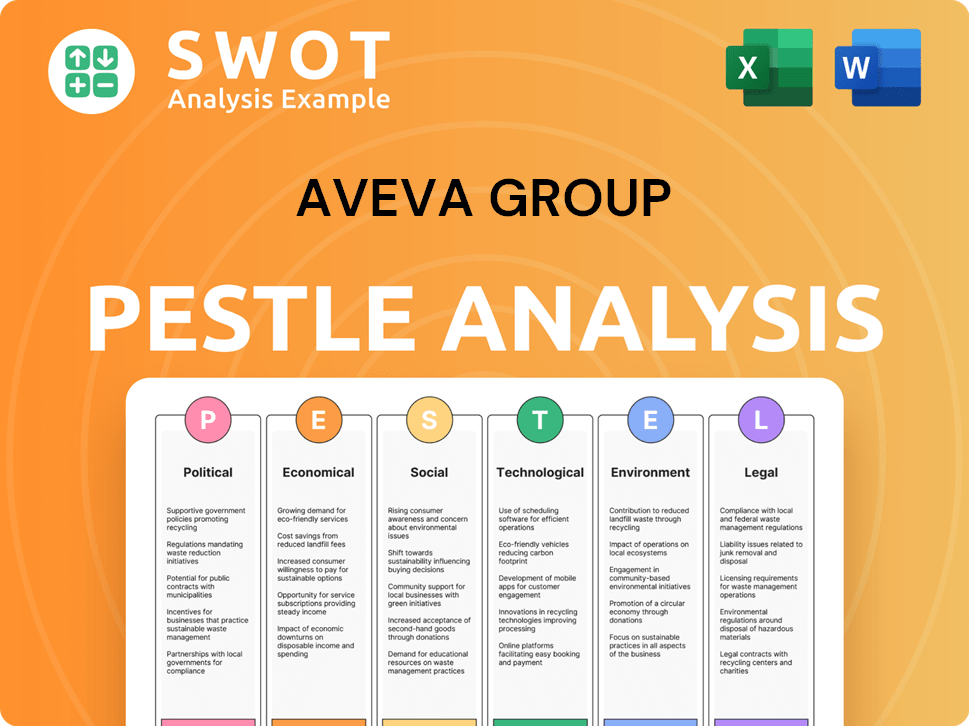

AVEVA Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AVEVA Group Bundle

What is included in the product

Evaluates AVEVA's external environment with Political, Economic, Social, Technological, Environmental, and Legal factors.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

AVEVA Group PESTLE Analysis

What you see in this preview is the full AVEVA Group PESTLE analysis. The content is complete and accurate. The structure and formatting remain consistent after purchase. This is the same comprehensive document you will receive instantly.

PESTLE Analysis Template

Navigate the complex world of AVEVA Group with our incisive PESTLE Analysis. We break down political, economic, and social factors impacting the company. Discover technological and legal influences that shape its strategy. Our analysis equips you to anticipate challenges. Gain a competitive edge; download the full report now!

Political factors

AVEVA faces impacts from government policies globally. Trade agreements, industrial policies, and software regulations affect its operations. For example, the UK's technology sector saw £18.8 billion in investment in 2023. Changes to these policies can create uncertainty, potentially affecting AVEVA's market access.

Geopolitical events can greatly affect AVEVA. Instability in customer regions impacts software demand and operations. The oil and gas sector, a key AVEVA market, is highly sensitive to these shifts. For instance, the Russia-Ukraine conflict affected project timelines, with potential impacts on revenue. In FY24, AVEVA reported its revenue was £1.5 billion.

Government investments in industrial digitalization offer avenues for AVEVA. Initiatives supporting smart manufacturing and infrastructure modernization boost demand for AVEVA's software. For example, the U.S. government allocated $3.5 billion in 2024 for advanced manufacturing research. Energy transition projects also spur AVEVA's adoption, reflecting a strategic alignment with governmental goals.

International Trade Relations

Changes in international trade relations, including tariffs and sanctions, directly impact AVEVA's global operations and supply chains. As a multinational entity, AVEVA must navigate diverse trade regulations across various regions. For instance, the UK's trade with the EU post-Brexit has introduced new customs procedures. In 2024, the World Trade Organization (WTO) reported a 2.6% increase in global trade volume, indicating a complex landscape for AVEVA.

- Brexit's impact on UK-EU trade introduced new customs procedures.

- WTO reported a 2.6% increase in global trade volume in 2024.

- AVEVA must comply with various trade regulations.

Political Stability in Key Markets

Political stability significantly influences customer confidence and investment decisions, particularly in long-term software solutions like those offered by AVEVA Group. Stable political climates foster a favorable environment for business expansion and technology integration across industrial sectors. Currently, the UK, AVEVA's base, faces moderate political stability challenges with 2024 forecasts indicating potential shifts impacting business confidence. Emerging markets like India, where AVEVA is expanding, present varying levels of stability; political risks could affect investment timelines.

- UK political risk is rated as moderate, with potential impacts on business confidence.

- India's political landscape presents varying stability levels, affecting investment.

- Political stability is crucial for long-term software adoption in industrial sectors.

AVEVA navigates complex global political landscapes. Government policies influence market access and create uncertainty, especially regarding trade and regulations. Geopolitical events, like the Russia-Ukraine conflict affecting project timelines, also pose risks.

| Factor | Impact | Example/Data |

|---|---|---|

| Trade Regulations | Affect global operations | UK-EU post-Brexit: New customs, WTO reported 2.6% trade increase (2024) |

| Political Stability | Influences investments | UK rated moderate risk; India's market varies. |

| Gov. Investments | Boost software demand | US allocated $3.5B for manufacturing (2024) |

Economic factors

Global economic conditions significantly influence AVEVA's software demand, with factors like GDP growth, inflation, and industrial output playing a crucial role. Economic downturns often lead to decreased capital expenditures by customers. For instance, in 2024, the global GDP growth is projected around 3.2%, but inflation rates remain a concern, impacting investment decisions. Industrial output fluctuations directly affect AVEVA's core markets.

AVEVA's revenue is heavily influenced by the economic health of industries like oil and gas, manufacturing, and energy. For example, in 2024, the global oil and gas sector saw investments of approximately $528 billion. A 2024 report by the IEA highlights that energy investments globally reached $2.8 trillion. These investments directly impact the demand for AVEVA's software solutions.

AVEVA, as a global entity, faces currency risk. Exchange rate volatility affects its financial outcomes, particularly when translating revenues and costs across various regions. For instance, a strengthening pound against the euro could lower reported revenue from European operations. In 2024-2025, currency fluctuations have impacted tech firms.

Inflation Rates

Inflation poses a significant challenge for AVEVA. Rising inflation can inflate operational expenses, potentially squeezing profit margins. This situation might also reduce customer spending on AVEVA's software and services. To counteract these effects, AVEVA might have to modify its pricing strategies. This is necessary to remain competitive in the market.

- In the UK, inflation reached 3.2% in March 2024.

- The Eurozone's inflation rate was 2.4% in March 2024.

- AVEVA's cost of sales increased by 10% in the last fiscal year.

Interest Rates

Interest rates significantly influence AVEVA's business. Fluctuating rates impact customer investment decisions, particularly for major projects. Rising rates can delay or cancel projects, affecting software demand. For example, the Bank of England held rates at 5.25% in May 2024, influencing investment decisions.

- Interest rate changes directly influence project financing costs.

- Higher rates potentially reduce capital expenditure by clients.

- Lower rates can stimulate investment in AVEVA's solutions.

Global economic trends, including GDP growth, inflation, and industrial output, directly affect AVEVA's software demand. Economic downturns may decrease customer spending; conversely, growth can spur investment. Currency exchange rates and interest rates add to financial risks.

| Metric | Value (2024-2025) | Impact on AVEVA |

|---|---|---|

| Global GDP Growth | Projected at 3.2% | Influences software demand. |

| UK Inflation (March 2024) | 3.2% | Raises operational costs. |

| Bank of England Rate (May 2024) | 5.25% | Impacts client investment. |

Sociological factors

A skills gap affects AVEVA's clients. A shortage of skilled workers can impede the use of advanced industrial software. The World Economic Forum highlights a growing skills gap in digital literacy. In 2024, 44% of workers need reskilling.

Changing demographics and the expectations of a younger workforce are reshaping demand. User-friendly, collaborative software solutions are increasingly vital. AVEVA must adapt its offerings to meet the evolving needs and digital literacy of the industrial workforce.

Societal focus on sustainability is intensifying. Consumers and governments increasingly push for eco-friendly practices. This boosts demand for AVEVA's software, aiding in efficiency and emission reduction. For instance, the global green technology and sustainability market is projected to reach $74.6 billion by 2025.

Remote Work Trends

The shift to remote work significantly influences software access and usage for AVEVA's clients. Businesses need remote-friendly software solutions that function seamlessly across different locations. This trend necessitates that AVEVA optimizes its products for remote environments, ensuring consistent performance and accessibility. In 2024, approximately 30% of the global workforce worked remotely or in hybrid models, highlighting the importance of adaptable software.

- Adaptability for remote environments is crucial.

- Performance and accessibility are key factors.

- Approximately 30% of the global workforce works remotely or in a hybrid model.

Perception of Technology in Industry

The perception of technology significantly impacts AVEVA's adoption. Workforce acceptance of digital transformation and automation directly influences implementation speed. Positive views accelerate adoption, while resistance creates delays. For example, a 2024 study showed that 65% of industrial workers in Europe are concerned about job displacement due to automation, potentially slowing adoption.

- Employee training and upskilling programs are crucial for mitigating resistance.

- Cultural factors, such as a company's openness to change, also play a role.

- Perceived ease of use and benefits of the software are key.

- Strong leadership can help drive acceptance of new technologies.

Societal trends affect AVEVA. A shift to remote work, with 30% of the global workforce in hybrid models in 2024, influences software access. Employee acceptance, influenced by training, accelerates digital adoption.

| Factor | Impact on AVEVA | 2024/2025 Data |

|---|---|---|

| Remote Work | Demands adaptable software. | 30% global workforce hybrid. |

| Skills Gap | Affects software adoption. | 44% of workers need reskilling in 2024. |

| Employee Acceptance | Impacts adoption speed. | 65% of European workers fear job displacement in 2024. |

Technological factors

Rapid advancements in AI and Machine Learning are crucial for AVEVA's software. These technologies improve analytics, predictive maintenance, and process optimization. They also create digital twins, boosting innovation. In 2024, the global AI market reached $238.8 billion, growing 18.6% year-over-year.

The rise of Industrial IoT (IIoT) is creating a surge in data within industrial environments. AVEVA's software is critical for processing this data, offering valuable insights. In 2024, the IIoT market was valued at $300 billion, with expectations to reach $1 trillion by 2028. This expansion directly fuels demand for AVEVA's data management solutions.

Cloud computing and SaaS are reshaping the software landscape. AVEVA is adapting, moving its services to the cloud. In 2024, the global SaaS market was valued at over $200 billion, growing rapidly. This shift offers AVEVA's clients more flexibility and scalability. Cloud adoption boosts accessibility for users.

Development of Digital Twin Technology

AVEVA's focus on digital twin technology is significant. This technology builds virtual models of physical assets and processes for simulation and analysis. It aids in optimization, crucial for industrial clients. In 2024, the digital twin market was valued at $10.5 billion, with projected growth. It's expected to reach $96.3 billion by 2030, showing its increasing importance.

- Simulation and Analysis: Digital twins allow for detailed simulations.

- Optimization: They enable the optimization of processes and assets.

- Market Growth: Significant growth is predicted.

- Industry Impact: It offers value to industrial customers.

Cybersecurity Threats

AVEVA faces escalating cybersecurity threats due to increased digitalization. The company must invest in strong security to protect its software and customer data from breaches. Cybersecurity incidents can lead to financial losses and reputational damage. In 2024, the global cost of cybercrime is projected to reach $10.5 trillion, emphasizing the need for vigilance.

- Cybersecurity breaches can cost a company millions.

- Investing in security is crucial to avoid financial and reputational damage.

- Protecting customer data is essential for maintaining trust.

Technological factors for AVEVA include AI and ML for analytics, digital twins, and cloud computing. In 2024, the global AI market reached $238.8B. The digital twin market, at $10.5B, is expected to hit $96.3B by 2030.

| Technology | 2024 Market Size | Projected Growth |

|---|---|---|

| AI Market | $238.8B | 18.6% YoY |

| IIoT Market | $300B | To $1T by 2028 |

| Digital Twin Market | $10.5B | To $96.3B by 2030 |

Legal factors

Data privacy regulations, like GDPR, are crucial. AVEVA must comply globally, impacting software design and data handling. Non-compliance can lead to hefty fines; for example, GDPR fines can reach up to 4% of annual global turnover. In 2024, the average cost of a data breach was $4.45 million, highlighting the financial stakes.

AVEVA operates under strict software licensing laws, vital for protecting its intellectual property. Copyright and patent laws are crucial in safeguarding its software code and designs. In 2024, global software piracy rates, a key concern, were around 37%, impacting revenue. Proper licensing ensures customers use software legally, with compliance audits increasing by 15% in 2024.

AVEVA's software caters to sectors like oil and gas, nuclear, and pharmaceuticals, all highly regulated. These industries face stringent rules on safety, environmental impact, and operational protocols. The company's solutions must ensure clients' compliance. In 2024, the global industrial software market was valued at $49.6 billion, reflecting the importance of regulatory adherence. These regulations directly influence AVEVA's product development and market strategy.

Anti-Corruption and Bribery Laws

AVEVA, as a global entity, faces stringent anti-corruption regulations like the UK Bribery Act and the US Foreign Corrupt Practices Act (FCPA). These laws require rigorous compliance across all operational regions. Ethical conduct is paramount for AVEVA's reputation and legal standing. Non-compliance can result in severe penalties, including hefty fines and reputational damage. Maintaining transparency and integrity is thus vital for sustained business success.

- In 2023, the DOJ and SEC collectively recovered over $5.2 billion in FCPA-related penalties.

- The UK Bribery Act has led to increased scrutiny, with the Serious Fraud Office (SFO) actively pursuing cases.

- Companies with robust compliance programs often see a 10-15% improvement in operational efficiency.

Employment Laws

AVEVA must navigate complex employment laws and labor regulations across various countries, impacting its workforce management and operational expenditures. Ensuring compliance is crucial for seamless global operations, which can be costly. For example, in the UK, the average cost of employment tribunal claims in 2024 was approximately £10,000. Non-compliance can lead to significant financial penalties and reputational damage.

- Compliance with diverse employment regulations is essential for AVEVA's global operations.

- Non-compliance can result in financial penalties and reputational harm.

Legal compliance is critical for AVEVA, especially concerning data privacy and software licensing. Data breaches, which cost an average of $4.45M in 2024, and global software piracy, around 37% in 2024, are ongoing challenges. Strict regulations in the oil and gas, nuclear, and pharma industries mean AVEVA's products must meet compliance standards, essential for their success.

| Legal Factor | Impact on AVEVA | 2024/2025 Data |

|---|---|---|

| Data Privacy | Global compliance needs, software design changes. | Avg. data breach cost: $4.45M (2024). GDPR fines up to 4% of global turnover. |

| Software Licensing | Protection of IP and customer compliance. | Global software piracy: ~37% (2024). Compliance audits +15% (2024). |

| Industry Regulations | Product development, market strategy. | Industrial software market value: $49.6B (2024). |

Environmental factors

Climate change and decarbonization goals are increasing globally, pushing industries to cut emissions. AVEVA's software helps clients monitor and reduce their environmental impact. In 2024, the global carbon capture and storage market was valued at $3.2 billion. AVEVA's solutions help clients meet these needs.

Stricter environmental regulations, particularly concerning emissions and waste, are pushing industrial firms to adopt compliance solutions. AVEVA's software aids clients in meeting these evolving demands. The global environmental technology market is projected to reach $118.7 billion by 2025, reflecting the growing importance of these factors. This creates opportunities for AVEVA.

AVEVA Group benefits from the growing corporate sustainability initiatives. Many businesses now prioritize environmental goals, even without legal mandates. This shift fuels demand for AVEVA's software, which helps track and enhance environmental performance. For instance, in 2024, the market for environmental, social, and governance (ESG) software is valued at approximately $1.2 billion, and is projected to reach $2.5 billion by 2027.

Resource Scarcity

Resource scarcity is a major environmental concern affecting industries globally. This includes water and raw materials, driving the need for efficient resource use and waste reduction. AVEVA's software solutions are designed to help companies manage resources effectively. The global water crisis is intensifying, with nearly 2.2 billion people lacking access to safely managed drinking water in 2024.

- Water stress affects over 25% of the global population, as of late 2024.

- The circular economy market is projected to reach $4.5 trillion by 2030.

- AVEVA's solutions support waste reduction, aligning with sustainability goals.

Public and Stakeholder Environmental Expectations

Public and stakeholder environmental expectations are rising, pushing companies like AVEVA to prioritize sustainability. Investors increasingly consider Environmental, Social, and Governance (ESG) factors in their decisions, impacting market valuations. AVEVA's commitment to sustainability, both internally and through its products, is crucial for maintaining a positive reputation. This commitment supports strong stakeholder relationships and long-term value creation.

- In 2024, ESG-focused investments reached over $40 trillion globally.

- AVEVA's sustainability initiatives include reducing its carbon footprint and developing software solutions that help customers improve their environmental performance.

- A strong ESG performance can lead to lower capital costs and enhanced brand value.

Environmental factors significantly impact AVEVA, fueled by global decarbonization and tougher regulations. The carbon capture and storage market hit $3.2B in 2024, driving demand for sustainable solutions. ESG-focused investments reached over $40 trillion globally in 2024.

| Environmental Factor | Impact on AVEVA | Data |

|---|---|---|

| Climate Change & Decarbonization | Increased demand for emission reduction software. | Global carbon capture market was $3.2B in 2024. |

| Environmental Regulations | Requires companies to meet emission and waste regulations, boosting demand for AVEVA's solutions. | Environmental tech market projected at $118.7B by 2025. |

| Resource Scarcity | Need for efficient resource management increases demand for AVEVA's resource management solutions. | 2.2B people lack access to safe drinking water in 2024. |

PESTLE Analysis Data Sources

The AVEVA Group PESTLE analysis incorporates data from industry reports, governmental databases, and market research firms. This provides a robust and factual foundation for analysis.