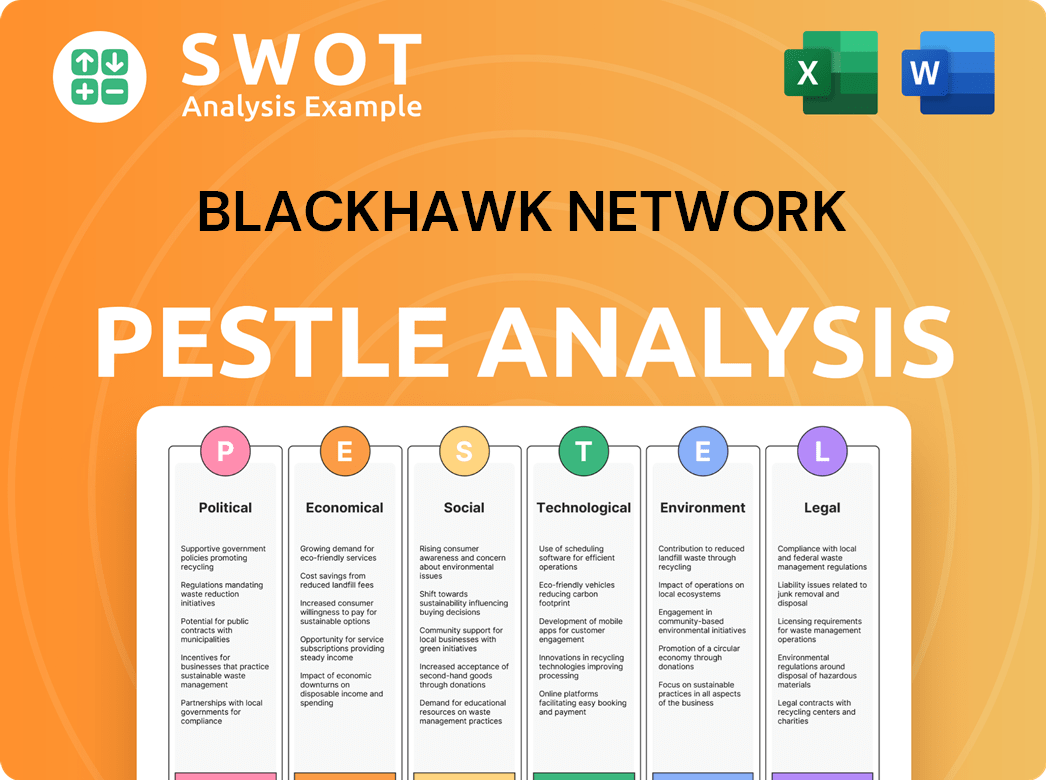

Blackhawk Network PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackhawk Network Bundle

What is included in the product

Assesses the Blackhawk Network through Political, Economic, Social, Technological, Environmental, and Legal factors.

Helps support discussions on external risk and market positioning during planning sessions.

Full Version Awaits

Blackhawk Network PESTLE Analysis

Preview the Blackhawk Network PESTLE Analysis here. What you're seeing now is the exact document you'll receive after purchase. The layout and information are fully displayed.

PESTLE Analysis Template

Uncover how external factors shape Blackhawk Network's strategy. Our PESTLE Analysis reveals the impact of politics, economics, and technology on its performance. We dissect the market landscape, highlighting key trends. Get the full version for expert insights to inform your decisions. Download now for a competitive edge.

Political factors

Government regulations are heavily influencing the fintech sector, which directly impacts Blackhawk Network. Stricter rules on prepaid cards and digital payments are emerging globally. These regulations affect Blackhawk's operations and can raise compliance costs. For example, the EU's PSD2 has reshaped payment services. Changes in consumer protection and AML laws are crucial.

Blackhawk Network's operations are sensitive to political stability in key markets. Geopolitical risks and trade policies can shift consumer spending. Changes in government priorities can also impact retail partnerships. For example, in 2024, shifts in trade policies in the EU impacted cross-border transactions.

Data privacy and security policies, like GDPR, shape Blackhawk Network's operations. These regulations impact how customer and transaction data is managed. Compliance is critical and can be operationally complex. The global data privacy market is projected to reach $130 billion by 2025.

International Trade and Sanctions Policies

International trade agreements, tariffs, and economic sanctions can significantly influence Blackhawk Network's international business. These policies can affect the cost of cross-border transactions and partnerships, potentially hindering operations in sanctioned regions. For example, the US imposed tariffs on certain goods from China, impacting companies involved in international trade. The World Trade Organization (WTO) reported a 15% decrease in global trade in 2023 due to trade barriers. Blackhawk Network's operations are vulnerable to these shifts.

- Impact of tariffs on cross-border transaction costs.

- Influence of sanctions on partnerships and regional operations.

- The need to adapt to changing trade regulations.

- WTO's 2023 report on global trade decrease.

Government Incentives for Digital Transformation

Governments worldwide are increasingly backing digital transformation, providing incentives to boost electronic payment adoption. These incentives, including tax breaks and grants, can significantly benefit companies like Blackhawk Network. Such policies encourage consumers and businesses to embrace digital wallets and prepaid solutions, creating new market opportunities. For example, in 2024, the EU allocated €6.7 billion for digital transformation projects.

- EU allocated €6.7B for digital transformation in 2024.

- Government incentives drive shift from cash to digital payments.

- Blackhawk Network can leverage these opportunities.

- Tax breaks and grants support digital adoption.

Political factors greatly shape Blackhawk Network's path. Regulations like PSD2 increase compliance needs, influencing operational costs. Trade policies, tariffs, and sanctions can directly affect transaction costs and partnerships. Governments' digital transformation support, seen in the EU's €6.7B allocation, fosters market expansion.

| Political Factor | Impact on Blackhawk Network | Example/Data (2024/2025) |

|---|---|---|

| Regulations | Increases compliance costs | EU's PSD2, global AML laws |

| Trade Policies | Affects cross-border transactions | US tariffs on China; WTO reports 15% trade decrease |

| Government Incentives | Supports digital payment adoption | EU's €6.7B digital transformation fund |

Economic factors

Consumer spending is crucial for Blackhawk Network. The economy and consumer confidence greatly affect gift card and retail purchases. In 2024, U.S. consumer spending rose, but inflation concerns persist. Strong economic growth usually increases sales. A recent report showed retail sales up 0.7% in March 2024.

Inflation poses risks to Blackhawk Network. High inflation erodes the real value of gift cards. The U.S. inflation rate was 3.5% in March 2024, according to the Bureau of Labor Statistics. Rising rates increase borrowing costs. This affects profitability.

Unemployment significantly impacts consumer behavior, a core factor for Blackhawk Network. High unemployment often curtails consumer spending, affecting gift card sales. Conversely, low unemployment boosts disposable income and increases sales volume. In March 2024, the U.S. unemployment rate was 3.8%, indicating a stable market.

Exchange Rate Fluctuations

Blackhawk Network, operating globally, faces currency exchange rate risks. These shifts affect international transaction values and revenue reporting. For example, a strong dollar can decrease the value of international sales when converted. Currency fluctuations can also raise operational costs in some areas. In 2024, the EUR/USD exchange rate varied significantly, impacting companies with European operations.

- Blackhawk Network's international revenue is subject to exchange rate risk.

- Currency fluctuations can alter the profitability of international ventures.

- Hedging strategies are employed to mitigate exchange rate impacts.

- Monitoring exchange rate trends is critical for financial planning.

Economic Growth in Emerging Markets

Blackhawk Network's expansion into emerging markets offers significant growth prospects. These markets provide access to new customer bases and distribution networks, which can boost revenue. However, companies must navigate economic volatility and infrastructure issues. For instance, in 2024, the World Bank projected that emerging market and developing economies would grow by 3.9%, indicating substantial, but variable, growth potential.

Economic factors significantly influence Blackhawk Network's performance, including consumer spending, inflation, and unemployment rates.

The U.S. retail sales increased by 0.7% in March 2024. High inflation, at 3.5% in March 2024, presents risks, as do currency fluctuations.

Emerging markets offer growth but involve volatility; the World Bank forecasts 3.9% growth in 2024 for these economies.

| Factor | Impact | 2024 Data |

|---|---|---|

| Consumer Spending | Affects gift card/retail sales | Retail sales up 0.7% (March) |

| Inflation | Erodes gift card value | 3.5% (March) |

| Unemployment | Impacts consumer spending | 3.8% (March) |

Sociological factors

Consumer behavior shifts, like the rise of digital payments, deeply affect Blackhawk Network. The company must evolve its offerings to match these new preferences. In 2024, mobile wallet usage jumped, with 60% of consumers using them monthly. Blackhawk needs to be where consumers are.

Demographic shifts, including aging populations in developed nations and a growing youth demographic in emerging markets, influence payment preferences. Older adults may favor traditional payment methods, while younger generations are more inclined towards digital solutions. For example, in 2024, 21% of the U.S. population was aged 60+, influencing demand for accessible payment options.

Cultural attitudes greatly influence gifting and prepaid card use. For instance, in Japan, gift-giving ( *ochugen* and *oseibo*) is deeply ingrained. Prepaid cards' acceptance also varies; mobile payment adoption in China is high. Understanding these cultural differences is vital for Blackhawk Network's global strategy. In 2024, the global prepaid card market was valued at $2.4 trillion.

Income Inequality and Financial Inclusion

Income inequality, a persistent issue, influences the market for gift cards and financial products. Blackhawk Network's role in financial inclusion is key. Their accessible payment options target underbanked populations, a potential growth area. The Federal Reserve's 2023 data shows the wealth gap widening. Blackhawk Network can capitalize on this.

- Wealth inequality in the U.S. reached new highs in 2023.

- Blackhawk Network can provide financial inclusion through accessible payment methods.

- This offers a growth opportunity by serving underserved markets.

Social Media and Influencer Marketing

Social media and influencer marketing significantly shape consumer perceptions of brands like Blackhawk Network. These platforms are crucial for reaching target audiences, especially younger demographics. Effective use of influencers can boost brand awareness and drive sales of gift cards and payment solutions. For instance, 72% of U.S. consumers trust online reviews and influencer content. This highlights the importance of a strong social media presence for Blackhawk Network.

- 72% of U.S. consumers trust online reviews and influencer content.

- Social media is crucial for reaching younger demographics.

- Influencers can boost brand awareness and sales.

Consumer behaviors are rapidly shifting towards digital payments. Demographics impact payment preferences, with older and younger generations differing. Cultural attitudes strongly affect gift card usage. Income inequality is a factor.

| Sociological Factor | Impact on Blackhawk Network | 2024/2025 Data Point |

|---|---|---|

| Digital Payments | Requires adaptation of offerings. | Mobile wallet use: 60% monthly (2024). |

| Demographics | Influences payment method preference. | U.S. population aged 60+: 21% (2024). |

| Cultural Attitudes | Shapes gifting & prepaid card use. | Global prepaid card market value: $2.4T (2024). |

| Income Inequality | Impacts demand for financial inclusion. | Wealth gap widened (2023, Fed data). |

Technological factors

Advancements in payment tech (NFC, QR codes, blockchain) offer Blackhawk Network innovation opportunities. These technologies enhance transaction security and speed. In 2024, mobile payments grew by 25% globally. Blackhawk Network must adapt to maintain its competitive advantage. Staying current with these trends is vital for future success.

The surge in e-commerce and mobile commerce is vital for Blackhawk Network. In 2024, global e-commerce sales hit $6.3 trillion, and mobile commerce is a big part of it. Blackhawk must work well with these platforms, because in 2025, mobile commerce is expected to grow by 20%. This helps them reach more online shoppers.

Blackhawk Network can leverage data analytics and AI to understand consumer behavior, personalize offers, and detect fraud. In 2024, the global AI market is estimated at $200 billion, projected to reach $1.8 trillion by 2030. These technologies can optimize network operations, improving efficiency. Investing in AI can boost customer experience, which is critical for sustained growth.

Cybersecurity Threats and Data Protection

Blackhawk Network, as a fintech firm, is highly vulnerable to cybersecurity threats, necessitating strong data protection. In 2024, the global cost of cybercrime is projected to reach $9.5 trillion. Maintaining customer trust requires constant vigilance and investment in cutting-edge security. Breaches can lead to significant financial losses and reputational damage.

- Cyberattacks are expected to increase by 15% annually.

- Average cost of a data breach: $4.45 million in 2023.

- Fintech firms are 300x more likely to be targeted.

- Ransomware attacks increased by 13% in 2023.

Development of APIs and Open Banking

The rise of open banking and APIs is transforming financial services. This allows for seamless integration, creating new partnership avenues for companies like Blackhawk Network. By leveraging these technologies, Blackhawk Network can expand its payment solutions. The global open banking market is projected to reach $60.9 billion by 2025, growing at a CAGR of 24.4% from 2019.

- Open banking market growth fuels integration.

- APIs enable Blackhawk Network to partner with fintech firms.

- This offers more integrated payment solutions.

- The market size is expected to be $60.9B by 2025.

Technological advancements like NFC and blockchain present innovation chances for Blackhawk Network. Mobile payments, up by 25% in 2024, demand adaptation. Cybersecurity is a major concern, with cybercrime costs reaching $9.5 trillion in 2024. Open banking, projected at $60.9B by 2025, boosts integration and partnerships.

| Technology Trend | Impact on Blackhawk Network | 2024/2025 Data |

|---|---|---|

| Mobile Payments | Adaptation for competitiveness | Mobile commerce growth expected at 20% in 2025. |

| Cybersecurity | Data protection and customer trust | Cybercrime cost $9.5T in 2024; breaches cost $4.45M on average. |

| Open Banking/APIs | Partnerships and Payment Solutions | Open Banking market size is expected to be $60.9B by 2025. |

Legal factors

Blackhawk Network navigates intricate payment system regulations. These rules cover transaction processing, settlement, and interchange fees. Compliance is essential, affecting costs and business models.

Gift card laws vary significantly by region, impacting Blackhawk Network's operations. Regulations dictate expiration dates, often prohibiting them, and limit or ban dormancy fees. Compliance involves navigating diverse state, federal, and international rules. In 2024, unclaimed property laws led to significant audits and compliance costs for gift card issuers, with billions in potential liabilities.

Blackhawk Network must comply with consumer protection laws. These laws cover unfair practices, misleading ads, and dispute resolution. Transparency and fair consumer treatment are crucial for Blackhawk. In 2024, the FTC reported over 2.6 million fraud reports. This impacts Blackhawk's gift card sales.

Financial Services Licensing Requirements

As a financial technology company, Blackhawk Network must secure licenses and registrations across various jurisdictions. This involves navigating complex legal landscapes to ensure compliance with financial regulations. Failure to comply can lead to penalties and operational disruptions. Maintaining legal compliance is crucial for Blackhawk Network's operations and market access.

- The global fintech market is projected to reach $324 billion in 2024.

- Regulatory compliance costs can consume a significant portion of operational budgets, up to 10-15% for some firms.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

Blackhawk Network faces stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules mandate thorough customer identity verification and transaction monitoring. Compliance is vital to avoid legal penalties and maintain financial institution relationships. Non-compliance can lead to significant fines; for example, in 2024, a major financial institution was fined $300 million for AML failures.

- AML/KYC compliance costs can reach 5-10% of operational expenses for financial services.

- The Financial Crimes Enforcement Network (FinCEN) issued over 1,000 enforcement actions in 2024.

- KYC failures result in over $5 billion in global fines annually.

Blackhawk Network operates within a web of complex legal factors. Payment regulations and consumer protection laws demand stringent compliance. Fintech-specific licensing, AML/KYC rules, and unclaimed property laws also play crucial roles.

| Legal Area | Impact | Data (2024-2025) |

|---|---|---|

| Payment Regulations | Affects transaction processes and fees | Global fintech market at $324B (2024). |

| Gift Card Laws | Dictates operations regarding expiration, fees | Unclaimed property audits & compliance cost. |

| Consumer Protection | Covers fraud, disputes, and fairness | FTC reported 2.6M fraud reports. |

| Licensing & Registration | Ensure market access and legitimacy | Compliance costs may go up to 15%. |

| AML/KYC | Controls money laundering | Fines up to $300M; AML/KYC costs reach 10%. |

Environmental factors

Blackhawk Network's retail presence means packaging and displays matter environmentally. Consumer and regulatory pressure for sustainable packaging is rising. The global sustainable packaging market is projected to reach $434.8 billion by 2027. This could impact Blackhawk's material choices and waste reduction strategies.

Digital payment systems and network infrastructure, essential for Blackhawk Network's operations, demand considerable energy, largely from data centers. The environmental footprint of this energy use is substantial, driving the need for energy-efficient technologies. Data centers globally consumed an estimated 240 TWh of electricity in 2022, and this is expected to increase. Blackhawk must consider energy efficiency to mitigate environmental impacts and operational costs.

Even with the rise of digital, physical gift cards persist, impacting waste management. The plastic composition of these cards raises disposal and recycling concerns. In 2024, approximately 1.5 billion gift cards were sold in the U.S., many of which are physical. Sustainable materials and recycling initiatives are key to mitigating environmental impact. For example, some companies are exploring cards made from recycled plastic or plant-based materials.

Corporate Social Responsibility (CSR) and Environmental Initiatives

Blackhawk Network faces growing pressure to demonstrate environmental responsibility. Stakeholders, including investors and consumers, increasingly prioritize companies with strong environmental stewardship. A commitment to reducing its environmental impact can boost Blackhawk Network's brand reputation. This shift is evident in the rise of ESG (Environmental, Social, and Governance) investing, with over $40 trillion in assets globally.

- ESG investments grew by 15% in 2024.

- Consumers are willing to pay 10-20% more for sustainable products.

- Companies with strong ESG ratings often see higher valuations.

Climate Change Impact on Supply Chains and Operations

Climate change poses indirect risks to Blackhawk Network. Retail partners' locations could face physical threats from extreme weather, potentially disrupting gift card sales. Supply chain issues could arise from climate-related events, impacting the availability of physical gift cards. Consumer behavior might shift, with increased demand for eco-friendly products.

- 2024 saw climate-related disasters cause $60B+ in US damages.

- Supply chain disruptions increased by 15% in 2024 due to climate events.

- Consumer interest in sustainable products grew by 20% in 2024.

Environmental factors for Blackhawk include the impact of packaging materials and data center energy use.

Consumer demand for sustainable products and responsible waste management are increasingly important. Blackhawk must consider its carbon footprint and demonstrate environmental stewardship. In 2024, ESG investments reached $40 trillion globally.

Climate change indirectly affects Blackhawk through extreme weather and supply chain disruptions, with $60B+ in US damages from climate disasters in 2024.

| Factor | Impact | Data (2024) |

|---|---|---|

| Packaging | Sustainable packaging demand | $434.8B market by 2027 |

| Energy | Data center energy use | 240 TWh electricity in 2022 |

| Climate Change | Disruptions & damage | $60B+ US climate damages |

PESTLE Analysis Data Sources

Our analysis leverages official reports from financial institutions, consumer behavior data, and technology adoption statistics. We utilize primary & secondary research ensuring accuracy and relevant insights.