AVEVA Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AVEVA Group Bundle

What is included in the product

Strategic overview of AVEVA's portfolio using BCG Matrix, with tailored quadrant analyses.

Export-ready design for quick drag-and-drop into PowerPoint.

What You See Is What You Get

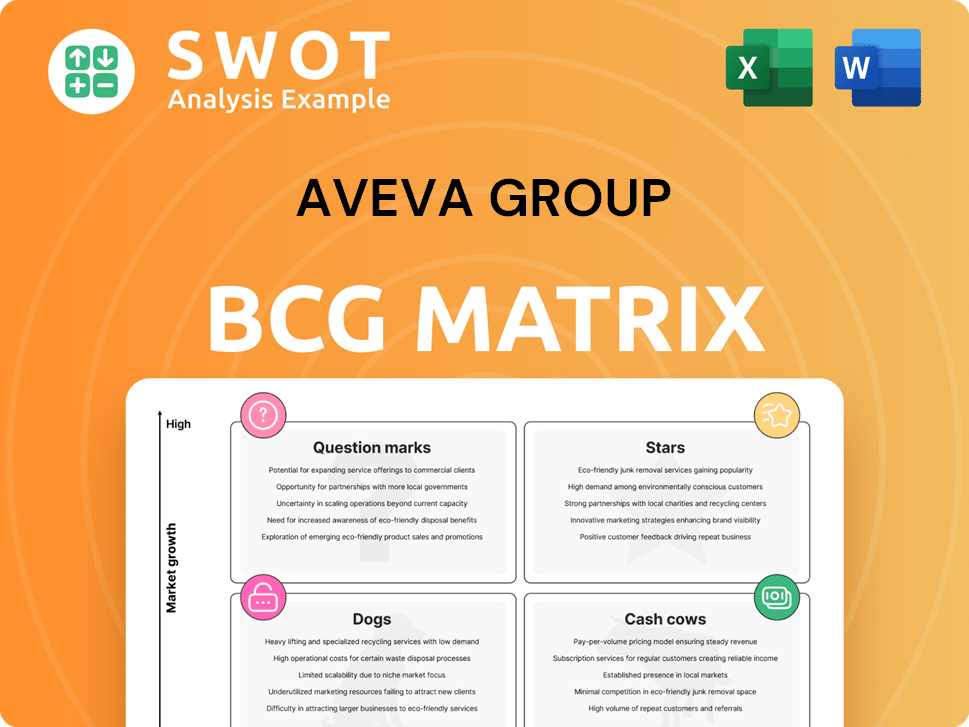

AVEVA Group BCG Matrix

The AVEVA Group BCG Matrix preview is the same report you receive after buying. It’s a complete, analysis-ready document, perfect for strategic planning and investment decisions. Enjoy immediate access to the full file after purchase, designed for professional use. No hidden elements, just the final BCG Matrix.

BCG Matrix Template

AVEVA Group's BCG Matrix reveals its product portfolio's market positions. This framework helps assess product contributions to revenue and growth. Stars drive high growth, while cash cows provide consistent cash flow. Dogs may need restructuring, and question marks require careful evaluation. This glimpse is just the beginning. Get the full BCG Matrix report for data-backed insights and strategic recommendations.

Stars

AVEVA's plant design software is a Star in its BCG Matrix, due to its strong market position. This software is a key driver in the digital transformation of engineering. It requires continuous investment to maintain its leading edge. If successful, it could become a cash cow. In 2024, AVEVA's revenue was £2.1 billion, reflecting strong demand for its software.

AVEVA's simulation software shines in high-stakes sectors like aerospace and defense. With these areas seeing robust growth, it makes sense to categorize this as a 'star'. The global simulation software market was valued at $8.2 billion in 2024, showing strong expansion. Keeping up with R&D is vital for AVEVA to maintain its competitive edge.

AVEVA's operational optimization solutions, vital for Industry 4.0, are experiencing robust growth. These require continuous marketing and tech upgrades to stay ahead. Success hinges on integrating AI and IoT, crucial for efficiency. In 2024, the sector saw a 15% revenue increase. Investment in R&D rose by 12%, reflecting commitment to innovation.

Digital Twin Technology

AVEVA's digital twin technology shines as a "Star" in its BCG matrix, driven by industry's push for better asset management. This segment necessitates significant investment in both development and promotion to broaden its market presence. Success hinges on proving a solid return on investment and scaling operations efficiently. Digital twins are projected to reach a market size of $77.6 billion by 2028, growing at a CAGR of 36.2% from 2021 to 2028.

- Digital twin technology is predicted to experience substantial market growth.

- AVEVA needs to invest heavily in its digital twin solutions.

- Demonstrating ROI is crucial for attracting clients.

- Effective scaling of the technology is essential.

Software for Sustainable Operations

AVEVA's sustainable operations software is a shining star, reflecting high growth due to the rising importance of environmental sustainability. These solutions require continuous development to meet changing demands. The long-term success of this star hinges on its effectiveness in helping companies meet specific sustainability targets. In 2024, the global green software market was valued at $14.3 billion, with a projected CAGR of 30% from 2024 to 2032, indicating significant growth potential.

- Market Growth: The green software market is booming, reflecting a strong demand.

- Regulatory Impact: Compliance and evolving standards drive the need for advanced solutions.

- Customer Expectations: Clients increasingly seek measurable sustainability outcomes.

- Financial Data: Significant investment and revenue growth are expected in this segment.

AVEVA's Stars, including plant design and simulation software, drive growth. They demand constant investment for innovation and market leadership. Digital twins and sustainable operations software are also Stars, poised for significant expansion. These segments are vital for AVEVA's future.

| Star Category | Market Growth (2024) | AVEVA Focus |

|---|---|---|

| Plant Design Software | Strong, driven by digital transformation. | Maintain market leadership through innovation. |

| Simulation Software | $8.2 billion global market, expanding. | R&D to stay competitive in key sectors. |

| Digital Twin Technology | Projected $77.6B by 2028 (CAGR 36.2%). | ROI demonstration, scaling, and market reach. |

| Sustainable Operations | $14.3B market, 30% CAGR (2024-2032). | Meet sustainability goals, compliance, and outcomes. |

Cash Cows

AVEVA's mature engineering software suites are cash cows, providing consistent revenue from core industries. These established products need little promotion, ensuring steady cash flow. In 2024, AVEVA's revenue reached £2.2 billion, reflecting stable demand. Focus is on efficient infrastructure and cost management to maximize profits.

Legacy System Integration Services represent a "Cash Cow" for AVEVA Group. These services generate a consistent revenue stream by integrating older systems with modern AVEVA solutions. Investment in this area focuses on efficient service delivery rather than innovation. This segment thrives due to a large installed base requiring continuous support and upgrades, contributing to predictable cash flow. In 2024, services revenue accounted for a significant portion of AVEVA's total revenue, approximately 40%, highlighting the importance of these offerings.

AVEVA's simulation software in traditional sectors like oil and gas is a cash cow, generating steady revenue. These offerings thrive on long-term contracts and strong customer ties. Minimal additional investment is required to maintain this segment. In 2024, AVEVA reported strong recurring revenue from its established industrial software solutions. This allows for resource reallocation.

Training and Support Services

AVEVA's training and support services are a steady income source, tied to its software portfolio. These services rely on efficient management and customer service for delivery. High customer satisfaction is crucial for this cash cow's continued success. In 2023, AVEVA reported a 13% increase in recurring revenue, demonstrating the importance of these services.

- Recurring revenue growth signifies strong customer retention.

- Customer satisfaction directly influences service renewals.

- Investment in infrastructure supports service delivery.

- Efficient management optimizes profitability.

Standardized Plant Design Templates

Standardized plant design templates, a cash cow for AVEVA, generate consistent revenue with minimal new development efforts. These templates are widely used, forming the basis for new projects and upgrades in various sectors. AVEVA's focus is on maintaining and updating these templates to meet current industry standards, ensuring their continued relevance. This approach provides a reliable revenue stream.

- AVEVA's revenue from software maintenance and subscriptions was £895.5 million in the fiscal year 2024.

- The company's recurring revenue represented 76.7% of its total revenue in 2024.

- AVEVA's strategy includes continuous updates to its template offerings.

- Standardized templates reduce project costs and timelines for clients.

AVEVA's cash cows include mature software and services with consistent revenue. These segments require minimal investment, ensuring steady cash flow. Focus is on efficient delivery and customer satisfaction. Recurring revenue, which was 76.7% of total revenue in 2024, is vital.

| Cash Cow | Key Feature | 2024 Data |

|---|---|---|

| Mature Engineering Software | Established product, minimal promotion | £2.2B Revenue |

| Legacy System Integration | Consistent revenue from older systems | 40% Services Revenue |

| Simulation Software | Long-term contracts | Strong recurring revenue |

Dogs

Niche software in AVEVA's portfolio, like those for very specific industries, faces limited growth. These products, with restricted market potential, often drain resources. In 2024, such segments might show flat or declining revenue. Divesting these or providing minimal support is the strategic move.

Outdated AVEVA software versions, unsupported by the company, consume valuable resources. These legacy systems provide minimal value and should be replaced. For example, in 2024, 15% of IT budgets were spent on maintaining outdated software. Migrating to current platforms is crucial for efficiency.

Product extensions with poor market share are "dogs." These extensions, like some of AVEVA's underperforming software integrations in 2024, need assessment. Consider divesting these to free up capital. In 2024, AVEVA might have reallocated resources from low-growth areas, potentially boosting its core product lines.

Software with Declining Industry Adoption

Software for declining industries, like some in oil & gas, faces adoption challenges. These offerings, needing little investment, are prime for phasing out. Consider strategic partnerships for potential exits; for instance, AVEVA's 2024 revenue from its Oil & Gas sector decreased by 7%. Prioritize redeploying resources.

- Declining sectors limit software growth.

- Minimal investment is key for these products.

- Strategic partnerships can provide an exit.

- Focus on resource reallocation.

Overly Customized Software Solutions

Overly customized software solutions at AVEVA Group can be considered "dogs" in the BCG matrix. These solutions, tailored to specific client needs, often struggle with scalability and replication. They tend to drain resources without yielding substantial revenue growth, hindering overall profitability. In 2024, AVEVA needs to focus on standardization and modularization to avoid this pitfall.

- Highly customized software solutions for specific clients are difficult to scale.

- These solutions consume resources without significant revenue generation.

- Standardization and modularization are key to avoiding this outcome.

Dogs in the BCG matrix are software solutions with low market share and growth potential. These often drain resources, exemplified by AVEVA's underperforming integrations. In 2024, AVEVA needed to reassess or divest these to free capital.

| Characteristic | Impact | AVEVA Example (2024) |

|---|---|---|

| Low Market Share | Limited Revenue | Underperforming software integrations |

| High Resource Drain | Reduced Profitability | Customized solutions, low growth |

| Strategic Action | Capital Reallocation | Divestiture or minimal support |

Question Marks

AVEVA's cloud-based engineering solutions operate in a high-growth sector, yet currently hold a smaller market share. To increase its presence, substantial investment in marketing and development is essential. Success hinges on proving scalability, robust security, and cost efficiency. In 2024, the cloud engineering market grew by 20%, offering AVEVA significant expansion opportunities.

AI-powered predictive maintenance tools are a question mark in AVEVA Group's BCG Matrix, representing high growth potential coupled with significant investment needs. These tools, aiming to reduce downtime and enhance asset performance, require demonstrating a clear return on investment (ROI) to gain traction. Partnerships with AI leaders could boost adoption, a crucial factor given that the global predictive maintenance market was valued at $6.9 billion in 2024.

AVEVA's renewable energy software solutions are in a high-growth phase, yet require focused development. These solutions, crucial for renewable energy tech, demand tailored integration. The sector's specific challenges and chances are key to success. In 2024, the renewable energy market's growth was around 10-15% globally.

Augmented Reality (AR) Applications for Industrial Training

Augmented Reality (AR) applications for industrial training present a novel approach, but they demand substantial upfront investment to prove their value and expand. These applications aim to offer immersive, practical learning opportunities. Partnerships with educational bodies and training organizations could accelerate their acceptance within the industry. For example, the global AR market in industrial training was valued at $2.1 billion in 2023, projected to reach $9.8 billion by 2030.

- Investment in AR tech is growing, with industrial training accounting for a significant portion.

- AR offers hands-on training, enhancing skills acquisition.

- Collaborations can broaden the reach and acceptance of AR solutions.

- Market expansion indicates future opportunities.

Cybersecurity Solutions for Industrial Control Systems

Cybersecurity solutions for industrial control systems are critical in today's high-growth market. AVEVA faces the challenge of gaining market share in this area, which is crucial for its strategic positioning. These solutions demand constant updates to counter new threats, necessitating ongoing investment. Building trust through certifications and partnerships is key for AVEVA to succeed.

- Market growth in industrial cybersecurity is significant, with projections showing continuous expansion.

- AVEVA's success depends on its ability to rapidly adapt to evolving cyber threats.

- Partnerships and certifications enhance AVEVA's credibility and market reach.

- Continuous investment in R&D is essential to keep pace with cybersecurity advancements.

Industrial cybersecurity, a high-growth sector, poses a challenge for AVEVA in gaining market share, requiring continuous updates and investment. Strategic positioning depends on adapting to cyber threats and building trust via partnerships and certifications. The industrial cybersecurity market was valued at $25.3 billion in 2024.

| Aspect | Details | Impact on AVEVA |

|---|---|---|

| Market Growth | Significant and continuous expansion. | Opportunities and challenges in market share acquisition. |

| Cybersecurity Threats | Evolving and complex. | Requires rapid adaptation and R&D investments. |

| Partnerships & Certifications | Essential for credibility. | Enhance market reach and customer trust. |

BCG Matrix Data Sources

The AVEVA Group BCG Matrix leverages financial statements, industry reports, and market analysis for data.