AT&T PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AT&T Bundle

What is included in the product

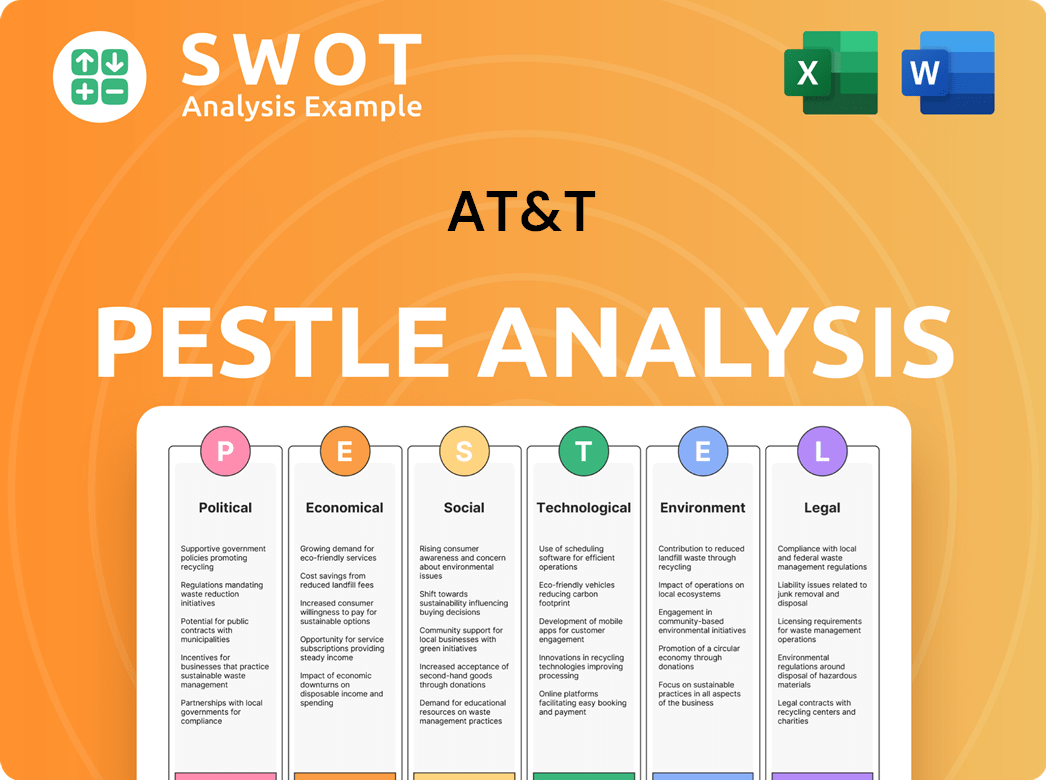

Analyzes external influences impacting AT&T using PESTLE: Political, Economic, Social, Tech, Environmental, and Legal.

Helps stakeholders readily identify and consider crucial external factors impacting AT&T's strategy.

Full Version Awaits

AT&T PESTLE Analysis

The AT&T PESTLE analysis previewed here presents the complete, final version.

This file, fully formatted, will be available instantly after purchase.

The detailed analysis and structure are identical to the downloaded document.

Enjoy immediate access to the exact analysis seen.

The document displayed is ready to download immediately.

PESTLE Analysis Template

The AT&T PESTLE analysis dissects crucial external factors. It explores political and economic influences on the telecom giant. Social and technological impacts are also carefully examined. Moreover, we address legal and environmental considerations. Get a complete picture of AT&T's market environment, download now!

Political factors

AT&T operates within a regulatory-heavy environment. The company deals with continuous government oversight of mergers, acquisitions, and network practices. For example, the FCC's recent actions on net neutrality could impact AT&T's network management. Regulatory shifts can substantially affect AT&T's costs and strategic choices. In 2024, AT&T spent approximately $2.9 billion on regulatory compliance.

Governments worldwide are heightening scrutiny on data privacy and cybersecurity. AT&T faces increasing regulatory pressures concerning data protection and security. The FCC and court rulings emphasize stringent data security measures. In 2024, AT&T allocated $2.5 billion towards cybersecurity, reflecting its commitment. Failure to comply can result in substantial penalties.

AT&T is heavily involved in politics via lobbying and donations to shape policies. In 2024, AT&T spent $18.5 million on lobbying efforts. They engage with lawmakers on network growth and regulations. This commitment is evident in their public disclosure of political activities.

International Political Climate

AT&T's global presence, including its operations in Latin America, exposes it to various international political risks. Geopolitical instability and shifts in foreign policies can directly affect AT&T's international business ventures and investment strategies. Trade wars, such as those observed between the U.S. and China, can disrupt supply chains and increase operational costs. Regulatory changes in Latin American countries, including shifts in telecom policies, can also significantly impact AT&T's market access and profitability.

- In 2024, AT&T generated $12.3 billion in revenue from its Latin American operations.

- Changes in U.S. foreign policy towards countries like Mexico could affect AT&T's investments.

- Geopolitical tensions have increased operational costs by 5% in certain regions.

Universal Service and Broadband Deployment Policies

Government policies focused on universal service and broadband deployment are crucial for AT&T. These initiatives, like the BEAD program, aim to extend broadband access, especially in rural areas, creating opportunities for AT&T. Such policies often come with funding and buildout obligations that shape AT&T's network strategies. For example, the BEAD program allocated $42.45 billion to states. AT&T must navigate these evolving regulatory landscapes.

- BEAD program allocated $42.45 billion.

- AT&T must comply with buildout requirements.

AT&T faces rigorous regulatory oversight, impacting costs and strategy, with $2.9 billion spent on compliance in 2024. Data privacy and cybersecurity concerns are critical, prompting a $2.5 billion investment in 2024. Political involvement via lobbying, totaling $18.5 million in 2024, is essential. International political risks affect global operations and profitability.

| Political Factor | Impact | 2024 Data |

|---|---|---|

| Regulatory Compliance | Costly and strategically impactful | $2.9B Compliance |

| Data Privacy/Cybersecurity | Increased scrutiny/investment | $2.5B Cybersecurity |

| Lobbying Efforts | Policy influence | $18.5M spent |

| Global Risks | Operational challenges | $12.3B LA revenue |

| Broadband Deployment | Growth opportunities | $42.45B BEAD allocation |

Economic factors

Economic growth significantly influences AT&T's performance, as consumer and business spending on telecommunications services correlate with economic health. In 2024, the U.S. GDP grew at a moderate pace, impacting demand for services like mobile and broadband. During economic expansions, AT&T typically sees increased demand, while downturns can pressure spending, as seen during the 2023 slowdown. The company's revenue is sensitive to these economic cycles.

Inflation poses a risk to AT&T's profitability, potentially elevating operational expenses. The Federal Reserve's interest rate decisions directly affect the cost of AT&T's borrowing for network upgrades. In 2024, inflation hovered around 3.1%, influencing AT&T's financial planning. Higher rates could slow infrastructure investments.

The telecommunications market faces fierce competition. AT&T competes with Verizon, T-Mobile, and others. This competition affects pricing and margins. In Q1 2024, AT&T's wireless service revenue increased by 3.7% due to competitive offers.

Investment in Network Infrastructure

AT&T's financial health is deeply linked to its substantial investments in network infrastructure, specifically 5G and fiber optic expansions. These investments, critical for maintaining a competitive edge, require significant capital outlays. The company's ability to secure funding and achieve returns on these expenditures directly impacts its future growth.

- In Q1 2024, AT&T's capital expenditures were $4.8 billion, primarily directed towards network infrastructure.

- AT&T plans to invest approximately $24 billion in capital expenditures for 2024.

- The company's debt as of Q1 2024 was around $135.2 billion.

ARPU and Subscriber Growth

Average Revenue Per User (ARPU) and subscriber growth are pivotal economic factors for AT&T. Increasing ARPU, especially from 5G and fiber services, directly boosts revenue. In Q1 2024, AT&T reported an ARPU of $55.21 for Mobility service. Adding profitable subscribers is crucial for financial health.

- In Q1 2024, AT&T's Mobility service added 349,000 net new subscribers.

- AT&T aims to expand its fiber network, targeting 30 million+ locations by late 2025.

- The company is focused on driving ARPU through premium service offerings.

Economic expansion drives demand for AT&T services. Inflation affects operating costs and investment strategies, as seen with a 3.1% rate in 2024. Competitive pressures, like Q1 2024's 3.7% wireless revenue rise, impact pricing.

| Economic Factor | Impact on AT&T | 2024/2025 Data Points |

|---|---|---|

| Economic Growth | Influences service demand | Moderate U.S. GDP growth in 2024. |

| Inflation | Elevates operating costs and funding. | 2024 inflation around 3.1%. |

| Competition | Affects pricing and margins | Q1 2024: 3.7% rise in wireless revenue. |

Sociological factors

Societal shifts heavily influence AT&T's market position. Increased mobile device usage and the necessity for faster internet speeds, fueled by remote work and streaming, are key drivers. Smart home technology adoption also impacts demand. In 2024, mobile data usage increased by 20%, reflecting these trends.

Demographic shifts significantly impact AT&T's operations. The U.S. population's aging trend, with a median age of 38.9 years in 2022, influences service demands. Urbanization continues, requiring infrastructure investments in densely populated areas, 83% of the U.S. population lived in urban areas as of 2023. These factors shape AT&T's strategic planning for network expansion and service offerings. Household formation rates also affect the demand for home internet and mobile services.

Digital inclusion is a key societal focus, aiming to provide affordable broadband and digital literacy for all. This trend impacts regulatory policies. In 2024, the FCC aimed to close the digital divide, allocating billions for broadband access. AT&T can capitalize on this by offering services that bridge the digital gap.

Workforce Trends and Labor Relations

Societal shifts favor flexible work and well-being, influencing AT&T's labor strategies. Past labor disputes, like the 2019 strike involving 21,000 workers, highlight operational risks. These factors necessitate proactive workforce management. The Communications Workers of America represents a significant portion of AT&T's workforce.

- 2023 saw increased emphasis on employee mental health programs.

- AT&T's labor costs represent a substantial portion of its operating expenses.

- Remote work options are increasingly offered to attract and retain talent.

Privacy Concerns and Data Usage

Growing public awareness of data privacy is impacting consumer trust, requiring companies like AT&T to be transparent. The Federal Trade Commission (FTC) has been active, fining companies for data breaches; in 2024, penalties for privacy violations reached record highs. Consumers are demanding control over their data, affecting AT&T's data collection and usage strategies. This leads to potential regulatory scrutiny and compliance costs.

- FTC fines for privacy violations hit record levels in 2024.

- Consumers increasingly seek control over their personal data.

- AT&T faces potential regulatory scrutiny and compliance costs.

Societal factors drive AT&T’s market and operational strategies, with mobile data usage increasing by 20% in 2024. Demographic shifts, like the aging U.S. population with a median age of 38.9 in 2022, influence service demands. Growing data privacy awareness, impacted by FTC fines hitting record levels in 2024, necessitates increased consumer data control and transparency.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Mobile Data Usage | Increased demand | 20% increase in 2024 |

| Aging Population | Service demand shift | Median age 38.9 in 2022 |

| Data Privacy | Regulatory Scrutiny | Record FTC fines in 2024 |

Technological factors

AT&T's technological landscape is heavily shaped by 5G. By the end of 2024, AT&T plans to have expanded its 5G+ network. This includes enhancing speeds and rolling out new 5G-driven services. Competitors like Verizon and T-Mobile are also investing heavily in 5G. AT&T must keep pace to maintain its market position.

AT&T's substantial investment in fiber optic networks is crucial for delivering high-speed internet. This expansion supports AT&T's strategic goal to offer integrated services, enhancing its competitive edge. In Q1 2024, AT&T added 322,000 fiber locations. Fiber expansion is vital for meeting growing data demands. By the end of 2024, AT&T plans to cover 30 million+ locations with fiber.

AT&T is heavily investing in AI and automation. They use AI for customer service, network optimization, and fraud detection. In 2024, AT&T reported a 15% increase in network efficiency due to AI. They aim to automate many tasks to cut operational costs by 10% by the end of 2025.

Cybersecurity and Network Security

Technological advancements introduce significant cybersecurity challenges for AT&T. The company faces constant threats, requiring robust security measures to safeguard its networks and customer data. Cyberattacks are increasing, with costs projected to reach $10.5 trillion annually by 2025. AT&T must invest heavily in cybersecurity to protect against data breaches and disruptions. This includes advanced threat detection and prevention systems.

- Projected cybersecurity spending worldwide is expected to reach $215.7 billion in 2025.

- Ransomware attacks cost businesses an average of $5.6 million in 2024.

- The global cybersecurity market is forecast to grow to $345.7 billion by 2026.

Development of New Services and Technologies

The telecommunications industry is experiencing rapid technological advancements. AT&T must adopt new technologies like Open RAN and satellite communication. This is crucial for creating new services and solutions. AT&T invested $24 billion in capital expenditures in 2023. This investment supports network upgrades and expansion.

- AT&T aims to expand 5G coverage, targeting 200 million subscribers by the end of 2025.

- Open RAN adoption is projected to reduce infrastructure costs by 15%.

AT&T's 5G expansion is a key technological focus. By the end of 2025, they plan to have 200M 5G subscribers. Fiber optic expansion is critical for high-speed internet and AT&T aims to cover 30M+ locations by the end of 2024. The firm invests heavily in AI and automation. The worldwide cybersecurity market is projected to reach $345.7 billion by 2026, a vital area of concern.

| Technology | Impact | 2024/2025 Data |

|---|---|---|

| 5G | Network enhancement | Targeting 200M subscribers by end of 2025. |

| Fiber Optics | High-speed internet | Plans to cover 30M+ locations by end of 2024. |

| AI and Automation | Operational Efficiency | Aim to cut operational costs by 10% by end of 2025. |

| Cybersecurity | Data Protection | Projected market size: $345.7B by 2026. |

Legal factors

AT&T faces intricate telecommunications regulations. These cover licensing, spectrum, consumer protection, and network access. The FCC oversees these, with potential fines for non-compliance. AT&T spent $5.1 billion on lobbying in 2024. They must adhere to these rules to operate.

As a major telecom player, AT&T faces antitrust scrutiny. Regulatory reviews and legal challenges can affect its strategies. In 2023, the DOJ reviewed AT&T's competitive practices. These reviews may impact future mergers and acquisitions. AT&T’s market dominance is under constant regulatory watch.

AT&T must adhere to stringent data privacy and security laws. These include regulations around Customer Proprietary Network Information (CPNI). Non-compliance can lead to hefty fines. In 2023, AT&T faced several legal challenges related to data breaches. This resulted in millions in settlements.

Consumer Protection Laws

AT&T faces stringent consumer protection laws. These laws govern advertising, billing, and customer service practices. Recent FCC rulings and court decisions emphasize fair practices. This includes areas like robocalls and customer consent, impacting operational strategies. AT&T must allocate resources for compliance and potential legal challenges. This is especially crucial in an era where consumer data privacy is paramount.

- FCC fines for privacy violations can reach millions of dollars.

- Consumer complaints against telecom companies increased by 15% in 2024.

- Data privacy regulations are becoming stricter, affecting marketing practices.

- AT&T allocated $500 million in 2024 for compliance and legal expenses.

Intellectual Property Law

Intellectual property (IP) laws, encompassing patents, trademarks, and copyrights, significantly impact AT&T's operations. AT&T must safeguard its inventions, branding, and media content through these protections. IP infringements can lead to costly litigation and damage brand reputation. For example, in 2024, AT&T spent $1.2 billion on research and development, underscoring its commitment to innovation and IP creation.

- AT&T holds thousands of patents globally, vital for its technological advancements.

- Trademark protection is crucial for maintaining brand identity and market position.

- Copyrights are essential for safeguarding content distributed via its media platforms.

AT&T navigates complex legal landscapes, from telecom regulations to antitrust reviews, shaping its operations. The company must comply with data privacy laws, facing potential fines and legal challenges, investing heavily in compliance. Protecting intellectual property, like patents and trademarks, is essential for innovation and brand maintenance.

| Legal Area | Impact | 2024/2025 Data |

|---|---|---|

| Regulations | Licensing, spectrum | $5.1B in lobbying, FCC fines reach millions. |

| Antitrust | M&A scrutiny | DOJ reviews ongoing. |

| Data Privacy | CPNI compliance | $500M allocated for legal and compliance, 15% rise in consumer complaints. |

Environmental factors

Climate change heightens extreme weather risks, potentially harming AT&T's infrastructure and service availability. In 2024, weather-related outages cost US businesses billions, a trend AT&T must address. AT&T must invest in resilient network designs. Specifically, in 2023, AT&T allocated $2.5 billion for network upgrades, including resilience measures.

AT&T faces environmental regulations on emissions, waste, and energy. They aim to cut greenhouse gas emissions. By 2024, AT&T invested $1.5 billion in energy efficiency. The company targets carbon neutrality by 2035.

AT&T's operations, including its vast network, consume substantial energy. The company actively seeks energy efficiency improvements and renewable energy sources. In 2023, AT&T's renewable energy use reached 38% of its total electricity consumption. Their goal is to achieve net-zero emissions by 2035.

Electronic Waste Management

AT&T, like other telecom companies, faces environmental challenges from electronic waste (e-waste). The industry generates significant e-waste from discarded devices and network infrastructure. Effective e-waste management and recycling are crucial for AT&T's environmental responsibility.

- In 2024, the global e-waste volume reached approximately 62 million metric tons.

- Only about 20% of global e-waste is formally recycled.

- AT&T has initiatives for device recycling and responsible disposal.

- The company invests in programs to reduce e-waste impact.

Sustainable Supply Chain Practices

AT&T faces growing scrutiny to promote environmental sustainability across its supply chain. The company collaborates with suppliers, urging them to adopt and meet their own environmental goals. This includes reducing carbon emissions and promoting the use of recycled materials. In 2024, AT&T reported a 30% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2019.

- AT&T aims for net-zero emissions by 2035.

- They are investing in renewable energy projects.

- The company promotes sustainable sourcing practices.

AT&T confronts environmental pressures from climate change impacting its infrastructure and services, compounded by increased extreme weather events. The company must comply with strict regulations concerning emissions, waste management, and energy use to lower environmental impact. Significant efforts center on energy efficiency, renewable energy adoption, and reducing electronic waste.

| Environmental Aspect | 2023/2024 Data | AT&T Strategy |

|---|---|---|

| Climate Risk | $2.5B allocated for network upgrades, addressing resilience. Weather-related outages cost US businesses billions annually. | Invest in resilient network designs. |

| Emissions | $1.5B investment in energy efficiency by 2024. AT&T aims for carbon neutrality by 2035. Scope 1&2 emissions decreased by 30% in 2024 versus 2019. | Reduce emissions, adopt energy efficiency. |

| E-Waste | ~62 million metric tons of e-waste globally in 2024. Only ~20% is formally recycled. | Improve e-waste management & device recycling. |

PESTLE Analysis Data Sources

This AT&T PESTLE leverages diverse data: economic indicators, government reports, tech analyses, & legal frameworks. Accurate and relevant data sources guarantee quality.