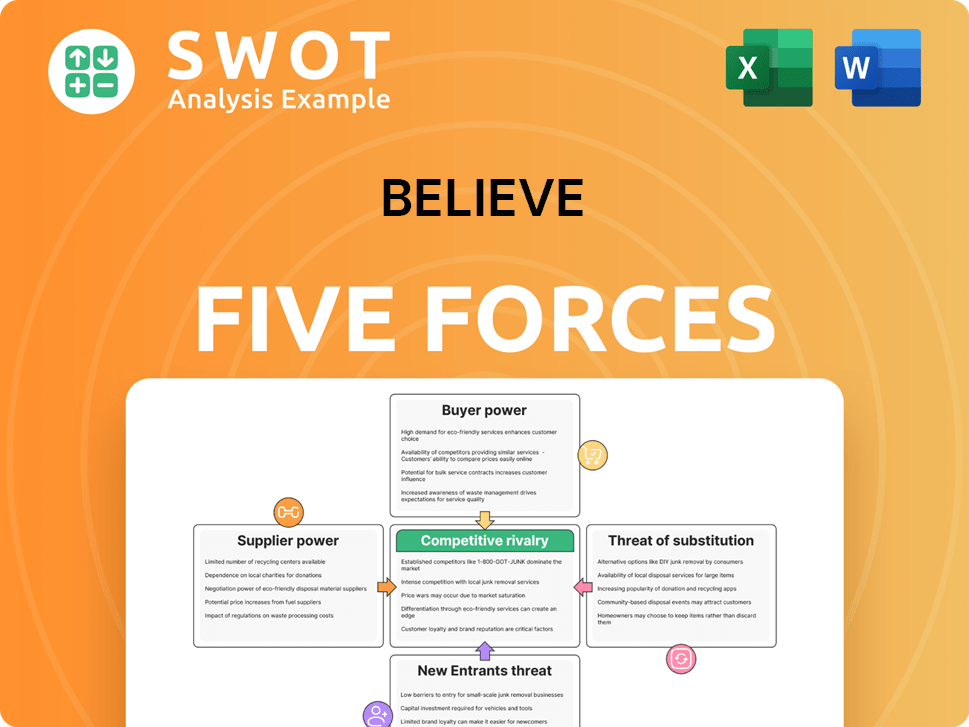

Believe Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Believe Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Identify strengths & weaknesses with an automated summary of all forces.

What You See Is What You Get

Believe Porter's Five Forces Analysis

This preview details Believe's Five Forces analysis, demonstrating the comprehensive assessment you'll receive. It provides insights into competitive rivalry, supplier power, and more. The information displayed here is identical to the final, downloadable document.

Porter's Five Forces Analysis Template

Believe's industry faces varying competitive pressures. Bargaining power of suppliers is moderate due to content creation. The threat of new entrants is high, driven by low barriers. Rivalry is intense, with strong competition among music distributors. Buyer power is significant, particularly from streaming services. Substitute threats, like alternative entertainment, are also a factor.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Believe’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Believe faces concentrated supplier power, particularly for tech and distribution. Roughly 20-30 key suppliers provided critical components in 2022. This concentration allows suppliers to influence pricing and contract terms significantly. This can impact Believe's profitability and operational flexibility. This is a crucial factor in assessing Believe's financial health.

Switching suppliers can be costly for Believe S.A., potentially incurring expenses that might reach 15-20% of overall procurement costs. This financial strain reduces Believe's willingness to change suppliers, boosting the suppliers' leverage. For instance, in 2024, Believe's operational expenses were approximately $1.2 billion. High transition costs restrict Believe's ability to negotiate favorable terms.

Believe relies on unique technological inputs, like specialized software and content distribution networks. Key suppliers in these areas, such as AWS and Google, hold a significant market share, controlling roughly 60% as of early 2024. This dependence strengthens suppliers' bargaining power. The limited availability of these critical inputs gives suppliers considerable leverage in negotiations.

Strong brand influence

Suppliers with strong brand influence, such as Spotify and Apple Music, significantly impact Believe's operations. Believe's partnerships with these influential brands mean it often has to accept their terms. This reduces Believe's ability to negotiate favorable pricing. In 2024, Spotify's revenue reached approximately €14.7 billion, demonstrating its market power.

- Spotify and Apple Music partnerships limit Believe's bargaining power.

- Strong brand recognition allows suppliers to set terms.

- Believe must adhere to supplier-dictated pricing.

- Spotify's 2024 revenue highlights supplier strength.

Potential for forward integration

Suppliers, such as music labels and artists, possess the ability to integrate forward into the digital music distribution market, posing a threat to Believe S.A. This forward integration could involve suppliers creating their own distribution channels, bypassing Believe. Such actions would weaken Believe's bargaining position, potentially leading to reduced revenue. The bargaining power of suppliers is a crucial factor, influencing Believe's ability to set prices and terms. Consider that in 2024, the top 3 major labels (Universal Music Group, Sony Music Entertainment, and Warner Music Group) controlled approximately 65% of the global recorded music market.

- Forward integration by suppliers diminishes Believe's control.

- Competition from suppliers directly impacts Believe's revenue streams.

- The market share of major labels highlights supplier influence.

- Believe's negotiation power decreases with supplier integration.

Believe S.A. confronts strong supplier bargaining power, particularly from tech providers and major music labels. Switching suppliers is expensive, with potential costs around 15-20% of procurement expenses. Reliance on crucial tech inputs, like from AWS and Google (60% market share in early 2024), increases supplier leverage.

| Aspect | Impact on Believe | 2024 Data |

|---|---|---|

| Supplier Concentration | Higher pricing power | Top 3 Labels control ~65% of market |

| Switching Costs | Limits negotiation | Operational expenses ~$1.2B |

| Tech Dependence | Reduces control | AWS/Google ~60% share |

Customers Bargaining Power

Artists and labels wield significant bargaining power due to the abundance of digital music distribution options. The independent music scene's growth has amplified this, fostering a competitive environment. In 2024, Believe reported over 600,000 artists distributed, highlighting the industry's fragmentation and artist choice. This competition allows artists to seek better deals. The ability to switch distributors easily strengthens their position.

Artists face low switching costs, making it easy to move between distribution platforms. This limits Believe's power to set unfavorable terms. Digital platforms offer artists direct access to streaming services. In 2024, the self-release market share grew, reflecting artist autonomy.

Independent artists and labels often prioritize cost-effective distribution, making them price-sensitive. The flat-fee convenience and vast libraries of streaming services appeal to today's listeners. However, poor monetization through low per-minute royalties has resulted in losses for labels and artists. For example, in 2024, the average per-stream payout on Spotify was roughly $0.003 to $0.005.

Demand for comprehensive services

Artists are increasingly demanding comprehensive services like distribution, marketing, and analytics, which allows them to negotiate more favorable terms. The record labels' role has shifted; in 2024, it's less about developing talent and more about proven marketability. Labels now focus on artists with existing fan bases, reducing the risk. This shift reflects a changing landscape where artists hold more power.

- In 2024, the global recorded music revenue reached $28.6 billion.

- Digital revenue accounted for 67% of the total in 2024.

- The top 1% of artists generate 80% of streaming revenue.

- Independent artists now capture a larger share of the market.

Direct-to-fan possibilities

Artists' direct access to fans boosts their bargaining power, lessening dependence on intermediaries. In 2024, the trend of independent artists surged, utilizing accessible distribution. Labels now compete by offering unique value to attract talent. This shift impacts traditional music industry dynamics.

- Independent artists' revenue grew by 25% in 2024.

- Direct-to-fan platforms saw a 30% increase in artist usage.

- Major labels are adapting by offering enhanced services.

Artists and labels, empowered by digital platforms, have substantial bargaining power. This is evident in the competitive landscape where independent artists thrive. With easy switching and direct access to fans, their negotiating strength is amplified. The rise in independent artist revenue by 25% in 2024 underscores this shift.

| Factor | Impact | 2024 Data |

|---|---|---|

| Switching Costs | Low | Easy platform transitions |

| Market Share | Growing | Independent artist revenue grew by 25% |

| Direct Access | Increased | 30% increase in artists using direct-to-fan platforms |

Rivalry Among Competitors

The digital music distribution market is fiercely competitive, with many companies fighting for prominence. Believe S.A. contends with major players like Universal Music Group and Warner Music Group. The global music market reached $28.6 billion in 2023, highlighting the stakes. Believe S.A. reported a revenue of €830 million in 2023, showcasing its significant position.

Major labels such as Universal, Sony, and Warner pose a significant challenge due to their substantial resources and existing artist connections. These established entities possess considerable financial clout and distribution networks, making it difficult for independent labels to compete directly. For example, in 2024, the "Big Three" controlled over 60% of global music revenue. Indie labels often focus on niche markets to differentiate themselves.

New independent distributors intensify competition. Non-majors are gaining market share. In 2024, independent labels and self-releasing artists collectively captured a notable portion of the music market, increasing competitive dynamics. This shift challenges established players, impacting revenue distribution and artist services. This trend influences industry strategies.

Focus on artist acquisition

Believe faces fierce competition to sign artists, heightening rivalry in the music industry. The independent music scene's growth presents opportunities but also challenges. Indie artists often struggle with funding, marketing, and distribution. In 2024, the global music market reached $28.6 billion, with streaming accounting for 67% of the revenue, highlighting the intense competition for artist acquisition and the importance of effective distribution and promotion.

- Competition is fierce to acquire artists.

- Independent music's growth brings challenges.

- Indie artists face funding, marketing, and distribution issues.

- Streaming dominates the music market.

Importance of innovation

Innovation is crucial for companies to remain competitive, especially in dynamic industries like music. The music industry, for instance, has rapidly evolved, driven by streaming platforms and social media. This shift has transformed how music is discovered and consumed, impacting revenue streams and artist strategies. A 2024 report revealed that streaming accounted for over 80% of the music industry's revenue.

- Streaming services like Spotify and Apple Music have reshaped the industry.

- Social media platforms drive music discovery through viral trends.

- The music industry's revenue is still growing.

- Artists must adapt to digital platforms to thrive.

Competitive rivalry in digital music distribution is intense. Believe S.A. competes with major labels and independent distributors. The music market reached $28.6B in 2023, with streaming at 67%.

| Aspect | Details |

|---|---|

| Market Size (2023) | $28.6 Billion |

| Believe S.A. Revenue (2023) | €830 Million |

| Streaming Revenue Share (2023) | 67% |

SSubstitutes Threaten

DIY distribution platforms pose a significant threat, enabling artists to bypass traditional distributors. Artists leverage technology and social media to build careers independently. The shift is evident: in 2024, DIY platforms like DistroKid and TuneCore saw a 30% increase in artist sign-ups. Home studios and digital distribution empower musicians to produce and market music without label backing.

Social media platforms, like TikTok and YouTube, are a significant threat because they enable artists to bypass traditional music distribution channels. This shift is amplified by the rise of short-form video, which is changing how people discover music. In 2024, the global music streaming market generated $14.1 billion, with platforms like TikTok and YouTube contributing significantly to music discovery and promotion. The dominance of algorithms in curating playlists and recommending music further intensifies this threat.

Traditional record labels, like Sony Music Entertainment, Universal Music Group, and Warner Music Group, represent a substitute for Believe. These labels still provide essential services such as funding, marketing, and distribution, which can be attractive to artists. In 2024, major labels accounted for approximately 60% of global recorded music revenue, demonstrating their continued dominance. However, independent labels and self-releasing artists are gaining ground, with independent labels holding about 30% of the market share.

Royalty-free music

The rise of royalty-free music services poses a threat to Believe Porter's original music distribution. This shift impacts demand, as creators opt for cost-effective alternatives. The royalty-free music market is expanding, with a value of USD 1.43 billion in 2024, projected to reach USD 1.52 billion in 2025. This evolution changes music integration in digital projects.

- Market Growth: The royalty-free music market's expansion.

- Substitution: Royalty-free music as an alternative to original music.

- Demand Impact: How substitutes affect original music distribution.

- Digital Integration: The changing landscape of music use.

Live performances

Live performances pose a threat to music streaming and recorded music sales. Artists use live shows to connect with fans and earn revenue, reducing reliance on recorded music. Record labels actively help artists secure lucrative festival slots, international tours, and sponsorships. In 2024, live music revenue is projected to reach $31.3 billion globally. This underscores the importance of live shows as a revenue source.

- Live music revenue is projected to reach $31.3 billion globally in 2024.

- Live performances offer alternative revenue streams for artists.

- Record labels focus on securing live performance opportunities for artists.

- Live shows create direct artist-fan connections.

The threat of substitutes significantly impacts Believe's market position. DIY platforms and social media offer artists alternative distribution channels, posing competition. Royalty-free music and live performances further diversify options for content and revenue. This competition affects Believe's market share and revenue streams.

| Substitute | Impact | 2024 Data |

|---|---|---|

| DIY Platforms | Direct artist distribution; bypasses traditional labels | 30% increase in artist sign-ups for DIY platforms |

| Social Media | Music discovery and promotion; platform-based revenue | $14.1B global music streaming market (2024) |

| Royalty-Free Music | Cost-effective alternative for content creators | $1.43B market value (2024) |

Entrants Threaten

The digital music distribution market faces low barriers to entry, allowing new competitors to join easily. Streaming services fragment audiences, while larger entities acquire smaller ones. In 2024, Spotify had 615 million users, indicating a massive market. Acquisitions like TuneCore by Believe highlight industry consolidation.

Technological advancements significantly lower distribution costs, making it easier for new entrants. Digital technologies enable real-time music editing and dynamic licensing. Cloud computing and data analytics offer personalized music catalogs, revolutionizing traditional processes. The music streaming market is projected to reach $34.4 billion in 2024. These advancements increase the threat of new entrants.

New entrants, armed with fresh business models, pose a constant threat. Believe leverages its growth and acquisitions to stay ahead. In 2024, Believe's revenue hit €827.6 million, up 13.8% organically, showing resilience.

Focus on niche markets

New entrants often concentrate on niche markets, like specific music genres or geographic areas, to establish a market presence. The Global South's growing influence is reshaping the music industry, with major labels acquiring local players to gain access. For example, in 2024, Warner Music Group acquired Rotana Music in Saudi Arabia, expanding its reach. This strategy allows new companies to compete effectively.

- Acquisitions enable access to new markets.

- The Global South is a key growth area.

- Niche markets offer entry points.

- Expansion is crucial.

Consolidation trends

Consolidation trends significantly impact the threat of new entrants in the music industry. While new players emerge, the industry sees larger companies merging or acquiring smaller ones, creating a more competitive landscape. Believe, backed by hypergrowth investors, aims to become music's "first global major independent," indicating a shift towards consolidation. This strategy makes it harder for smaller companies to survive long-term.

- Consolidation reduces the chances for new entrants to thrive.

- Believe's strategy reflects the changing dynamics of the music market.

- Hypergrowth investors are backing industry consolidation.

- The aim is to become a global major independent entity.

Low barriers to entry, aided by tech, increase the threat of new entrants. The music streaming market, valued at $34.4B in 2024, attracts various players. Acquisitions and niche market focus are strategies to compete. Consolidation intensifies competition, making it harder for new entrants to thrive.

| Factors | Impact | Example |

|---|---|---|

| Technological Advancement | Reduced Distribution Costs | Digital Music Editing |

| Market Dynamics | Consolidation | Believe's €827.6M Revenue in 2024 |

| Strategic Moves | Niche Focus | Warner Music Group's acquisition of Rotana Music |

Porter's Five Forces Analysis Data Sources

The analysis uses data from market reports, financial statements, and industry publications. This data helps to assess each competitive force effectively.