Best Buy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Best Buy Bundle

What is included in the product

Analyzes Best Buy's position, exploring competitive pressures from suppliers, buyers, and rivals.

Clean, simplified layout—ready to copy into pitch decks or boardroom slides.

Same Document Delivered

Best Buy Porter's Five Forces Analysis

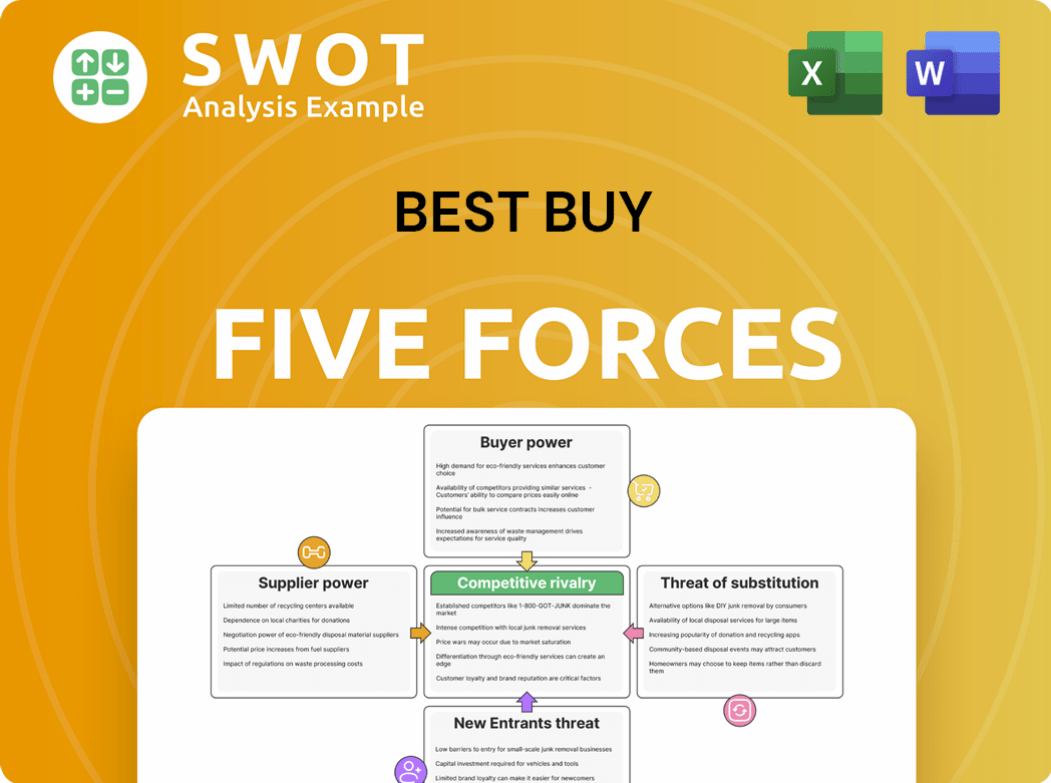

This preview presents Best Buy's Porter's Five Forces analysis exactly as it will be delivered. It meticulously examines industry rivalry, supplier power, buyer power, the threat of substitutes, and the threat of new entrants. The in-depth analysis provides strategic insights into Best Buy's competitive landscape. This comprehensive document is available instantly after purchase.

Porter's Five Forces Analysis Template

Best Buy operates in a competitive retail landscape shaped by powerful forces. Buyer power is significant due to price transparency & online options. The threat of new entrants is moderate, facing high capital costs. Substitutes, like online retailers, pose a considerable challenge. Supplier power is limited, given Best Buy's scale. Rivalry is intense, fueled by similar product offerings.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Best Buy’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Best Buy benefits from limited supplier concentration, sourcing products from a wide array of manufacturers. This strategy enhances their negotiating power, allowing them to switch suppliers if needed. For example, in 2024, Best Buy had over 3,000 suppliers. This diversification shields them from price hikes or supply issues. It strengthens their ability to secure favorable terms.

Best Buy benefits from standardized product offerings. Most items it sells, like TVs and laptops, are similar across brands. This allows Best Buy to switch suppliers easily. With many comparable products available, Best Buy holds more power. For example, in 2024, Best Buy sourced from numerous tech giants.

Best Buy's substantial size grants it robust bargaining power over suppliers. Its large order volumes encourage suppliers to offer competitive pricing and terms. For example, in 2024, Best Buy's revenue reached approximately $43.4 billion, reflecting its significant market influence. This position allows Best Buy to negotiate advantageous agreements.

Supplier competition

In the consumer electronics market, suppliers face fierce competition, compelling them to offer competitive prices and terms to retailers like Best Buy. This dynamic is intensified by the need to secure shelf space, as exemplified by the $1.5 billion in revenue generated by Samsung in Best Buy stores in 2024. Suppliers must maintain strong relationships to guarantee product visibility and sales. Best Buy's 2024 annual report shows that supplier competition significantly impacts its cost of goods sold (COGS).

- Intense competition among suppliers pressures pricing.

- Strong supplier-retailer relationships are crucial for market access.

- Samsung generated $1.5B in Best Buy stores in 2024.

- Supplier competition affects Best Buy's COGS.

Potential for backward integration is low

Best Buy's potential for backward integration, like entering manufacturing, is low, keeping its focus on retail. This strategic choice lets Best Buy manage a diverse supplier base without the complexities of production. The emphasis on retail operations strengthens its position in negotiating with suppliers. Best Buy's revenue in 2024 was approximately $43.4 billion.

- Focus on retail strengthens Best Buy’s negotiation position.

- Best Buy's 2024 revenue was roughly $43.4 billion.

- Best Buy maintains a diverse supplier base.

- Backward integration into manufacturing is unlikely.

Best Buy has strong bargaining power due to varied suppliers and sizable revenue, which was about $43.4 billion in 2024. This allows it to secure favorable terms and pricing. Intense competition among suppliers further enhances Best Buy's advantage.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Supplier Diversity | Reduces dependency | Over 3,000 suppliers |

| Market Position | Influences negotiation | $43.4B Revenue |

| Supplier Competition | Pressure on prices | Samsung $1.5B in revenue |

Customers Bargaining Power

Best Buy faces high customer price sensitivity because consumer electronics are often discretionary purchases. Customers can easily compare prices, making them highly sensitive to changes. In 2024, the average selling price of consumer electronics could fluctuate greatly. Best Buy must stay competitive on pricing to retain customers. Data indicates that online retailers like Amazon often set the price benchmark.

Customers have many choices, like Amazon or Walmart, for electronics, raising their power. Because alternatives are easy to find, buyers can quickly go elsewhere if Best Buy's prices or service aren't great. This competition makes Best Buy keep its offers attractive. In 2024, Amazon's revenue was over $575 billion, showing the strong competition Best Buy faces.

Switching costs for Best Buy customers are generally low. Customers can easily switch to competitors like Amazon or Walmart without significant costs. This ease of switching boosts customer bargaining power. Best Buy must offer competitive pricing and services to retain customers.

Access to information

Customers can easily find product reviews and compare prices online, giving them significant bargaining power. This access to information lets them make informed choices and seek better deals, increasing their leverage. Price and product transparency further enhance their ability to negotiate. In 2024, online sales accounted for about 30% of Best Buy's total revenue, highlighting the importance of online information in customer decisions.

- Online product reviews influence over 70% of purchasing decisions.

- Price comparison websites are used by 60% of consumers before buying electronics.

- Best Buy's customer satisfaction score is 75 out of 100 in 2024.

- The ability to price match increases customer bargaining power.

Fragmented customer base

Best Buy benefits from a fragmented customer base, meaning no single customer group holds significant sway over its sales. This distribution of customers limits the power any one group can exert on the company's strategies. In 2024, Best Buy's diverse customer base allowed it to navigate economic shifts with greater resilience. This setup enables Best Buy to appeal to a wide range of consumers without relying heavily on specific segments.

- Customer diversity helps stabilize revenue streams.

- Reduces vulnerability to changes in any single customer group's behavior.

- Best Buy can adapt its offerings to broader market trends.

Best Buy's customers wield considerable power due to price sensitivity and easy comparison shopping. Numerous alternatives like Amazon and Walmart heighten this power, making switching costs low. The prevalence of online reviews and price comparison tools further boosts customer leverage, as customers make informed decisions.

| Aspect | Details | 2024 Data |

|---|---|---|

| Price Sensitivity | Customers are very sensitive to price changes. | Avg. electronics price changes +3% |

| Alternative Options | Many choices exist, increasing customer power. | Amazon's revenue: $575B+ |

| Switching Costs | Low switching costs to competitors. | Online sales: 30% of revenue |

Rivalry Among Competitors

The consumer electronics market is fiercely competitive, with Best Buy facing rivals like Amazon and Walmart. Price wars are common, as retailers use discounts to lure customers. This puts pressure on Best Buy's profit margins, particularly with electronics sales down 5.5% in Q3 2024. Best Buy must constantly adapt pricing to stay competitive.

The consumer electronics market is highly concentrated, with Amazon, Walmart, and Best Buy holding substantial market share. These giants fiercely compete, employing strategies like aggressive pricing and expansive product offerings. In 2024, Best Buy's revenue reached approximately $43.4 billion, reflecting the intense rivalry. This dominance by a few major players significantly heightens competitive pressures.

The surge of e-commerce has amplified competition, with giants like Amazon challenging brick-and-mortar stores. Best Buy must integrate its online and offline channels to compete effectively. This is vital for holding onto its market share. In 2024, Amazon's net sales reached approximately $574.7 billion, reflecting its e-commerce dominance.

Product differentiation challenges

Product differentiation presents a significant challenge for Best Buy, as it competes with numerous retailers offering similar products. This lack of distinctiveness often intensifies price competition, pressuring profit margins. To thrive, Best Buy needs to innovate beyond just product selection, focusing on enhancing the customer experience and offering unique services. This is especially critical given the competitive landscape.

- Best Buy's 2024 revenue was approximately $43.4 billion, highlighting the scale of its operations.

- The electronics retail market is highly competitive, with major players like Amazon and Walmart.

- Best Buy has invested in services like Geek Squad to differentiate itself.

- Price wars can erode profitability, as seen in various retail sectors.

High advertising expenditure

The consumer electronics industry sees significant advertising spending, intensifying competition among major players. High marketing costs increase the financial pressure on companies like Best Buy. Best Buy allocated $1.34 billion for selling, general, and administrative expenses, which includes marketing, in fiscal year 2024. These expenditures are crucial for maintaining market share and brand visibility.

- Best Buy's marketing budget impacts its profitability.

- Advertising expenses are a key element of competitive dynamics.

- High spending increases the cost of doing business.

- Best Buy must compete with other retailers like Amazon.

Best Buy faces fierce competition from Amazon and Walmart, driving price wars and margin pressures. The market is concentrated, with these giants dominating the electronics sector. Best Buy's 2024 revenue was about $43.4 billion, reflecting the scale of competition. Intense rivalry demands constant adaptation to stay competitive.

| Aspect | Details |

|---|---|

| Key Competitors | Amazon, Walmart |

| 2024 Revenue | Best Buy: ~$43.4B |

| Market Dynamics | Price wars, e-commerce dominance |

SSubstitutes Threaten

Online marketplaces, like Amazon and eBay, pose a significant threat. They offer electronics at competitive prices. Best Buy competes with their vast product selection and reach. In 2023, Amazon's electronics sales were $147 billion, highlighting the challenge. Best Buy must adapt to stay competitive.

The threat of substitutes for Best Buy includes direct manufacturer sales. Companies like Apple and Samsung increasingly sell directly to consumers. This strategy can provide lower prices and more customization options. In 2024, direct-to-consumer sales accounted for a significant portion of electronics purchases. Best Buy must compete with these evolving distribution channels.

Refurbished electronics pose a threat to Best Buy. These used products, often at lower prices, are attractive to budget-conscious consumers. In 2024, the market for used electronics is substantial. Statista projects the global market for used consumer electronics to reach $68.8 billion in 2024, increasing the substitution risk.

Rental and subscription services

Rental and subscription services are becoming viable substitutes for outright purchases of electronics. Services like those offered by Grover and others allow customers to access products without the long-term commitment. This shift is driven by consumers seeking flexibility and the latest tech without ownership burdens. Best Buy faces pressure to adapt its offerings to stay competitive.

- The global market for electronics rental is projected to reach $87.6 billion by 2024.

- Subscription services for consumer electronics are experiencing 15-20% annual growth.

- Best Buy's revenue from services and subscriptions grew by 7.9% in Q3 2024.

Product alternatives

Customers have numerous choices that can satisfy their needs, which poses a threat to Best Buy. Tablets can substitute for laptops, and streaming services can replace DVD players. The availability of these alternatives increases the threat of substitution. This forces Best Buy to compete with a wider range of products and services.

- In 2024, the global streaming market is estimated to be worth over $80 billion, highlighting the significant shift from traditional media.

- The tablet market, though smaller than laptops, still represents a viable alternative, with sales reaching $16 billion in 2024.

- Best Buy's ability to offer unique services like in-store tech support can help mitigate this threat.

The threat of substitutes for Best Buy is substantial, encompassing various alternatives that meet consumer needs. Online platforms, like Amazon and direct manufacturer sales, offer competitive choices, pressuring Best Buy to adapt. Rental and subscription models provide alternatives to outright purchases, further diversifying consumer options.

| Substitute Type | Market Size/Growth (2024) | Best Buy's Strategy |

|---|---|---|

| Online Marketplaces | Amazon Electronics Sales: $155B | Competitive Pricing, Enhanced Services |

| Direct Manufacturer Sales | Significant growth in DTC | Focus on unique in-store experiences |

| Rental/Subscription Services | $87.6B (Projected) | Expand subscription and service offerings |

Entrants Threaten

Best Buy faces a threat from new entrants due to high capital requirements. Establishing a consumer electronics retail operation demands substantial investment in inventory, store locations, and infrastructure. These financial barriers significantly deter potential new entrants. For example, in 2024, the average cost to open a Best Buy store was estimated to be between $5-10 million, depending on the size and location.

Best Buy benefits from strong brand loyalty, a key barrier against new entrants. Customers often stick with familiar brands, making it tough for newcomers to gain traction. New entrants must invest heavily in marketing and customer service to build trust. In 2024, Best Buy's brand recognition helped maintain a 20% market share in consumer electronics.

Best Buy, as a large retailer, benefits from economies of scale, particularly in purchasing, distribution, and marketing. Established companies like Best Buy can negotiate lower prices from suppliers due to their high-volume purchases. This cost advantage makes it challenging for new entrants to compete on price, as seen with Best Buy's revenue of $43.4 billion in fiscal year 2024. New companies often struggle to match the efficiency and pricing of established players.

Complex supply chain

Managing a complex supply chain and distribution network is crucial in consumer electronics retail. New entrants struggle with the established infrastructure and relationships required for efficiency. This creates a significant barrier to entry, protecting existing players like Best Buy. Building an effective supply chain is a substantial challenge, often involving high initial investments and operational complexities. In 2024, Best Buy's supply chain costs were approximately 6% of revenue, reflecting its significant investment and expertise.

- High Initial Investment

- Operational Complexities

- Established Infrastructure

- Supply Chain Costs

Online competition

The online retail landscape presents a mixed bag for Best Buy. The ease of setting up an e-commerce store has lowered barriers, enabling new entrants to reach customers faster. However, these new players face intense competition from established giants like Amazon. Best Buy's revenue in 2024 was $43.4 billion, highlighting the scale of the market.

- E-commerce allows quick market access for new entrants.

- Competition is fierce, especially with major players like Amazon.

- Best Buy's 2024 revenue was $43.4B, indicating the market's size.

New entrants face hurdles due to high capital needs and established infrastructure. Brand loyalty and economies of scale favor existing players like Best Buy. E-commerce lowers some barriers, but competition remains intense.

| Barrier | Impact on New Entrants | 2024 Data |

|---|---|---|

| Capital Requirements | High investment in inventory, stores | Best Buy store opening cost: $5-10M |

| Brand Loyalty | Difficult to gain customer trust | Best Buy market share ~20% |

| Economies of Scale | Price competition challenge | Best Buy revenue: $43.4B |

Porter's Five Forces Analysis Data Sources

This Porter's Five Forces analysis synthesizes information from Best Buy's annual reports, market share data, and competitor analysis reports. Industry publications and financial data providers also provide additional data.