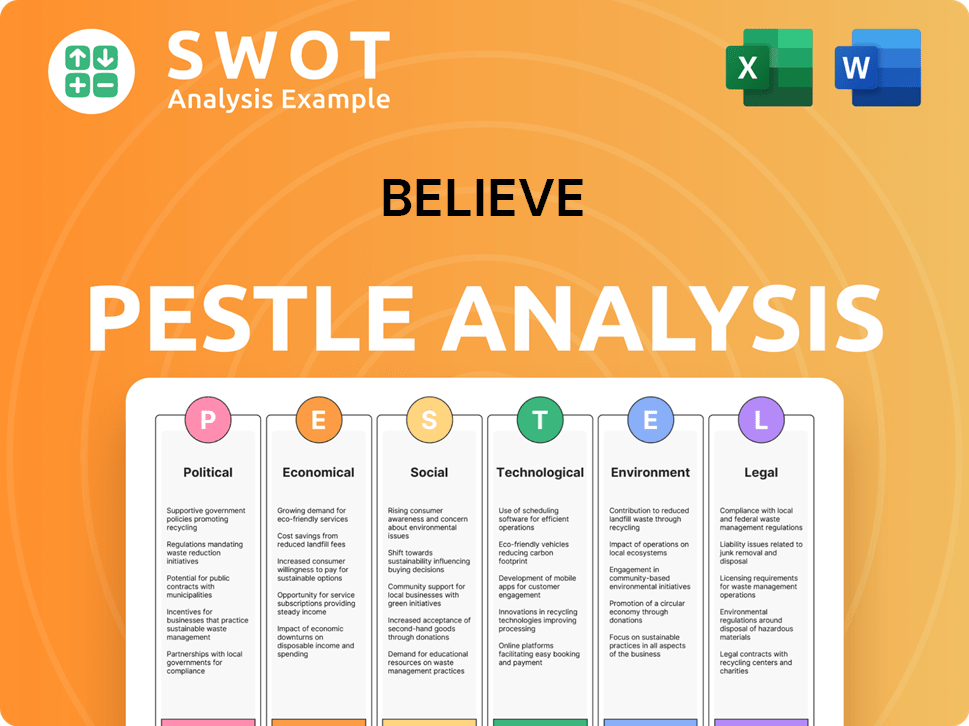

Believe PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Believe Bundle

What is included in the product

Examines how external factors influence Believe, using Political, Economic, Social, etc., perspectives.

The Believe PESTLE provides a concise version perfect for use in team brainstorming sessions and to ensure cross-functional agreement.

What You See Is What You Get

Believe PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Believe PESTLE analysis assesses the Political, Economic, Social, Technological, Legal, and Environmental factors. The in-depth examination and layout remain unchanged post-purchase. Download the full report instantly!

PESTLE Analysis Template

Navigate Believe's future with precision using our PESTLE Analysis. Uncover the key external factors impacting their strategies. Understand political, economic, social, technological, legal, and environmental influences. This is ideal for investors, analysts, and strategists. Access comprehensive, actionable insights. Purchase now for the full report!

Political factors

Government regulations and censorship heavily influence digital music firms like Believe. Content restrictions, varying across nations, can lead to artist bans or song removals. For example, in 2024, several songs faced censorship in specific regions due to content policies. This impacts Believe's distribution and revenue streams.

Believe's global presence means it's impacted by international trade agreements. These pacts shape distribution, potentially adding tariffs or taxes. For example, in 2024, the EU-Mercosur trade deal faced delays, affecting trade dynamics. Such barriers can increase costs, squeezing profit margins, as seen in fluctuating import duties impacting fashion retailers.

Political stability is vital for Believe's operations. Disruptions, like those seen in regions with political unrest, can hinder digital music services. For example, internet access disruptions can halt music streaming. In 2024, countries with high political risk saw significant drops in digital service revenues. Believe must monitor political landscapes closely.

Data Privacy and Security Laws

Believe, as a digital platform, must navigate evolving data privacy laws globally. Compliance requires substantial investment and operational adjustments. Regulations like GDPR in Europe and CCPA in California impact how Believe manages user data. Failure to comply can lead to significant financial penalties and reputational damage.

- GDPR fines can reach up to 4% of global annual turnover.

- CCPA violations can result in fines of up to $7,500 per record.

- Data breaches cost companies an average of $4.45 million in 2023.

Intellectual Property Rights Enforcement

Believe's revenue streams hinge on robust intellectual property rights enforcement, crucial for safeguarding licensing agreements with artists and labels. Weak enforcement can lead to substantial financial repercussions, including piracy and unauthorized music use. The IFPI's 2024 report highlighted that global recorded music revenue reached $28.6 billion, yet piracy remains a persistent threat. This could undermine Believe's profitability.

- Piracy and unauthorized music use erode revenue streams.

- Strong enforcement protects licensing agreements.

- Weakness can result in financial losses.

Political factors critically shape Believe’s operations, including content regulation and international trade dynamics.

Stringent censorship policies worldwide influence music distribution, and delays in trade agreements can lead to increased costs.

Additionally, data privacy regulations like GDPR and CCPA demand significant compliance investments to avoid substantial penalties.

| Factor | Impact on Believe | Example/Data |

|---|---|---|

| Content Regulations | Affects distribution and revenue | Censorship in specific regions |

| Trade Agreements | Shapes distribution, costs, profit | EU-Mercosur delays |

| Data Privacy Laws | Requires investment and operational adjustments | GDPR, CCPA compliance costs |

Economic factors

Economic conditions, like recessions or expansions, heavily impact consumer spending on music services. During economic downturns, consumers might cut back on non-essential spending, potentially leading to decreased subscriptions. However, in 2024, global music revenue hit $28.6 billion, showing resilience even amid economic uncertainties. This data suggests that while economic factors play a role, the music industry continues to adapt and grow.

Believe, operating internationally, faces currency exchange rate risks. These fluctuations affect international sales profitability. For example, a stronger euro could make Believe's products more expensive in the US, impacting sales. In Q4 2024, EUR/USD volatility reached levels unseen since 2022, highlighting the potential impact. This necessitates careful financial planning and hedging strategies.

Inflation impacts Believe's service pricing and operational costs. As of early 2024, inflation in the Eurozone, where Believe has significant operations, was around 2.6%. Interest rates affect Believe's borrowing costs for investments. The European Central Bank's key interest rate was at 4.5% in late 2023, influencing Believe's financial planning.

Economic Growth in Emerging Markets

Investing in emerging music markets offers growth potential, but requires understanding economic factors. Market size and consumer behavior significantly influence revenue. Infrastructure development, including digital access, is key for distribution and consumption. For example, the global music market was valued at $26.2 billion in 2024, with emerging markets contributing significantly to growth.

- Market size drives revenue potential.

- Consumer behavior impacts purchasing patterns.

- Infrastructure development supports distribution.

- Digital access is crucial for consumption.

Revenue Streams and Artist Compensation

The economic structure of the music industry directly impacts Believe's revenue streams and artist compensation. Streaming royalties are a crucial revenue source, but the distribution models are under constant scrutiny. This affects Believe's financial performance and relationships with artists. The industry's shift towards streaming has altered traditional revenue streams.

- In 2024, streaming accounted for over 60% of global music revenue.

- Artist royalty rates from streaming platforms vary, typically ranging from 10-20%.

- Believe’s financial success depends on effective royalty management and favorable agreements.

Economic cycles influence consumer spending on music. Believe faces currency risks, affecting international sales profitability. Inflation and interest rates impact costs and borrowing. Investing in emerging markets is key for growth.

| Economic Factor | Impact on Believe | 2024-2025 Data |

|---|---|---|

| Recession | Reduced subscriptions | Global music revenue $28.6B (2024) |

| Currency Fluctuations | Affects sales profitability | EUR/USD volatility (Q4 2024) |

| Inflation | Impacts service pricing | Eurozone inflation ~2.6% (early 2024) |

Sociological factors

Music consumption is rapidly changing, with streaming dominating. In 2024, streaming accounted for over 84% of U.S. music revenue. Playlists and social media now drive music discovery. Platforms like TikTok influence music popularity, with 60% of users discovering new music there.

Social media and online communities are vital for artist-fan connections and music promotion. Viral trends, such as those on TikTok, can quickly boost a song's popularity. For instance, in 2024, 60% of music discovery happened on social media. This direct engagement impacts marketing strategies. Streaming services like Spotify and Apple Music also use social listening.

Cultural trends significantly shape music consumption and artist popularity. Believe's diverse artist roster across genres means its success hinges on adapting to these shifts. In 2024, streaming accounted for over 80% of global music revenue, influenced by specific genre popularity. The rise of genres like Afrobeats and K-pop, for example, has driven substantial market growth. Believe's ability to identify and capitalize on these trends is critical.

Demographics and Audience Preferences

Understanding the demographics of music listeners and their preferences is crucial for effective marketing and artist growth. Age, culture, and socio-economic status significantly influence musical tastes. For instance, in 2024, the 18-24 age group showed a 35% preference for streaming services. Cultural background also shapes preferences, with Latin music experiencing a 15% rise in global popularity by early 2025. Socio-economic factors affect access and choices.

- Age significantly impacts music choices, with younger demographics favoring streaming.

- Cultural background influences preferences; Latin music's popularity is rising globally.

- Socio-economic status affects access to and choices in music consumption.

Shift from Ownership to Access

The music industry has seen a big change: moving from owning CDs to streaming. In 2024, streaming made up over 80% of recorded music revenue globally. This shift has changed how people see music's worth and how they listen. Consumers now often prefer access over ownership, impacting how music is bought and used.

- Streaming accounted for 83% of the U.S. recorded music revenue in the first half of 2024.

- Global streaming revenues reached $28.6 billion in 2023, a 10.5% increase from 2022.

- Subscription services, like Spotify and Apple Music, are key drivers of this trend.

Age plays a huge role in music tastes, with streaming heavily favored by younger groups; in 2024, 35% of 18-24 year olds preferred streaming. Cultural backgrounds also shape preferences, influencing global music trends; Latin music gained a 15% rise in popularity by early 2025. Socio-economic status determines access and choice in music consumption habits, impacting the industry dynamics.

| Factor | Impact | Data |

|---|---|---|

| Age | Younger demos favor streaming | 35% of 18-24 year olds in 2024 |

| Culture | Influences taste | 15% rise in Latin music popularity by early 2025 |

| Socio-economic Status | Determines access | Impacts consumer choices |

Technological factors

Technological advancements have reshaped music distribution. Streaming services now dominate, with platforms like Spotify and Apple Music controlling a significant market share. Believe's business model is heavily reliant on these digital platforms. In 2024, streaming accounted for over 80% of global recorded music revenue. This trend is expected to continue.

AI is transforming music creation, crafting lyrics and full tracks. Streaming platforms use AI for personalized music recommendations. In 2024, AI-generated music saw a 200% rise in user engagement. The global AI music market is projected to reach $4.5 billion by 2025.

Mobile technology has revolutionized music consumption, making it accessible anywhere. In 2024, over 6.92 billion people globally use smartphones. Streaming apps like Spotify and Apple Music are booming. Mobile music revenue reached $20.1 billion in 2024, a 15% increase. This constant availability shapes listening habits.

Data Analytics and Personalization

Believe leverages data analytics for personalized user experiences. This involves understanding user behavior to offer tailored recommendations and curated playlists. The global music streaming market is projected to reach $53.2 billion in 2024. This growth is fueled by personalization.

- Personalized recommendations increase user engagement.

- Data analytics optimize content discovery.

- User data drives platform improvements.

Blockchain and Royalty Distribution

Blockchain technology and NFTs are reshaping royalty distribution in the music industry. This offers new avenues for artists to gain revenue and manage royalties with increased transparency. In 2024, platforms like Royal and Catalog are using blockchain to enable fractional ownership of music rights. This helps artists to raise capital and for fans to invest in their favorite music. The global blockchain music market is projected to reach $1.4 billion by 2025.

- Blockchain is used for transparent royalty tracking.

- NFTs provide new ways to monetize music.

- Platforms like Royal and Catalog are emerging.

- The market is expected to grow significantly.

Technological factors significantly impact Believe's operations. Streaming dominates the music industry, with 80%+ of global revenue in 2024. AI is used for music creation and personalization, with the AI music market projected to reach $4.5B by 2025. Mobile technology continues to drive accessibility and revenue, hitting $20.1B in mobile music revenue in 2024.

| Technology | Impact | Data (2024) |

|---|---|---|

| Streaming | Dominant distribution | 80%+ of global music revenue |

| AI | Music creation/Personalization | 200% rise in user engagement |

| Mobile | Accessibility/Revenue | $20.1B mobile music revenue |

Legal factors

Copyright laws are crucial for Believe. They secure its music assets. Believe needs robust licensing to operate legally. Infringement cases require swift, decisive action. In 2024, music copyright disputes cost the industry billions.

Believe faces legal hurdles in music licensing. They must secure rights for music distribution, a complex process. Royalty distribution to artists and rights holders presents another challenge. In 2024, the music industry saw $28.6 billion in global revenue, highlighting the stakes. Proper legal compliance is crucial for Believe's operations.

Adhering to data protection laws like GDPR is crucial for businesses managing user data internationally. Non-compliance can result in significant penalties; for instance, Meta faced a $1.3 billion fine in 2023 for GDPR violations. Staying updated with evolving regulations is vital.

Contract Disputes with Artists and Labels

Believe, like other digital music distributors, confronts contract disputes with artists and labels. These disputes often involve royalty payments, copyright infringements, and control over creative works. Legal battles can be costly and time-consuming, potentially impacting Believe's financial performance and reputation. For example, in 2023, music copyright infringement cases cost the industry $800 million.

- Royalty disputes are common, with artists claiming underpayment.

- Copyright infringements can lead to costly legal battles.

- Creative control disagreements can damage relationships.

- Legal fees and settlements can affect profitability.

Platform Responsibility for User-Generated Content

Legal landscapes are shifting on platform accountability for user-posted content, especially concerning copyrighted music. In 2024, court decisions and legislation are increasingly defining platform liability. For example, in 2023, a major music publisher won a significant copyright infringement case against a social media platform, setting a precedent. This creates pressure for platforms to actively monitor and remove infringing content.

- The Digital Millennium Copyright Act (DMCA) provides a framework, but interpretations vary.

- GDPR and other data privacy regulations add complexities to content moderation.

- Platforms face challenges in balancing copyright compliance with free speech.

Legal issues significantly affect Believe's operations. Copyright, licensing, and data protection are major concerns, impacting revenue and compliance. Disputes over royalties, infringements, and platform accountability are common challenges.

| Legal Area | Issue | Impact |

|---|---|---|

| Copyright | Infringement disputes | Legal fees and settlements |

| Licensing | Securing music rights | Operational complexity |

| Data Privacy | GDPR compliance | Penalties, data breaches |

Environmental factors

Data centers, crucial for digital music, are energy-intensive. In 2023, data centers consumed about 2% of global electricity. This consumption leads to carbon emissions, impacting the environment significantly. The growth in streaming increases this footprint. Reducing this requires efficiency improvements and renewable energy adoption.

Streaming music significantly impacts the environment. Data from 2024 indicates that the carbon footprint of streaming is substantial. This includes the energy used for data centers and devices.

The environmental cost of streaming is often overlooked. The cumulative effect of billions of streams creates a considerable carbon footprint. This can potentially surpass the benefits of physical media.

In 2024, the energy demands of data centers supporting streaming services continue to rise. This trend contributes to higher carbon emissions globally.

The industry is exploring solutions like renewable energy. However, the environmental impact remains a key concern for the foreseeable future. It is particularly relevant for investors.

This environmental factor influences consumer behavior and company strategies. Investors should consider it in their assessments.

The shift to digital music fuels electronic device consumption, escalating e-waste. In 2023, over 57.4 million metric tons of e-waste were generated globally. Only 22.3% was recycled. This poses environmental and economic challenges. The proper disposal of electronics is crucial to mitigate pollution.

Sustainable Practices in Digital Infrastructure

The digital music industry's environmental footprint is increasingly under scrutiny, driving the need for sustainable practices in digital infrastructure. Data centers, crucial for music streaming and storage, consume vast amounts of energy. Reducing carbon emissions is a key goal, with the industry exploring renewable energy sources and energy-efficient technologies. The focus is on minimizing waste and promoting circular economy models within digital infrastructure.

- Data centers account for about 1-2% of global electricity consumption.

- The global data center market is projected to reach $62.3 billion by 2025.

- Companies are investing in green data centers to reduce energy usage by up to 30%.

- The use of renewable energy in data centers has increased by 15% in the last 3 years.

Awareness and Demand for Environmental Responsibility

Growing consumer and industry awareness of digital activities' environmental effects is crucial. This awareness drives demand for greener practices in the music sector. Recent data shows a 15% increase in consumers prioritizing eco-friendly brands (2024). Consequently, music companies face pressure to adopt sustainable strategies. This shift is fueled by both consumer preference and regulatory changes.

- 15% rise in consumers prioritizing eco-friendly brands (2024).

- Increased pressure on music companies for sustainability.

- Driven by consumer preferences and regulations.

The digital music industry significantly impacts the environment. Data centers, essential for streaming, consume considerable energy and contribute to carbon emissions. The increasing e-waste from devices is another challenge, as 57.4 million metric tons were generated globally in 2023. Sustainable practices and green data centers are crucial for mitigating these impacts.

| Environmental Factor | Impact | Data (2024/2025) |

|---|---|---|

| Data Center Energy Consumption | High, carbon emissions | 1-2% of global electricity; $62.3B market by 2025. |

| E-waste | Pollution, resource depletion | 57.4M tons generated in 2023. |

| Consumer Awareness | Demand for sustainability | 15% rise in eco-friendly brands (2024). |

PESTLE Analysis Data Sources

The PESTLE Analysis incorporates data from economic forecasts, legal frameworks, government publications, and market research, providing comprehensive coverage.