Bio-Rad Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bio-Rad Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

Printable summary optimized for A4 and mobile PDFs, allows quick sharing and avoids formatting issues.

Preview = Final Product

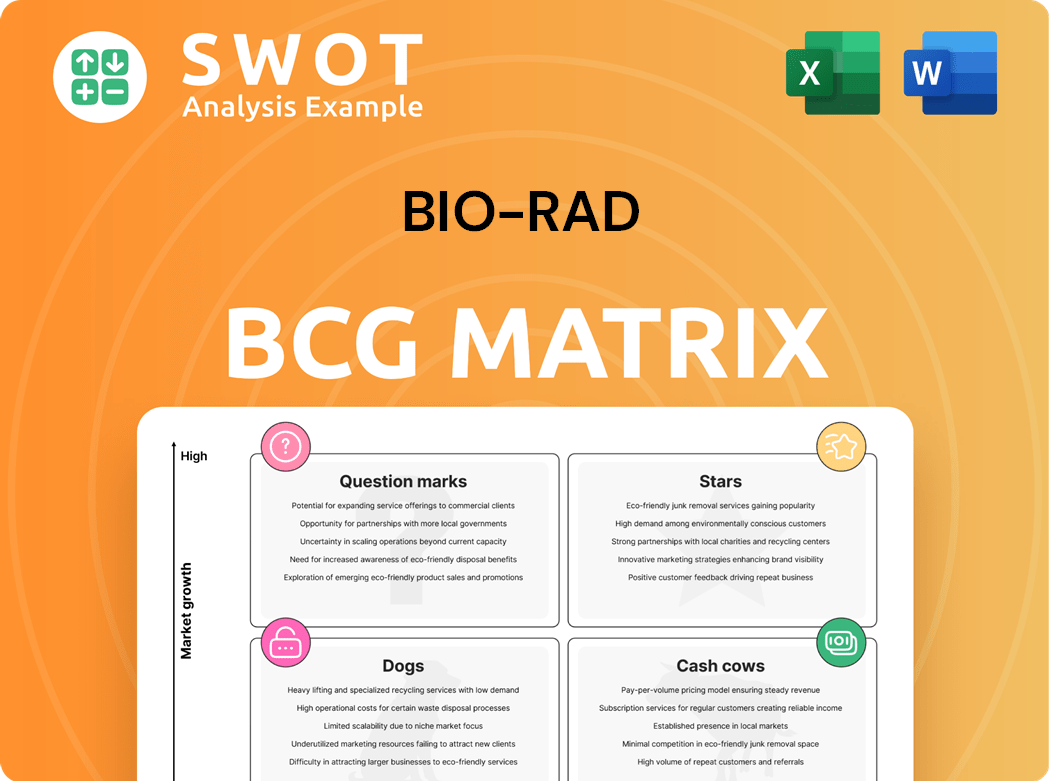

Bio-Rad BCG Matrix

The Bio-Rad BCG Matrix preview shows the complete, downloadable document you'll receive. It's the finalized, ready-to-use version, perfect for immediate strategic application and insights. There are no hidden features or edits needed—it’s ready for immediate use.

BCG Matrix Template

Bio-Rad's BCG Matrix preview offers a glimpse into its diverse product portfolio's market position. Stars shine, showcasing high growth and market share, while Cash Cows generate steady revenue. Question Marks present growth potential, and Dogs may need strategic reconsideration. This snapshot only scratches the surface.

Get the full BCG Matrix and unlock detailed quadrant analysis, data-driven recommendations, and strategic insights. Purchase now for a clear roadmap!

Stars

Bio-Rad's Clinical Diagnostics segment is a cornerstone of its business, showing consistent expansion. In 2024, this segment accounted for a significant portion of Bio-Rad's total revenue. The segment's growth is supported by the increasing demand for advanced diagnostic tools. It includes products for blood typing, infectious disease testing, and diabetes monitoring.

Bio-Rad's Quality Control Products are a key part of its portfolio, holding a leading position in diagnostic quality controls, essential for ensuring accurate lab results. In 2024, the clinical diagnostics market, where these products play a vital role, reached an estimated $90 billion globally. Bio-Rad's focus on quality control helps labs meet regulatory standards, increasing the products' value. This aligns with the company's strategic goal of expanding its clinical diagnostics segment, with an estimated revenue of $3.1 billion in 2024.

Blood typing products are seeing increased demand, fueling growth in this area. In 2024, Bio-Rad's clinical diagnostics segment, which includes these products, showed steady revenue. The global blood typing market is expanding, with projections estimating it will reach $1.5 billion by 2028.

Digital PCR

Bio-Rad's digital PCR offerings, strengthened by the Stilla Technologies acquisition, provide precise nucleic acid quantification. This technology is a key part of Bio-Rad's BCG Matrix. Digital PCR is experiencing market growth; the global digital PCR market was valued at $620.8 million in 2023. The market is projected to reach $1.11 billion by 2028.

- Stilla Technologies acquisition boosted digital PCR capabilities.

- Global digital PCR market was estimated at $620.8 million in 2023.

- Market projected to reach $1.11 billion by 2028.

- Digital PCR offers precise nucleic acid quantification.

Innovation

Bio-Rad's "Stars" segment is fueled by innovation, particularly through strategic investments. The company's backing of firms like Geneoscopy and Oncocyte highlights this commitment. These investments aim to foster advancements in areas such as cancer diagnostics, reflecting a forward-thinking approach. This focus is crucial for maintaining a competitive edge in the rapidly evolving life science industry.

- Geneoscopy's Series B funding round in 2024 raised $147 million.

- Oncocyte's 2024 revenue was approximately $28.5 million.

- Bio-Rad's R&D spending was about $226.6 million in 2023.

Bio-Rad's "Stars" represent high-growth areas, like digital PCR. These segments benefit from substantial investment and strategic acquisitions. Investments in companies like Geneoscopy, which secured $147 million in Series B funding in 2024, are key. Oncocyte's 2024 revenue was roughly $28.5 million, driven by innovation.

| Category | Metric | Value |

|---|---|---|

| R&D Spending (2023) | Bio-Rad | $226.6M |

| Geneoscopy Series B (2024) | Funding | $147M |

| Oncocyte Revenue (2024) | Approximate | $28.5M |

Cash Cows

Bio-Rad is a leader in quality controls for clinical diagnostics, a key part of its "Cash Cows" in the BCG Matrix. In 2024, Bio-Rad's clinical diagnostics segment saw a revenue of $1.7 billion. This area provides consistent revenue, essential for supporting innovation and growth. Quality controls ensure test accuracy, making them vital for labs worldwide.

Immunohematology, a key part of Bio-Rad's offerings, consistently delivers revenue. In 2024, this segment contributed significantly to Bio-Rad's overall financial performance. The steady demand for blood typing and related products ensures a reliable income stream. This stability makes it a crucial component of the company's portfolio.

Consumable reagents are a major revenue driver for Bio-Rad. In 2023, reagents and consumables represented around 60% of their total sales. This segment's consistent demand provides a steady income stream. It also supports recurring revenue through ongoing customer needs.

Molecular Diagnostics

Molecular diagnostics, a cash cow for Bio-Rad, benefits from robust demand, driving growth. The global molecular diagnostics market was valued at $9.7 billion in 2024. This segment provides steady revenue streams. Bio-Rad's focus on this area strengthens its market position.

- Market Size: The global molecular diagnostics market was valued at $9.7 billion in 2024.

- Revenue Stability: This segment provides steady revenue streams.

- Strategic Focus: Bio-Rad's focus strengthens its market position.

Blood Typing

Blood typing is a stable market for Bio-Rad, representing a reliable revenue stream. The company's blood typing products cater to a consistent demand in healthcare. Bio-Rad leverages its established market position to generate steady cash flow from this segment. In 2024, the blood typing market is estimated to have a value of approximately $1.2 billion globally.

- Consistent Revenue: Blood typing provides a predictable income source.

- Market Stability: The demand for blood typing is relatively constant.

- Established Position: Bio-Rad has a strong foothold in this market.

- Global Market Size: The worldwide blood typing market is significant.

Cash Cows are stable revenue sources for Bio-Rad. The clinical diagnostics segment brought in $1.7 billion in 2024. Blood typing, valued at $1.2 billion, offers consistent income. Reagents and consumables represent around 60% of total sales, ensuring steady cash flow.

| Segment | 2024 Revenue (approx.) | Market Stability |

|---|---|---|

| Clinical Diagnostics | $1.7 billion | High |

| Blood Typing | $1.2 billion | High |

| Reagents/Consumables | ~60% of sales | High |

Dogs

Weakness in biotech end-markets negatively impacted sales in 2024. Bio-Rad's Q1 2024 revenue decreased by 1.9% year-over-year, reflecting these challenges. This downturn is linked to reduced demand and funding constraints within the biotech sector. The company is adapting to the shifting market dynamics.

The biopharma sector poses challenges, affecting Life Science segment results. In 2024, Bio-Rad's Life Science revenue decreased. Specifically, Q3 2024 showed a decline in sales within this segment. The slowdown is attributed to biotech funding constraints.

Bio-Rad's Asia Pacific region saw decreased sales, partially negating gains elsewhere. In Q3 2023, the Asia Pacific region's sales decreased, impacting overall revenue. This decline was influenced by factors like reduced demand or currency fluctuations. The company's strategic focus aims to address these regional challenges.

COVID-related Sales

COVID-related sales for Bio-Rad have seen a notable downturn. Following a surge in 2020-2021, revenue declined. This shift reflects the changing dynamics of the pandemic. The company's strategic adjustments are crucial.

- 2021: $773 million in sales

- 2022: Sales decreased to $301 million

- 2023: Further decrease to $163 million

- Market adjustments are ongoing.

Life Science Segment

In 2024, Bio-Rad's Life Science segment faced a sales decrease. This segment, a key part of Bio-Rad's BCG Matrix, saw changes influenced by market dynamics. The company's focus on innovation and strategic adjustments aims to navigate these shifts effectively. Understanding the segment's performance is crucial for assessing Bio-Rad's overall financial health and market position.

- Sales decrease in 2024.

- Impacted by market dynamics.

- Focus on innovation and strategy.

- Crucial for financial assessment.

Dogs in the BCG matrix represent products with low market share in a low-growth market. Bio-Rad's COVID-related sales, like its PCR products, fit this profile in 2024, showing declining revenues after the pandemic surge. The company's focus is on adapting to changing market dynamics.

| Year | COVID Sales (Millions) | Market Position |

|---|---|---|

| 2021 | $773 | High |

| 2022 | $301 | Decreasing |

| 2023 | $163 | Low |

| 2024 | Ongoing Decline | Dog |

Question Marks

The genomics market is positioned as a "Question Mark" in Bio-Rad's BCG Matrix. This indicates high market growth but uncertain market share. The global genomics market was valued at $27.4 billion in 2023, with projections reaching $60.2 billion by 2030. Bio-Rad faces the challenge of capturing a larger share in this rapidly expanding sector.

Proteomics, as highlighted by Bio-Rad, is advancing rapidly, promising better clinical results. In 2024, the proteomics market was valued at approximately $35 billion globally. The growth rate is projected to be around 15% annually. This expansion is driven by new technologies.

Cell biology is a key area for Bio-Rad's future growth. In 2024, the global cell biology market was valued at approximately $30 billion. Bio-Rad can leverage this by creating innovative cell biology products.

Food Safety

Food safety is a burgeoning market, and Bio-Rad's involvement is strategic. The global food safety testing market was valued at $20.4 billion in 2023 and is projected to reach $30.8 billion by 2028. Bio-Rad's focus here aligns with significant growth potential. This sector is crucial for public health and regulatory compliance.

- Market growth is driven by increasing foodborne illnesses and stricter regulations.

- Bio-Rad offers various food safety testing solutions.

- Key competitors include Thermo Fisher Scientific and Eurofins Scientific.

- The market is expected to grow at a CAGR of 8.6% from 2023 to 2028.

Process Chromatography

Process chromatography, a key segment within Bio-Rad's BCG Matrix, is anticipated to experience high single-digit growth. This positive outlook is supported by the increasing demand for biopharmaceuticals and the critical role chromatography plays in their production. In 2024, the market continues to expand, driven by technological advancements and the need for efficient separation and purification processes. This growth trajectory indicates a healthy and promising area for Bio-Rad's strategic investments.

- High single-digit growth is expected for process chromatography.

- Driven by biopharmaceutical demand and efficient purification needs.

- Technological advancements support market expansion in 2024.

- Chromatography plays a critical role in biopharma production.

In Bio-Rad's BCG Matrix, the genomics market is classified as a "Question Mark". This highlights high growth potential. The global genomics market reached $27.4B in 2023, with projections of $60.2B by 2030. Bio-Rad aims to increase its market share in this sector.

| Characteristic | Details |

|---|---|

| Market Position | Question Mark |

| 2023 Market Value | $27.4 Billion |

| Projected 2030 Value | $60.2 Billion |

BCG Matrix Data Sources

This Bio-Rad BCG Matrix uses financial data, market analyses, and competitive intelligence from trusted research for robust strategic insights.