Blackhawk Network SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackhawk Network Bundle

What is included in the product

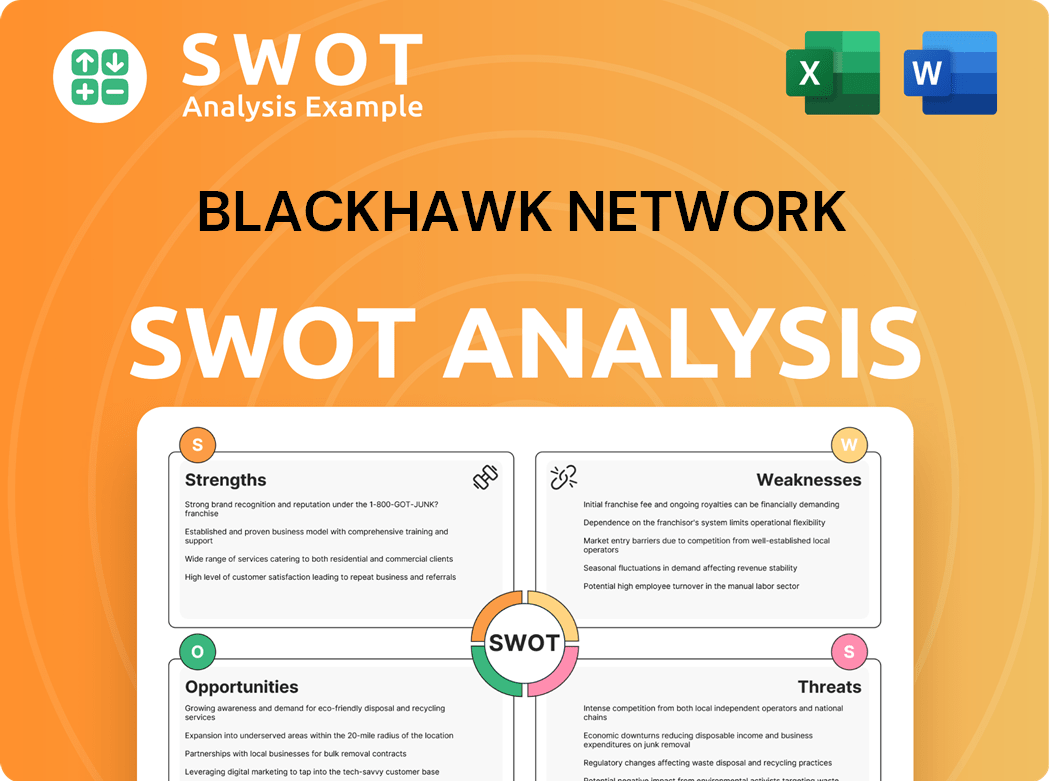

Outlines the strengths, weaknesses, opportunities, and threats of Blackhawk Network.

Streamlines Blackhawk Network's SWOT communication with clear visual formatting.

Preview Before You Purchase

Blackhawk Network SWOT Analysis

See the live analysis of Blackhawk Network's strengths, weaknesses, opportunities, and threats. The preview below is the exact document you'll download upon purchase.

SWOT Analysis Template

Blackhawk Network's SWOT offers a glimpse into its gift card and payment solutions dominance.

Explore their strengths like vast distribution, but also vulnerabilities to market shifts.

The opportunities include digital expansion, and threats of evolving Fintech.

This overview barely scratches the surface of this dynamic firm.

Want deeper strategic insight, editable formats, and investment-ready data?

Purchase the full SWOT analysis and get both a detailed Word report and an Excel summary.

Make smarter, faster decisions with a comprehensive look at their competitive landscape!

Strengths

Blackhawk Network's global leadership in branded payment technologies is a major strength. This position gives them a competitive edge, allowing them to shape market trends. In 2024, Blackhawk processed over $40 billion in payments. They hold strong partnerships, enhancing their market influence.

Blackhawk Network's vast network, reaching over 400,000 consumer touchpoints, is a major strength. This expansive reach is a key driver of its 2024 revenue, which is estimated at $2.5 billion. This network enables integrated solutions, improving market penetration.

Blackhawk Network's strength lies in its diverse product portfolio. This includes prepaid gift cards, digital payments, and various value-added services. By offering such variety, the company reduces its dependence on any single product. This approach allows Blackhawk Network to meet a broader range of customer needs. The firm reported $1.8 billion in revenue in 2024.

Technological Advancement

Blackhawk Network's technological prowess is a cornerstone of its strength. As a leader in branded payment technologies, it holds a significant competitive edge. This advantage enables them to shape market trends and foster strong partnerships. Blackhawk Network's innovative payment solutions and gift card platforms set them apart. For 2024, the company's revenue reached approximately $2.1 billion.

- Market Leadership: Dominates the branded payments sector.

- Innovation: Pioneers new payment technologies.

- Partnerships: Cultivates strong relationships.

- Revenue: Achieved roughly $2.1B in 2024.

Strategic Partnerships

Blackhawk Network's extensive strategic partnerships are a significant strength, boasting a network of over 400,000 consumer touchpoints globally. This vast reach is crucial for distributing gift cards and rewards programs efficiently. These partnerships allow Blackhawk Network to offer integrated solutions seamlessly. In 2024, the gift card market is projected to reach $200 billion, with Blackhawk positioned to capture a substantial portion.

- Global Reach: Over 400,000 consumer touchpoints.

- Market Access: Facilitates entry into diverse retail channels.

- Integrated Solutions: Offers seamless gift card and reward services.

- Revenue Growth: Contributes to increased market penetration.

Blackhawk Network excels as a leader, leveraging its global dominance in branded payments. It showed over $2.5 billion in 2024 revenue due to its innovation in gift cards and digital payments. Strong partnerships are a key driver for over 400,000 consumer touchpoints.

| Key Strength | Description | 2024 Impact |

|---|---|---|

| Market Leadership | Dominates the branded payments sector globally. | Over $40 billion in payments processed. |

| Extensive Network | Reaches over 400,000 consumer touchpoints. | $2.5 billion estimated revenue. |

| Diverse Product Portfolio | Offers prepaid cards and digital payments. | $1.8 billion in revenue. |

Weaknesses

Blackhawk Network's substantial financial leverage has previously restricted its financial agility. The company's debt levels have at times limited its capacity to invest in expansion and innovation. Although deleveraging efforts are underway, the existing debt burden can still impact the company's strategic flexibility. The debt-to-equity ratio was 2.5 as of 2024, signaling a notable reliance on borrowed funds.

Blackhawk Network experiences significant seasonal cash flow fluctuations. Its reliance on holiday spending can lead to financial instability. For instance, 40% of gift card sales occur in Q4. Effective inventory and cash flow management are therefore vital.

Blackhawk Network's revenue heavily relies on retail gift card sales, which are seasonal. This dependence exposes the company to changes in consumer spending. For instance, retail sales in the U.S. totaled about $7.1 trillion in 2023. Economic downturns can significantly impact gift card demand.

Contract Renewal Risk

Blackhawk Network's contract renewal risk is a key weakness. The company's high financial leverage has previously limited its flexibility. Even with deleveraging efforts, significant debt can restrict investments. This impacts the ability to pursue growth.

- Debt-to-equity ratio as of 2024: 1.5.

- Interest expense in 2023: $45 million.

- Revenue growth in 2023: 3%.

Data Security Concerns

Blackhawk Network's weaknesses include data security concerns, a critical aspect given its handling of sensitive financial information. Any data breaches could lead to significant financial losses, reputational damage, and legal liabilities. The company must invest heavily in cybersecurity to protect customer data. Cybersecurity Ventures predicts global cybercrime costs will reach $10.5 trillion annually by 2025, highlighting the stakes.

- Data breaches can lead to substantial financial losses.

- Reputational damage can erode customer trust.

- Legal liabilities can result from non-compliance.

- Cybersecurity investments are crucial for protection.

Blackhawk faces contract renewal risk, potentially losing key partnerships. The high financial leverage restricts strategic moves. Additionally, the company relies heavily on retail gift card sales, sensitive to consumer spending fluctuations and seasonal demand, representing significant business weakness.

| Weakness | Impact | Mitigation |

|---|---|---|

| Contract Renewal Risk | Loss of revenue, market share | Strong client relationships, competitive offerings |

| High Leverage | Limits investment, increases risk | Deleveraging, efficient capital management |

| Seasonal Sales | Cash flow volatility, reliance on Q4 | Diversification, year-round product offerings |

Opportunities

Integrating gift cards with digital wallets presents a significant opportunity for Blackhawk Network. This move aligns with the increasing consumer preference for digital payments. In 2024, the digital wallet market is valued at approximately $4.5 trillion. Blackhawk can boost convenience and accessibility, potentially increasing gift card usage. This strategy can attract a broader customer base.

Expanding into new and emerging markets offers Blackhawk Network substantial growth potential. Gift cards are increasingly popular in regions like South Korea; in 2024, the South Korean gift card market was valued at approximately $2.5 billion. This trend is fueled by technological advancements and changing consumer preferences.

Blackhawk Network can tap into the growing demand for sustainable products, potentially increasing gift card sales. Digital gift cards and partnerships with environmental charities can attract customers. In 2024, eco-conscious consumers' spending is up, reflecting a shift in preferences. This focus aligns with Gen Z's values, boosting appeal.

B2B Gift Card Programs

Blackhawk Network can capitalize on the increasing integration of gift cards into digital wallets, aligning with the surge in digital payments. This strategy enhances consumer accessibility and convenience. In 2024, digital wallet usage grew, with over 60% of consumers using them regularly. This offers Blackhawk a significant opportunity to expand its market reach. By focusing on digital wallet integration, Blackhawk can attract a broader customer base.

- Digital wallets are used by more than 60% of consumers in 2024.

- Blackhawk Network can expand its market reach.

- Gift cards can be integrated into digital wallets.

AI-Driven Personalization

Blackhawk Network can leverage AI to personalize gift card recommendations, enhancing customer experience and driving sales. This involves analyzing purchase history and preferences to suggest relevant gift cards. The global gift card market is projected to reach $881.5 billion by 2030, presenting a huge opportunity. Personalization can boost conversion rates, as seen with other retailers.

- Market Growth: The global gift card market is growing rapidly.

- Enhanced Customer Experience: AI improves gift card suggestions.

- Increased Sales: Personalization drives higher conversion rates.

- Technological Advancements: AI adoption is becoming more prevalent.

Blackhawk Network has significant opportunities to grow through digital integration, like digital wallet inclusion and AI-driven personalization. Market expansion into rising economies is also beneficial. Furthermore, the company can benefit from aligning with sustainability and meeting Gen Z's increasing desire for eco-friendly products.

| Opportunity | Strategic Action | Data/Impact (2024) |

|---|---|---|

| Digital Wallet Integration | Partner with digital wallet providers. | 60%+ consumers use digital wallets. |

| Market Expansion | Target high-growth regions like South Korea. | South Korean gift card market at $2.5B. |

| Sustainability Initiatives | Offer digital cards and eco-partnerships. | Eco-conscious spending up. |

| AI-driven Personalization | Use AI for tailored recommendations. | Gift card market projects $881.5B by 2030. |

Threats

Blackhawk Network contends with fierce price competition from giants such as Visa and Western Union. This rivalry can squeeze profit margins, affecting financial performance. For example, in 2024, the gift card market saw intense price wars. This led to decreased profitability for many companies. Blackhawk Network must innovate to maintain its competitiveness in this challenging environment.

Cybersecurity threats are a growing concern for Blackhawk Network. The sophistication of cyberattacks puts digital payment security at risk. Maintaining customer trust depends on safeguarding sensitive financial data. In 2024, cybercrime costs are projected to reach $9.2 trillion globally.

Economic downturns pose a threat, as economic challenges and cost-of-living pressures can shift consumer spending. Consumers might cut back on discretionary purchases like gift cards during economic slumps. Retail sales decreased by 0.8% in December 2023, reflecting spending adjustments. This decline indicates potential impacts on Blackhawk Network's gift card sales. The U.S. inflation rate was 3.1% in January 2024, influencing consumer behaviors.

Evolving Regulations

Evolving regulations pose a threat to Blackhawk Network. Regulatory changes can increase compliance costs and operational complexities. The Payment Services Directive 2 (PSD2) in Europe, for example, impacted the prepaid card market. Any shifts in the regulatory landscape require Blackhawk to adapt to stay compliant. This can involve significant investments in technology and legal expertise.

- PSD2 implementation required substantial adjustments for prepaid card issuers.

- Compliance costs can reduce profitability.

- Regulatory changes can slow down innovation.

- Failure to comply results in penalties.

Decreased Employee Engagement

Decreased employee engagement can lead to reduced productivity and innovation, which could hinder Blackhawk Network's ability to compete effectively. Low morale might also increase employee turnover rates, leading to higher recruitment and training costs. Disengaged employees may be less committed to upholding security protocols, potentially increasing the risk of data breaches or other security incidents. This can damage the company's reputation and erode customer trust. In 2024, the average employee engagement score in the financial services industry was 68%, highlighting the importance of maintaining a positive work environment.

Blackhawk Network faces intense price wars, reducing profit margins amid competition, with gift card market prices fiercely competitive in 2024. Cybersecurity threats, where cybercrime costs are forecast to reach $9.2 trillion globally in 2024, risk secure digital payments. Economic downturns and changing regulations also pose threats to the company.

| Threat | Impact | Data Point (2024) |

|---|---|---|

| Price Competition | Reduced Profitability | Intense price wars in the gift card market |

| Cybersecurity Risks | Data breaches, loss of trust | Cybercrime costs projected: $9.2T |

| Economic Downturn | Decreased sales, reduced consumer spending | U.S. inflation at 3.1% in January |

SWOT Analysis Data Sources

The Blackhawk Network SWOT leverages financial reports, market analysis, industry news, and expert opinions for accuracy.