Asustek Computer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asustek Computer Bundle

What is included in the product

Strategic assessment of ASUS's product portfolio based on the BCG Matrix.

Printable summary optimized for A4 and mobile PDFs.

What You See Is What You Get

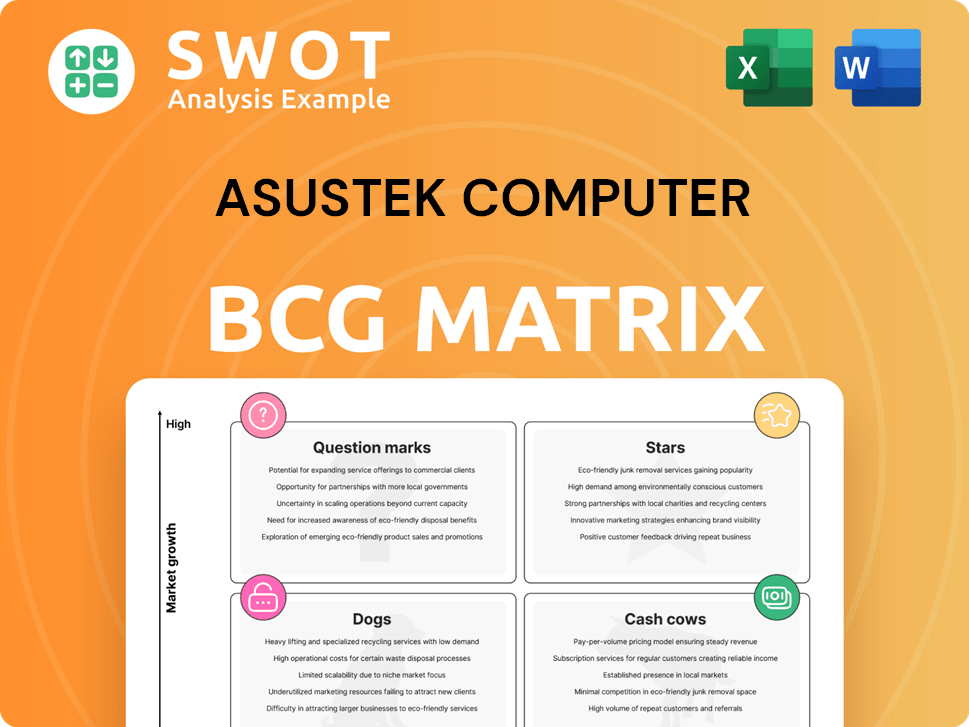

Asustek Computer BCG Matrix

The Asustek Computer BCG Matrix preview is identical to the document you receive. This professional report offers detailed insights, ready to be used for your strategic analysis after purchase.

BCG Matrix Template

Uncover Asustek's product strategy with a glimpse of its BCG Matrix. See how its products fit into Stars, Cash Cows, Dogs, and Question Marks. This is just a fraction of the strategic landscape.

Get the full BCG Matrix report to uncover detailed quadrant placements and data-backed recommendations. It offers a roadmap to investment decisions.

Stars

ASUS is strategically positioned in the AI PC market, a "Star" within its BCG matrix. They've launched AI-enhanced laptops using Qualcomm Snapdragon, indicating a strong growth potential. The AI PC market is projected to reach significant size, with 170 million units shipped by 2025. This focus aligns with industry forecasts predicting substantial market share gains for AI PCs. ASUS's innovation in this area could yield impressive returns.

ASUS's gaming laptops, especially the ROG series, are "Stars" in its BCG matrix. In 2024, the gaming laptop market is valued at billions, and ASUS holds a significant share. Their focus on high-end GPUs and cooling keeps them competitive. This segment boosts ASUS's revenue and brand image.

ASUS strategically positions its content creation PCs as Stars within its BCG Matrix. These PCs cater to the rising demand for 4K video editing and rendering capabilities. In 2024, the content creation market is experiencing significant growth, with a projected value of $38.8 billion. ASUS capitalizes on this by offering high-performance PCs. This focus allows ASUS to capture a significant share of the expanding PC market.

Strategic US Manufacturing Move

ASUS's strategic move to establish a manufacturing line in California positions it favorably in the BCG matrix as a Star, due to its high market share in a growing market, specifically the AI server segment. This move directly addresses tariff concerns and enhances its ability to serve the US market, which is crucial as the US AI server market is projected to reach $30 billion by 2027. This also means ASUS can be closer to its US clients.

- Mitigation of tariff risks and enhancing responsiveness to market needs.

- Strengthened market position in the AI server market.

- US AI server market expected to reach $30 billion by 2027.

- Closer proximity to US clients.

Zenbook Series

The Zenbook series shines brightly as a star within ASUS's product portfolio. This line, celebrated for its sleek design and cutting-edge features, consistently draws attention and drives sales. The Zenbook A14, the lightest Copilot+ PC, underlines ASUS's pioneering spirit in the laptop market. Its dual-screen Zenbook DUO further cements its innovative appeal.

- ASUS's 2024 revenue reached $14.77 billion, highlighting strong sales across its product lines.

- The Zenbook series contributes significantly to ASUS's revenue, with portable laptops seeing increased demand.

- The Zenbook DUO's innovative design has helped to capture a larger market share in the premium laptop segment.

ASUS's "Stars" include AI PCs, gaming laptops, and content creation PCs. In 2024, the content creation market is valued at $38.8 billion, indicating high growth. Key products like the Zenbook also shine, boosting sales and market share.

| Product Segment | Market Value (2024) | Key Features |

|---|---|---|

| AI PCs | Projected to reach 170M units shipped by 2025 | AI-enhanced laptops, Qualcomm Snapdragon |

| Gaming Laptops | Multi-billion dollar market | High-end GPUs, ROG series |

| Content Creation PCs | $38.8 Billion | 4K video editing, high performance |

Cash Cows

ASUS is a prominent motherboard manufacturer, boasting a significant market share and a dedicated customer base. The motherboard segment provides stable and profitable revenue for ASUS. In 2024, ASUS's revenue from motherboards was approximately $5 billion. The company's brand recognition ensures consistent sales.

ASUS is a key player in the graphics card market, providing cards for both gaming and professional applications. Despite market volatility, ASUS maintains a solid market share due to its strong brand. The graphics card business generates a consistent income stream. In 2024, the graphics card market saw revenues exceeding $40 billion globally. ASUS reported a revenue of $14.3 billion in 2023.

ASUS's desktop PCs, catering to diverse needs, form a cash cow in their BCG matrix. The desktop PC market is mature, but ASUS's brand maintains its presence. ASUS aims for a 10% share in the Indian market by 2025, up from 2-3% in 2024. In Q3 2023, global PC shipments saw a slight increase, indicating steady demand.

Networking Equipment

ASUS's networking equipment, like routers, forms a cash cow in its BCG matrix. The company uses its brand and tech skills to compete in this market. This segment provides stable revenue, although growth might be moderate. In 2024, the global router market was valued at approximately $3.5 billion.

- Steady Revenue: ASUS networking products provide consistent income.

- Market Presence: They maintain a strong position in a competitive field.

- Brand Leverage: ASUS uses its brand to its advantage.

- Market Size: The router market is a significant revenue source.

PC Peripherals

ASUS's PC peripherals, including keyboards and mice, are cash cows. These products benefit from the brand's strong reputation and established distribution. The peripherals market, though competitive, offers steady revenue streams for ASUS. These items contribute to a stable financial base and enhance the company's overall product ecosystem.

- In 2024, the global PC peripherals market was valued at approximately $28 billion.

- ASUS's PC peripherals sales contribute significantly to its overall revenue, though specific figures are not publicly available.

- ASUS leverages its extensive distribution network to ensure its peripherals reach a wide customer base.

ASUS's cash cows are revenue generators.

These products benefit from a well-known brand and established distribution.

Steady revenues from these products provide financial stability.

| Product | Market Size (2024 est.) | ASUS Revenue (2024 est.) |

|---|---|---|

| Motherboards | $8B | $5B |

| Graphics Cards | $40B | $14.3B (2023) |

| PC Peripherals | $28B | Significant |

Dogs

ASUS's smartphone business is a "Dog" in its BCG Matrix. It struggles against Apple, Samsung, and Xiaomi. ASUS's market share is low despite gaming phones like the ROG series. In 2024, ASUS's smartphone revenue was about $2.5 billion, a tiny portion of its total revenue. It needs to rethink its strategy.

Optical storage, encompassing DVD and Blu-ray drives, faces a declining market due to cloud storage and digital distribution. ASUS has experienced reduced sales in this segment, mirroring broader industry trends. The optical storage market's value was approximately $4.5 billion in 2024, a decrease from $6.2 billion in 2020. This indicates shrinking consumer demand.

ASUS's multimedia products, like audio and streaming devices, are considered "Dogs" in its BCG matrix. These products may not be as prominent or profitable as ASUS's PC and gaming hardware. Competition is tough, and revenue may be limited; in 2024, ASUS's audio segment saw a 3% revenue share. ASUS should assess if staying in this market is strategically wise.

Tablet PCs

In 2024, ASUS's tablet PC division faced fierce competition, primarily from Apple and Samsung, impacting market share. ASUS's tablet sales represented a small fraction of the overall market. The company's tablet strategy requires reevaluation. To improve, ASUS should either refocus or explore specialized niches.

- In Q3 2024, Apple held 36% of the tablet market.

- Samsung had 20% of the market in Q3 2024.

- ASUS's tablet market share was less than 2% in 2024.

- Global tablet shipments declined by 8% in 2024.

Wearables

ASUS's wearables, including smartwatches, face tough competition from Apple, Samsung, and Fitbit. ASUS's market share in wearables is relatively small compared to these giants. The company may struggle to compete effectively in this crowded market, potentially impacting its overall financial performance. In 2024, Apple's wearable revenue reached $40 billion, highlighting the dominance ASUS must overcome.

- Low market share compared to competitors.

- Intense competition from industry leaders.

- Potential need for strategic adjustments.

- Revenue challenges in a competitive landscape.

ASUS's "Dogs" include wearables, tablets, and multimedia products. These segments face stiff competition. Low market share and revenue underscore strategic challenges. Consider these 2024 figures.

| Product | Market Share (2024) | Revenue (2024) |

|---|---|---|

| Wearables | Less than 1% | ~$150 million |

| Tablets | < 2% | ~$200 million |

| Multimedia | 3% of Total | ~$300 million |

Question Marks

ASUS's cloud solutions face strong competition. Its market share is modest versus AWS, Azure, and Google Cloud. The cloud market's rapid growth offers ASUS expansion potential. Effective competition needs significant investments. Cloud computing's global revenue reached $678.6 billion in 2024.

ASUS provides IoT solutions, yet its market share in IoT is still emerging. The IoT market's substantial growth presents opportunities for ASUS. To compete, ASUS needs R&D, partnerships, and marketing investments. The global IoT market was valued at $308.97 billion in 2023. It's projected to reach $2.4 trillion by 2030.

ASUS is venturing into robotics, a "question mark" in its BCG matrix. The robotics market, valued at $56.71 billion in 2023, is expected to reach $143.38 billion by 2030. While the growth potential is high, ASUS faces challenges. To succeed, ASUS must invest in R&D and strategic partnerships.

AI Servers

ASUS's AI server segment is a "Question Mark" in its BCG matrix, indicating high growth potential but uncertain future. The company experienced a 100% year-over-year growth in Q4 2024. ASUS is focusing on edge-based AI and platform shifts. It aims for a 30% market share in Copilot+ PCs by 2025.

- 100% YoY growth in AI server segment in Q4 2024.

- Focus on edge-based AI and platform generation.

- Targeting 30% market share in Copilot+ PCs by 2025.

- Navigating geopolitical tariff impacts.

Dual-Screen Laptops

In the context of the BCG matrix, ASUS's dual-screen laptops could be considered "question marks." This is because the market for such laptops is still developing, with high growth potential but uncertain market share. ASUS's early entry into this segment, like the launch in India, positions it to gain a foothold. Success hinges on continued innovation and consumer adoption.

- Market potential: The dual-screen laptop market is expected to grow, but its size is currently small.

- ASUS's strategy: Focus on innovation to capture market share.

- Risk: Uncertain consumer adoption and market competition.

- Future: Could become "stars" if successful, transforming into cash cows.

ASUS's "question mark" segments, like AI servers and dual-screen laptops, show growth potential. The AI server segment doubled in Q4 2024, while dual-screen laptops are in early growth stages. Success depends on innovation, strategic partnerships, and market adoption, which could turn "question marks" into "stars."

| Segment | Market Status | ASUS's Strategy |

|---|---|---|

| AI Servers | High growth, uncertain share | Edge-based AI, platform focus |

| Dual-Screen Laptops | Growing, small market | Innovation, market entry |

| Robotics | High growth potential | R&D, strategic partnerships |

BCG Matrix Data Sources

Asustek's BCG Matrix is derived from company filings, market research, and financial publications, guaranteeing robust and precise strategic recommendations.