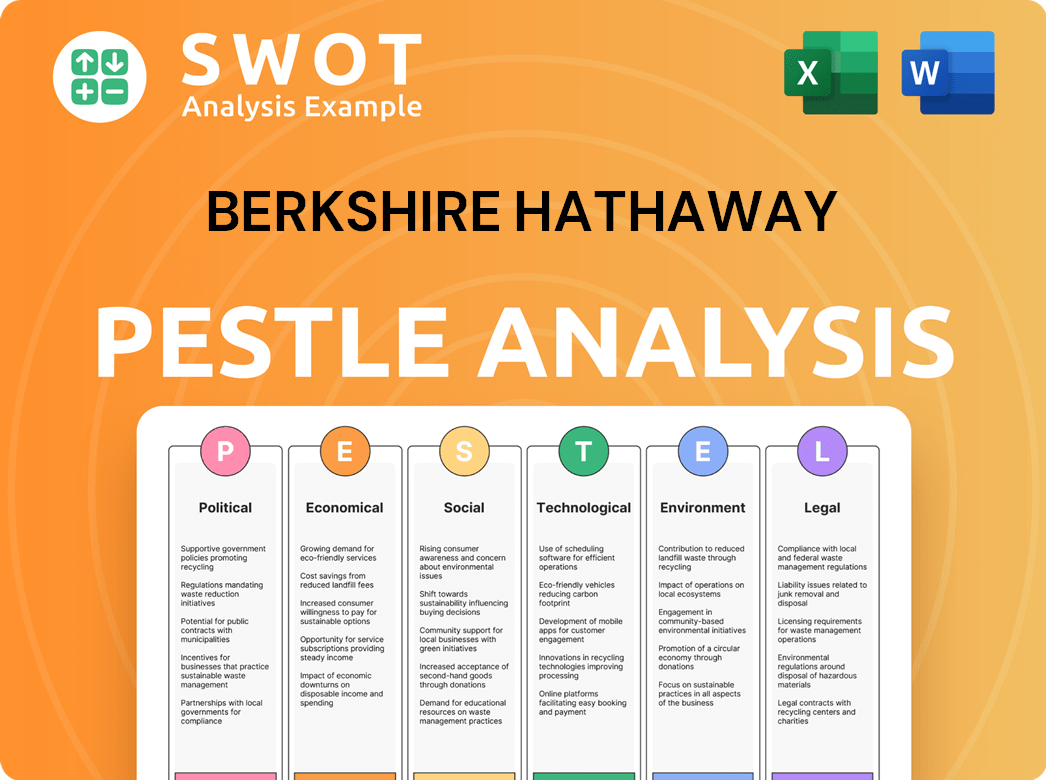

Berkshire Hathaway PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Berkshire Hathaway Bundle

What is included in the product

Evaluates how PESTLE factors impact Berkshire Hathaway, offering actionable insights and strategic guidance.

Helps quickly identify opportunities and threats, streamlining strategic decision-making for growth.

Preview the Actual Deliverable

Berkshire Hathaway PESTLE Analysis

The file you’re seeing now is the final version—ready to download right after purchase. This Berkshire Hathaway PESTLE analysis examines Political, Economic, Social, Technological, Legal, & Environmental factors. Every section shown in the preview will be fully included. Gain immediate access and benefit from this in-depth report.

PESTLE Analysis Template

Gain a crucial edge with our detailed PESTLE analysis of Berkshire Hathaway. Uncover the complex external forces shaping its performance, from economic shifts to technological advancements. Understand regulatory challenges and market opportunities. Armed with these insights, elevate your investment strategies or business planning. Download the full PESTLE analysis now to unlock deeper strategic intelligence and make data-driven decisions.

Political factors

Berkshire Hathaway faces impacts from government regulations. Environmental standards affect energy and rail. Financial rules impact insurance and investments. Trade policies influence manufacturing and retail. The company engages with policymakers. For 2024, regulatory changes in the insurance sector are closely watched.

Berkshire Hathaway, operating globally, faces impacts from trade policies and geopolitical tensions. Fluctuating tariffs and currency rates affect its international subsidiaries. For example, in 2024, tariffs on steel and aluminum impacted its manufacturing businesses. Geopolitical events like the Russia-Ukraine war have also indirectly affected market sentiment and investment decisions. These factors necessitate careful risk management and strategic adaptability.

Political stability is crucial for Berkshire Hathaway's operations. Stable regions offer predictable regulations, fostering long-term investments. The U.S., a key market, generally provides stability. However, global events, like the 2024 elections, can create uncertainty. Berkshire's diverse portfolio is designed to withstand such fluctuations.

Government Spending and Infrastructure Projects

Government spending and infrastructure projects significantly influence Berkshire Hathaway's diverse portfolio. These projects can boost demand for BNSF Railway's freight services and Berkshire Hathaway Energy's operations. Increased government spending typically stimulates economic activity, benefiting various subsidiaries. The Infrastructure Investment and Jobs Act, signed in 2021, allocated substantial funds, affecting these sectors.

- BNSF Railway transports materials essential for infrastructure projects.

- Berkshire Hathaway Energy benefits from increased energy demand.

- Government spending can spur economic growth, aiding overall performance.

- The Infrastructure Investment and Jobs Act is a key driver.

Shareholder Activism and Political Agendas

Shareholder activism, particularly on environmental, social, and governance (ESG) issues, significantly impacts Berkshire Hathaway. Proposals related to climate change and diversity, equity, and inclusion (DE&I) can alter governance and public perception. In 2024, ESG-related shareholder proposals saw an average support of 25%, indicating growing investor interest. Even when management opposes these, high support levels signal potential regulatory or societal pressures.

- ESG-related shareholder proposals average support: 25% (2024).

- Berkshire Hathaway's governance faces scrutiny from politically charged shareholder proposals.

Political factors greatly influence Berkshire Hathaway. Regulations and trade policies impact insurance, manufacturing, and global operations. Government spending and geopolitical events affect BNSF Railway and investment decisions. Shareholder activism on ESG issues also shapes the company's direction.

| Factor | Impact | 2024 Data |

|---|---|---|

| Regulations | Insurance and energy | Insurance sector changes monitored. |

| Trade Policies | Manufacturing, global subs | Steel/aluminum tariffs impacted businesses. |

| Shareholder Activism (ESG) | Governance/public perception | Avg. support: 25%. |

Economic factors

Interest rate shifts deeply affect Berkshire Hathaway. Rising rates boost investment income from its substantial cash and fixed-income holdings. This can enhance earnings, especially given their large portfolio. Conversely, higher rates can increase borrowing costs for its subsidiaries and potentially curb consumer spending. In Q1 2024, Berkshire's cash reached $188.9B. The Federal Reserve's moves are key.

Inflation remains a key economic factor, influencing Berkshire Hathaway's operational costs. High inflation can squeeze consumer spending, affecting retail and manufacturing. In 2024, the U.S. inflation rate hovered around 3%, impacting pricing strategies. Effective cost management is vital for sustained profitability.

Berkshire Hathaway thrives on economic growth, with its varied businesses performing well during expansions. However, recessions pose risks, potentially reducing demand and earnings across its portfolio. The company's financial results closely mirror the U.S. economic trends. For example, in 2024, the GDP growth was around 3%. Berkshire's massive cash reserves, totaling over $189 billion as of Q1 2024, provide a vital cushion against economic uncertainty.

Currency Exchange Rates

Currency exchange rates are a significant economic factor for Berkshire Hathaway, affecting its global investments and earnings. These fluctuations can either boost or diminish the value of international profits. For example, if the U.S. dollar strengthens, it can reduce the reported earnings from overseas operations when translated back into dollars. Conversely, a weaker dollar can enhance these earnings.

- In 2023, Berkshire Hathaway's international revenues accounted for a substantial portion of its total revenue, highlighting the importance of exchange rates.

- A 10% change in the USD exchange rate can significantly impact the company's reported earnings.

- The company actively manages its currency exposure through hedging strategies.

Market Volatility and Investment Performance

Berkshire Hathaway's investment performance is susceptible to market volatility, impacting its financial results. Fluctuations in equity values directly affect reported earnings, although operating earnings are prioritized for performance evaluation. In 2024, the S&P 500 saw significant swings, influencing Berkshire's portfolio value. The company's diverse holdings help to mitigate some risks, but overall market trends remain crucial.

- Market volatility directly impacts Berkshire's financial results.

- Equity value fluctuations affect reported earnings.

- Operating earnings are key for performance evaluation.

- S&P 500 performance significantly influences Berkshire.

Economic factors heavily influence Berkshire Hathaway's performance. Interest rates impact investment income and borrowing costs. Inflation affects operating costs and consumer spending. Economic growth or recessions directly influence earnings and demand. Currency exchange rate fluctuations significantly alter international profits.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Interest Rates | Investment income/borrowing costs | Q1 2024 Cash: $188.9B, Fed moves are key. |

| Inflation | Operational costs/consumer spending | U.S. inflation ~3% in 2024, impacting pricing. |

| Economic Growth | Demand/earnings | 2024 GDP growth ~3%, reserves over $189B (Q1 2024). |

Sociological factors

Changes in demographics impact Berkshire Hathaway's consumer-facing businesses. For example, an aging population could boost demand for healthcare products from companies like Alleghany, a subsidiary. Shifting consumer preferences also drive product innovation and marketing adjustments. In 2024, the U.S. population grew by approximately 0.5%, impacting various sectors.

Shifts in lifestyle choices and societal values, like environmental consciousness, affect consumer preferences. For instance, the global green technology and sustainability market is projected to reach $74.7 billion by 2025. This impacts demand and requires business practice changes. Berkshire Hathaway's investments must adapt to these trends.

Workforce diversity, equity, and inclusion (DEI) are increasingly important. Societal pressure influences hiring, employee relations, and public perception. Berkshire Hathaway's historical approach to DEI has been minimalist. Shareholder interest and external pressure are rising. In 2024, companies face greater scrutiny regarding DEI metrics.

Public Perception and Brand Reputation

Berkshire Hathaway's strong reputation, earned through decades of successful investing and the public image of its leaders, is a key asset. Public perception of corporate ethics and social responsibility influences its brand across its diverse subsidiaries. For instance, in 2024, ethical concerns impacted some subsidiaries, leading to public scrutiny. The company actively manages these perceptions through its actions and communications. This includes investments in socially responsible initiatives.

- Reputation as a key asset.

- Public perception affects brand value.

- Ethical concerns can lead to scrutiny.

- Active management of public image.

Community Engagement and Social Responsibility

Expectations for corporate social responsibility (CSR) and community engagement are increasing. Berkshire Hathaway's decentralized structure allows its subsidiaries to manage these aspects individually. Many Berkshire Hathaway businesses actively participate in local initiatives. For example, in 2024, GEICO contributed over $1 million to various community programs. These efforts help build positive brand perception and social goodwill.

- GEICO's 2024 community contributions totaled over $1 million.

- Individual subsidiaries tailor CSR to their industries.

- Community engagement enhances brand reputation.

Societal trends heavily influence Berkshire Hathaway's operations and brand image. Changing demographics impact consumer behavior and demand across various subsidiaries. The company's focus on corporate social responsibility, like GEICO's $1M+ community contributions in 2024, shapes its public perception and enhances goodwill.

| Sociological Factor | Impact on Berkshire | 2024/2025 Data/Examples |

|---|---|---|

| Demographic Shifts | Affect consumer demand | US population growth approx. 0.5% in 2024; aging population boosts healthcare product demand. |

| CSR & DEI | Shapes public image and values | GEICO's $1M+ in community programs. Increased scrutiny of DEI metrics for companies. |

| Reputation and Ethics | Influences brand and trust | Ethical concerns in some subsidiaries impact public perception. Active management through communication. |

Technological factors

Technological advancements pose both challenges and opportunities for Berkshire Hathaway. Disruptive technologies can reshape industries, potentially impacting companies like BNSF Railway and Precision Castparts. To stay competitive, Berkshire must invest in innovation across its diverse holdings. For instance, in 2024, Berkshire Hathaway Energy invested $2.3 billion in renewable energy projects.

Automation and efficiency are key. Berkshire Hathaway uses tech to boost productivity and cut costs. BNSF Railway, for example, employs tech for better freight management. This improves profitability. In 2024, BNSF's operating ratio was around 60%, showing efficiency.

Digital transformation and e-commerce are crucial for Berkshire Hathaway's retail and service businesses. Online sales and digital marketing are vital for reaching consumers. In 2024, e-commerce sales in the US hit $1.1 trillion, showing the shift. Adapting to these technologies is key to staying competitive.

Cybersecurity Risks

Cybersecurity risks are escalating as technology integrates deeper into business. Berkshire Hathaway's subsidiaries face significant threats in protecting sensitive data and infrastructure. The cost of cybercrime is predicted to reach $10.5 trillion annually by 2025. This necessitates robust security measures across all operations.

- Data breaches cost an average of $4.45 million globally in 2023.

- Ransomware attacks increased by 13% in 2023.

- Cybersecurity spending is projected to exceed $250 billion in 2025.

Adoption of New Technologies (e.g., AI)

Berkshire Hathaway has shown increased interest in companies using Artificial Intelligence, despite its historical caution about the tech sector. The impact of AI is being felt across various industries, including Berkshire's subsidiaries, such as insurance and energy. This creates both opportunities and challenges for the company. For example, AI could streamline operations, but also introduce new risks.

- AI adoption is expected to drive significant market growth, with projections estimating the global AI market to reach $267 billion by 2027.

- Berkshire Hathaway Energy is exploring AI applications in grid management and renewable energy optimization.

- The insurance sector, where Berkshire has a strong presence, is seeing AI used for risk assessment and claims processing.

Berkshire Hathaway faces tech-driven industry shifts, necessitating investment in innovation. Automation improves efficiency; BNSF's operating ratio was about 60% in 2024. Cybersecurity threats, costing up to $4.45 million per breach in 2023, require strong measures. The AI market may hit $267 billion by 2027.

| Tech Area | Impact | 2024/2025 Data |

|---|---|---|

| Innovation | Industry transformation | Berkshire Hathaway Energy invested $2.3B in renewables. |

| Automation | Cost reduction, efficiency gains | BNSF's operating ratio: ~60% in 2024. |

| Cybersecurity | Risk Management | Avg. breach cost: $4.45M globally (2023); cybersecurity spending projected over $250B in 2025. |

Legal factors

Berkshire Hathaway faces extensive regulatory compliance across various sectors and locations. This involves adhering to rules in insurance, transportation, and energy. For example, in 2024, the insurance industry saw increased scrutiny on capital adequacy. Legal costs for compliance totaled $1.2 billion in 2024, reflecting the complexity.

Berkshire Hathaway, like any large conglomerate, is exposed to litigation risks. Legal challenges can arise from environmental issues, labor disputes, or business disagreements. For example, in 2024, the company faced lawsuits related to its railroad operations. Any substantial legal settlement could affect its financial results; in 2024, legal expenses were approximately $200 million.

Changes in tax laws significantly affect Berkshire Hathaway. Corporate tax rate adjustments at federal, state, and international levels directly impact profits. For example, the 2017 Tax Cuts and Jobs Act influenced Berkshire's tax liabilities. Staying updated on tax legislation is critical.

Industry-Specific Regulations

Berkshire Hathaway operates across diverse sectors, each governed by unique legal frameworks. Its energy businesses, like Berkshire Hathaway Energy, must comply with stringent regulations on pricing and infrastructure. Insurance subsidiaries, such as GEICO, navigate complex insurance industry laws. These regulations impact operational costs, compliance requirements, and strategic decisions.

- Energy regulations: focus on renewable energy targets and grid modernization.

- Insurance regulations: vary by state, affecting policy terms and financial stability.

- Compliance costs: substantial, impacting profitability and operational efficiency.

- Recent data: regulatory changes in 2024/2025 affecting financial reporting.

Corporate Governance Standards

Berkshire Hathaway, while adhering to corporate governance standards, operates with a unique structure. The company complies with securities regulations, ensuring legal compliance. Shareholder proposals regarding governance are regularly addressed. Berkshire Hathaway's commitment to transparency and ethical conduct is a key factor.

- Berkshire Hathaway's board includes independent directors, promoting unbiased oversight.

- The company's governance structure is designed to protect shareholder interests.

- Compliance with Sarbanes-Oxley and other regulations is ongoing.

Legal factors significantly impact Berkshire Hathaway. The company faces regulatory compliance across diverse sectors; compliance costs hit $1.2B in 2024. Litigation and tax law changes also pose financial risks; 2024 legal expenses were around $200M.

| Area | Impact | 2024/2025 Data |

|---|---|---|

| Regulations | Compliance, Operations | Increased scrutiny of capital adequacy; focus on renewable energy |

| Litigation | Financial Results | Lawsuits regarding railroad operations. |

| Tax Laws | Tax Liabilities | Ongoing updates on tax legislation. |

Environmental factors

Climate change poses significant risks to Berkshire Hathaway. Extreme weather events, like hurricanes and floods, increase claims for its insurance units, as seen with significant payouts in 2023. The company's energy and transportation sectors face infrastructure damage and operational disruptions. Adapting involves investing in resilient infrastructure and risk management.

Berkshire Hathaway faces environmental challenges. Stricter regulations on emissions, pollution, and resource use affect its subsidiaries. For example, BNSF Railway might need to invest in cleaner locomotives. Compliance costs and tech upgrades are crucial. Consider the $11.7 billion spent on renewable energy in 2023.

Berkshire Hathaway faces increasing scrutiny regarding its environmental impact and ESG practices. Investors are pushing for greater transparency in areas like carbon emissions and sustainability initiatives. For instance, in 2024, ESG-focused funds saw inflows, reflecting the growing importance of these factors. This necessitates changes in reporting and strategic alignment to meet evolving expectations.

Natural Resource Availability and Costs

Berkshire Hathaway faces environmental challenges tied to natural resource availability and costs. Fluctuations in fuel prices directly affect its transportation businesses like BNSF Railway. Raw material costs impact manufacturing units such as Precision Castparts. Efficient supply chain management and resource optimization are critical for maintaining profitability.

- BNSF Railway moves significant volumes of coal, subject to market and regulatory pressures.

- Precision Castparts relies on metals, with prices influenced by global supply and demand.

- Berkshire Hathaway Energy's renewable energy investments aim to manage resource costs.

Renewable Energy Transition

The shift to renewable energy impacts Berkshire Hathaway's utilities. This transition creates chances and hurdles for its energy companies. Investments in wind, solar, and related infrastructure are vital. Berkshire Hathaway Energy (BHE) is investing heavily; in 2024, BHE invested roughly $10 billion in renewable projects. Federal tax credits are supporting these investments.

- BHE’s renewable energy capacity is growing significantly.

- Increased competition and regulatory changes in the energy sector.

- The need to balance renewable investments with existing fossil fuel assets.

- The Inflation Reduction Act of 2022 offers significant tax credits.

Environmental factors significantly affect Berkshire Hathaway. Climate change, particularly extreme weather, drives insurance claim increases, such as large 2023 payouts. Regulatory shifts influence operations, with rising renewable energy investments. Resource costs, including fuel, also impact the firm.

| Impact Area | Specific Challenge/Opportunity | 2024/2025 Data/Examples |

|---|---|---|

| Insurance | Climate Change Risk | 2023 claims payout from extreme weather. |

| Energy | Transition to Renewables | BHE invested ~$10B in renewables (2024). |

| Transportation | Resource Cost | Fluctuating fuel prices impact BNSF. |

PESTLE Analysis Data Sources

The PESTLE relies on governmental reports, economic forecasts, market research, and industry-specific analyses. We also utilize credible news and financial publications.