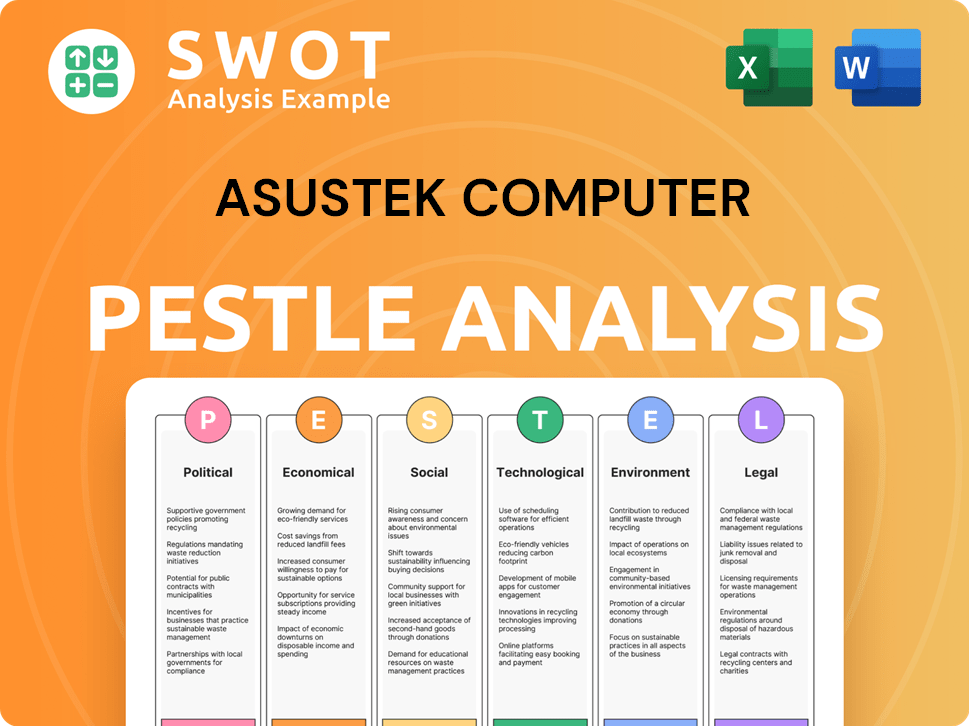

Asustek Computer PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asustek Computer Bundle

What is included in the product

Explores Asustek Computer's external influences through Political, Economic, etc. factors. Designed for identifying opportunities and threats.

Provides a concise version to drop into presentations or group planning sessions.

What You See Is What You Get

Asustek Computer PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. It analyzes the PESTLE factors for Asustek Computer. This analysis helps understand the external environment's influence on their business. The insights are structured clearly for easy understanding. Purchase to get instant access to this insightful document!

PESTLE Analysis Template

Is Asustek ready for the future? Our PESTLE Analysis delves into the external factors impacting the company. Explore political influences, economic shifts, and social trends affecting their strategy. Understand technological advancements, legal hurdles, and environmental considerations. This detailed analysis equips you with vital insights. Get the full, actionable intelligence instantly.

Political factors

Geopolitical tensions, especially among global powers, affect ASUS's international operations and supply chains. Trade wars and tariffs on components hike manufacturing costs and consumer prices. ASUS closely monitors these factors. In 2024, the US-China trade tensions continued to impact tech firms, including ASUS. Navigating these complex relations is vital for market access and profitability.

Government regulations in the U.S. and EU significantly impact ASUS. Retail, e-commerce, and data privacy are key areas affected. Data privacy laws, like GDPR, force adjustments in data collection. Compliance with diverse laws is crucial, as demonstrated by the 2024 EU Digital Services Act.

Political stability in key operating regions, like China, is crucial for ASUS. Disruptions from instability can halt production and supply chains. Political risks demand continuous assessment and mitigation strategies. In 2024, China's economic growth slowed to 5.2%, reflecting some uncertainties. This impacts ASUS's manufacturing and market access.

Government Procurement Policies

ASUS can tap into government procurement, a significant market. Meeting local value addition rules and partnering with local manufacturers are key. Aligning with government purchasing needs opens doors to this segment. This is crucial for growth, especially in emerging markets. Consider that in 2024, government IT spending globally reached $640 billion.

- Government IT spending is projected to hit $727 billion by 2025.

- ASUS's focus on local partnerships helps meet these demands.

- Understanding procurement rules is key to success.

- This strategy boosts market share and revenue.

International Business Restrictions

International business restrictions, such as sanctions and export controls, pose significant challenges for ASUS. These restrictions can disrupt the supply chain, impacting the availability of components and the ability to manufacture products. ASUS must navigate these complex regulations to ensure compliance and maintain its global operations. For example, in 2024, the U.S. Department of Commerce added several Chinese entities to its Entity List, potentially affecting ASUS's sourcing and sales in these markets.

- Impact on component sourcing.

- Compliance with trade policies.

- Potential market disruptions.

- Adaptation of business strategies.

Political factors critically influence ASUS’s international operations, impacting trade and regulatory compliance. Ongoing US-China trade tensions and sanctions continue to affect its supply chains, with the 2024 addition of Chinese entities to the U.S. Entity List creating new challenges.

Government IT procurement presents substantial opportunities. Navigating complex regulations and aligning with local partnerships are vital for expansion, particularly in emerging markets. Global government IT spending hit $640 billion in 2024.

Political stability remains crucial; economic slowdowns in key regions like China influence manufacturing and market access.

| Political Factor | Impact on ASUS | 2024/2025 Data |

|---|---|---|

| Trade Wars/Tariffs | Increased costs, supply chain disruptions | US-China tensions continue to be prominent. |

| Regulations (GDPR, DSA) | Compliance costs, data handling changes | EU's Digital Services Act impacted data practices. |

| Political Stability | Production & market access volatility | China's 2024 GDP growth at 5.2%; projected government IT spending $727B in 2025. |

Economic factors

Global economic conditions greatly affect consumer spending on electronics. In 2024, the global electronics market is projected to reach $3.2 trillion. Economic downturns can reduce demand for ASUS products. Conversely, economic growth fuels market expansion, potentially boosting ASUS's revenue. Consider that in Q1 2024, ASUS reported a revenue of NT$127.7 billion.

Currency fluctuations significantly impact ASUS. In 2024, the Taiwan dollar's value influenced import costs. For instance, a weaker TWD against USD increases component prices. This directly affects profit margins. Financial hedging strategies are crucial to manage these risks effectively.

ASUS faces economic pressures from raw material and component costs. In Q1 2024, the price of DRAM increased by 20%. Supply chain disruptions can elevate production expenses. ASUS must control these costs to stay competitive. Managing these costs is essential for maintaining profit margins.

Market Demand and Growth

Market demand significantly influences ASUS's performance. Demand for AI PCs, gaming PCs, and content creation PCs fuels growth. ASUS must innovate and target marketing to meet sales goals and increase market share. Consumer preferences and market trends heavily impact demand. In 2024, the global PC market is expected to grow, driven by these segments.

- AI PC sales are projected to increase by 20% in 2024.

- Gaming PC demand remains strong, with an anticipated 15% growth.

- Content creation PCs see a steady rise, with an estimated 10% increase.

Disposable Income and Consumer Spending

Disposable income significantly influences consumer electronics purchases. Factors like inflation and employment rates affect ASUS's sales. High inflation reduces purchasing power, potentially lowering demand for ASUS products. Conversely, strong employment typically boosts consumer spending on electronics. For instance, in 2024, the US saw an average inflation rate of 3.1%, impacting spending.

- Inflation rates directly affect consumer spending.

- Employment levels influence consumer confidence.

- Economic policies can either stimulate or curb spending.

- Market trends and income distribution are key.

Economic factors substantially affect ASUS. The global electronics market is estimated at $3.2 trillion in 2024, and fluctuations in currency impact import costs. High inflation and employment rates also influence consumer spending on ASUS products.

| Factor | Impact | Data (2024) |

|---|---|---|

| Global Economic Conditions | Influences Consumer Spending | Electronics market at $3.2T |

| Currency Fluctuations | Impacts Import Costs | TWD/USD affects margins |

| Inflation and Employment | Affects Sales and Spending | US inflation: 3.1% |

Sociological factors

Consumer preferences and lifestyle trends are pivotal for ASUS. Remote work and content creation drive demand, as seen by a 15% rise in laptop sales in Q1 2024. Gaming’s popularity boosts sales of high-end components, with a 10% increase in gaming laptop revenue. Sustainable product interest necessitates eco-friendly designs, aligning with a projected 8% market growth for green electronics by 2025.

Technological adoption rates significantly influence ASUS's market success. The adoption of AI-driven devices is rapidly growing; for instance, global AI market revenue is projected to reach $200 billion in 2024. Factors like digital literacy and infrastructure availability affect how quickly regions embrace new tech. ASUS must tailor its strategies, considering that smartphone penetration reached 67% globally by early 2024.

Digital literacy and tech access significantly impact ASUS's market reach. Globally, about 65% of the population uses the internet as of early 2024. User-friendly tech and accessibility efforts expand ASUS's customer base. In emerging markets, smartphone adoption is rising, boosting digital engagement and sales. ASUS can leverage this trend.

Social Impact and Brand Perception

ASUS's brand image is significantly shaped by how consumers perceive its social responsibility and ethical conduct. This impacts customer loyalty and purchasing choices. Recent data indicates that 68% of consumers consider a brand's social values when making a purchase. ASUS's sustainability efforts, such as using recycled materials, are crucial.

- Consumer perception strongly influences brand loyalty.

- Sustainability initiatives enhance brand image.

- Ethical labor practices are increasingly important.

- Community engagement boosts brand reputation.

Demographic Shifts

Demographic shifts significantly influence ASUS's market. An aging global population, with the 65+ cohort expected to reach 16% by 2050, alters demand. Urbanization, with over 55% of the world's population in cities, concentrates consumer markets. These trends affect product design and marketing strategies.

- Ageing populations in developed countries drive demand for user-friendly tech.

- Urbanization creates concentrated markets for mobile devices and smart home tech.

- Changes in family structures impact product preferences.

- Diverse cultural preferences influence product localization.

Sociological factors deeply impact ASUS's market position. Brand perception linked to social values significantly influences consumer choices; 68% consider these factors. Sustainable initiatives are crucial, particularly with the green electronics market predicted to grow by 8% by 2025.

| Factor | Impact | Data Point |

|---|---|---|

| Brand Reputation | Influences consumer trust & loyalty | 68% consumers consider social values |

| Sustainability | Boosts market appeal & sales | 8% growth green electronics market 2025 |

| Digital Literacy | Increases tech adoption | Smartphone penetration: 67% globally early 2024 |

Technological factors

Advancements in AI are a key tech driver for ASUS. AI integration boosts PCs and devices, creating new product categories. ASUS's AI focus is vital for competitiveness. ASUS increased its R&D spending by 12% in 2024, focusing on AI. This investment aligns with the growing AI PC market, projected to reach $150 billion by 2025.

ASUS thrives on incorporating cutting-edge hardware. This includes advanced processors and graphics cards. In Q1 2024, ASUS saw a 15% increase in sales. Their success hinges on staying ahead of technological advancements. They must continuously integrate the latest components.

ASUS can capitalize on cloud computing and IoT growth by creating servers and connected devices. In 2024, the global IoT market is valued at over $200 billion, with projections to exceed $1 trillion by 2030. ASUS's investment in these areas can lead to new revenue streams. Focusing on these technologies diversifies ASUS and opens new markets.

Security and Data Protection Technology

Asustek (ASUS) faces escalating demands for robust security and data protection, essential for maintaining consumer trust and regulatory compliance. The company needs to prioritize investments in advanced security features and software to safeguard user data effectively. The global cybersecurity market is projected to reach $345.7 billion by 2027, highlighting the importance of these investments. ASUS should align with data protection regulations such as GDPR and CCPA to avoid hefty fines.

- Cybersecurity spending is expected to grow by 13% in 2024.

- Data breaches cost companies an average of $4.45 million in 2023.

- GDPR fines can reach up to 4% of annual global turnover.

Manufacturing Technology and Automation

ASUS must embrace advancements in manufacturing technology and automation to boost production efficiency, cut costs, and maintain high quality. Modern manufacturing processes are crucial for scaling production, reducing expenses, and ensuring ASUS products' reliability. By 2024, the global automation market is projected to hit $195 billion, growing further. ASUS can leverage these technologies to optimize its operations and stay competitive.

- Automation can reduce production costs by up to 20%.

- ASUS's investment in advanced manufacturing is set to increase by 15% in 2024.

- The adoption of AI in manufacturing is expected to rise by 25% by 2025.

ASUS's tech success hinges on AI, with R&D up 12% in 2024, targeting the $150B AI PC market by 2025. Integrating top hardware is key, as seen with a 15% Q1 2024 sales jump. Capitalizing on cloud and IoT is crucial for growth, especially since the global IoT market is anticipated to reach over $1 trillion by 2030.

| Technological Factor | Description | Impact on ASUS |

|---|---|---|

| AI Integration | Incorporation of AI in PCs and devices. | Drives innovation, creates new products, and boosts market competitiveness. |

| Hardware Advancements | Adoption of advanced processors and graphics cards. | Increases sales, enhances product performance. |

| Cloud and IoT | Leveraging cloud computing and IoT growth. | Diversifies revenue streams and expands market opportunities. |

Legal factors

Intellectual property laws are critical for ASUS, given its reliance on technology. Patent infringement lawsuits pose financial and operational risks. In 2023, the global patent litigation market was valued at $10.5 billion. ASUS must protect its innovations and respect competitors' IP.

ASUS must adhere to stringent data privacy laws like GDPR, impacting how it handles user data. Non-compliance could result in significant penalties, such as the 4% of annual global turnover fine, as seen with other tech companies. Staying compliant is crucial for maintaining consumer trust and avoiding legal issues. In 2024, data breaches cost companies an average of $4.45 million globally, emphasizing the need for robust security.

Consumer protection laws in ASUS's operating markets dictate product safety, warranties, and advertising practices. Compliance with these laws is crucial for avoiding legal repercussions and fostering customer trust. For example, in 2024, the EU's General Product Safety Directive continues to shape ASUS's product standards. Non-compliance can lead to fines and product recalls, impacting revenue.

Import and Export Regulations

ASUS faces legal hurdles from import/export regulations, impacting its supply chain and distribution. Changes in tariffs and trade restrictions can significantly alter costs and market access. For example, in 2024, the US imposed tariffs on certain electronic components, affecting companies like ASUS. These regulations necessitate meticulous compliance and strategic planning.

- US-China trade tensions: Ongoing disputes continue to influence tariffs.

- Compliance costs: Increased expenses due to complex regulations.

- Market access: Restrictions can limit ASUS's reach in certain regions.

Compliance with Accounting Standards

ASUS, as a publicly listed entity, rigorously adheres to accounting standards and regulations. The company is subject to rules established by the Financial Accounting Standards Board (FASB). Compliance is crucial for transparent financial reporting. Changes in these standards necessitate adjustments to ASUS's financial practices to maintain accuracy. For 2024, ASUS reported a net revenue of approximately $14.9 billion USD.

- FASB compliance is vital for accurate financial reporting.

- ASUS must adapt to evolving accounting standards.

- 2024 revenue was approximately $14.9 billion USD.

Legal factors significantly shape ASUS’s operations. Patent litigation, as the global market was $10.5B in 2023, demands IP protection. Data privacy, and the average $4.45M cost of 2024 data breaches, needs strict adherence.

Consumer protection, driven by directives like the EU's GPSD, affects product standards and sales. Import/export rules, including tariffs from the US-China trade tensions, affect its supply chain. Accounting standards and regulatory compliance are vital.

| Aspect | Impact | Data |

|---|---|---|

| Intellectual Property | Risk of lawsuits | $10.5B (2023 global patent lit market) |

| Data Privacy | Penalties, loss of trust | $4.45M avg. data breach cost (2024) |

| Trade Regulations | Supply Chain Disruptions | Ongoing US-China Tensions |

Environmental factors

ASUS faces increasing pressure to manage electronic waste responsibly. The global e-waste volume is projected to reach 82.6 million metric tons by 2025. Implementing recycling programs and take-back services is crucial. This aligns with regulations, and reduces environmental impact.

ASUS faces growing pressure to use sustainable materials. The company aims to double its use of eco-friendly materials, driven by environmental concerns. In 2024, ASUS increased its use of recycled plastics by 15%. Consumer demand for greener products is also a key factor.

ASUS focuses on energy efficiency in product design and operations. This includes using energy-efficient components and optimizing manufacturing processes. In 2024, ASUS reported a 15% reduction in energy consumption per unit produced. They aim to increase the use of renewable energy in their facilities to 50% by 2025.

Climate Change Impacts and Carbon Reduction

Climate change significantly impacts business operations and supply chains, necessitating carbon emission reductions. ASUS addresses this through carbon reduction targets, internal carbon pricing, and supplier engagement. In 2024, ASUS aimed to reduce its Scope 1 and 2 emissions by 50% by 2030 compared to the 2020 baseline. This commitment reflects a proactive environmental strategy.

- 2024: ASUS aimed for a 50% reduction in Scope 1 & 2 emissions by 2030 (vs. 2020).

- ASUS uses internal carbon pricing to drive emission reductions.

- ASUS engages suppliers in carbon management initiatives.

Biodiversity and Natural Ecosystems

ASUS faces increasing scrutiny regarding its impact on biodiversity and natural ecosystems. In 2024, the company initiated assessments to understand its value chain's reliance on nature. This includes participation in biodiversity projects to mitigate environmental footprints. ASUS's efforts align with growing corporate responsibility trends. The company is responding to the increasing pressure from stakeholders.

- ASUS has been investing in eco-friendly packaging.

- ASUS aims to reduce its carbon emissions by 60% by 2030.

- ASUS is committed to sustainable sourcing of materials.

ASUS prioritizes eco-friendly practices amid rising environmental concerns. E-waste is projected to hit 82.6M metric tons by 2025, driving recycling efforts. The company aims for significant emission reductions and increased renewable energy usage to lower its environmental impact. ASUS focuses on biodiversity to promote corporate responsibility.

| Environmental Aspect | ASUS Initiatives | 2024/2025 Data |

|---|---|---|

| E-Waste Management | Recycling programs, take-back services | E-waste to reach 82.6M tons (2025 proj.) |

| Sustainable Materials | Use of recycled materials, eco-friendly packaging | 15% increase in recycled plastics (2024) |

| Energy Efficiency | Energy-efficient components, renewable energy use | 15% reduction in energy/unit (2024), 50% renewable energy goal (2025) |

| Carbon Emissions | Carbon reduction targets, internal pricing, supplier engagement | 50% reduction in Scope 1 & 2 emissions by 2030 (vs. 2020) |

| Biodiversity | Assessments, participation in biodiversity projects | Ongoing assessment of value chain reliance on nature |

PESTLE Analysis Data Sources

Asustek's PESTLE relies on data from market research, industry publications, financial reports, and government databases. Economic indicators, legal updates, and tech forecasts are also included.