Bio-Rad PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bio-Rad Bundle

What is included in the product

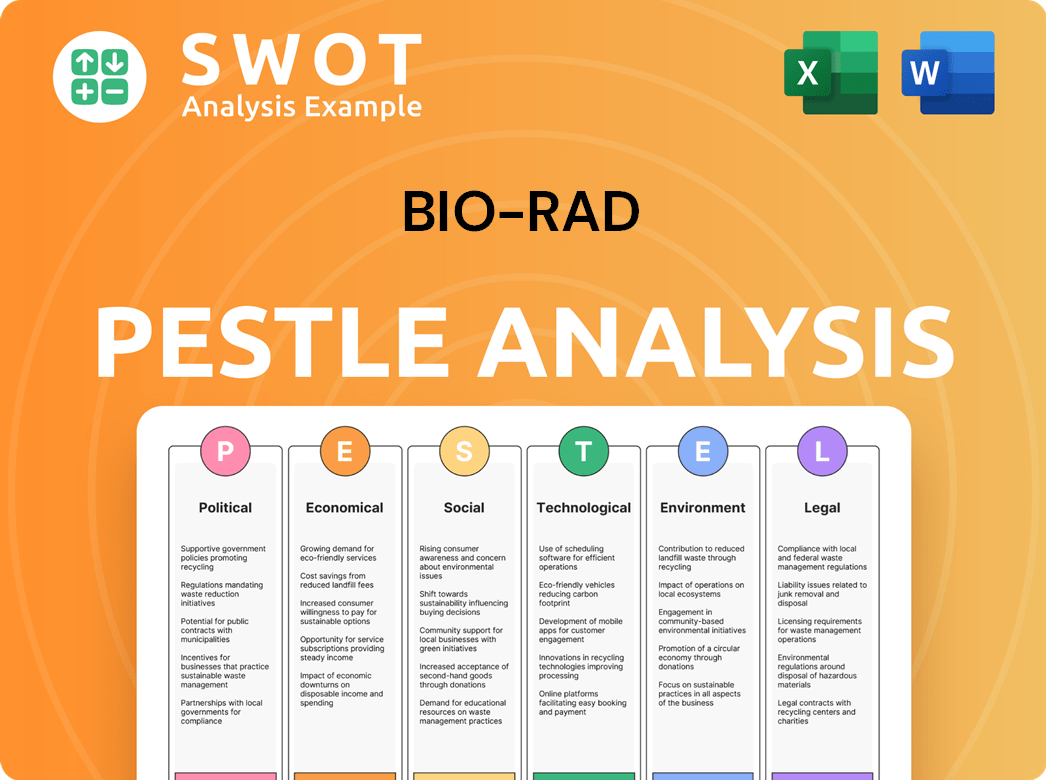

Unpacks how macro-environmental forces influence Bio-Rad, covering Political, Economic, Social, Tech, Environmental, and Legal realms.

Helps quickly identify external factors, fostering better decision-making. This is essential for anticipating and adapting to changes.

Same Document Delivered

Bio-Rad PESTLE Analysis

The preview of the Bio-Rad PESTLE analysis showcases the final product.

You'll download this complete, professional document immediately after purchase.

This is not a sample; it's the fully realized analysis.

The formatting and content shown are what you receive.

Get ready to analyze!

PESTLE Analysis Template

Explore the critical external factors influencing Bio-Rad with our expertly crafted PESTLE analysis. Uncover the political, economic, social, technological, legal, and environmental forces shaping its industry. Gain clarity on market opportunities and potential risks. Download the full analysis now and empower your strategic decisions with actionable insights.

Political factors

Government healthcare spending and policies heavily influence Bio-Rad's market. Increased spending boosts demand for diagnostics and research tools. Conversely, austerity measures or shifting funding priorities can curb sales. For example, in 2024, US healthcare spending reached $4.8 trillion, impacting the company's revenue. Governments globally aim to control costs, potentially limiting growth.

International trade relations and tariffs significantly impact Bio-Rad's global operations. Global trade tensions, like those with China, can disrupt supply chains and increase manufacturing costs. For instance, pharmaceutical tariffs, if implemented, would directly affect Bio-Rad's product pricing. In 2024, Bio-Rad's international sales accounted for roughly 55% of total revenue, making trade policy crucial.

Bio-Rad faces evolving global regulations in life science and clinical diagnostics. Political actions affect rules on product approvals, manufacturing, and data privacy. Compliance changes are costly for the company. For example, in 2024, Bio-Rad spent $120 million on regulatory compliance and anticipates $125 million in 2025.

Political Stability in Operating Regions

Political stability significantly impacts Bio-Rad's operations. Instability in regions with manufacturing or sales can disrupt supply chains and market access. A global footprint exposes the company to diverse political climates, requiring careful risk management. For example, political tensions in certain European countries have previously affected market dynamics.

- Bio-Rad operates in over 70 countries, increasing its exposure to political risks.

- Changes in trade policies (e.g., tariffs) can affect Bio-Rad's international sales.

- Political risks include potential disruptions to research collaborations.

Government Initiatives in Health and Research

Government initiatives are vital for Bio-Rad's growth. Initiatives targeting diseases like cancer fuel demand for Bio-Rad's products. Funding for research projects and health programs opens doors for the company. Policies supporting personalized medicine also boost market opportunities. In 2024, the U.S. government allocated $1.5 billion for cancer research.

- U.S. government allocated $1.5 billion for cancer research in 2024.

- Government funding supports Bio-Rad's market opportunities.

- Policies on personalized medicine can boost demand.

Government healthcare spending and policies are critical for Bio-Rad, with increased funding driving demand. Trade policies significantly affect Bio-Rad's global sales and supply chains. Evolving regulations globally influence Bio-Rad's product approval and manufacturing processes. Political stability also has a major impact, potentially disrupting operations.

| Political Factor | Impact on Bio-Rad | Data/Example (2024-2025) |

|---|---|---|

| Healthcare Spending | Boosts or curtails demand | U.S. healthcare spending reached $4.8T (2024). |

| Trade Policies | Affects international sales, supply chains | Bio-Rad's international sales accounted for ~55% of total revenue in 2024. |

| Regulations | Influences product approval, manufacturing costs | Compliance cost $120M in 2024; $125M expected in 2025. |

| Political Stability | Disrupts operations | Instability may affect market access. |

Economic factors

Bio-Rad faces global economic headwinds affecting customer spending. Weakness in biotech and biopharma impacts Life Science results. Economic uncertainty reduces budgets for research institutions. In Q1 2024, Bio-Rad's sales decreased by 12.4% due to these challenges. The company is adapting to navigate these conditions.

Bio-Rad generates a substantial part of its revenue from international markets, with sales often in local currencies. A strong U.S. dollar can decrease the reported value of international sales when translated. For example, in Q1 2024, currency fluctuations negatively affected Bio-Rad's sales. Managing currency risk is crucial for the company's financial health. Hedging strategies are essential to mitigate currency impacts.

The biopharma and biotech funding environment significantly impacts Bio-Rad's sales, especially in Life Science. Challenges in these markets led to sales declines. For instance, in Q1 2024, Bio-Rad's Life Science segment saw a decrease due to funding pressures. A rebound in biopharma investment could positively affect Bio-Rad's performance, potentially boosting demand for its products. Recent reports suggest a cautious but improving outlook for biotech funding in late 2024 and early 2025.

Healthcare Spending and Reimbursement Policies

Economic pressures on healthcare systems worldwide influence the demand for clinical diagnostics. Governments and insurers are constantly trying to control costs, which directly impacts product demand. For example, changes in China's diabetes testing reimbursement policies have affected sales. The need to manage healthcare costs is a key consideration.

- Global healthcare spending is projected to reach $10.1 trillion by 2024.

- China's healthcare spending grew by 6.3% in 2023.

- Reimbursement cuts can decrease sales volumes by up to 15% in some markets.

Overall Revenue Growth and Operating Margin

Bio-Rad's financial health is closely tied to economic trends affecting revenue and margins. The company anticipates non-GAAP, currency-neutral revenue growth for 2025, showing optimism for better market conditions. Successfully hitting operating margin targets hinges on effective cost management and sales strategies amid economic changes.

- In Q1 2024, Bio-Rad's revenue decreased by 6.8% to $694.7 million.

- The company's operating margin was 10.8% in Q1 2024.

- Bio-Rad expects 2024 revenue to be flat to up 2% on a currency-neutral basis.

Bio-Rad faces economic hurdles, impacting revenue and margins across its segments. Global economic trends, like fluctuating exchange rates, also play a pivotal role in sales figures, particularly for international markets. Successfully navigating operating margin goals relies heavily on prudent cost management and effective sales approaches amidst ongoing economic volatility.

| Metric | Q1 2024 | 2025 Projection |

|---|---|---|

| Revenue Decline (YoY) | 6.8% | Flat to +2% (currency-neutral) |

| Operating Margin | 10.8% | Depends on cost management |

| Healthcare Spending (Global, 2024) | $10.1 trillion | N/A |

Sociological factors

Growing health awareness globally boosts diagnostic test demand. Infectious diseases, cancer, and genetic conditions fuel this need. Bio-Rad's clinical products, like quality control and blood typing, thrive. Rapid testing, such as HIV self-testing, shapes the market. The global in vitro diagnostics market is projected to reach $109.7 billion by 2025.

Globally, aging populations drive chronic disease prevalence, boosting demand for diagnostics. Bio-Rad's solutions, crucial for managing age-related conditions, benefit from this trend. In 2024, the global market for in-vitro diagnostics was valued at over $90 billion. The World Health Organization projects a rise in chronic diseases, increasing the need for Bio-Rad's offerings.

A significant societal challenge is the scarcity of skilled lab personnel, critical for diagnostic testing and research. This shortage can limit lab capacity, potentially affecting the adoption of new technologies. According to a 2024 study, there's a 15% vacancy rate for medical technologists in the US. Addressing this is vital for effective use of diagnostic products and maintaining healthcare standards.

Public Health Initiatives and Disease Control

Public health initiatives greatly impact Bio-Rad, driving demand for diagnostic tools. Efforts to control diseases like HIV and foodborne illnesses necessitate specific testing methods. Bio-Rad's infectious disease tests and food safety tools directly support these initiatives. Public health priorities also shape Bio-Rad's product development and market strategies.

- In 2024, the global in vitro diagnostics market, where Bio-Rad operates, was valued at approximately $88 billion, reflecting the ongoing importance of public health.

- The CDC reports that in 2023, there were over 32,000 new HIV diagnoses in the US, highlighting the continued need for HIV testing.

- Bio-Rad's revenues in 2024 were around $2.9 billion, a portion of which is tied to public health-related products.

Focus on Personalized Medicine and Therapy Monitoring

The growing emphasis on personalized medicine, where treatments are customized to individual needs, significantly impacts Bio-Rad. This trend fuels demand for sophisticated diagnostic tools that monitor therapy effectiveness and guide treatment decisions. Bio-Rad's technologies, like Droplet Digital PCR, are key in this shift. This reflects a societal move towards more targeted healthcare. In 2024, the personalized medicine market was valued at $567.8 billion, expected to reach $878.7 billion by 2029.

- Personalized medicine market growth drives demand for advanced diagnostics.

- Bio-Rad's technologies support individualized healthcare approaches.

- Societal shift towards targeted medical interventions.

- The personalized medicine market is rapidly expanding.

Societal focus on health and personalized medicine boosts demand for advanced diagnostics, directly impacting Bio-Rad's business. The aging global population increases chronic disease prevalence. However, a shortage of skilled lab personnel poses a challenge.

| Sociological Factor | Impact on Bio-Rad | Data Point |

|---|---|---|

| Health Awareness | Increased Demand | IVD market projected to $109.7B by 2025 |

| Aging Population | Rising Diagnostics Needs | IVD market valued at $90B+ in 2024 |

| Skilled Lab Personnel Shortage | Potential Capacity Limits | 15% vacancy for medical technologists in the US (2024) |

Technological factors

Bio-Rad excels in Droplet Digital PCR (ddPCR), a technology offering high sensitivity and quantification. Innovation drives Bio-Rad, with new systems and assays constantly emerging. The acquisition of Stilla Technologies will broaden Bio-Rad's digital PCR offerings. In Q1 2024, Bio-Rad's Life Science revenue was $460.4 million, showing growth. This includes ddPCR's contribution to their portfolio.

Bio-Rad's tech advancements drive assay and kit expansion. They create tools for cancer diagnostics, cell therapy, and food safety. New assays keep Bio-Rad competitive. In Q1 2024, Bio-Rad's Life Science revenue hit $450M, reflecting strong demand for these products.

Bio-Rad's innovation in cell biology and flow cytometry is ongoing, with the introduction of new dyes and tools. The company's recent launches, like Annexin V and StarBright dyes, give researchers more options for studying cellular processes. These advancements support various biological studies, improving research capabilities. Bio-Rad's revenue in 2024 was approximately $1.7 billion.

Progress in Single-Cell and Rare Cell Analysis

Technological advancements in single-cell and rare cell analysis are crucial for both research and clinical applications. Bio-Rad's offerings, such as the ddSEQ Single-Cell RNA-Seq Kit and Celselect Slides, highlight their focus on providing tools for detailed cell analysis. These technologies enable deeper biological insights, which is very important. The single-cell analysis market is expected to reach $6.3 billion by 2025.

- Bio-Rad's ddSEQ Single-Cell RNA-Seq Kit.

- Celselect Slides for rare cell capture.

- Single-cell analysis market projected to $6.3B by 2025.

Integration of Automation and Software Solutions

Technological advancements in laboratories are rapidly transforming workflows, with automation and sophisticated software solutions at the forefront. These trends significantly influence the design and development of products within the laboratory supplies sector. For instance, in 2024, the global laboratory automation market was valued at approximately $5.6 billion, and is projected to reach $8.9 billion by 2029. This growth underscores the increasing demand for automated systems.

- Market growth: From $5.6B (2024) to $8.9B (2029) in laboratory automation.

- Software integration: Essential for data management and workflow optimization.

- Impact on Bio-Rad: Drives product innovation and market competitiveness.

- Automation adoption: Increases efficiency and reduces errors.

Bio-Rad uses advanced technologies such as ddPCR, driving growth. Continuous innovation expands their offerings, including assays for cancer diagnostics and cell therapy. In 2024, Bio-Rad's revenue hit about $1.7B. They have single-cell analysis tools, targeting a $6.3B market by 2025.

| Technology Area | Specific Technologies | Market Data |

|---|---|---|

| Digital PCR | ddPCR systems, assays | Significant contribution to revenue, ~$460M in Q1 2024 (Life Science). |

| Cell Analysis | ddSEQ Single-Cell RNA-Seq Kit, Celselect Slides | Single-cell analysis market projected to $6.3B by 2025. |

| Laboratory Automation | Workflow automation, software solutions | Global market valued at $5.6B in 2024, expected to reach $8.9B by 2029. |

Legal factors

Bio-Rad faces strict legal obligations, especially concerning healthcare regulations. IVDR compliance is crucial for selling in the EU; for example, the IVDR Class C certification. This is legally required for certain diagnostic kits. Failure to comply can result in product recalls and legal penalties. In 2024, non-compliance resulted in approximately $1 million in fines for similar companies.

Adhering to global quality and safety standards is legally essential for Bio-Rad. The company must meet international standards to ensure product reliability. Compliance with these standards is vital for business operations. Failure to comply can lead to significant penalties and market restrictions. In 2024, Bio-Rad spent $130 million on R&D to maintain and improve product quality.

Intellectual property protection is crucial for Bio-Rad, especially given its reliance on proprietary tech. Legal battles may arise to defend patents or address infringement. In 2024, Bio-Rad spent approximately $70 million on R&D, underscoring its investment in innovation. The outcome of IP litigation can significantly affect Bio-Rad's market position and revenue streams.

Corporate Governance and Shareholder Regulations

Bio-Rad's legal environment includes strict corporate governance rules due to its public listing. These rules cover how the company is run, how it reports its finances, and shareholder rights. The company must hold annual meetings, manage executive pay, and get shareholder approval for auditors. Following these rules is crucial for transparency and keeping investors informed. In 2024, Bio-Rad's governance structure was reviewed to ensure it met the latest standards.

- Annual meetings are essential for shareholder engagement and voting on key issues.

- Executive compensation plans require careful structuring to align with performance and shareholder interests.

- Auditor ratification ensures financial statements are independently and accurately reviewed.

- Compliance with regulations helps maintain investor trust and confidence in the company.

Contractual Obligations and Partnership Agreements

Bio-Rad frequently engages in legal agreements, covering partnerships, investments, and acquisitions. These agreements create legal obligations and risks, such as the need for regulatory approvals. For example, in 2024, Bio-Rad's acquisitions required adherence to stringent antitrust regulations. Legal compliance and review are crucial for business development.

- Regulatory approvals can significantly delay or prevent acquisitions, as seen with recent cases in the biotech industry.

- Breach of contract can lead to substantial financial penalties and reputational damage.

- Legal due diligence is critical to assess risks and ensure compliance before finalizing any agreement.

Bio-Rad must adhere to healthcare and IVDR regulations for product sales; compliance failures can lead to recalls and fines. Global quality and safety standards adherence is crucial, requiring investments to maintain product reliability, with around $130 million spent on R&D in 2024. Intellectual property protection through patents is key, as seen with a $70 million R&D spend in 2024, with legal battles impacting market position.

| Legal Factor | Impact | 2024/2025 Data |

|---|---|---|

| Regulatory Compliance | Product recalls, fines, market restrictions | Non-compliance fines: ~$1 million. R&D on quality: $130M. |

| Intellectual Property | Patent disputes, market position impact | IP R&D Spending: ~$70 million |

| Corporate Governance | Transparency, investor trust | Governance structure review |

| Legal Agreements | Contract breaches, delays | Acquisition antitrust regulations. |

Environmental factors

Bio-Rad actively works to reduce its environmental impact, focusing on its carbon footprint and energy use across all locations. They're upgrading equipment and insulation, plus retrofitting lighting. By measuring and reporting emissions, Bio-Rad finds ways to cut down on waste. In 2024, they aimed to decrease energy use by 5%.

Bio-Rad's environmental strategy includes renewable energy investments. A key move is installing solar panels at its headquarters. This reduces reliance on fossil fuels, boosting sustainability. The global renewable energy market is booming, with investments projected to reach $2.3 trillion by 2025.

Bio-Rad actively reduces packaging waste through sustainable initiatives. They use eco-friendly shipping boxes made with recycled fibers. Alternatives include recyclable kraft paper and molded paper pulp. These changes align with customer preferences. This decreases Bio-Rad's environmental footprint, and it can also boost their brand image.

Compliance with Environmental Regulations

Bio-Rad faces environmental compliance demands linked to its manufacturing, waste, and product materials. Compliance ensures minimal pollution and responsible practices. Evolving environmental laws necessitate process adjustments. For instance, in 2024, environmental fines in the biotech sector averaged $50,000 per violation.

- Bio-Rad must adhere to environmental regulations.

- Compliance minimizes pollution.

- Changes in laws can affect operations.

- Environmental fines in 2024 averaged $50,000.

Products for Environmental Quality Testing

Bio-Rad offers products for environmental quality testing, addressing water, air, and food safety concerns. This segment benefits from rising environmental awareness and regulatory demands. The global environmental testing market is projected to reach $27.9 billion by 2025. Bio-Rad's solutions support broader environmental protection initiatives.

- Market growth driven by pollution concerns.

- Regulatory compliance fuels product demand.

- Supports environmental protection efforts.

Bio-Rad focuses on environmental impact by cutting energy use and boosting sustainability. Renewable energy, like solar panels, supports its goals. The company streamlines packaging. Plus, it adheres to environmental rules. By 2025, environmental testing may reach $27.9B.

| Aspect | Details | Data |

|---|---|---|

| Renewable Energy Market | Global Investments | $2.3 trillion (2025 projected) |

| Environmental Testing Market | Market Value | $27.9 billion (2025 projected) |

| Environmental Fines | Biotech Sector | $50,000 per violation (2024 average) |

PESTLE Analysis Data Sources

The Bio-Rad PESTLE Analysis utilizes governmental, industry reports, and financial news. Our data also comes from market research firms and scientific publications.