BJ's Wholesale Club Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BJ's Wholesale Club Bundle

What is included in the product

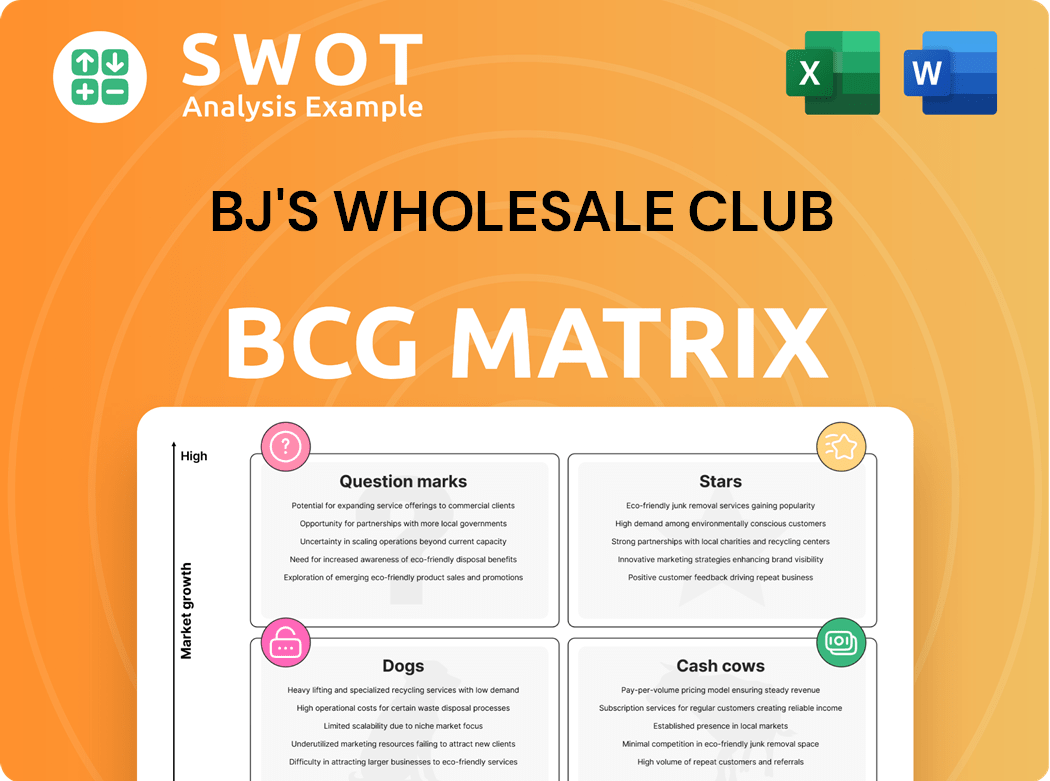

BJ's Wholesale Club's BCG Matrix assesses its offerings, identifying investment opportunities & areas for strategic focus.

Printable summary optimized for A4 and mobile PDFs, showcasing BJ's diverse business portfolio.

Full Transparency, Always

BJ's Wholesale Club BCG Matrix

The BCG Matrix you see now is the complete document you'll download instantly after purchase. This fully editable report offers a clear strategic overview, ready to integrate directly into your presentations or business analyses. With purchase, you get the unedited file—no hidden content or final version surprises.

BCG Matrix Template

BJ's Wholesale Club navigates its product portfolio. Some items likely shine as Stars, while others generate steady Cash Flow. Question Marks hint at potential growth or decline. Identifying Dogs, underperforming products, is crucial for resource allocation. This is just a glimpse into the company's strategic landscape. Purchase the full BCG Matrix for detailed quadrant placements and strategic insights.

Stars

BJ's Wholesale Club is actively growing, with plans to open 25-30 new clubs in the next two fiscal years. This includes entering Texas in 2026 and opening several locations in 2025. In fiscal year 2024, BJ's opened seven new clubs and 12 gas stations. This expansion boosts market presence and aims to increase revenue.

BJ's Wholesale Club's digital sales are booming. Digitally enabled comparable sales surged 26% year-over-year in Q4 2024. Over two years, this growth reached 53%. This reflects strong e-commerce and omnichannel investments. BOPIC, curbside, and same-day delivery drive sales.

BJ's Wholesale Club's membership model is a significant strength, evidenced by a loyal customer base of over 7.5 million members. This loyalty is underscored by a high renewal rate, approximately 90%, ensuring a steady revenue stream. The company's focus on enhancing membership benefits, like credit card programs, supports both member retention and long-term revenue expansion. This strategy helps BJ's maintain a competitive edge in the wholesale market.

Fresh Produce Performance

BJ's Wholesale Club's fresh produce segment is a "Star" in its BCG matrix. The segment has seen significant growth, with double-digit comparable sales growth. The Fresh 2.0 initiative has boosted the fresh business, growing at a rate 10 percentage points above the market. Loyal members rely on BJ's for fresh produce.

- Double-digit comparable sales growth in the last three quarters.

- Fresh business grew 10 percentage points faster than the market.

- Loyal members are primary fresh destination users.

Value Proposition

BJ's Wholesale Club's value proposition centers on significant savings for its members. They offer up to 25% off compared to regular grocery stores. This approach is especially appealing during times of inflation, attracting budget-conscious consumers. BJ's has cultivated a loyal customer base through this value-focused strategy.

- Membership fees contribute significantly to BJ's revenue, with over 7 million members as of 2024.

- In 2024, BJ's reported a net sales increase of 3.8% compared to the previous year.

- Comparable sales, excluding fuel sales, increased by 2.7% in 2024.

- BJ's focuses on offering a curated assortment of products, including private-label brands, to enhance value.

In BJ's BCG matrix, the fresh produce segment is a "Star". The "Fresh 2.0" initiative significantly boosted this area. In 2024, comparable sales grew by double digits. This success is fueled by loyal member demand.

| Metric | 2024 Performance | Notes |

|---|---|---|

| Comparable Sales Growth | Double-Digit | Driven by "Fresh 2.0" |

| Fresh Business Growth | 10% faster | Vs. Market Average |

| Member Loyalty | High | Primary fresh destination |

Cash Cows

BJ's Wholesale Club's grocery and essential goods segment is a cash cow, generating steady revenue. Roughly 70% of BJ's sales come from groceries, ensuring stable demand. This segment's consistent performance is supported by BJ's value-driven approach. In 2024, BJ's reported strong comparable sales growth in its grocery category.

BJ's Wholesale Club's mature membership model is a cash cow. The company's over 7.5 million members, with a 90% renewal rate, ensure a steady revenue stream. In Q3 2024, membership fee income rose to $108.5 million. BJ's focuses on marketing and merchandising to maintain its loyal customer base.

BJ's Wholesale Club's operational efficiency is a key strength as a Cash Cow in its BCG Matrix. It leverages strategic inventory management and cost controls to boost margins. This includes supply chain improvements and store optimization across its 264 locations in 29 states. In Q3 2024, BJ's reported a 1.6% increase in comparable club sales, demonstrating effective strategies.

Reliable Profit Generator

BJ's Wholesale Club operates as a cash cow within the BCG matrix, thanks to its consistent profitability. The company's focus on value and membership model ensures a steady revenue stream. For the twelve months ending January 31, 2025, net income reached $0.534B, reflecting a 2.04% year-over-year increase. Net sales were primarily driven by $14.3 billion.

- Reliable Profitability: BJ's benefits from a well-established business model.

- Consistent Revenue: The membership structure provides a predictable income.

- Financial Performance: Net income increased by 2.04% year-over-year in 2025.

- Sales Dominance: Net sales of $14.3 billion drive the financial results.

Private Label Brands

BJ's private label brands are considered Cash Cows. These brands generated 26% of merchandise sales in fiscal 2024, demonstrating strong market presence. The company is working towards a 30% goal. BJ's closely monitors tariffs and geopolitical uncertainties to manage costs and consumer demand effectively.

- 26% of merchandise sales from private label brands in fiscal 2024.

- Target of 30% for private label brand sales.

- Ongoing monitoring of tariffs and geopolitical factors.

BJ's Wholesale Club's cash cows include a solid revenue base from groceries and a mature membership model with high renewal rates. In Q3 2024, membership fee income was $108.5 million. Operational efficiency and private label brands, contributing 26% of merchandise sales in fiscal 2024, also act as key drivers.

| Aspect | Details | 2024 Data |

|---|---|---|

| Membership Income | Steady revenue from membership fees | $108.5M (Q3) |

| Private Label Sales | Contribution to merchandise sales | 26% (Fiscal 2024) |

| Net Income | Financial Performance | $0.534B, +2.04% YoY |

Dogs

BJ's Wholesale Club is a "Dog" in the BCG matrix due to its limited geographic footprint, mainly on the East Coast. This concentration, with a strong presence in NY, NJ, MA, and FL, restricts expansion opportunities. In 2024, BJ's operated around 240 clubs, a smaller scale than national rivals. This regional focus heightens vulnerability to local economic shifts.

BJ's Wholesale Club faces a challenge with a smaller market share compared to its main rivals. In Q4 2024, BJ's held a 1.75% market share, significantly less than Costco's 22.58% and Sam's Club's 55.41%. This limited market presence could hinder BJ's ability to leverage economies of scale.

BJ's Wholesale Club, like other retailers, faces tariff risks. Geopolitical events and trade policies can increase import costs. In 2024, rising costs could impact consumer demand. Monitoring these risks is key for strategic planning. BJ's must adapt to maintain profitability.

Competition from Small Box Grocers

BJ's Wholesale Club encounters fierce competition from small-box grocers, such as Aldi, which challenges its low-price strategy. Given that the majority of BJ's stores are located in densely populated urban areas, the warehouse club retailer is set to face stiff competition. This competitive landscape could pressure BJ's margins and market share over the coming years, requiring strategic adaptation. In 2024, Aldi's revenue reached approximately $18.5 billion, underscoring its growing market presence.

- Competition from Aldi and other small-box grocers is intensifying.

- BJ's must defend its value proposition in urban markets.

- Margin and market share could be pressured.

- Aldi's 2024 revenue: ~$18.5B.

Sensitivity to Discretionary Purchasing

BJ's Wholesale Club's performance is significantly tied to consumer spending habits, making it sensitive to discretionary purchases. In 2024, rising inflation and economic uncertainty could lead consumers to cut back on non-essential spending, impacting BJ's sales. Maintaining profitability is another challenge, especially with increased operational costs and competitive pricing pressures. This sensitivity positions BJ's in the BCG matrix as a potential "Dog" if sales decline.

- BJ's Q1 2024 comparable sales increased by 1.9%.

- The company's gross profit margin decreased by 0.4% in Q1 2024.

- Inflation remains a concern, potentially affecting consumer spending.

- BJ's faces competition from other retailers like Costco and Sam's Club.

BJ's faces intense competition and regional constraints, limiting growth potential, positioning it as a "Dog" in the BCG matrix. Despite slight sales increases in Q1 2024, profitability faces pressure. Smaller market share and dependence on consumer spending add to its challenges.

| Metric | BJ's | Notes |

|---|---|---|

| Market Share Q4 2024 | 1.75% | Significantly less than rivals. |

| Q1 2024 Comp Sales Increase | 1.9% | Modest growth. |

| Q1 2024 Gross Margin Change | -0.4% | Profitability pressure. |

| Aldi's 2024 Revenue | ~$18.5B | Intensifying competition. |

Question Marks

BJ's Market, a smaller format, is a Question Mark in its BCG Matrix. Its potential is still uncertain. The Delray Beach stores are key to expansion. This format allows entry into markets where larger stores are not feasible. BJ's aims to accelerate long-term growth with this concept.

BJ's Wholesale Club is venturing into Texas in 2026, a move signifying a "Question Mark" in its BCG matrix. This expansion includes four stores in the Dallas-Fort Worth area. Each store will be around 106,000 square feet. Construction starts June 2025, with openings by early 2026.

Strategic partnerships can significantly boost BJ's Wholesale Club's growth. Consider collaborations to broaden product lines or tap into new markets. For example, partnering with food delivery services could increase sales. In 2024, BJ's reported strong membership fee income, indicating potential for partnerships to enhance member value and drive further growth.

Integration of Technology

BJ's Wholesale Club can leverage technology to significantly enhance customer experience, a key element in its growth strategy. Integrating technology can streamline operations and personalize shopping. This includes mobile apps for easy shopping and checkout. These enhancements are crucial for maintaining a competitive edge in the retail sector.

- Mobile app usage among BJ's members increased by 25% in 2024, showing the growing importance of digital tools.

- Implementation of self-checkout kiosks saw a 15% reduction in average transaction times.

- Personalized offers delivered via the app led to a 10% increase in customer spending.

- Data analytics were used to refine supply chain efficiency, reducing inventory costs by 8%.

Product Offering Expansion

Product offering expansion is a key strategy for BJ's Wholesale Club, involving the addition of new product categories or services to attract a wider customer base. This could include expanding into areas like home goods, electronics, or specialty foods to diversify offerings. BJ's aims to increase its revenue streams and market share through strategic product additions, aligning with consumer demand and market trends. This expansion strategy supports BJ's efforts to maintain its competitive edge in the wholesale retail sector.

- Expansion into new product categories can increase revenue.

- Diversifying offerings helps attract a broader customer base.

- Strategic product additions are key for market share growth.

- It is important to align with consumer demand and market trends.

BJ's expansion in Texas represents a "Question Mark". The success of new stores is yet uncertain, marking them as such. Their potential is high, but faces market competition. Strategic moves are critical for future performance.

| Aspect | Details | Impact |

|---|---|---|

| Texas Expansion | 4 stores in DFW area; construction begins June 2025, opening by 2026 | Significant investment, high risk-reward |

| Market Performance | 2024: strong membership income, growing digital tool usage, up to 25% | Highlights potential, but needs strong market execution |

| Strategy | Partnerships, Tech Integration, Product expansion | Enhances customer experience, boosts sales and market share |

BCG Matrix Data Sources

BJ's BCG Matrix leverages SEC filings, industry reports, and sales data to inform product placement. Market growth forecasts also guide our quadrant analysis.