Aurubis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aurubis Bundle

What is included in the product

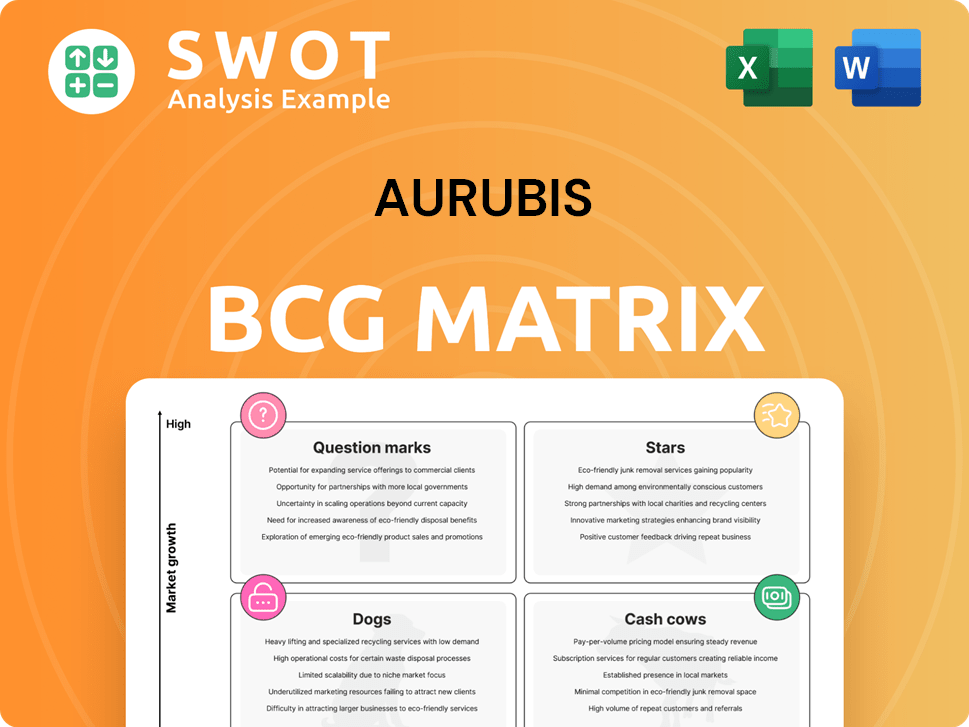

Aurubis' BCG Matrix analysis reveals investment, holding, and divestment strategies across its portfolio.

Quickly assess Aurubis' portfolio with an easily shareable, visually appealing matrix.

Full Transparency, Always

Aurubis BCG Matrix

The preview showcases the complete Aurubis BCG Matrix you'll receive. This downloadable file mirrors the preview—a fully editable report for strategic analysis. Purchase grants instant access to the final, watermark-free document. It’s ready for immediate implementation in your presentations or planning.

BCG Matrix Template

Aurubis navigates the metals market with a diverse portfolio. Its products likely range from established cash cows to emerging stars. Understanding their position is key to strategic decisions. This sneak peek offers a glimpse into their potential quadrants. Dive deeper into the Aurubis BCG Matrix for a complete breakdown and actionable strategic insights.

Stars

The US Recycling Plant in Richmond, Georgia, is a strategic move by Aurubis, costing $800 million. Slated to start in 2025, it will process 180,000 metric tons of copper scrap yearly. This plant will produce 70,000 tons of refined copper, addressing a crucial domestic need. It positions Aurubis well for recycled copper demand.

Aurubis strategically invests in recycling tech. They use X-ray, eddy currents, and AI for sorting. These methods achieve 99.9% pure copper, like new. This tech boost competitiveness and supports sustainability. Aurubis reported €1.8 billion in revenue from recycling in 2024.

Aurubis is boosting copper cathode production in Bulgaria. The Pirdop refinery's capacity will grow by 50%, reaching 340,000 tons annually. This €400 million investment supports local metal refinement and reduces European copper import needs. The expansion focuses on the European market, meeting demand from renewable energy and EV sectors. In 2024, the EU's copper demand rose by 7%, signaling robust market growth.

New Recycling Plant in Olen, Belgium

Aurubis's new recycling plant in Olen, Belgium, is a strategic move. It uses a hydrometallurgical process to extract metals like nickel and copper. This plant supports European industry by keeping essential metals within the region. The facility boosts Aurubis's recycling capacity in Europe, aligning with their growth strategy.

- The plant's strategic importance is highlighted by the increasing demand for recycled metals.

- It aligns with the EU's focus on circular economy initiatives.

- The investment shows Aurubis's commitment to sustainable practices.

- This enhances Aurubis's market position.

Industrial Heat Expansion at Hamburg Site

Aurubis's Hamburg site is expanding its industrial heat capacity, a move that could supply carbon-neutral heat to 28,000 homes. This project is set to prevent roughly 120,000 tons of CO2 emissions each year. This strategic investment reflects Aurubis's commitment to sustainability, boosting its image. It also positions Aurubis as an environmentally conscious leader.

- Carbon-neutral heat for 28,000 households.

- Avoidance of up to 120,000 tons of CO2 annually.

- Enhances sustainability goals.

- Positions Aurubis as a green leader.

Aurubis's "Stars" include strategic recycling and expansion initiatives. Investments in recycling tech and capacity boosts are core. Sustainable practices and market positioning drive growth.

| Initiative | Investment | Impact |

|---|---|---|

| Richmond, GA Plant | $800M | 180kt scrap/yr; 70kt refined Cu |

| Pirdop Refinery | €400M | +50% capacity, 340kt annually |

| Hamburg Heat | N/A | 28,000 homes, 120kt CO2 saved |

Cash Cows

Aurubis, a key player, produces over 1 million tons of copper cathodes each year, vital for diverse industries. For fiscal year 2024/25, stable demand is anticipated. Free cathode sales rely on in-group processing, ensuring consistent revenue. In 2024, copper prices fluctuated, reflecting market dynamics.

Aurubis' continuous cast rod, vital for wires and cables, aligns with the "Cash Cows" quadrant of the BCG Matrix. The company expects steady demand from construction and potentially automotive sectors through fiscal year 2024/25. This dependable demand ensures a stable cash flow. In Q1 2023/24, Aurubis' revenue was €3.8 billion.

Aurubis's shapes and profiles, crafted from copper and its alloys, are essential for various industries. Although a slight downturn in continuous cast shapes is anticipated, Aurubis' diverse offerings provide stability. In 2024, this segment contributed significantly to overall revenue, with specific figures available in the company's financial reports. These products ensure a consistent income flow.

Precious Metals

Aurubis's precious metals segment, a cash cow, efficiently extracts gold and silver from copper production by-products. Their advanced, eco-friendly facilities process diverse precious metal-rich materials. This area consistently bolsters Aurubis's financial performance. The recovery of precious metals is a crucial part of their business model.

- In 2024, Aurubis reported substantial revenue from precious metals, demonstrating its significance.

- The company's precious metal refining capacity is among the largest globally.

- Aurubis's focus on sustainability enhances its precious metal operations.

- Precious metals contribute a considerable portion to Aurubis's overall profitability.

Sulfuric Acid

Aurubis is a key player in the sulfuric acid market, primarily serving Europe, Turkey, and North Africa. Demand in these regions is robust, supported by various industrial applications. Sulfuric acid, a by-product of copper smelting, significantly boosts Aurubis's revenue and profitability. In 2024, Aurubis produced approximately 2.6 million tonnes of sulfuric acid.

- Strong demand in Europe, Turkey, and North Africa.

- Sulfuric acid is a by-product of copper smelting.

- Contributes to revenue and profitability.

- 2.6 million tonnes produced in 2024.

Aurubis' Cash Cows generate consistent revenue and stable cash flow. These include continuous cast rod, shapes, profiles, and precious metals refining. Sulfuric acid production is also a significant contributor. In 2024, these segments bolstered Aurubis's financial performance.

| Product Segment | Description | 2024 Revenue Contribution |

|---|---|---|

| Continuous Cast Rod | Used for wires and cables. | Steady |

| Shapes and Profiles | Essential for various industries. | Significant |

| Precious Metals | Gold and silver extraction. | Substantial |

Dogs

Aurubis anticipates a decrease in demand for flat rolled products due to market consolidation. This could lead to reduced profitability for this segment; for instance, in 2024, the segment's revenue might see a 5% decrease. The company might need to adjust its strategy, potentially through restructuring or cost-cutting, to maintain its market position. In 2024, the flat rolled products segment's contribution to the overall revenue was approximately 18%.

Aurubis has strategically divested European sites to concentrate on core copper production and recycling. This restructuring, including the sale of its rolled products business in 2024, aims at enhancing profitability. Although these moves might decrease overall revenue, they streamline operations and reduce expenses. For instance, Aurubis's focus on high-margin products should improve financial performance.

Aurubis sold its Buffalo, US site to Wieland Group. This strategic move allows Aurubis to concentrate on its core business. The sale, however, means a revenue stream is gone. Aurubis must seek new revenue sources; in 2024, the Buffalo site contributed significantly.

Lead Production

In Aurubis's portfolio, lead production is a smaller segment. It doesn't drive substantial revenue compared to copper or precious metals. This area might be categorized as a 'dog' within the BCG matrix. Aurubis needs to carefully consider its lead strategy.

- Lead production contributes a smaller portion to Aurubis's overall revenue compared to its core business.

- The profitability of lead may be limited compared to other metals.

- Aurubis might evaluate whether to reduce or divest its lead operations.

Tin and Zinc Production

Aurubis extracts tin and zinc alongside copper, akin to lead. These by-products contribute less significantly to overall revenue. In 2024, the global zinc market saw prices around $2,800 per metric ton, and tin at $27,000 per metric ton. Aurubis should evaluate its strategies for these metals to boost profitability.

- By-products' Revenue: Tin and zinc contribute less to overall revenue.

- Market Data: Zinc prices in 2024 are around $2,800/MT.

- Market Data: Tin prices in 2024 are around $27,000/MT.

- Strategic Review: Aurubis needs to reassess its strategy to improve market standing and profitability.

In Aurubis's BCG matrix, lead production is a 'dog'. It generates less revenue than copper, a core product. Aurubis might consider scaling back or selling its lead operations.

| Category | Details | 2024 Data |

|---|---|---|

| Revenue Contribution | Lead's share of total revenue | Less than 5% |

| Market Position | Low market share | Compared to copper |

| Strategic Action | Potential divestiture | Review and decision |

Question Marks

Aurubis is collaborating with Talga to pioneer a unique method for producing battery-grade recycled graphite. This initiative aims to significantly cut CO2 emissions by integrating recycled graphite into anode manufacturing. While success is not guaranteed, it could establish Aurubis as a frontrunner in sustainable battery materials. In 2024, the global graphite market was valued at approximately $20 billion, with recycled graphite representing a small but growing segment.

Aurubis is investing €300 million in a new precious metals processing plant in Hamburg. This significant investment aims to enhance plant security and improve precious metal recovery rates. The project's success hinges on operational efficiency and sustained market demand. In 2024, gold prices fluctuated, impacting profitability.

Aurubis is boosting sustainable partnerships in the automotive sector. This includes a renewed multi-year deal with COFICAB for copper wire rod. These partnerships support Aurubis's sustainability aims, though their financial effects remain unclear. Success hinges on demand for sustainable automotive products. In 2024, the automotive industry shows increased interest in sustainable materials.

Minor Metals (Selenium, Tellurium)

Aurubis extracts minor metals such as selenium and tellurium as byproducts. The market for these metals is smaller and less predictable than core products like copper. Their profitability is also subject to more volatility. Aurubis must innovate to find new applications and markets. This will boost revenue from these "question mark" metals.

- Selenium prices in 2024 fluctuated significantly, reflecting demand variations.

- Tellurium's market is similarly niche, with prices impacted by industrial needs.

- Aurubis reported €100 million in revenue from minor metals in the last fiscal year.

- Research and development are key to expanding minor metal applications.

Complex Recycling of Electronic Scrap

Aurubis employs the Kayser Recycling System (KRS) in Lünen to tackle complex electronic scrap. This method processes materials with low copper and precious metal content. However, the profitability of this process is still uncertain. Success hinges on the KRS's efficiency and market demand for recycled materials. In 2024, electronic waste recycling is a growing market, with global e-waste generation projected to reach 82 million metric tons.

- KRS processes complex materials.

- Profitability is uncertain.

- Success depends on efficiency and demand.

- Global e-waste is growing.

Aurubis's minor metals like selenium and tellurium represent Question Marks in its BCG Matrix. These metals have a smaller, volatile market, impacting profitability. Aurubis generated €100 million in revenue from these metals last year. Success requires innovation in applications and market expansion.

| Aspect | Details |

|---|---|

| Market Size | Niche, subject to volatility |

| 2024 Revenue | €100 million (minor metals) |

| Strategic Need | R&D for new applications |

BCG Matrix Data Sources

The Aurubis BCG Matrix is derived from financial filings, market analyses, industry reports, and expert forecasts, providing robust and dependable strategic insights.