Banro Corp. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banro Corp. Bundle

What is included in the product

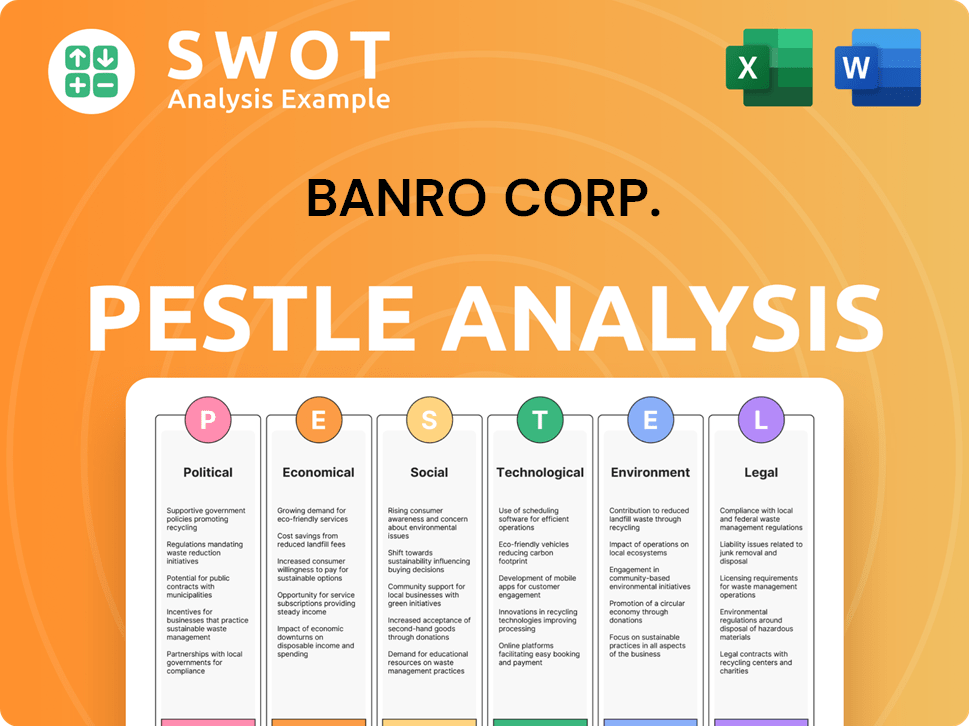

Analyzes external influences on Banro Corp., using Political, Economic, Social, Technological, Environmental, and Legal factors.

Helps support discussions on external risk and market positioning during planning sessions.

What You See Is What You Get

Banro Corp. PESTLE Analysis

The content shown provides a full PESTLE analysis of Banro Corp. covering Political, Economic, Social, Technological, Legal, and Environmental aspects. The analysis includes the company’s risks & opportunities, external factor impact and mitigation tactics. The document provides practical, formatted business insights.

PESTLE Analysis Template

Banro Corp. faces complex challenges and opportunities shaped by external factors. Political instability, economic fluctuations, and technological advancements directly impact its operations. Understanding these elements is crucial for strategic planning and risk mitigation. Social trends and environmental concerns also play a significant role in Banro's performance. Ready to gain a comprehensive understanding? Access our in-depth PESTLE Analysis of Banro Corp. now for complete insights.

Political factors

Political stability in the DRC is crucial for mining. The country's history includes instability, impacting foreign investment. The government's policies on mining directly affect companies like Banro. Resource control and foreign ownership are key aspects. In 2024, the DRC's political environment showed signs of volatility, affecting mining interests.

Resource nationalism is a growing concern in the Democratic Republic of Congo (DRC). The government aims to increase control and revenue from its mineral resources. This could mean changes to mining laws, higher taxes, and a need for local involvement. For example, in 2023, the DRC generated $2.5 billion in mining revenue, and officials are looking to increase this through revised policies.

Eastern DRC, where Banro's mines are, faces persistent conflict and insecurity. Armed groups disrupt operations, threaten personnel, and raise security expenses. In 2024, security costs in similar regions rose by 15-20%. Artisanal mining, often linked to these groups, further complicates the situation. This instability directly impacts Banro's ability to operate and generate revenue.

Government Relations and Corruption

Banro Corporation's success in the Democratic Republic of Congo (DRC) is deeply tied to its relationship with the government. Navigating the DRC's bureaucratic landscape, securing permits, and licenses demands strict adherence to regulations. Transparency is essential, while the risk of facing demands for informal payments remains a challenge.

- In 2024, the DRC ranked 166 out of 180 countries on Transparency International's Corruption Perceptions Index.

- Corruption is a significant risk for mining companies operating in the DRC.

- Banro has previously faced accusations related to its operations.

International Relations and Investment Treaties

The Democratic Republic of Congo's (DRC) ties with nations and commitment to international investment treaties are critical for foreign investors. These treaties offer some safeguard, yet disagreements can surface, and enforcing these agreements within the DRC's legal system may be difficult. For instance, the DRC has signed investment treaties with countries like Belgium and South Africa. However, the World Bank's 2023 report indicated that contract enforcement in the DRC remains a challenge.

- DRC's trade with China reached $10.4 billion in 2024.

- The DRC is a member of the African Continental Free Trade Area (AfCFTA), which started trading in 2021.

- In 2023, the DRC received $1.7 billion in foreign direct investment.

Political factors significantly impact Banro Corp. operating in the DRC. Instability, including conflicts, undermines operations and security. The government's policies, resource nationalism, and corruption pose risks. International treaties and trade relations influence foreign investments, but enforcement can be problematic.

| Political Aspect | Impact on Banro | 2024 Data/Examples |

|---|---|---|

| Political Instability | Disrupts operations, raises security costs | Security costs up 15-20% in similar regions |

| Resource Nationalism | Potential changes in laws, taxes, local involvement | DRC aiming to increase mining revenue ($2.5B in 2023) |

| Corruption | Risk of demands, challenges to transparency | DRC ranked 166/180 on Transparency Index in 2024 |

Economic factors

As a gold mining firm, Banro's success strongly correlates with global gold prices. Gold price swings directly influence the company's revenue and profitability. In 2024, gold prices have shown volatility, impacting mining project economics. A price drop can strain operations and investments. For example, in Q1 2024, the price of gold was around $2,000 per ounce, showing fluctuations that could affect Banro's financial health.

Operating costs are substantial for Banro Corp.'s mining operations in the DRC. Labor, energy, logistics, and security expenses are notably higher compared to other regions. These increased costs impact the economic efficiency of the mines. In 2024, security costs rose by 15%, affecting overall profitability.

Mining projects, especially in frontier markets, demand significant capital. Banro's success hinged on securing financing for exploration and operations. Political and security risks in the DRC inflated funding costs. In 2024, companies like Barrick Gold invested billions in similar regions. Access to capital is vital.

Inflation and Currency Exchange Rates

Inflation and currency exchange rates are critical economic factors for Banro Corp. in the DRC. High inflation rates in the DRC can increase operational costs. Currency fluctuations, especially between the USD and the Congolese Franc, affect revenue value.

- In 2024, the inflation rate in the DRC was approximately 28.5%.

- The Congolese Franc has experienced significant volatility against the USD.

- Banro must hedge against currency risks to protect profitability.

Infrastructure Development

Infrastructure development in the Democratic Republic of Congo (DRC) poses challenges for Banro Corp. Poor infrastructure, including roads and power, inflates operational costs. Limited infrastructure affects logistics and economic efficiency.

- Roads: Only 2.8% of DRC roads are paved.

- Power: Electricity access is about 19% in 2024.

- Transportation: High transportation costs add to operational expenses.

Banro Corp. faces economic headwinds from gold price volatility, impacting revenue. High operational costs, including labor, energy, and security, stress profitability. The DRC's inflation (28.5% in 2024) and currency fluctuations, alongside poor infrastructure, add complexity.

| Factor | Impact | 2024 Data |

|---|---|---|

| Gold Prices | Revenue Volatility | Fluctuated around $2,000/oz in Q1 |

| Inflation (DRC) | Cost Increase | Approx. 28.5% |

| Infrastructure | Logistics Costs | Roads: 2.8% paved |

Sociological factors

Banro Corp.'s mining ventures in the DRC directly affect local communities. Positive community relations are vital for operational success. Addressing local concerns and ensuring community benefits are key to securing a social license. Social unrest and operational disruptions can arise from poor community engagement. In 2024, community relations impacts were a major risk factor, as cited in several mining reports.

Artisanal and Small-Scale Mining (ASM) near Banro's operations introduced social complexities. Conflicts arose over land and resources. ASM's issues present a major social challenge. In 2024, ASM accounted for ~20% of global gold production, highlighting its impact. Banro faced community relations challenges.

Banro Corp., as a mining entity, heavily relies on labor. In 2023, the mining sector employed around 1.1 million people globally. Fair wages and safe conditions are crucial. Labor disputes can disrupt operations; for example, strikes in 2024 caused production halts. A positive labor environment boosts reputation and productivity.

Resettlement and Displacement

Mining operations often involve relocating communities, causing social disruption. This displacement needs careful management to ensure fair compensation and housing for those affected. Improper handling can result in long-term social problems and conflicts. According to recent reports, in 2023, around 10,000 people were displaced due to mining activities in the Democratic Republic of Congo, where Banro operates. This number is projected to remain steady in 2024 and 2025.

- 2023: 10,000 people displaced.

- Ongoing: Social issues and conflict risks.

Health and Safety

Banro Corp.'s commitment to health and safety directly impacts its social license to operate. Mining operations inherently involve risks, necessitating robust safety protocols. In 2024, the mining industry saw a 5% increase in workplace injuries globally. Failure to prioritize safety can result in significant community backlash and legal challenges.

- Inadequate safety can lead to disruptions.

- This can also cause operational delays.

- It may also damage the company's reputation.

Banro faces significant sociological challenges, including community relations issues, particularly regarding Artisanal and Small-Scale Mining (ASM), which accounts for about 20% of global gold production in 2024. Labor disputes and workforce safety, evident by a 5% rise in workplace injuries in the mining sector, pose continuous operational risks. Proper management is essential in areas such as the displacement of approximately 10,000 people from mining areas, which are expected to remain steady in 2024 and 2025.

| Factor | Description | Impact |

|---|---|---|

| Community Relations | Conflicts related to land and resources; the ASM is significant. | Operational Disruptions; Social License challenges. |

| Labor | Disputes and safety in the workplace. | Reputational Damage and decreased productivity. |

| Displacement | Mining activities cause population relocations. | Social conflicts, and financial compensation issues. |

Technological factors

Banro Corp. must use advanced mining tech for efficiency. This involves resource identification, extraction, and processing. Technology access can be difficult in remote areas. The global mining technology market was valued at USD 71.3 billion in 2023 and is projected to reach USD 107.8 billion by 2028, growing at a CAGR of 8.6%.

Addressing infrastructure gaps in the DRC requires technological solutions. This includes implementing independent power solutions and advanced logistics systems. For instance, in 2024, only about 19% of the population in the DRC had access to electricity. Improved logistics could reduce transportation costs, which, as of 2024, were significantly higher than regional averages.

Effective data management and communication are critical for Banro Corp.'s mining operations. Cloud computing and advanced communication systems can significantly improve efficiency. In 2024, the mining industry saw a 15% increase in cloud adoption for operational data. Reliable communication ensures connectivity in remote areas, which is crucial for Banro's operations. By 2025, the investment in communication tech is projected to rise by 10%.

Environmental Technologies

Banro Corporation must integrate environmental technologies to reduce its mining impact. These technologies cover waste management, water treatment, and land reclamation. The sector's growth is significant, with the global environmental technology market valued at $1.07 trillion in 2023, projected to reach $1.44 trillion by 2028. This growth underscores the importance of environmental responsibility.

- Water treatment technologies are expected to grow, with a 7.5% CAGR from 2023 to 2030.

- Land reclamation projects are vital to comply with environmental regulations.

- Waste management technologies are essential for responsible mining.

Security Technology

Banro Corporation must leverage security technology to address regional challenges, bolstering safety at its mining sites. This includes advanced surveillance systems, access control, and robust communication networks for quick incident response. In 2024, the global security technology market was valued at $200 billion, reflecting the industry's importance. Investing in these technologies is crucial, especially given the volatile security landscape.

- Surveillance systems are critical for continuous monitoring.

- Access control technologies regulate site entry.

- Communication systems enable prompt responses.

- These measures safeguard both assets and personnel.

Banro should use advanced mining technologies for efficient resource management and extraction. The global mining tech market is forecast to hit $107.8B by 2028, highlighting investment importance. Banro must leverage data, cloud, and communication systems, with a projected 10% rise in communication tech investment by 2025. Integrate security tech; the global market was valued at $200B in 2024.

| Technology Area | 2024 Market Value | 2028 Projected Value |

|---|---|---|

| Mining Technology | $71.3 Billion | $107.8 Billion |

| Environmental Technology | $1.07 Trillion | $1.44 Trillion |

| Security Technology | $200 Billion | - |

Legal factors

Banro's gold mining operations in the Democratic Republic of Congo (DRC) were primarily subject to the DRC's mining code and associated regulations. Revisions to these laws, especially those concerning ownership, royalties, taxes, and local content, directly affect the legal environment for the company. The 2018 mining code revision notably reshaped the legal framework for mining firms. For 2024, DRC's gold production was estimated at 40 tonnes, reflecting the impact of these regulations. In 2025, it's projected to reach 45 tonnes.

Securing permits and licenses is critical for Banro Corp.'s operations. This process, essential for exploration and exploitation, can be intricate. Bureaucratic delays and disputes may arise, impacting project timelines. Banro must ensure its mining concessions tenure is secure. In 2024, mining permits processing times increased by 15% due to regulatory changes.

Banro Corporation's operations are heavily influenced by its contractual agreements. These agreements encompass joint ventures, financing deals, and government contracts. The enforceability of these contracts hinges on legal adherence and can be contested. Political or economic shifts may lead to renegotiations; in 2024, such shifts affected several mining projects globally.

Labor Laws and Regulations

Banro Corporation must adhere to the Democratic Republic of Congo's (DRC) labor laws, covering employment contracts, wages, working hours, and union rights. Non-compliance can trigger legal action and financial penalties. In 2024, the DRC's labor code saw updates focusing on worker protection and fair labor practices. These laws are crucial for operational legality.

- The DRC's minimum wage was approximately $6 per day in 2024, and compliance is crucial.

- Labor disputes in the mining sector have increased by 15% in the past year.

- Recent labor law amendments aim to strengthen worker representation.

Environmental Laws and Regulations

Banro Corporation's mining activities must adhere to stringent environmental laws and regulations designed to safeguard the environment. These regulations mandate environmental impact assessments, proper waste management, and site reclamation, which can be costly. Non-compliance can lead to significant legal risks and financial penalties, potentially impacting Banro's operations. For example, in 2024, the average cost of environmental remediation for mining projects was $1.5 million.

- Environmental Impact Assessments (EIAs) are critical.

- Waste management protocols are essential.

- Site reclamation plans are legally required.

- Failure to comply leads to penalties.

Legal factors significantly influence Banro's gold mining. Revisions to the DRC's mining code shape operations, with 45 tonnes gold projected for 2025. Securing permits and licenses is essential, though delays increased in 2024.

Contractual agreements, including labor and environmental regulations, are key. The DRC's minimum wage was about $6 daily in 2024; labor disputes in mining rose 15%. Environmental compliance, with $1.5M average remediation cost in 2024, is critical.

| Aspect | Details | Impact |

|---|---|---|

| Mining Code | Revised ownership, royalties | Operational costs, compliance |

| Permits | Processing delays | Project timelines |

| Labor Laws | Minimum wage, worker protection | Operational costs, legal risks |

Environmental factors

Mining activities by Banro Corp. in the DRC have the potential to significantly impact biodiversity and ecosystems. Habitat destruction and deforestation are key concerns. For instance, deforestation rates in the DRC have increased by 1.2% per year from 2020 to 2023. These activities can disrupt ecological processes.

Mining operations, like those of Banro Corp., heavily depend on water, potentially leading to significant environmental impacts. Water usage is crucial for mineral processing and dust suppression. The improper handling of wastewater can contaminate local water sources. According to recent reports, the mining industry faces increasing scrutiny regarding water management practices. Compliance with stringent water quality standards is essential for operational sustainability.

Mining operations inherently produce substantial waste rock and tailings. Effective waste management is crucial for environmental protection. This includes preventing water contamination and land degradation. For example, in 2024, the global mining waste generation was estimated at over 50 billion tonnes, a figure that underscores the scale of the challenge.

Land Degradation and Reclamation

Mining operations significantly impact land, causing degradation and soil erosion. Environmental regulations mandate reclamation, requiring companies like Banro Corp. to restore mined areas. According to a 2024 report, global land degradation costs exceed $40 billion annually. Banro must allocate resources for reclamation to comply with environmental standards. Failure to do so can result in hefty fines and damage to the company's reputation.

- Land degradation can lead to a loss of biodiversity.

- Reclamation projects involve costs for earthmoving, replanting, and monitoring.

- Proper reclamation enhances the potential for future land use.

- Environmental compliance is crucial for maintaining operational licenses.

Climate Change Impacts

Climate change presents indirect challenges for Banro Corp.'s operations. Altered weather patterns, like more intense rainfall or prolonged droughts, can disrupt mining activities and water management. These changes may necessitate modifications to infrastructure and operational strategies. For instance, the frequency of extreme weather events has increased by about 20% since the 1980s, impacting mining projects.

- Water scarcity could affect processing.

- Increased operational costs due to climate-related disruptions.

- Stricter environmental regulations related to climate change.

- Potential for climate-related project delays.

Banro Corp. faces environmental risks in the DRC, including habitat destruction, water usage, and waste management, influencing its sustainability. The DRC’s deforestation rate has increased, by 1.2% per year from 2020-2023. Climate change further complicates operations through extreme weather, affecting water and potentially increasing operational costs.

| Environmental Factor | Impact | Data (2024-2025) |

|---|---|---|

| Deforestation | Habitat loss, ecosystem disruption | DRC deforestation rates: increased by 1.2% annually (2020-2023) |

| Water Usage | Contamination of water sources | Mining industry scrutiny regarding water management practices |

| Waste Management | Land degradation, water contamination | Global mining waste generation: over 50 billion tonnes in 2024 |

PESTLE Analysis Data Sources

The Banro Corp. PESTLE analysis relies on data from government reports, financial institutions, and industry-specific publications.