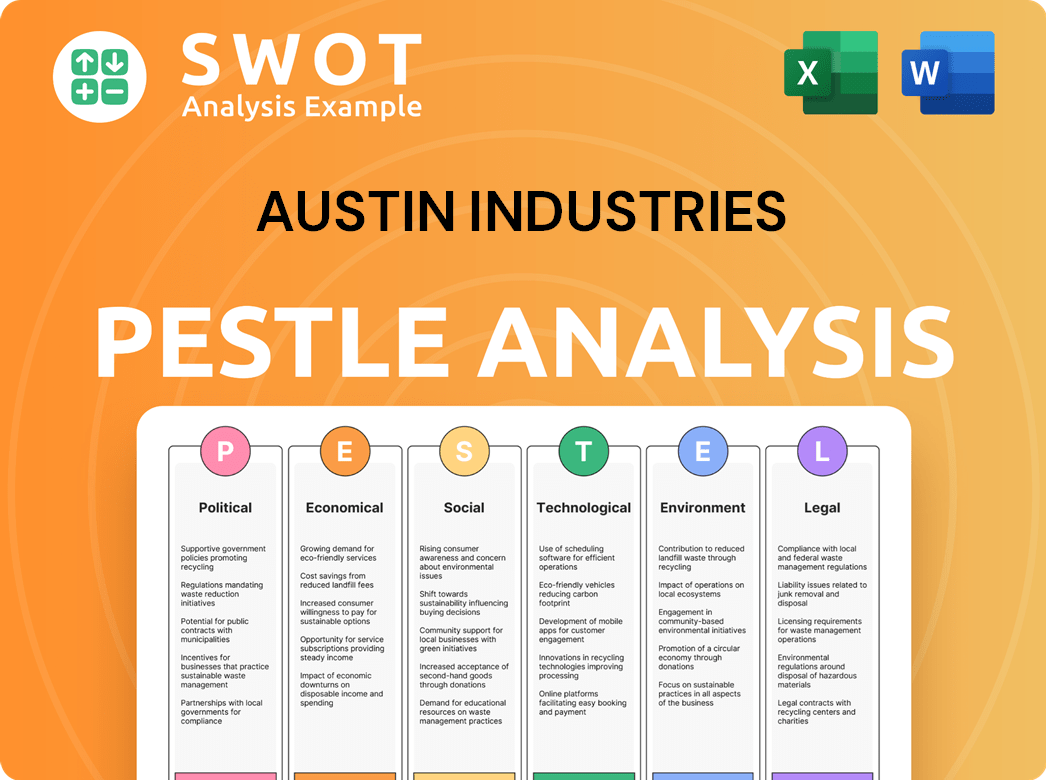

Austin Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Austin Industries Bundle

What is included in the product

Assesses external factors affecting Austin Industries: Political, Economic, Social, Technological, Environmental, and Legal.

Allows users to modify or add notes specific to their own context, region, or business line.

What You See Is What You Get

Austin Industries PESTLE Analysis

The preview showcases the Austin Industries PESTLE analysis, providing insights. This document is complete and ready for immediate download.

The exact formatting, structure, and content are preserved.

What you see here represents the complete, finalized document.

Upon purchase, you'll receive this identical, actionable analysis.

PESTLE Analysis Template

Assess Austin Industries' external landscape with our PESTLE analysis. We explore political stability's impact, economic trends, and tech disruptions. Dive into social shifts and evolving legal/environmental pressures shaping the firm. Enhance your strategy: get our full analysis now for key insights!

Political factors

Government infrastructure spending heavily influences construction. The Bipartisan Infrastructure Law in the U.S. allocates billions, benefiting firms like Austin Industries. This funding supports transportation, utilities, and public facilities. Such investment directly affects project volume and type. For 2024, infrastructure spending is projected to increase by 8%, with continued growth expected through 2025.

Changes in government policies, zoning laws, and building codes directly influence Austin Industries' construction projects. New city development policies in Austin, like those impacting industrial zones, can affect project locations. For 2024, Austin's construction spending is projected to be $5.5 billion, reflecting regulatory impacts. Adapting to these shifts is vital for operational success.

Political stability is crucial for Austin Industries, ensuring steady project flows and investment returns. Fluctuations in trade policies, such as tariffs on steel and aluminum, directly affect project expenses and supply chain dependability. For example, in 2024, steel tariffs rose by 10% in certain regions, increasing construction costs. Therefore, keeping a close watch and adapting to these policy shifts is vital for maintaining project financial viability.

Government Building Plans and Initiatives

Austin Industries should monitor ambitious government building plans, as these create demand for construction services. For instance, the U.S. government aims to address the housing shortage, with a focus on affordable housing, which could boost construction spending. These initiatives often come with specific regulations and incentives that Austin Industries must understand to capitalize on opportunities. Aligning with these governmental priorities can unlock new business prospects.

- U.S. construction spending in 2024 is projected to be over $2 trillion.

- The Infrastructure Investment and Jobs Act allocates significant funds for infrastructure projects.

- Government targets for new housing construction are increasing annually.

Support for Specific Construction Sectors

Government backing for specific construction sectors significantly influences demand. The CHIPS and Science Act, for instance, boosts manufacturing facilities, benefiting industrial construction firms. Austin Industries' specialization in this area could capitalize on these opportunities. The U.S. government allocated $52.7 billion for semiconductor manufacturing and research through the CHIPS Act. Additionally, the Infrastructure Investment and Jobs Act provides substantial funding for various construction projects.

- CHIPS Act: $52.7 billion for semiconductor manufacturing.

- Infrastructure Act: Significant funding for construction projects.

- Focus on clean energy projects.

Political factors substantially affect Austin Industries via infrastructure spending, which is expected to rise. Changes in zoning and building codes influence project locations and operations. Political stability and trade policies are critical for consistent project flow, with steel tariffs increasing construction costs in 2024.

| Political Factor | Impact on Austin Industries | 2024 Data |

|---|---|---|

| Infrastructure Spending | Directly impacts project volume. | Projected 8% increase in spending. |

| Zoning & Building Codes | Affects project locations & costs. | Austin construction spending: $5.5B |

| Trade Policies | Influence costs and supply chains. | Steel tariffs up 10% in some regions. |

Economic factors

The overall economic growth and stability significantly affect Austin Industries. A robust GDP, like the projected 2.1% growth in 2024, fuels construction demand. High inflation, although expected to ease to 2.8% in 2024, still influences project costs. Positive consumer confidence supports private sector investments, boosting construction projects.

Interest rate fluctuations significantly influence construction project financing, affecting both developers and Austin Industries. Lower rates can boost investment, potentially increasing project viability. In 2024, the Federal Reserve held interest rates steady, but future cuts are anticipated. Austin Industries must factor in these rates when bidding and managing finances, with the prime rate currently around 8.5%.

Material and labor costs are key economic factors. Construction material prices rose in 2024, impacting project budgets. Labor shortages also drive up costs, affecting project timelines. Austin Industries manages these with strategic sourcing and workforce training. In 2024, construction costs increased by an average of 5-7%.

Market Demand in Key Sectors

Market demand in construction is segmented across civil, commercial, industrial, and infrastructure sectors. For example, data center construction is booming, while manufacturing construction is stabilizing. These trends affect Austin Industries' project pipeline and strategic focus. Understanding these sector-specific shifts is crucial for business planning.

- Data center construction spending in the U.S. is projected to reach $50 billion by 2025.

- Commercial construction spending is expected to grow by 3% in 2024.

- Infrastructure spending is set to increase by 7% in 2024, driven by government initiatives.

Investment Levels in Infrastructure

Investment in infrastructure significantly impacts Austin Industries. Public and private funding for infrastructure projects, like roads and utilities, directly affects project opportunities. Monitoring infrastructure investment reports and funding levels is crucial for understanding potential growth. The Infrastructure Investment and Jobs Act of 2021 allocated billions for infrastructure. This investment is expected to create substantial opportunities for construction and related services in 2024 and 2025.

- The Infrastructure Investment and Jobs Act of 2021 allocated $1.2 trillion for infrastructure projects.

- The American Society of Civil Engineers (ASCE) estimates a $2.59 trillion infrastructure funding gap over the next decade.

- Increased investment in infrastructure projects is projected to increase construction spending by 5-7% in 2024.

Economic conditions, including GDP growth, inflation, and interest rates, impact Austin Industries' financial performance. Material and labor costs also are key factors impacting the industry. Changes in construction market demand across sectors are a major component for financial success.

| Economic Factor | Impact on Austin Industries | 2024/2025 Data |

|---|---|---|

| GDP Growth | Fuels construction demand | Projected 2.1% in 2024 |

| Inflation | Influences project costs | Expected 2.8% in 2024 |

| Interest Rates | Affects project financing | Prime rate ~8.5% |

| Construction Costs | Impact project budgets | Increased 5-7% in 2024 |

Sociological factors

The construction industry relies heavily on a skilled workforce, a key sociological factor. The industry faces labor shortages, an aging workforce, and the need for new skills in tech and sustainability. According to the Associated General Contractors of America, 70% of construction firms reported difficulties filling hourly craft positions in 2024. Austin Industries needs to attract, train, and retain skilled workers to remain competitive.

Societal expectations and regulations increasingly emphasize workplace safety and worker well-being. A strong safety culture and health initiatives are vital for attracting talent and reducing accidents. Austin Industries, with 2024 revenue of $3.5 billion, prioritizes safety, reflected in a 15% reduction in incident rates. This commitment boosts its reputation.

Construction projects significantly affect communities through traffic, noise, and environmental concerns. Building strong community relationships and addressing concerns is crucial for project success and public image. Austin Industries' community engagement strategies play a vital role in this area. In 2024, the construction industry faced increased scrutiny regarding environmental impact, with stricter regulations emerging. Community perception directly influences project timelines and approvals.

Demographic Trends and Urbanization

Shifting demographics and urbanization significantly impact construction demand. Austin's rapid population growth, with an estimated 2.3 million residents in 2024, fuels the need for residential and commercial projects. Urbanization drives infrastructure development, creating opportunities for companies like Austin Industries. These trends affect the company's project portfolio and strategic planning.

- Austin's population grew by approximately 2.3% in 2024.

- The commercial real estate market in Austin saw a 5% increase in demand in 2024.

- Infrastructure spending in Texas increased by 7% in 2024.

Public Perception of the Construction Industry

Public perception significantly impacts the construction industry, influencing talent acquisition and community support. Concerns about safety and sustainability shape public views; addressing these is crucial. Data from 2024 shows a slight improvement in industry safety perception, yet sustainability remains a key concern. Highlighting career opportunities can also improve the industry's image.

- Safety perception saw marginal improvement in 2024, with a 3% increase in positive views.

- Sustainability concerns remain high, with 65% of the public citing environmental impact as a major issue.

- Promoting career opportunities can attract skilled workers, addressing labor shortages.

Sociological factors like labor shortages and an aging workforce significantly influence the construction industry, necessitating strategic talent acquisition and retention. Public perception, particularly regarding safety and sustainability, also shapes project success and community support. In 2024, 65% of the public cited environmental impact as a major concern.

| Factor | Impact | Data (2024) |

|---|---|---|

| Workforce | Labor Shortages | 70% firms struggle to fill hourly positions |

| Safety | Public Perception | 3% increase in positive views |

| Sustainability | Community Concern | 65% cite environmental impact as issue |

Technological factors

The construction industry's embrace of digital tools, like BIM, is significant. These technologies boost project management and collaboration. For example, the global BIM market is expected to reach $18.17 billion by 2025. Austin Industries' adoption of these is a key technological factor.

Automation and robotics are transforming construction. They're helping with tasks like bricklaying and surveying. This can address labor shortages and boost efficiency. However, it demands investment and workforce training. Austin Industries may adopt these technologies. In 2024, the construction robotics market was valued at $1.5 billion. Projections estimate it to reach $3.2 billion by 2029.

Data analytics and AI are transforming construction, improving efficiency. They optimize schedules, resource allocation, and risk management. AI enhances safety monitoring and predictive maintenance. For instance, in 2024, the global AI in construction market was valued at $1.4 billion, projected to reach $4.5 billion by 2029. Leveraging data and AI creates a competitive edge.

Modern Methods of Construction (MMC)

Modern Methods of Construction (MMC) are becoming increasingly popular, offering potential benefits like faster project completion, reduced costs, and better quality control. Austin Industries could explore prefabrication and modular construction to enhance its project efficiency. Government support for MMC underscores its rising significance in the construction sector. The global modular construction market is projected to reach $157 billion by 2025.

- Prefabrication and modular construction can reduce project timelines by up to 50%.

- MMC can lower construction costs by 10-20%.

- Government investment in MMC is expected to grow by 15% annually through 2025.

Technological advancements in Materials

Technological advancements in materials significantly influence the construction industry. Innovations like self-healing concrete and carbon fiber composites are changing building performance and sustainability. Austin Industries must monitor these developments to stay competitive and meet evolving environmental standards. The global green building materials market is projected to reach $439.7 billion by 2027.

- New materials can reduce construction costs and improve project efficiency.

- Sustainable materials are increasingly important for meeting regulatory requirements and client demand.

- Advanced materials can enhance the durability and lifespan of infrastructure projects.

Austin Industries leverages tech to boost efficiency. BIM adoption aligns with the $18.17B global market by 2025. AI & data analytics ($4.5B market by 2029) & MMC ($157B by 2025) are key.

| Technology Area | Market Size (2024/2025) | Key Impact |

|---|---|---|

| BIM | $18.17B (2025) | Improved project management, collaboration |

| AI in Construction | $1.4B (2024) -> $4.5B (2029) | Enhanced efficiency, risk management |

| Modular Construction | $157B (2025) | Faster project completion, cost reduction |

Legal factors

Austin Industries must strictly adhere to construction regulations and codes. This includes building codes, safety rules, and quality standards. For instance, OSHA standards are crucial for on-site safety. Recent updates, like those in fall protection, impact daily operations. Non-compliance may lead to penalties, affecting project costs and timelines. In 2024, OSHA reported over 100,000 workplace inspections.

Construction projects rely heavily on contracts, making contract law and dispute resolution essential. These legal frameworks dictate obligations and how disputes are handled. Austin Industries must adhere to these laws to mitigate risks. In 2024, construction disputes averaged $50 million, highlighting the importance of legal compliance.

Austin Industries must adhere to labor laws, encompassing wage/hour rules and worker classification. Employment regulation changes can affect workforce costs. As a merit shop, it operates without mandatory union agreements. In 2024, the construction industry saw a 4.6% rise in labor costs.

Environmental Regulations and Permitting

Austin Industries must navigate stringent environmental regulations for its construction projects. These regulations cover emissions, water discharge, and waste disposal, necessitating careful planning. Securing permits and adhering to environmental laws are critical for project success. New construction product requirements, like those in California's 2024 regulations, also affect project costs and timelines.

- California's 2024 regulations on construction materials impact costs.

- Permitting delays can cause project setbacks.

- Compliance failures can lead to significant fines.

Safety Legislation and Enforcement

Safety legislation and enforcement are critical for Austin Industries. The Building Safety Act in the UK, while not directly applicable in the US, reflects the global trend toward increased construction safety accountability. Stricter enforcement from OSHA, with potential penalties, necessitates a strong safety focus.

Austin Industries must prioritize safety compliance to mitigate legal risks. Staying informed about OSHA's enforcement priorities is crucial for the company.

- OSHA inspections increased by 5% in 2024.

- Building Safety Act fines in the UK can reach £10 million.

Legal factors significantly impact Austin Industries through regulations, contracts, and labor laws. Compliance with building codes and environmental standards, like those in California's 2024 regulations, is essential to avoid penalties and delays. OSHA enforcement, increasing by 5% in 2024, underscores the need for robust safety protocols.

| Regulation Area | Impact | 2024 Data |

|---|---|---|

| OSHA Inspections | Safety Compliance | 5% Increase |

| Construction Disputes | Contract Law | $50M Average Cost |

| Labor Costs | Employment Law | 4.6% Rise |

Environmental factors

The construction industry faces growing pressure to adopt sustainable practices. Green building standards, such as LEED, are increasingly common. In 2024, the global green building materials market was valued at $368.5 billion and is projected to reach $684.8 billion by 2032. Austin Industries' capacity to meet these evolving demands is crucial.

Climate change, marked by extreme weather, impacts construction, demanding resilient designs and novel site management. For example, the construction industry faces increased costs due to weather-related delays; in 2024, these costs reached $20 billion. Building infrastructure that withstands environmental shifts is essential.

Resource depletion and material sourcing significantly impact construction. The construction industry is increasingly pressured to use eco-friendly materials. For instance, the global green building materials market is projected to reach $498.1 billion by 2025.

Waste Management and Recycling

Regulations and environmental goals increasingly emphasize better waste management in construction, including waste reduction and recycling. Austin Industries must consider waste management strategies to meet these requirements. In 2024, the construction industry saw a 20% increase in recycling initiatives. This focus is critical for long-term sustainability and compliance.

- 2024: Construction industry saw a 20% increase in recycling initiatives.

- Regulations are pushing for better waste management practices.

- Implementing effective waste management is essential.

Emissions and Carbon Footprint

Austin Industries faces growing pressure to reduce emissions and its carbon footprint due to stricter regulations. The construction industry is under scrutiny, with demands for greener methods and materials. Minimizing environmental impact, including embodied and operational carbon, is becoming crucial. The global construction industry accounts for nearly 40% of carbon emissions.

- Embodied carbon: 10-20% of total emissions.

- Operational carbon: 80-90% of total emissions.

- Focus on sustainable materials and practices.

- Compliance with emerging environmental standards.

Environmental factors shape Austin Industries' operations. Growing focus on sustainability includes green building materials, which is projected to reach $498.1 billion by 2025. Climate change demands resilient infrastructure, and waste management sees rising emphasis. Regulations on emission reductions add to the firm's operational complexities.

| Aspect | Details | Data |

|---|---|---|

| Sustainability | Green building material demand | $498.1 billion by 2025 |

| Climate Change | Costs related to weather delays | $20 billion in 2024 |

| Waste Management | Construction recycling initiatives | 20% increase in 2024 |

PESTLE Analysis Data Sources

Our analysis leverages government databases, industry reports, and economic indicators.