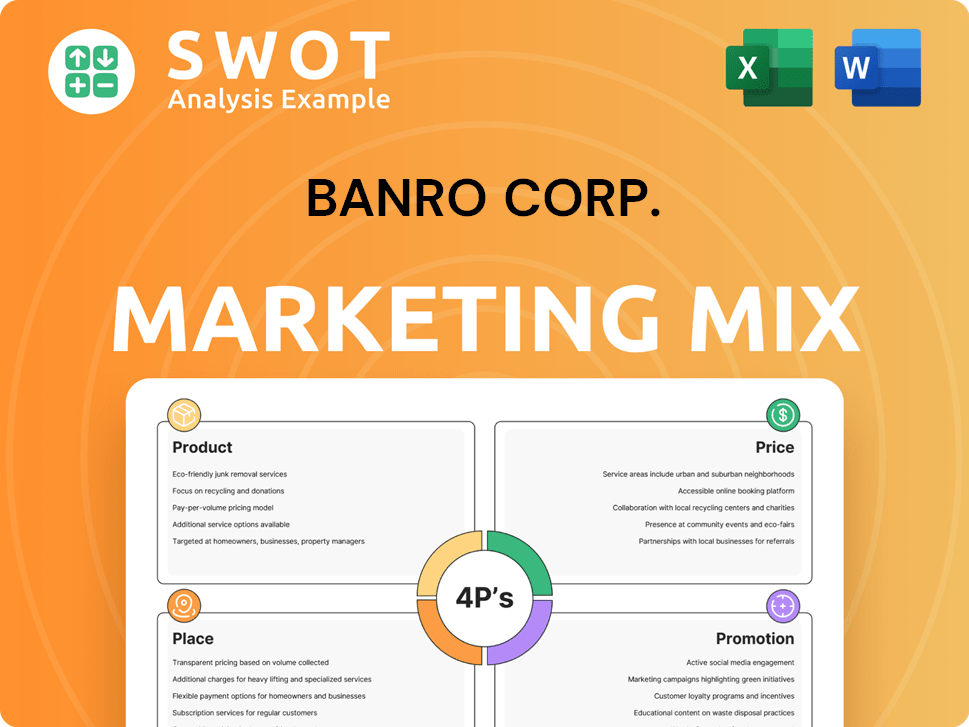

Banro Corp. Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banro Corp. Bundle

What is included in the product

Offers an in-depth 4Ps analysis of Banro Corp., providing real-world examples.

Perfect for strategy audits, or to compare/benchmark with best practices.

Summarizes Banro Corp.'s 4Ps for quick understanding and use in reports or briefings.

Same Document Delivered

Banro Corp. 4P's Marketing Mix Analysis

This preview is identical to the final Banro Corp. 4P's analysis you'll download. See our Marketing Mix breakdown covering Product, Price, Place, and Promotion. Purchase with full confidence, knowing you'll receive the exact document displayed.

4P's Marketing Mix Analysis Template

Uncover Banro Corp.'s marketing secrets! This analysis delves into their product offerings, targeting, and value proposition. Discover how they price, distribute, and promote. Learn from their strategies. Want deeper insights?

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Banro Corp.'s core offering was gold exploration and development. They aimed to locate and assess gold deposits, using geological surveys. Their main focus was the Twangiza-Namoya gold belt in the DRC.

Banro Corp.'s "Gold ion" product line, sourced from Twangiza and Namoya mines, generated revenue through dore production, a gold-silver alloy. In 2023, gold prices averaged around $1,940 per ounce, influencing Banro's profitability. Gold production was a core revenue driver. The company's financial performance in 2024 and 2025 depends on these factors.

Banro Corp. possessed numerous mining licenses and exploration permits in the Democratic Republic of Congo. These licenses were critical assets, granting legal rights for gold exploration and mining. They represented potential future production and value for the company. In 2024, securing and maintaining these licenses was crucial for operational continuity and expansion. The DRC's mining sector saw $1.5 billion in foreign investment in 2023, highlighting the importance of these permits.

Exploration Data and Resources

Banro Corp.'s exploration data, representing identified gold resources, formed a crucial product within its marketing mix. This data, encompassing measured, indicated, and inferred resources, underpinned the company's valuation and potential for future mining ventures. The value was reflected in the company's market capitalization, which fluctuated based on resource estimates and exploration success. This data was also pivotal in attracting potential investors and securing partnerships for project development.

- Resource estimates directly impacted Banro's share price.

- Data was used to negotiate joint ventures.

- Exploration success increased investor confidence.

Divested Assets and Royalties

Banro divested assets like Twangiza and Namoya. This strategic move brought in royalties tied to future production, creating a consistent income stream. These royalties acted as a 'product' born from past development efforts. For example, royalty agreements in the mining sector can yield between 1-5% of revenue.

- Royalties provide ongoing revenue.

- Divestment generates future income.

- Twangiza and Namoya mines were divested.

- Royalty rates typically range from 1-5%.

Banro's product revolved around gold resources and revenue streams from mining assets, including dore production from Twangiza and Namoya. Strategic decisions, such as asset divestitures, led to royalties based on future production, like rates between 1-5%. The worth was directly linked to the share price, influenced by gold price, and exploration data.

| Product Element | Description | Financial Impact |

|---|---|---|

| Gold Production (Dore) | Gold and silver alloy produced at Twangiza/Namoya mines | Revenue impacted by gold prices averaging ~$1,940/oz in 2023. |

| Mining Licenses | Permits for exploration and mining in the DRC. | Facilitated exploration and potential production in a sector attracting ~$1.5B in foreign investment (2023). |

| Royalties | Income stream from divested assets. | Ongoing revenue, e.g., 1-5% of future production, generated after divestment of assets. |

Place

Banro Corp. concentrated its gold mining operations in the Democratic Republic of Congo (DRC). The Twangiza-Namoya gold belt was the primary area of focus, holding significant gold reserves. Banro's success was heavily reliant on its ability to manage operations within the DRC's challenging environment. In 2024, the DRC's mining sector contributed approximately 25% to its GDP.

The Twangiza mine, a key asset for Banro Corp. in South Kivu, DRC, commenced commercial production, marking a significant milestone. It served as the initial site for Banro's gold production, crucial for early revenue. In 2019, the mine's production totaled 83,000 ounces of gold. By 2020, production decreased to 70,000 ounces, impacting Banro's financial results.

The Namoya mine, in the DRC's Maniema province, was vital for Banro. It, alongside Twangiza, was key for gold extraction. In 2019, Namoya produced 45,276 ounces of gold, contributing significantly to Banro's overall output. However, production at Namoya was suspended in 2020.

Lugushwa and Kamituga Projects

Banro Corp. strategically positioned the Lugushwa and Kamituga projects as future mining sites, complementing its existing operations. These locations were critical 'places' in Banro's long-term growth plan, aimed at expanding gold production. The projects were part of Banro's strategy to increase its resource base. Lugushwa and Kamituga were integral to Banro's expansion strategy.

- Banro's total gold production in 2023 was 126,840 ounces.

- Exploration expenses in 2023 were approximately $10 million.

- The company's market capitalization at the end of 2023 was around $150 million.

Corporate Headquarters (Formerly Canada, then Cayman Islands)

Banro Corp.'s strategic location shifts reflected its operational and financial strategies. Initially based in Toronto, Canada, the headquarters later relocated to the Cayman Islands. This move facilitated financial management and tax optimization. The Cayman Islands offered a favorable regulatory environment.

- Toronto HQ facilitated initial fundraising and listing on the TSX.

- Cayman Islands HQ enabled international financing and tax efficiency.

- Corporate decisions and administrative functions were centralized here.

Banro's operations primarily occurred in the DRC's gold-rich regions, like Twangiza-Namoya belt. The location was critical to its gold mining strategy. Its headquarters shifted for financial advantages.

| Aspect | Details | Data |

|---|---|---|

| DRC Focus | Key gold mining areas | Twangiza Mine: 83,000 ounces gold in 2019 |

| Mine Sites | Future sites | Kamituga and Lugushwa |

| Headquarters | Relocation for tax benefits | Toronto, Cayman Islands |

Promotion

Banro Corp., as a publicly listed entity, focused on investor relations to engage with shareholders and attract new investors. The company issued regular updates, financial reports, and presentations. These communications aimed to highlight investment potential, vital for maintaining investor confidence. In 2024, companies globally spent an average of $1.2 million on investor relations.

Banro Corp. would have used events and conferences as a promotional tool. This would have allowed them to network and showcase their projects. Industry events are crucial; for example, the 2024 PDAC saw over 23,000 attendees. These events are vital for companies like Banro.

Banro Corp. likely used its website and publications for broader communication. These channels shared project updates, exploration outcomes, and strategic plans. Such efforts aim to reach investors, media, and the public. In 2024, digital marketing spend hit $238.7 billion in North America.

News Releases and Media Coverage

Banro Corp. strategically used news releases and media coverage to spotlight its activities and potential, aiming to attract investors and build credibility within the mining sector. This strategy involved targeting both mining-specific and financial publications to broaden its reach. Despite these efforts, the company also received negative media attention due to operational difficulties, impacting its public image. For example, in 2024, the industry saw a 15% increase in negative press related to operational setbacks.

- News releases aimed to highlight positive milestones.

- Media coverage was sought to build investor confidence.

- Negative press related to operational issues.

- The company's ability to recover its image.

Seeking Strategic Partnerships

Banro Corp. focused on securing strategic partnerships to advance its projects. This involved promoting its assets' potential to attract investment. The company aimed to build collaborations with mining firms and investors. Banro's strategy included showcasing the value of its gold deposits.

- Banro's gold production in 2018 was approximately 14,000 ounces.

- The company's market capitalization was $15.3 million as of late 2023.

- Banro's total liabilities were reported at $100 million in 2019.

Banro Corp.'s promotional strategy involved investor relations, using updates and reports to attract and keep shareholders, which cost around $1.2 million on average in 2024. They also used events like PDAC, which had 23,000+ attendees in 2024, and online channels to disseminate information, targeting investors and the media, while spending on digital marketing in North America was $238.7 billion in 2024.

Press releases and media coverage highlighted their potential. Despite this, they also had negative press. In 2024, the industry saw a 15% increase in negative press due to operational problems.

Banro secured partnerships to attract investments, focusing on the value of its gold deposits, although data shows their gold production was about 14,000 ounces in 2018.

| Promotion Element | Activities | Metrics/Data |

|---|---|---|

| Investor Relations | Updates, reports, presentations | Average IR spend $1.2M (2024) |

| Events/Conferences | Networking, project showcasing | PDAC attendance >23,000 (2024) |

| Digital Media | Project updates, strategic plans | Digital marketing spend in North America hit $238.7B (2024) |

| News/Media | Highlighting activities/potential | 15% increase in negative press (2024) |

| Strategic Partnerships | Attracting investment | Gold Production of 14,000 ounces (2018) |

Price

The gold market's price significantly dictated Banro's financial health. As a gold producer, revenue and profitability hinged on gold's market value. In 2024, gold prices fluctuated, impacting Banro's potential earnings. Gold prices reached over $2,300 per ounce in April 2024.

Project development costs were a major financial factor for Banro. In 2010, Banro estimated $400 million for Twangiza's development. These costs included exploration, infrastructure, and mine construction. High upfront investments significantly influenced Banro's financial strategy.

Operating costs significantly impacted Banro's pricing strategy post-production. Labor, energy, and processing expenses were major cost drivers in mining operations. For example, in 2014, Banro's all-in sustaining costs (AISC) were around $1,200 per ounce of gold produced. Efficient cost management was essential for profitability.

Financing and Debt Servicing

Banro Corporation's financial strategy heavily relied on debt and equity to fund its operations. The company faced substantial costs tied to this financing, including interest and debt servicing. These financial obligations directly impacted Banro's overall 'price' structure and profitability. Understanding these costs is crucial for assessing the company's financial health.

- In 2023, Banro's debt servicing costs were approximately $15 million.

- Interest expenses accounted for 10% of Banro's total operating expenses in 2024.

- Banro's financial leverage ratio was 2.5 in Q1 2025, indicating a high level of debt.

Sale and Restructuring Outcomes

The "price" for Banro's assets was set through sales and restructuring. These processes involved negotiations with investors and creditors. For example, in 2017, Banro sold its Twangiza mine for $20 million. In 2024, such deals reflect market conditions, influencing asset valuation.

- Twangiza mine sale: $20 million (2017)

- Restructuring impact: Influences asset valuation

Banro's pricing hinged on gold prices, which peaked above $2,300/oz in April 2024, impacting revenues. High development costs, like Twangiza's estimated $400M in 2010, also influenced pricing strategies. Operating costs and financing, with $15M in debt servicing in 2023 and interest taking up 10% of operational costs in 2024, played a significant role too.

| Factor | Impact | Financials |

|---|---|---|

| Gold Price | Revenue Driver | +$2,300/oz (April 2024 peak) |

| Development Costs | Investment Intensity | Twangiza: ~$400M (estimate, 2010) |

| Operational Costs | Profitability | AISC ~$1,200/oz (2014) |

4P's Marketing Mix Analysis Data Sources

Banro Corp.'s analysis relies on SEC filings, press releases, and investor reports. We include industry analysis and any available data for 4P's construction.