BJ's Wholesale Club Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BJ's Wholesale Club Bundle

What is included in the product

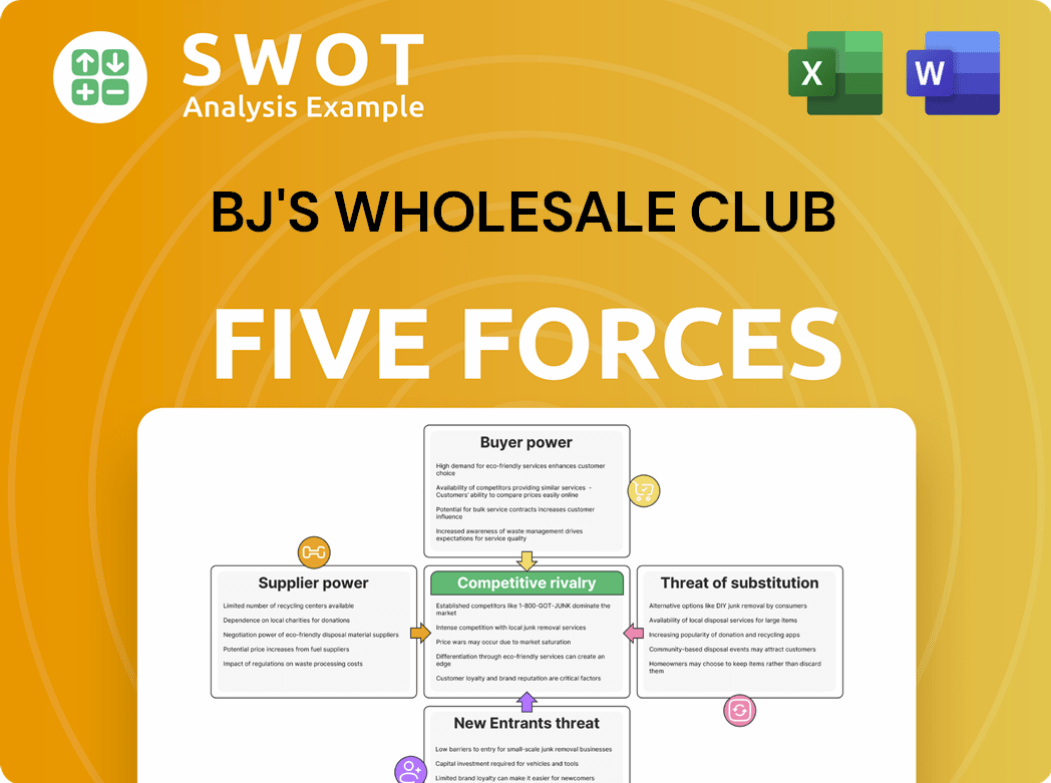

Analyzes BJ's Wholesale Club's competitive landscape, including rivalry, buyers, and new entrants.

Instantly identify vulnerabilities to make informed strategic decisions.

Same Document Delivered

BJ's Wholesale Club Porter's Five Forces Analysis

You're previewing the complete BJ's Wholesale Club Porter's Five Forces analysis. The document thoroughly examines industry competition, supplier power, and more.

This in-depth study also assesses buyer power, the threat of new entrants, and the threat of substitutes, providing a holistic view.

This is the comprehensive analysis you'll receive instantly after purchase—fully formatted and ready for immediate use.

The preview precisely mirrors the final deliverable—no alterations or additional steps are needed.

What you see is what you get: a ready-to-use, professionally crafted Porter's Five Forces analysis.

Porter's Five Forces Analysis Template

BJ's Wholesale Club faces moderate rivalry from established players like Costco and Sam's Club. Buyer power is significant due to consumer choice and price sensitivity. Suppliers have limited influence due to BJ's scale and sourcing. The threat of new entrants is mitigated by capital requirements and brand recognition. Substitutes, primarily online retailers, pose a growing challenge.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore BJ's Wholesale Club’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

BJ's Wholesale Club's supplier concentration is moderate, as it sources from a wide array of vendors. This dispersed supplier base limits the impact of any single supplier. The availability of substitutes further reduces supplier power. In 2024, BJ's had over 1,500 suppliers.

Suppliers with highly differentiated products, like exclusive brands, wield more power. In contrast, commodity suppliers have less leverage. BJ's can negotiate better deals with commodity suppliers. For example, in 2024, BJ's reported a gross profit margin of approximately 17%. This highlights the impact of supplier bargaining power.

BJ's Wholesale Club benefits from low switching costs with suppliers. This flexibility allows BJ's to easily change suppliers without major expenses, except maybe for private-label products. The ability to switch enhances BJ's negotiation power. In 2024, BJ's reported a gross profit margin of around 17% demonstrating effective cost management. This supports competitive pricing strategies.

Forward integration threat is limited

The threat of forward integration from BJ's suppliers is limited. Most suppliers lack the resources and retail expertise to compete directly. This acts as a barrier, protecting BJ's market position. The high capital costs and operational complexities of running retail stores deter suppliers. This strategic advantage helps BJ's maintain its control.

- Capital-intensive retail operations.

- Lack of retail expertise among suppliers.

- BJ's market position remains strong.

- Limited threat from supplier competition.

Impact of inputs on BJ's product quality

The quality of inputs from suppliers significantly impacts BJ's product quality and brand reputation. Reliable suppliers are vital for ensuring consistent quality, especially for perishables and private-label goods, which accounted for 27% of BJ's net sales in fiscal year 2023. Maintaining high standards requires strong supplier relationships to meet customer expectations. Any supply chain disruptions or substandard inputs could damage BJ's perceived value.

- 27% of BJ's net sales in fiscal year 2023 came from private-label items.

- BJ's operates over 230 clubs across multiple states.

- Consistent product quality is crucial for customer loyalty.

BJ's Wholesale Club's bargaining power over suppliers is generally strong due to its diverse supplier base and low switching costs. The company's ability to negotiate favorable terms is enhanced by the availability of substitutes and limited threat of forward integration. However, the reliance on quality inputs and private-label goods, which made up 27% of 2023 sales, makes reliable supplier relationships vital.

| Factor | Impact | Data |

|---|---|---|

| Supplier Concentration | Moderate | Over 1,500 suppliers in 2024 |

| Gross Profit Margin | Impacted by Supplier Bargaining | Approx. 17% in 2024 |

| Private Label Sales | Supplier Quality Dependence | 27% of 2023 net sales |

Customers Bargaining Power

BJ's Wholesale Club's membership model grants customers significant bargaining power. Members have the flexibility to decline renewal if they find the offerings unappealing. In 2024, BJ's had about 7.4 million members. This model compels BJ's to persistently provide value to sustain its customer base.

BJ's customers are highly price-sensitive, actively hunting for value and discounts. This heightened price sensitivity significantly boosts buyer power. Customers readily switch to rivals like Costco or online retailers if BJ's pricing isn't competitive. In 2024, BJ's reported a 4.8% increase in total revenue, underscoring the importance of maintaining competitive pricing. This customer behavior compels BJ's to adopt aggressive, competitive pricing strategies.

Customers wield significant power due to readily available substitutes like Costco, Sam's Club, supermarkets, and online platforms. This wide array of options allows shoppers to easily compare prices and value. In 2024, online retail sales are projected to reach $1.2 trillion, showing the ease of switching. This high availability of alternatives significantly boosts buyer power.

Information availability is high

Customers wield significant bargaining power due to readily available information on prices and product quality. Online platforms and competitor advertising offer transparency, enabling informed purchasing decisions. This forces BJ's to maintain competitive pricing and product offerings to retain customers. In 2024, BJ's saw a 2.6% increase in membership fee income demonstrating their ability to attract and retain members despite competitive pressures.

- Online price comparison tools enhance customer bargaining power.

- BJ's must offer competitive pricing to retain customers.

- Transparency in pricing and promotions is crucial.

- Membership fee income growth reflects customer loyalty.

Low switching costs for customers

Switching costs for BJ's customers are low because canceling a membership is simple, allowing them to easily choose a competitor. This ease of switching significantly boosts buyer power, as customers are not bound to BJ's. To maintain its customer base, BJ's must consistently provide exceptional value and competitive pricing. This constant need to attract and retain members shapes BJ's strategies. In 2024, BJ's saw a membership renewal rate of approximately 89%, highlighting the importance of customer satisfaction and value.

- Low switching costs enable customers to switch easily.

- Buyer power increases when switching is easy.

- BJ's must offer strong value to retain members.

- Membership renewal rate in 2024 was about 89%.

BJ's customers have significant bargaining power, amplified by their ability to decline membership renewals if dissatisfied. Price sensitivity further strengthens buyer power, with customers readily switching to competitors like Costco if prices are not competitive. Available alternatives, including online retailers and supermarkets, offer consumers numerous options.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Membership Model | Customer Retention | 7.4M Members |

| Price Sensitivity | Buyer Power | 4.8% Revenue Growth |

| Alternatives | Buyer Power | Online Retail: $1.2T |

Rivalry Among Competitors

BJ's Wholesale Club battles fierce competition, primarily from Costco and Sam's Club. These rivals boast strong brand recognition and substantial customer bases. This intense rivalry significantly influences BJ's pricing, marketing strategies, and expansion decisions. For example, in 2024, Costco's revenue reached $242.2 billion, highlighting the scale of its competitive advantage.

Supermarkets, including Kroger and Walmart, and online retailers like Amazon, are key competitors. These entities offer similar goods and services, increasing the competition for BJ's. In 2024, Walmart's revenue was approximately $648 billion, showing their considerable market presence. BJ's needs to differentiate to stay competitive.

BJ's Wholesale Club faces intense price competition, leading to price wars and promotional blitzes. These strategies, vital for attracting budget-conscious shoppers, squeeze profit margins. In 2024, promotional spending in the retail sector reached nearly $1.2 trillion, indicating the scale of these activities. BJ's must constantly refine its pricing to stay competitive and maintain profitability.

Differentiation through private label brands

BJ's Wholesale Club uses private-label brands to stand out in a competitive market. These unique products help build customer loyalty and set BJ's apart. Differentiation is key for maintaining market share and driving profits. This strategy is crucial for success against rivals.

- BJ's has seen strong growth in its private-label brands, with sales increasing by 10% in 2024.

- The company's private-label brands contribute to about 25% of total sales.

- BJ's focuses on offering high-quality, value-driven products.

- This approach helps build a strong brand reputation.

Geographic concentration of competition

BJ's Wholesale Club faces intense competition due to its geographic concentration, primarily on the East Coast. This market is crowded with established players like Costco and Walmart, increasing rivalry. BJ's needs a robust regional strategy to compete effectively, considering local consumer preferences and market dynamics. The East Coast's retail landscape, including areas like New York and Florida, is highly contested.

- BJ's operates in 20 states, with a strong presence along the East Coast.

- Costco and Walmart have significant market shares in the same regions.

- The concentration increases the need for competitive pricing and promotions.

- Understanding local market demands is crucial for BJ's success.

Competitive rivalry is high for BJ's Wholesale Club, primarily due to Costco and Sam's Club's strong presence.

Supermarkets, online retailers also add to the competition. This leads to price wars, impacting profit margins.

BJ's differentiates itself with private-label brands, accounting for about 25% of sales, with a 10% growth in 2024.

| Competitor | 2024 Revenue (approx.) | Key Strategy |

|---|---|---|

| Costco | $242.2 Billion | Membership model, bulk sales |

| Walmart | $648 Billion | Low prices, extensive product range |

| Amazon | $575 Billion (Retail) | Online convenience, subscription services |

SSubstitutes Threaten

Traditional supermarkets and grocery stores present a direct substitution threat to BJ's Wholesale Club. They offer similar products, competing for the same customer base. In 2024, the U.S. grocery market reached approximately $800 billion, highlighting the vast competitive landscape. This accessibility makes them a convenient alternative, especially for those unwilling to pay membership fees. This competition impacts BJ's pricing power and market share.

Online retailers like Amazon are significant substitutes, offering diverse products and convenience. Their ease of use and delivery services appeal to customers. This creates a substantial threat to BJ's, which must compete with online giants. In 2024, Amazon's net sales reached approximately $574.7 billion, highlighting its vast market presence.

Discount retailers like Walmart and Target present a significant threat to BJ's. They offer a wide array of products, including groceries and household items, at competitive prices, appealing to budget-conscious consumers. In 2024, Walmart's revenue reached approximately $648 billion, showcasing their substantial market presence and ability to compete. These stores act as a convenient one-stop-shop, potentially substituting the need for a BJ's membership. This substitution reduces BJ's customer base and market share.

Specialty stores for specific products

Specialty stores pose a substitution threat to BJ's by offering focused expertise and products. These stores, like Best Buy for electronics or Bed Bath & Beyond for home goods, cater to customers seeking specific items. This targeted approach can draw customers away from BJ's broader offerings in certain categories. For instance, in 2024, Best Buy's revenue was approximately $43.4 billion, indicating a significant market presence. This niche substitution impacts BJ's sales.

- Specialty stores offer focused product expertise.

- They attract customers seeking specific items.

- This can divert customers from BJ's offerings.

- Example: Best Buy's $43.4B revenue in 2024.

Other warehouse clubs

Other warehouse clubs, such as Costco and Sam's Club, pose a direct threat to BJ's Wholesale Club. These competitors offer comparable membership structures and product selections, presenting customers with viable alternatives. This similarity heightens the risk of substitution, impacting BJ's market share. In 2024, Costco's revenue reached approximately $253 billion, while Sam's Club generated around $84 billion, indicating their significant market presence and competitive strength.

- Costco's 2024 revenue: ~$253B

- Sam's Club's 2024 revenue: ~$84B

- Similar membership models and product ranges

- Primary alternatives for customers

Specialty stores, like Best Buy, pose a substitution threat by focusing on specific products. They attract customers looking for niche items. This can pull customers away from BJ's, impacting sales. Best Buy's 2024 revenue was ~$43.4 billion.

| Substitute | Description | Impact on BJ's |

|---|---|---|

| Best Buy | Focus on electronics | Attracts customers for specific needs, reducing BJ's reach |

| Specialty Stores | Focused expertise and products. | Diverts customers. |

| 2024 Revenue | Best Buy's Revenue | ~$43.4B |

Entrants Threaten

Entering the warehouse club market demands substantial capital. New entrants face high costs for land, inventory, and facilities. This significant financial barrier limits competition. BJ's benefits from this, maintaining its market share. For example, BJ's reported $4.7 billion in revenue in Q1 2024, showing its strong position.

Existing warehouse clubs such as BJ's, Costco, and Sam's Club benefit from strong brand loyalty. This makes it tough for newcomers to gain traction. Brand recognition and trust require substantial time and financial investment. For instance, Costco's membership renewal rate was around 93% in 2024, showcasing customer dedication. This loyalty presents a considerable obstacle.

Existing companies like BJ's Wholesale Club operate with significant economies of scale, which translates into lower operational costs. This allows them to offer competitive pricing and attractive value propositions. For example, in 2024, BJ's reported a gross profit of $4.3 billion. New entrants face challenges in replicating these cost efficiencies from the outset. This scale-driven advantage serves as a barrier, safeguarding established players within the market.

Complex supply chain logistics

BJ's Wholesale Club's operational model relies on intricate supply chain logistics, presenting a significant hurdle for new competitors. Establishing an efficient supply chain to manage inventory, distribution, and logistics demands considerable expertise and substantial infrastructure investments. This complexity creates a formidable barrier to entry, protecting BJ's market position. In 2024, BJ's reported a robust supply chain, crucial for maintaining its competitive edge.

- High initial investment costs in infrastructure and technology.

- Need for advanced inventory management systems.

- Complex distribution network to handle large volumes.

- Established vendor relationships are essential.

Regulatory hurdles and compliance

New entrants to the wholesale club market encounter significant regulatory hurdles and compliance demands. These challenges include stringent requirements for food safety, consumer protection, and adherence to local zoning laws. Successfully navigating these regulations often proves to be both time-intensive and expensive, posing a substantial barrier. This regulatory complexity effectively discourages potential new competitors from entering the market. These factors collectively limit the threat of new entrants.

- Compliance costs can be substantial, impacting profitability.

- Food safety regulations necessitate specific infrastructure and protocols.

- Zoning laws restrict where new clubs can be established.

- The need for permits and inspections adds to the challenges.

The threat of new entrants to BJ's is moderate due to high barriers. Substantial capital, brand loyalty, and economies of scale make entry difficult. Complex supply chains and regulations further restrict potential competitors. Data from 2024 highlights these challenges.

| Barrier | Impact | 2024 Data |

|---|---|---|

| Capital Needs | High Investment | BJ's Q1 Revenue: $4.7B |

| Brand Loyalty | Customer Retention | Costco Renewal Rate: ~93% |

| Economies of Scale | Cost Advantages | BJ's Gross Profit: $4.3B |

Porter's Five Forces Analysis Data Sources

BJ's analysis uses company filings, market research, and industry reports. These sources allow a deep understanding of competitive dynamics.