Blackstone Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackstone Bundle

What is included in the product

Tailored exclusively for Blackstone, analyzing its position within its competitive landscape.

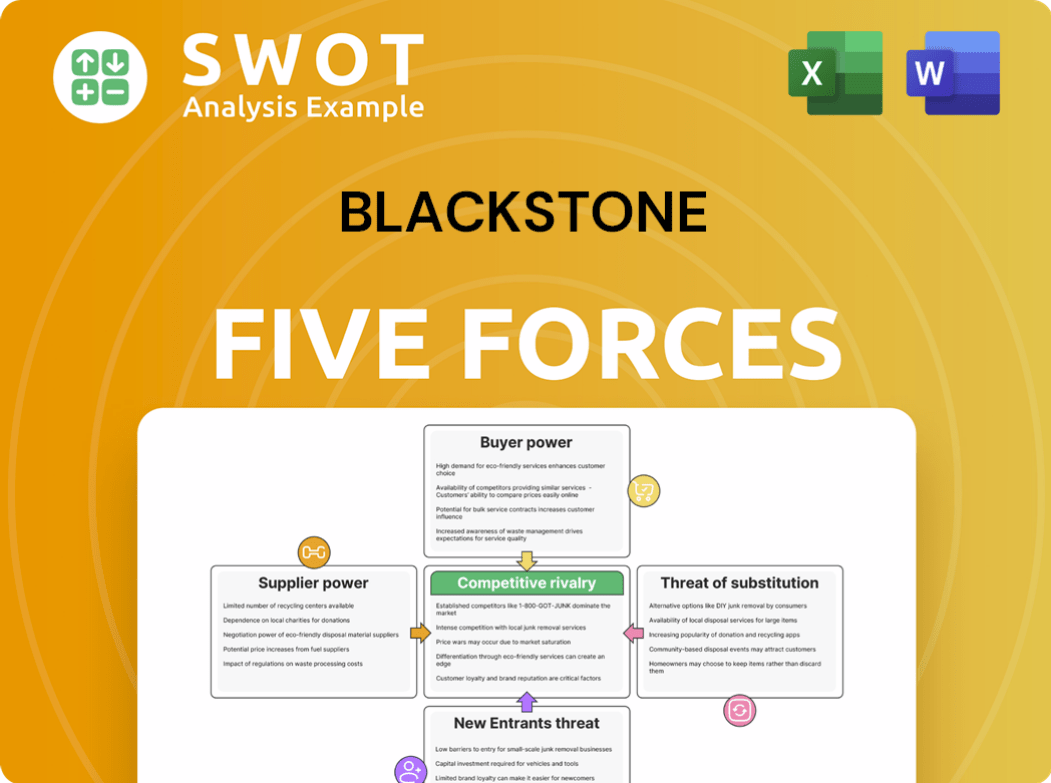

Blackstone Porter's Five Forces: instantly visualize threats and opportunities.

Full Version Awaits

Blackstone Porter's Five Forces Analysis

This preview showcases the complete Blackstone Porter's Five Forces Analysis. You're seeing the final, fully-formatted document. It includes a thorough examination of industry competitiveness. The analysis is ready for your immediate use, with no alterations needed. You'll receive this exact file instantly after purchase.

Porter's Five Forces Analysis Template

Blackstone operates within a dynamic competitive landscape, constantly shaped by industry forces. Supplier power, particularly regarding deal flow, plays a significant role. Buyer power varies, depending on the specific investment vehicles and client segments. The threat of new entrants is moderate, given the high barriers to entry. Substitute products, like alternative investment strategies, present a constant challenge. Competitive rivalry among other large asset managers is intense.

Unlock the full Porter's Five Forces Analysis to explore Blackstone’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Blackstone's supplier landscape in alternative investment management exhibits limited concentration, with key financial technology, research, and data analytics providers. Their substantial procurement budget, reaching $342.7 million in 2024, significantly boosts negotiation leverage. This translates into a negotiation leverage ratio of 4.6:1, granting Blackstone a strong position in securing favorable terms. The top suppliers include 4 financial technology providers, 3 investment research platforms, and 5 data analytics services.

Blackstone's reliance on specialized financial talent, like investment managers and analysts, gives these individuals supplier power. High demand drives up costs. In 2024, Blackstone spent $78.6 million on recruitment. Senior investment pros earn about $2.4 million yearly.

Blackstone's immense financial strength gives it significant bargaining power with suppliers. The firm's procurement budget reached $342.7 million in 2024, and a negotiation leverage ratio of 4.6:1. Supplier contracts vary, ranging from $5 million to $87 million, showcasing effective relationship management.

Data and Analytics

Blackstone's reliance on data and analytics services makes it susceptible to supplier power. The market is concentrated, giving key providers leverage. In 2024, Blackstone's annual spending on investment research platforms was $92.5 million. They also spent $64.3 million on data analytics. This dependence can impact costs and service terms.

- Concentrated market increases supplier power.

- High spending on data and analytics.

- Potential impact on costs and terms.

- Critical for investment decisions.

Technology Dependence

Blackstone's reliance on financial technology providers is a key factor in supplier bargaining power. Dependence on specialized tech, especially for AI and machine learning, can increase costs. The market for AI in investment analysis is booming, with projections showing significant growth in 2024. This dependence gives suppliers leverage, impacting Blackstone's profitability and strategic flexibility.

- Blackstone's tech dependence increases supplier power.

- AI in investment analysis is a growing market.

- Specialized tech can lead to higher costs.

- Suppliers' leverage impacts profitability.

Blackstone faces supplier power due to reliance on key vendors, especially for data analytics and financial technology. Their procurement budget was $342.7 million in 2024. High demand for specialized services and talent further enhances supplier leverage. Dependence impacts costs and strategic flexibility.

| Area | Data (2024) | Impact |

|---|---|---|

| Procurement Budget | $342.7M | Negotiation leverage |

| Recruitment Spend | $78.6M | Talent costs |

| Investment Research Platforms | $92.5M spent | Supplier influence |

Customers Bargaining Power

Institutional investors, representing a significant portion of Blackstone's client base, possess substantial bargaining power. They manage a large percentage of the firm's assets. Specifically, they can negotiate fees and influence investment strategies. As of Q4 2023, institutional investors managed 68% of Blackstone's $941 billion in assets under management. This impacts Blackstone's profitability.

Blackstone's clients show high fee sensitivity. This is due to cheaper alternatives like passive index funds and ETFs. Performance fees are crucial, accounting for 42% of their 2023 revenue. This reliance makes them susceptible to client fee negotiations.

Investors heavily scrutinize investment performance, demanding consistent, robust returns. This pressure forces Blackstone to maintain competitive yields. Underperformance can trigger increased scrutiny and redemption requests, impacting assets under management and revenue. Despite these pressures, Blackstone's AUM grew 8% to over $1.1 trillion, with $171 billion in inflows in 2024.

Alternative Investment Options

Blackstone's customers, including institutional investors and high-net-worth individuals, have significant bargaining power due to the availability of alternative investment options. This power is amplified by the ease with which investors can shift to competitors like KKR or Apollo Global Management if Blackstone's performance or fees are unfavorable. The rise of digital investment platforms and the increasing popularity of alternative investment vehicles further enhance customer choice, potentially driving down fees and improving service quality to remain competitive.

- Hedge fund assets reached $4 trillion in 2024.

- Real estate investments remain a popular alternative, with global volumes at $700 billion in 2024.

- Robo-advisors now manage over $1 trillion in assets globally.

- Blackstone's AUM was around $1 trillion in 2024.

Long-Term Commitments

Blackstone's alternative investments, often involving long-term commitments, reduce the immediate threat from substitutes due to lock-up periods. This structure allows Blackstone to maintain a degree of control over its client base. However, sustained underperformance could erode investor confidence, prompting them to allocate future capital elsewhere. Maintaining strong client relationships and delivering consistent returns are thus crucial for retaining bargaining power. In 2024, Blackstone's assets under management (AUM) reached $1.06 trillion, highlighting its scale.

- Long-term commitments create barriers to exit for investors.

- Consistent returns are vital to retain investors over time.

- Poor performance increases the likelihood of investors seeking alternatives.

- Blackstone's AUM of $1.06 trillion in 2024 underscores its market position.

Customers, especially institutional investors, wield considerable bargaining power over Blackstone. This is fueled by the availability of alternative investments. The ease of switching to competitors further amplifies their influence.

| Aspect | Details |

|---|---|

| AUM 2024 | $1.06 Trillion |

| Hedge Fund Assets (2024) | $4 Trillion |

| Real Estate Investment Volumes (2024) | $700 Billion |

Rivalry Among Competitors

Blackstone encounters fierce competition in the alternative asset management arena. It battles with industry giants for capital and prime investment prospects. Key rivals include BlackRock and Vanguard, boasting substantial assets under management. Blackstone's leading market share and global reach mitigate rivalry from smaller firms. In 2024, Blackstone's AUM reached $1.06 trillion, demonstrating its strong position.

Blackstone faces intense pressure to perform, as investors compare returns against rivals. Strong performance is key to Blackstone's reputation. In 2024, Blackstone's assets under management (AUM) reached $1.04 trillion, reflecting its ability to attract and retain investors. Its expertise allows for attractive returns.

Blackstone's diverse strategies offer a competitive edge, yet rivalry exists. They compete in private equity, real estate, and credit. Their varied sectors expose them to different market dynamics. In 2024, they managed ~$1T in assets, showing scale. This diversification helps navigate competitive pressures.

Market Consolidation

The asset management sector is experiencing significant market consolidation, intensifying competitive rivalry. Larger firms are actively acquiring smaller ones, reshaping the industry landscape. According to PwC's '2023 Global Asset and Wealth Management Survey', this trend is accelerating, with a notable increase in mergers and acquisitions. This environment forces Blackstone to remain agile and competitive, emphasizing innovation and strategic adaptation.

- Approximately 1 in 6 asset and wealth management companies are likely to be acquired by 2027.

- This represents a turnover rate twice the historical average.

- Blackstone must continuously seek to innovate to maintain its market position.

Global Reach

Blackstone's global footprint strengthens its competitive stance, yet it faces local rivals across different markets. Staying ahead and setting itself apart is a consistent hurdle. Blackstone boasts a broad global presence, with offices spanning North America, Europe, Asia, and the Middle East. The firm's investments span private equity, infrastructure, real estate, and credit strategies.

- Blackstone's assets under management (AUM) reached $1.06 trillion as of Q1 2024.

- In 2023, Blackstone invested approximately $117 billion globally.

- Blackstone's real estate portfolio includes properties in over 15 countries.

- Blackstone's competition includes global firms like KKR and local players.

Blackstone faces strong competition in asset management. Rivals like BlackRock and Vanguard have substantial AUM. Intense pressure exists to deliver high returns, impacting its reputation. Market consolidation, with mergers, also increases competition.

| Metric | 2023 | 2024 (Q1) |

|---|---|---|

| Blackstone AUM (USD Trillion) | ~$1.0T | $1.06T |

| Global Investments (USD Billion) | $117B | N/A |

| Est. Acquired Firms by 2027 | N/A | 1 in 6 |

SSubstitutes Threaten

Blackstone faces a substantial threat from passive investments, particularly index funds and ETFs. These alternatives boast lower fees and require less active management, drawing investors seeking cost-effective solutions. The global alternative assets market hit $18.3 trillion in 2023. Blackstone's AUM reached $941 billion by the end of Q4 2023.

Emerging digital investment platforms and robo-advisors pose a threat to Blackstone. These platforms offer automated, low-cost investment solutions, attracting tech-savvy investors. In 2024, robo-advisors managed over $1 trillion globally. Blackstone's adaptation and regulatory compliance are essential. Effective compliance mitigates the threat, as clients value stability.

The growing appeal of alternative investments, like real estate and hedge funds, poses a threat to Blackstone. Competing asset managers offering similar alternative investments intensify this substitution risk. Investors have numerous alternatives to private equity, including public equities and fixed-income. In 2024, the alternative assets market was valued at over $15 trillion, highlighting the competition.

Direct Investments

The threat of substitutes for Blackstone comes from direct investments, where institutional investors and high-net-worth individuals bypass private equity funds. This disintermediation reduces demand for Blackstone's services, increasing the threat. Blackstone's economies of scale provide cost-efficient services, making it tough for smaller firms to be direct substitutes. However, the trend towards direct investments is growing; in 2024, direct investments accounted for a significant portion of overall investment activity.

- Direct investments in 2024 saw increased activity, with significant capital allocated outside traditional PE funds.

- Blackstone's size and resources offer a competitive advantage, but the trend poses a challenge.

- Smaller firms struggle to match Blackstone's expertise and cost efficiency.

- High-net-worth individuals are increasingly exploring direct investment options.

Regulatory Compliance

Blackstone faces regulatory compliance pressures, influencing its competitive edge. Adapting to evolving rules is key to retaining clients. Robust compliance reduces substitute threats by ensuring stability. The financial sector's shifts impact the competitive environment. In 2024, global regulatory changes have increased compliance costs by 15%.

- Compliance costs rose by 15% in 2024 due to global regulatory changes.

- Clients value stability and adherence to industry standards.

- Regulatory scrutiny is a significant factor in the alternative asset management industry.

- Blackstone's ability to comply is crucial to mitigate substitute threats.

Blackstone's substitutes include passive investments and digital platforms, reducing the need for active management. The appeal of alternative investments and direct investments also intensifies the competition. Regulatory pressures and rising compliance costs further influence Blackstone's competitive environment. In 2024, the total global AUM for alternative assets was over $15 trillion.

| Substitute Type | Impact on Blackstone | 2024 Data |

|---|---|---|

| Passive Investments | Lower Fees & Less Management | Global AUM: $18.3T |

| Digital Platforms | Automated, Low-Cost Solutions | Robo-advisors managed over $1T |

| Alternative Investments | Competition among asset managers | Alternative Assets Market over $15T |

Entrants Threaten

The alternative asset management sector faces high barriers to entry, primarily due to substantial capital needs. New firms require significant funds to launch, attract investors, and build a diverse investment portfolio. Regulatory compliance is complex, demanding considerable financial investment and expertise. For example, in 2024, starting an alternative asset management firm could require tens or even hundreds of millions of dollars.

Regulatory hurdles significantly impact new entrants. Complex rules need expertise and resources, increasing the barrier to entry. Blackstone's reputation, built over many years, is a strong advantage. This credibility with institutional investors is hard to replicate. In 2024, regulatory compliance costs rose by 15% for financial firms.

Blackstone's strong reputation and decades of successful operations create a significant barrier. This history of success, including managing over $1 trillion in assets as of late 2024, fosters trust with investors. New entrants struggle to match this proven track record. This brand strength, a key asset, aids in attracting institutional investment.

Network Effects

The alternative asset management industry, like Blackstone, thrives on strong networks. Building relationships with institutional investors takes considerable time. Blackstone's established network offers a significant competitive advantage, making it tough for newcomers to replicate these connections. This network effect creates a substantial barrier to entry. Blackstone's assets under management (AUM) reached $1.06 trillion in 2024, showcasing the strength of its network.

- Blackstone's AUM: $1.06 trillion (2024)

- Network effect creates a barrier for new entrants.

- Building relationships takes time.

- Existing networks provide a competitive advantage.

Economies of Scale

Established firms, like Blackstone, leverage economies of scale, spreading fixed costs across a vast asset base. This cost advantage makes it hard for new entrants to compete. For example, in 2024, Blackstone managed approximately $1 trillion in assets, allowing for cost-efficient service delivery. Smaller competitors struggle to match the resources and expertise of established firms.

- Blackstone's substantial assets under management ($1T in 2024) create economies of scale.

- Economies of scale result in cost efficiencies.

- New entrants find it difficult to replicate the cost advantages.

- Blackstone's expertise and resources provide a competitive edge.

Threat of new entrants to Blackstone is low due to high barriers. These barriers include hefty capital requirements and complex regulations. Blackstone’s reputation and vast network further protect its market position.

| Factor | Impact | Data (2024) |

|---|---|---|

| Capital Needs | High investment to start | $100M+ to launch |

| Regulatory Compliance | Complex and costly | Compliance costs up 15% |

| Brand Reputation | Difficult to replicate | Blackstone AUM: $1.06T |

Porter's Five Forces Analysis Data Sources

Blackstone's Porter's analysis uses financial reports, industry studies, and economic data. We consult SEC filings, news, and market research. This offers detailed market competition insights.