Best Buy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Best Buy Bundle

What is included in the product

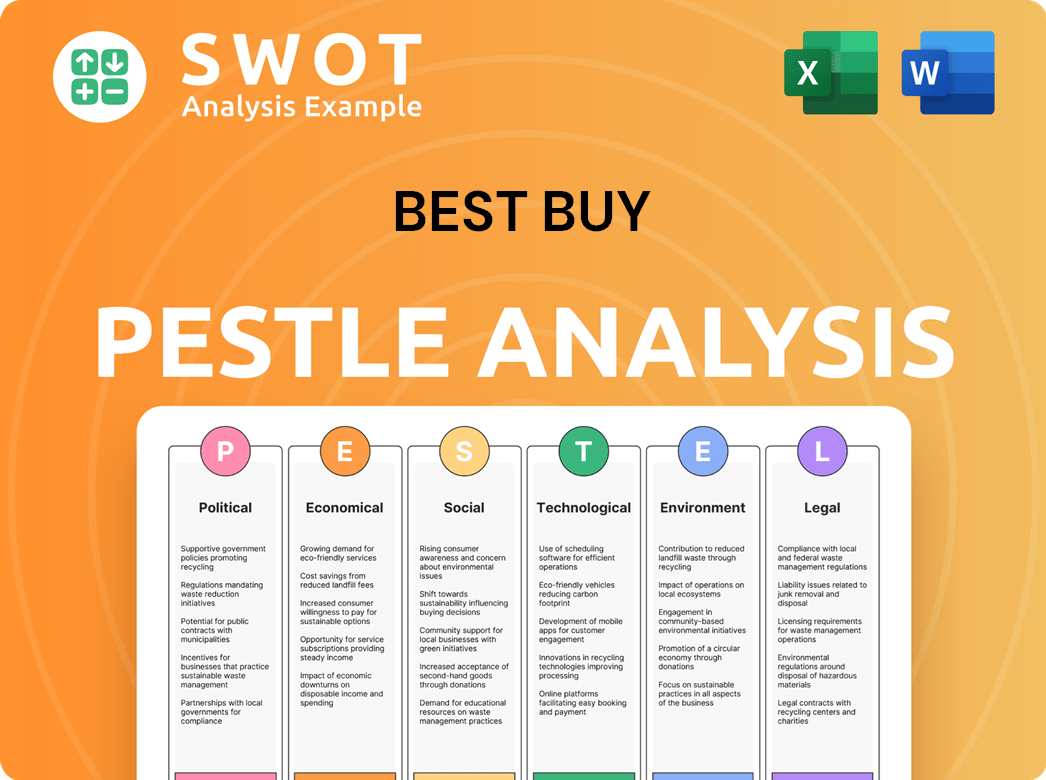

Examines how external factors impact Best Buy through Political, Economic, Social, Technological, Environmental, and Legal lenses.

Provides a concise version for quick understanding of complex factors impacting Best Buy.

Same Document Delivered

Best Buy PESTLE Analysis

The preview is the final document. What you see here is a complete Best Buy PESTLE Analysis.

The content, structure, and formatting will be exactly the same.

After purchasing, download the identical, ready-to-use file.

There are no changes, you are buying the exact analysis.

Own this fully formatted document after checkout!

PESTLE Analysis Template

Explore Best Buy's strategic landscape with our PESTLE Analysis.

Uncover political, economic, social, technological, legal, and environmental influences.

Gain vital insights into Best Buy's operational success and challenges.

Perfect for investors and business strategists alike.

Get the full analysis now to make informed decisions and strengthen your plans.

Political factors

Changes in trade agreements and tariffs on electronics directly influence Best Buy's costs. For instance, tariffs on Chinese imports have affected pricing. In 2024, Best Buy closely monitors trade policies to adjust pricing. This is critical for maintaining competitiveness. A 2024 study showed a 5% increase in prices due to tariffs.

Best Buy must comply with stringent government regulations on electronic product safety. These regulations, such as those from the Consumer Product Safety Commission (CPSC), are crucial. In 2024, the CPSC recalled over 100 products. Adherence ensures customer safety and avoids costly recalls. This compliance demands strong quality control and supply chain management.

Data privacy laws are becoming stricter worldwide, impacting Best Buy's handling of customer data. Compliance necessitates investment in cybersecurity and data management. Non-compliance can lead to hefty fines and erode customer trust. Best Buy must adapt to regulations like GDPR and CCPA, which have led to companies facing penalties. In 2024, global data privacy fines reached $1.5 billion, reflecting the importance of compliance.

Political Stability in Operating Regions

Best Buy's operations are significantly influenced by political stability in its key markets. The U.S., Canada, and Mexico's political and economic climates directly impact consumer behavior and market dynamics. For example, in 2024, the U.S. saw a 3.2% GDP growth, reflecting relative economic stability. Political instability can disrupt supply chains and affect consumer spending, as seen during periods of trade tensions. Strategic planning requires careful monitoring of these political factors.

- U.S. GDP Growth (2024): 3.2%

- Canada's Inflation Rate (April 2024): 2.7%

- Mexico's Economic Growth Forecast (2024): 2.5%

Government Stimulus Programs

Government stimulus programs significantly impact consumer spending and, consequently, Best Buy's sales. Policies like tax rebates or unemployment benefits can boost demand for electronics. For instance, during the COVID-19 pandemic, stimulus checks led to increased spending on home entertainment. Best Buy must monitor these policies to anticipate market shifts. These programs can lead to temporary sales surges.

- Stimulus checks often result in a short-term spike in consumer spending.

- Unemployment benefits can support the demand for essential goods, including electronics.

- Tax incentives for energy-efficient products could boost sales of related items.

- Understanding policy timelines is crucial for inventory and marketing strategies.

Trade policies and tariffs affect Best Buy's costs and pricing strategies; in 2024, prices increased 5% due to tariffs. Strict product safety regulations require robust quality control. Data privacy laws necessitate investments in cybersecurity to avoid penalties.

| Factor | Impact | Example (2024) |

|---|---|---|

| Trade Policies | Cost fluctuations | 5% price increase due to tariffs |

| Product Safety Regulations | Compliance costs | 100+ product recalls by CPSC |

| Data Privacy Laws | Cybersecurity Investment | Global fines: $1.5B |

Economic factors

Rising inflation diminishes consumer purchasing power, potentially curbing spending on non-essential goods like those sold by Best Buy. With sales heavily reliant on consumer spending, Best Buy faces headwinds when purchasing power declines. In 2024, the U.S. inflation rate hovered around 3.1%, impacting consumer behavior. Managing inventory and pricing is crucial; Best Buy's gross profit margin was 22.2% in Q3 2024.

Interest rates significantly impact Best Buy and its customers. Rising rates increase borrowing costs, potentially decreasing consumer spending on electronics. Best Buy's financing options and investment strategies are also affected. In early 2024, the Federal Reserve maintained interest rates, influencing market dynamics.

Unemployment rates significantly influence consumer behavior and disposable income. Elevated unemployment often curtails spending on discretionary items, which could negatively impact Best Buy's sales. For example, in early 2024, the U.S. unemployment rate hovered around 3.7%, a crucial factor to consider. Tracking labor market shifts offers a glimpse into future demand for Best Buy's products.

Economic Growth and Recession Risks

Economic growth significantly affects Best Buy. In 2024, the U.S. GDP grew, but concerns about a potential recession lingered. Consumer spending on electronics often declines during economic downturns. Best Buy's financial health correlates with the economic cycle.

- 2024 U.S. GDP growth rate: approximately 3.1%.

- Consumer electronics spending in recession: typically decreases.

- Best Buy's revenue fluctuations: linked to economic performance.

Currency Exchange Rates

Best Buy faces currency exchange rate risks. The US dollar's strength against the Canadian dollar and Mexican peso impacts import costs. Currency fluctuations affect international sales revenue. Hedging strategies are crucial for financial stability. For instance, in 2024, the USD/CAD exchange rate averaged around 1.35, while USD/MXN was about 17.00.

- Impact on import costs and international sales.

- Need for hedging strategies to manage risk.

- Focus on financial stability.

- Exchange rate values in 2024 as examples.

Economic conditions, like inflation, interest rates, and unemployment, heavily affect consumer spending. Rising inflation and interest rates can decrease Best Buy's sales by impacting consumer spending and their borrowing behavior. GDP growth, like the 3.1% in the US for 2024, plays a crucial role in Best Buy's financial success, and fluctuations impact revenues.

| Factor | Impact on Best Buy | 2024/2025 Data |

|---|---|---|

| Inflation | Reduces purchasing power. | U.S. 2024 Inflation: ~3.1%. |

| Interest Rates | Influence borrowing and spending. | Early 2024: Fed maintained rates. |

| Unemployment | Affects disposable income. | Early 2024 U.S. ~3.7%. |

Sociological factors

Consumer shopping habits are shifting online, impacting Best Buy. E-commerce growth demands a strong omnichannel presence. Physical stores still matter for services. In 2024, online sales rose, representing about 35% of total revenue. Adapting to these shifts is crucial for maintaining market share.

Demographic shifts significantly influence Best Buy's market. An aging population and tech-savvy younger generations alter demand. Best Buy must adapt offerings and marketing. In 2024, Millennials and Gen Z represented over 40% of consumer electronics spending. Understanding generational tech preferences is crucial for success.

Emerging lifestyle trends, like smart homes and remote work, open new markets for Best Buy. Demand for tech products rises with these shifts. Best Buy can benefit by offering relevant products, services, and solutions. In 2024, smart home tech sales are projected to reach $78.3 billion, showing strong growth. Remote work boosts demand for home office setups.

Social Responsibility and Ethical Consumerism

Consumers are increasingly prioritizing social and environmental impacts when making purchasing decisions. Best Buy's ethical sourcing, labor practices, and community involvement significantly influence its brand perception. Corporate social responsibility strengthens brand loyalty, particularly among younger demographics. This focus is crucial for long-term sustainability and market share. In 2024, 77% of consumers said they would choose brands that align with their values.

- Consumer preference for ethical brands is rising.

- Best Buy's reputation directly affects sales.

- CSR boosts customer loyalty.

- Younger consumers highly value ethical practices.

Brand Perception and Trust

Brand perception and trust are crucial for Best Buy's success. Customer service, product reliability, and pricing fairness shape consumer trust. A positive brand image fosters repeat business and attracts new customers. Maintaining a strong reputation requires continuous effort. In 2024, Best Buy's customer satisfaction score was 78%, reflecting these factors.

- Customer satisfaction scores directly impact brand perception.

- Product reliability is key to building trust and loyalty.

- Fair pricing strategies enhance customer trust.

- Consistent customer service quality is essential.

Ethical brand preference increases; this influences Best Buy. CSR boosts loyalty, key for younger buyers. Reputation greatly affects sales.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Ethical Consumption | Drives purchasing | 77% of consumers favor ethical brands |

| CSR Initiatives | Boosts loyalty | Focus on ESG is vital for younger consumers |

| Brand Perception | Impacts sales | Best Buy's customer satisfaction (78% in 2024) |

Technological factors

E-commerce advancements and competition are critical. Best Buy faces stiff competition from online giants like Amazon. To compete, it must invest in its online platform. In Q4 2023, Best Buy's online sales were $3.8 billion, showing the importance of digital. Continuous innovation is key to staying relevant.

The consumer electronics market sees swift tech changes and frequent upgrades. Best Buy combats obsolescence by managing inventory and stocking the latest products. In 2024, the average product lifecycle in consumer electronics was about 12-18 months. Keeping pace with innovation is crucial for product relevance. Best Buy's inventory turnover rate in 2024 was approximately 3.5 times, showing efficient inventory management.

Best Buy's adoption of AI and automation is pivotal. It streamlines inventory, customer service, and marketing. This tech enhances efficiency and customer experience. For example, AI-driven chatbots have improved customer interactions. Investing in AI is crucial for a competitive edge. Best Buy's tech spending in 2024 reached $1.2 billion.

Cybersecurity Threats

Best Buy faces significant cybersecurity threats due to its extensive customer data and online sales. Data breaches can lead to substantial financial losses, reputational damage, and legal liabilities. In 2024, the average cost of a data breach was $4.45 million globally. Protecting customer data is crucial, and robust cybersecurity is a must.

- Average cost of a data breach globally in 2024: $4.45 million.

- Cybersecurity Ventures projects global cybercrime costs to reach $10.5 trillion annually by 2025.

- Best Buy's online sales accounted for a significant portion of its revenue in 2023, making it a prime target.

- Companies with strong cybersecurity measures often see increased customer trust and loyalty.

Evolving Payment Technologies

The rise of innovative payment methods, like contactless payments and mobile wallets, demands Best Buy to integrate these options. A smooth checkout experience is crucial, making it vital to offer easy and secure payment methods. Remaining updated with payment tech trends is paramount for customer satisfaction. In 2024, mobile payments are projected to reach $1.5 trillion in the US.

- Contactless payments adoption increased by 40% in 2024.

- Mobile wallet usage grew by 25% year-over-year.

- Cryptocurrency payments are still niche but growing.

Best Buy navigates e-commerce competition by investing heavily in its digital platform; online sales hit $3.8B in Q4 2023. Fast-paced tech changes and frequent upgrades force Best Buy to keep inventory fresh, as product lifecycles average 12-18 months. AI and automation adoption streamline inventory, customer service, and marketing, while cybersecurity remains a crucial investment. They need to embrace mobile wallets, too, as mobile payments in the US are forecast to hit $1.5T in 2024.

| Tech Aspect | Impact | 2024 Data |

|---|---|---|

| E-commerce | Competition & Sales | Online Sales: $3.8B (Q4 2023) |

| Product Lifecycles | Inventory | 12-18 months average |

| AI & Automation | Efficiency & CX | Tech Spending: $1.2B (2024) |

| Cybersecurity | Data Protection | Avg. Breach Cost: $4.45M |

| Payment Tech | Customer Experience | Mobile Payments: $1.5T (Projected in US) |

Legal factors

Best Buy is subject to consumer protection laws regarding warranties, advertising, and returns. Compliance is essential for maintaining a good reputation and avoiding legal issues. For example, in 2024, the FTC issued over $100 million in civil penalties for consumer protection violations. These laws help build consumer trust.

Best Buy must navigate labor laws, including minimum wage, working hours, and employee benefits. Compliance with federal and state regulations is crucial for operational costs. For example, the federal minimum wage remained at $7.25 in 2024. Changes in these laws can impact staffing and profits. Some states, like California, have higher minimum wages, affecting Best Buy's expenses.

Best Buy must comply with data security and privacy laws like the CCPA. This is vital for protecting customer data. Strong data protection is essential. Non-compliance risks legal issues and reputational damage. In 2024, data breaches cost companies an average of $4.45 million globally, emphasizing the financial impact of non-compliance.

Intellectual Property Rights

Best Buy faces legal obligations related to intellectual property. It must uphold the intellectual property rights of brands whose products it sells, avoiding counterfeit items. Proper software licensing is also essential for compliance. Protecting intellectual property maintains the integrity of its product range. In 2024, the global anti-counterfeiting market was valued at $600 billion, highlighting the scale of IP protection efforts.

- Compliance with IP laws is crucial for avoiding legal issues and maintaining customer trust.

- Best Buy's reputation depends on selling authentic, properly licensed products.

- Failure to protect IP can lead to significant financial penalties and reputational damage.

Product Compliance and Safety Standards

Best Buy must ensure all products meet safety standards, a key legal duty. This includes close collaboration with suppliers and constant monitoring of product certifications. Non-compliant products can lead to significant financial repercussions, including product recalls and hefty fines. For instance, in 2024, the Consumer Product Safety Commission (CPSC) issued over $30 million in penalties for safety violations across various retailers. Legal compliance is crucial to maintain consumer trust and avoid costly legal battles.

- Product recalls can cost companies millions, affecting brand reputation.

- Best Buy must adhere to federal and state regulations.

- Regular audits and testing are essential for compliance.

Legal compliance for Best Buy spans consumer protection, labor, data privacy, intellectual property, and product safety. Non-compliance results in reputational damage and substantial penalties. In 2024, data breaches cost firms ~$4.45M globally.

| Legal Area | Impact | 2024 Data |

|---|---|---|

| Consumer Protection | Reputation, Fines | FTC Penalties: ~$100M+ |

| Data Privacy | Financial, Trust | Breach Cost: ~$4.45M/incident |

| Product Safety | Recalls, Fines | CPSC Penalties: ~$30M+ |

Environmental factors

E-waste regulations significantly affect Best Buy's trade-in and recycling programs. Compliance with these laws is crucial for environmental responsibility and legal adherence. Best Buy's commitment to responsible disposal is essential for sustainability. The global e-waste market is projected to reach $106.5 billion by 2025. Best Buy collected 1.5 billion pounds of electronics and appliances for recycling in 2023.

Energy efficiency is a major factor. Best Buy's product choices and facility operations are shaped by it. Consumers want energy-efficient products. In 2024, Best Buy's sustainability report highlighted energy savings across its stores and supply chain. This reduces environmental impact and operational costs.

Best Buy faces increasing pressure to make its supply chain sustainable. This involves managing environmental impacts from raw materials to shipping. Collaboration with suppliers on green practices is crucial. In 2024, Best Buy reported progress in reducing its supply chain emissions. Best Buy's commitment to supply chain sustainability is part of its corporate responsibility strategy.

Climate Change Impact and Adaptation

Climate change presents significant physical risks to Best Buy, with extreme weather potentially disrupting supply chains and store operations. Adapting to these challenges involves making infrastructure and logistics more resilient. Addressing climate-related risks is becoming increasingly crucial for businesses. Best Buy's sustainability efforts, including energy efficiency measures, are vital.

- In 2024, the U.S. saw 28 weather/climate disaster events exceeding $1 billion each.

- Best Buy aims to reduce its carbon emissions by 60% by 2030.

- Investments in renewable energy and sustainable packaging are crucial.

- Extreme weather events have caused supply chain disruptions, impacting retail.

Consumer Demand for Eco-friendly Products

Consumer demand for eco-friendly products significantly impacts Best Buy's strategies. The rising consumer awareness drives the need for sustainable product choices. Focusing on green options can attract customers and boost sales. This shift is evident; in 2024, the market for sustainable products reached $170 billion.

- Sustainable products market reached $170 billion in 2024.

- Promoting eco-friendly options enhances brand image.

- Responding to demand can boost sales.

- Consumer awareness drives the need for sustainable options.

Environmental factors heavily influence Best Buy. E-waste rules impact recycling programs, with a projected $106.5 billion market by 2025. Energy efficiency and sustainable supply chains, crucial for costs and image, drive eco-friendly product demand, reaching $170 billion in 2024. Climate risks, like disruptions from extreme weather costing the U.S. over $1B per event in 2024, are addressed through emission cuts (60% by 2030) and sustainable investments.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| E-waste Regulations | Shapes recycling, trade-in programs | $106.5B e-waste market (2025 projection) |

| Energy Efficiency | Influences product choices & operations | Store/supply chain energy savings in 2024 |

| Supply Chain Sustainability | Managing impact, collaboration with suppliers | Emissions reduction progress in 2024 |

PESTLE Analysis Data Sources

Best Buy's PESTLE analysis utilizes industry reports, economic data from reputable sources, and government publications for relevant insights.