Societal views on manufacturing impact AQ Group, with public perception shaping talent acquisition and community relations. Workplace health and safety, increasingly crucial, affects operational costs and employee morale; non-compliance carries severe financial penalties. Demographic shifts, notably aging populations in regions like Europe and North America, influence product demand and workforce dynamics, requiring AQ Group to adapt.

| Factor | Impact on AQ Group | Data (2024/2025) |

|---|---|---|

| Public Perception | Affects talent pool & community ties. | 70% consumers favor brands supporting locals. |

| Health & Safety | Impacts operational expenses & employee well-being. | Workplace injuries cost US businesses $170B annually. |

| Demographics | Shapes product demand & workforce planning. | Europe: 21.1% aged 65+; US: healthcare spending rise. |

Technological factors

Rapid advancements in manufacturing technologies, including automation and robotics, significantly influence AQ Group's operational efficiency. Investing in these technologies is crucial for cost-effectiveness; for example, automation can reduce labor costs by up to 30%. Additive manufacturing, or 3D printing, enables faster prototyping and production cycles. Maintaining competitiveness hinges on adopting these advanced manufacturing solutions.

Technological advancements in electric power and EV tech are crucial for AQ Group. These innovations directly affect the company's products and systems. To stay relevant, AQ Group must prioritize being at the forefront of these developments. The global EV market is projected to reach $823.75 billion by 2030, showing the importance of this area.

The rise of AI and digitalization offers AQ Group chances for efficiency gains. Smart manufacturing, predictive maintenance, and supply chain improvements are key. The global AI market is projected to reach $200 billion by 2025. This growth indicates significant potential for AQ Group's tech adoption.

Material Science Advancements

Material science advancements are pivotal for AQ Group, shaping its products. Innovations can create more efficient and sustainable materials. This impacts product performance, cost, and environmental impact. The global advanced materials market is projected to reach $145.2 billion by 2025.

- 2024: Significant R&D in lightweight composites.

- 2025: Focus on bio-based materials.

- Impact: Reduced carbon footprint, enhanced product durability.

- Financial Impact: Potential for cost savings and increased market share.

Connectivity and IoT

The rise of connectivity and IoT is pivotal for AQ Group. This allows for smarter product development, enhanced monitoring, and new service models. Globally, the IoT market is forecast to reach $1.5 trillion by 2025. AQ Group can leverage this for real-time data analysis. This will optimize operations and offer predictive maintenance.

- IoT spending in manufacturing is projected to hit $108 billion by 2025.

- The number of IoT devices is expected to exceed 30 billion by 2025.

- Smart factories can boost productivity by up to 25% through IoT integration.

Technological factors significantly shape AQ Group's operations and product offerings.

Investments in automation and advanced manufacturing are essential for cost efficiency. The global EV market's growth, expected to reach $823.75 billion by 2030, emphasizes the need for tech focus.

AI, IoT, and material science advancements also provide chances for optimization and market share growth. IoT spending in manufacturing is projected to reach $108 billion by 2025.

| Technology Area | 2024 Focus | 2025 Focus |

|---|---|---|

| Advanced Manufacturing | Automation implementation | 3D printing expansion |

| Electric Power & EV Tech | Battery tech R&D | Charging infrastructure partnerships |

| AI and Digitalization | Predictive maintenance systems | Smart manufacturing scaling |

Legal factors

AQ Group faces the challenge of adhering to intricate international trade laws. This includes export/import regulations and sanctions. In 2024, the World Trade Organization reported a 1.7% increase in global trade. Non-compliance leads to penalties, potentially impacting financial performance.

AQ Group must comply with stringent product liability and safety regulations. These are vital for its manufacturing operations. The company faces potential legal risks if its products fail to meet safety standards. In 2024, product recalls cost companies an average of $12 million. Maintaining customer trust hinges on adherence to these regulations.

AQ Group faces stricter environmental laws. These laws focus on emissions, waste, and hazardous substances. Compliance demands investment in new equipment. For example, in 2024, companies globally spent $300 billion on environmental compliance. This spending is expected to rise by 5% annually through 2025.

Labor Laws and Employment Regulations

AQ Group's global presence means it must navigate a complex web of labor laws. These laws vary widely across countries, affecting wages, working hours, and employee rights. For example, minimum wage laws in 2024 ranged from $0.78/hour in Cuba to $16.90/hour in Washington, USA.

- Compliance costs can be significant, potentially impacting profitability.

- Failure to comply can result in legal penalties and reputational damage.

- Employee relations are crucial for maintaining a productive workforce.

- Adapting to changing labor standards is an ongoing challenge.

Intellectual Property Laws

Protecting intellectual property is crucial for AQ Group, especially with its innovative solutions. Patents and trademarks safeguard its unique offerings in target sectors. The global IP market was valued at $687.2 billion in 2023, expected to reach $894.2 billion by 2025. AQ Group must actively enforce its IP rights to maintain its competitive edge.

- Patent filings increased by 4% globally in 2024.

- Trademark applications grew by 7% in the EU.

- IP litigation costs average $3 million per case.

- Copyright infringement cases rose by 10% in 2024.

AQ Group must navigate complex global trade laws, including regulations and sanctions. These laws directly affect its export/import activities and are crucial for legal compliance. Non-compliance leads to severe penalties and financial impacts, reflecting the importance of adherence.

| Legal Factor | Impact | 2024 Data |

|---|---|---|

| Trade Regulations | Penalties | WTO: 1.7% trade increase |

| Product Liability | Recalls, Lawsuits | Recalls avg $12M/company |

| Environmental Laws | Compliance Costs | $300B spent globally |

Environmental factors

Climate change intensifies extreme weather, potentially disrupting AQ Group's operations and supply chains. For instance, in 2024, weather-related disasters caused over $100 billion in damages in the US alone, showcasing the financial risks. Adapting and ensuring resilience are crucial as these events become more frequent and severe. Companies are increasingly investing in climate risk assessments, with spending expected to reach $10 billion globally by 2025.

Resource availability and cost are significantly shaped by environmental factors. Regulations, like those promoting renewable energy, impact operational costs. For example, in 2024, the global renewable energy market grew by 12%. Sustainable practices are vital for long-term success. Companies adopting these strategies often see improved resilience and reduced costs.

Stricter environmental regulations and standards, focusing on emissions, waste, and energy use, necessitate AQ Group's investment in cleaner technologies. This shift is crucial, as the global green technology and sustainability market is projected to reach $74.6 billion by 2024. Companies like AQ Group must adapt to avoid penalties and capitalize on sustainable market opportunities. In 2024, the EU's Emissions Trading System saw carbon prices around €80-€100 per ton, influencing operational costs.

Customer Demand for Sustainable Solutions

Customer demand for sustainable solutions is significantly influencing AQ Group's operations. There's increasing pressure to provide products with lower environmental impacts. This involves transparent sustainability credentials and eco-friendly manufacturing. According to a 2024 report, 68% of consumers prefer sustainable brands. This shift requires AQ Group to adapt its offerings.

- 68% consumer preference for sustainable brands (2024).

- Increased demand for eco-friendly products.

- Need for transparent sustainability credentials.

- Pressure to adopt sustainable manufacturing.

Circular Economy Principles

The global shift towards circular economy principles is reshaping how businesses operate. This trend pushes companies like AQ Group to prioritize product durability, recyclability, and waste reduction. Implementing these principles can open new market avenues and decrease environmental impact. Specifically, the circular economy market is projected to reach $4.5 trillion globally by 2025.

- AQ Group could explore eco-friendly materials and designs.

- This could also reduce waste and operational costs.

- The company could improve its brand image.

- AQ Group could attract environmentally conscious investors.

Environmental factors significantly influence AQ Group's operations, including climate impacts and resource availability, pushing for sustainable practices. Stricter environmental regulations demand investments in cleaner tech, shaping operational costs. Customer preferences for sustainable solutions, along with circular economy trends, create opportunities for AQ Group.

| Aspect | Details | Data |

|---|---|---|

| Climate Risk | Weather events impacting supply chains and operations. | $100B+ in 2024 US damage from weather disasters. |

| Regulations | Emission, waste and energy use influence business models. | Green tech market expected to reach $74.6B by 2024. |

| Sustainability | Eco-friendly demand requires change and sustainability. | 68% of consumers prefer sustainable brands by 2024. |

PESTLE Analysis Data Sources

Our PESTLE analyzes utilize data from government bodies, financial institutions, market research firms, and academic publications.