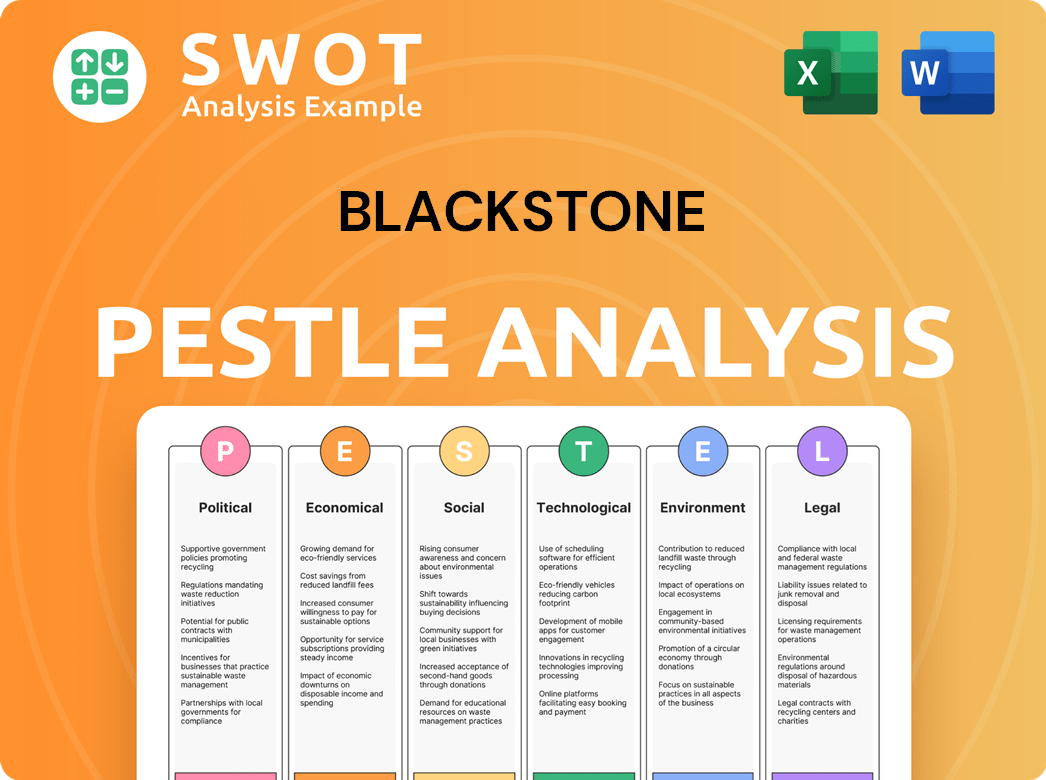

Blackstone PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Blackstone Bundle

What is included in the product

Unveils how external forces impact Blackstone via Political, Economic, Social, etc., dimensions. Includes forward-looking insights for proactive strategy.

Uses clear language and organized layout for stakeholders, providing essential understanding and action.

What You See Is What You Get

Blackstone PESTLE Analysis

This is the full Blackstone PESTLE Analysis! The preview here displays the complete, final document. After your purchase, you'll receive the exact file. It's ready to download and use immediately. Get a real look at what you’re buying!

PESTLE Analysis Template

Navigate the complexities impacting Blackstone with our insightful PESTLE analysis. Uncover key external factors: political shifts, economic trends, and social influences. Our analysis expertly breaks down the competitive landscape. Equip yourself to identify risks and opportunities. For deeper strategic insights, download the full, ready-to-use report today.

Political factors

Blackstone's global investments are heavily influenced by geopolitical tensions and trade policies. The firm's diverse portfolio across many countries exposes it to political risks. For example, in 2024, Blackstone had approximately $1 trillion in assets under management globally. Political stability and trade relations are crucial; a 2024 report indicated a 5% impact on investment returns due to geopolitical events.

Blackstone's success is heavily influenced by the regulatory environment. Changes in investment laws, financial regulations, and asset-specific rules (like those for real estate) directly impact its business. For instance, in 2024, stricter rules on private equity fees could affect Blackstone's earnings. A favorable regulatory climate, such as streamlined investment processes, is generally beneficial.

Government spending and infrastructure policy significantly impact Blackstone. Increased infrastructure investment, as proposed in the Infrastructure Investment and Jobs Act, presents opportunities for Blackstone's infrastructure funds. However, political gridlock and debates over the efficiency of government spending could hinder these opportunities. For example, in 2024, the U.S. government allocated $1.2 trillion for infrastructure projects. Delays or changes in these plans could affect Blackstone's investments.

Political Stability and Elections

Political stability is critical for Blackstone's investments. Upcoming elections and shifts in government policies can significantly affect the economic and regulatory environments where Blackstone operates. Policy changes can directly influence asset performance and investment strategies. For instance, the 2024 U.S. election could bring tax reforms impacting real estate and private equity.

- Tax policies: Potential changes in capital gains tax rates.

- Regulatory environment: Impact of new regulations on financial markets.

- Geopolitical risks: Global instability affecting investment strategies.

- Policy shifts: Government spending and infrastructure projects.

International Relations and Protectionism

Broadening protectionism and shifts in international relations pose risks to global investment. These changes can disrupt supply chains, affecting firms like Blackstone. For example, in 2024, trade tensions led to a 15% decrease in certain cross-border investments. This situation creates both challenges and chances for global investment firms.

- Trade wars can increase costs and reduce market access.

- Geopolitical instability may lead to investment diversifications.

- New trade agreements could open up new investment zones.

- Policy changes can influence asset values and returns.

Blackstone's global strategy hinges on political factors, including geopolitical risks, trade policies, and upcoming elections, impacting its diverse portfolio. For example, in 2024, policy shifts could influence asset values; 2024 saw approximately $1 trillion in assets under management globally. Regulatory changes and infrastructure policies directly impact their business.

| Political Aspect | Impact | 2024 Data/Example |

|---|---|---|

| Geopolitical Risk | Investment returns could be affected. | 5% impact on investment returns due to geopolitical events in 2024. |

| Regulatory Environment | Stricter rules could affect earnings. | Stricter rules on private equity fees could affect earnings in 2024. |

| Infrastructure Policy | Creates investment opportunities. | The U.S. government allocated $1.2T for infrastructure projects in 2024. |

Economic factors

Interest rates and inflation are critical for Blackstone. Lower rates encourage investments. As of May 2024, the Federal Reserve held rates steady, with expectations of cuts in 2025. High inflation raises costs. The Consumer Price Index rose 3.5% in March 2024.

Blackstone's success is closely linked to global economic expansion. Despite market volatility, forecasts indicate stable global GDP growth in 2025. The IMF projects global growth of 3.2% in 2024 and 3.2% in 2025. This positive outlook creates opportunities for investment.

Ongoing market volatility, fueled by tech and geopolitical events, poses challenges. In Q1 2024, the VIX index, a measure of market volatility, saw fluctuations, reflecting uncertainty. Blackstone must adapt its strategies to manage risk effectively. The firm's ability to anticipate and respond to market shifts will be crucial for its success. This includes careful asset allocation and risk management practices.

Real Estate Market Conditions

Blackstone's real estate investments are influenced by market conditions. Elevated interest rates have posed challenges. However, there's evidence of stabilization and recovery. Private capital inflows are bolstering confidence in real estate.

- Q1 2024: Blackstone's Real Estate segment saw a 1.3% increase in AUM.

- 2024: Interest rates remain a key factor.

- Market analysts predict a rebound in 2025.

Private Markets Trends

Private markets, such as private equity and credit, are anticipated to experience careful expansion in 2025. Investor enthusiasm for these markets persists, with projections of augmented capital commitments. The secondary market also demonstrates considerable activity, reflecting ongoing investor interest. According to a 2024 report, private equity deal value reached $684 billion globally.

- Private equity deal value reached $684 billion globally in 2024.

- Increased capital commitments are expected in 2025.

- The secondary market shows robust activity.

Interest rates and inflation significantly impact Blackstone. The Federal Reserve maintained rates in May 2024, with 2025 cuts anticipated. Global GDP growth, predicted at 3.2% for both 2024 and 2025, drives investment opportunities.

Market volatility, seen in Q1 2024's VIX fluctuations, requires risk management. Private equity deal value reached $684 billion in 2024. Real estate shows signs of recovery, supported by private capital.

| Economic Factor | Impact on Blackstone | Data (2024/2025) |

|---|---|---|

| Interest Rates | Influence Investment | Stable in May 2024; Cuts Expected in 2025 |

| Inflation | Affects Costs | CPI rose 3.5% in March 2024 |

| Global Growth | Creates Opportunities | 3.2% growth in 2024 & 2025 (IMF) |

Sociological factors

Aging populations in developed nations present both challenges and opportunities for Blackstone. The demand for healthcare and senior living facilities is projected to rise, offering investment prospects. For example, the over-65 population in the U.S. is expected to reach 73 million by 2030.

Shifting investor behaviors are critical for Blackstone. The firm's growth in private wealth depends on understanding these trends. Family offices and individual investors now seek tailored offerings. In 2024, sustainable investing grew, with $2.3 trillion in U.S. assets. This impacts Blackstone's strategy.

Stakeholders increasingly prioritize ESG factors, influencing investment choices and corporate strategies. Blackstone actively integrates ESG considerations into its investment processes. In 2024, ESG-linked assets reached $4.3 trillion globally. Blackstone aims to enhance its sustainable investment portfolio.

Workforce Trends and Digital Nomadism

The increasing popularity of hybrid work and digital nomadism significantly influences real estate demands. These trends are reshaping how people utilize spaces, impacting both commercial and residential markets. Blackstone must adjust its real estate investments to reflect these shifts, focusing on adaptable properties. Consider that, in 2024, approximately 16.1 million U.S. workers identified as digital nomads.

- Growing remote work: 30% of the global workforce will be remote by the end of 2025.

- Changing office needs: Demand for flexible office spaces is expected to rise.

- Residential property shifts: Increased demand in areas popular with digital nomads.

- Investment adaptation: Blackstone must diversify to meet evolving market needs.

Diversity and Inclusion

Blackstone faces increasing societal pressure to prioritize diversity and inclusion (D&I). This impacts its corporate social responsibility (CSR) initiatives, influencing stakeholder perceptions and potentially affecting investment decisions. Companies with strong D&I metrics often attract more diverse talent and may outperform those lacking such focus. In 2024, Blackstone highlighted its commitment to D&I, aiming to increase representation across its workforce.

- Blackstone's 2023 Impact Report showed continued focus on D&I in its portfolio companies.

- Industry reports indicate a growing investor preference for diverse and inclusive firms.

- D&I efforts are increasingly integrated into ESG (Environmental, Social, and Governance) assessments.

Sociological factors significantly influence Blackstone's strategies.

Aging populations drive healthcare investment; by 2030, the over-65 population in the U.S. is expected to be 73 million.

Remote work and digital nomadism shape real estate, with 30% of the global workforce remote by end of 2025.

Diversity and inclusion are critical; Blackstone is focusing on D&I, which aligns with ESG metrics.

| Factor | Impact | 2024 Data/Trends |

|---|---|---|

| Aging Populations | Increased demand for healthcare/senior living facilities | Over-65 pop. in U.S. to 73M by 2030 |

| Remote Work/Nomadism | Changes in real estate, need for flexible spaces | ~16.1M U.S. digital nomads in 2024 |

| Diversity & Inclusion | Influences stakeholder perception and investment | Blackstone's commitment to D&I highlighted in reports. |

Technological factors

Artificial Intelligence (AI) is rapidly changing industries, opening new investment opportunities. The surge in AI applications boosts data generation, increasing the demand for data centers. Blackstone sees data centers as a crucial investment, with the global data center market projected to reach $700 billion by 2025. This aligns with Blackstone's strategic focus.

Blackstone heavily invests in digital infrastructure, including data centers, to capitalize on the growing digital economy. This sector benefits from increasing data reliance. In 2024, data center investments surged, with global spending expected to reach $200 billion. Blackstone's strategic moves reflect this trend, aiming to capture significant returns.

Technological advancements significantly impact operational efficiency. Blackstone uses technology to boost portfolio company performance, focusing on data analytics and automation. In 2024, Blackstone invested heavily in tech-driven solutions across its portfolio. This approach aims to generate higher returns and improve operational agility.

Evolution of Financial Technology

Technological advancements are reshaping the financial landscape, impacting Blackstone's operations. Adapting to fintech, including AI and blockchain, is crucial for investment strategies. Digital platforms offer new avenues for accessing and managing investments, requiring Blackstone to innovate. The fintech market is projected to reach $698.4 billion by 2025.

- AI in finance could automate 40% of financial tasks by 2025.

- Blockchain could reduce infrastructure costs by 20-30%.

- Mobile payments are expected to reach $3.1 trillion in 2025.

Cybersecurity Risks

As Blackstone leverages technology, cybersecurity risks become paramount. State-backed hacking and cloud infrastructure threats necessitate robust defenses. The global cybersecurity market is projected to reach $345.7 billion in 2024, growing to $469.5 billion by 2029. Protecting sensitive financial data and operational integrity is crucial for maintaining investor trust and regulatory compliance.

- Cybersecurity spending is expected to increase by 12-15% annually.

- Ransomware attacks cost businesses globally $20 billion in 2023.

- Cloud-based attacks are on the rise, with a 20% increase in 2024.

Blackstone's technological focus includes AI and data analytics, crucial for operational efficiency. Digital infrastructure, like data centers, is a key investment area due to rising data demands. Cybersecurity remains vital as the market is projected to hit $345.7 billion in 2024.

| Technology Impact | Financial Metrics (2024/2025) | Blackstone's Strategic Response |

|---|---|---|

| AI Adoption | Automation of 40% financial tasks by 2025. Fintech market $698.4B by 2025. | Investments in AI and data analytics across portfolio companies. |

| Digital Infrastructure | Global data center market: $700B by 2025; data center spending $200B (2024) | Significant investments in data centers and digital infrastructure. |

| Cybersecurity | Global market: $345.7B (2024) growing to $469.5B (2029) Cloud-based attacks up 20% (2024). | Prioritization of robust cybersecurity measures. |

Legal factors

Blackstone must navigate evolving legal landscapes. Recent regulatory shifts, like those impacting private equity, demand adaptation. For example, the SEC's focus on fee transparency affects Blackstone's practices. Compliance costs are rising; in 2024, these hit $500 million. Staying ahead of these changes is key to avoiding penalties and maintaining investor trust.

The legal landscape for ESG reporting is changing. Regulations are moving toward global standard harmonization. Blackstone must improve its sustainability disclosures. In 2024, the SEC finalized rules requiring climate-related disclosures. The EU's CSRD also impacts Blackstone, demanding detailed ESG data.

Real estate regulations significantly influence Blackstone's operations. Zoning laws, building codes, and environmental regulations are crucial. Compliance costs can be substantial. For example, in 2024, Blackstone faced increased scrutiny regarding environmental impact, potentially increasing costs by 5-10% on certain projects. These regulations directly affect project feasibility and profitability.

Tax Laws and Policies

Tax laws significantly influence Blackstone's financial outcomes. Changes in tax regulations in various countries affect investment returns and financial planning. For instance, the 2017 Tax Cuts and Jobs Act in the U.S. impacted corporate tax rates. This can alter the attractiveness of certain investments. Blackstone actively monitors global tax developments to optimize its strategies.

- U.S. corporate tax rate: Currently at 21% following the 2017 tax reform.

- Blackstone's assets under management (AUM): Approximately $1 trillion as of early 2024, subject to tax implications.

- Impact of tax changes on investment returns: A 1% change in tax rates can significantly affect profitability.

Legal Challenges and Litigation Risks

Blackstone confronts legal hurdles and litigation risks tied to its investments, operational practices, and regulatory compliance. These risks encompass potential issues linked to ESG disclosures, increasing the need for precise and transparent reporting. In 2024, the SEC intensified its scrutiny of ESG disclosures, signaling a heightened risk landscape. Litigation related to investment performance or conflicts of interest can also arise.

- SEC scrutiny of ESG disclosures is increasing.

- Litigation related to investment performance.

- Compliance with evolving global regulations.

Blackstone faces shifting legal and regulatory terrains affecting operations. Compliance costs have risen; around $500 million in 2024. Evolving ESG reporting standards require improved disclosures. Tax laws significantly influence Blackstone's financial outcomes.

| Legal Aspect | Impact | Data |

|---|---|---|

| Regulatory Changes | Compliance Costs | $500M in 2024 |

| ESG Reporting | Enhanced Disclosures | SEC and EU CSRD |

| Tax Laws | Investment Returns | US corporate tax at 21% |

Environmental factors

Blackstone sees major chances in the shift to clean energy and climate solutions. The firm invests in businesses and assets related to energy transition. In 2024, Blackstone invested over $10 billion in green energy. They aim for a portfolio aligned with sustainability goals.

Blackstone actively focuses on decarbonization across its investments. They are setting emissions reduction targets, aiming for significant environmental improvements. For example, in 2023, Blackstone’s real estate portfolio saw a 6% reduction in carbon emissions. The firm invests heavily in energy efficiency and renewable energy projects. This strategy aligns with growing investor and regulatory pressures for sustainable practices.

Climate risks, including extreme weather events, are increasing, affecting property values and insurance costs. For example, in 2024, insured losses from natural disasters in the U.S. reached $60 billion. Blackstone must integrate these risks into its real estate investment and risk management strategies. This includes assessing the vulnerability of properties and adjusting investment decisions accordingly.

Environmental Regulations

Blackstone must adhere to environmental regulations across its real estate development, energy use, and investment portfolio. Compliance is crucial, especially given increasing global focus on sustainability. Non-compliance can lead to significant financial penalties and reputational damage. Regulations like those in the EU, which aim to cut emissions by at least 55% by 2030, directly affect Blackstone's operations.

- EU's Green Deal targets a 55% emissions reduction by 2030.

- Blackstone's ESG-linked financing reached $5.5 billion in 2023.

- US EPA’s focus on reducing emissions impacts real estate.

Natural Capital and Biodiversity

Blackstone must consider natural capital and biodiversity, going beyond climate change. Companies are now assessing nature-related risks and incorporating biodiversity into sustainability plans. In 2024, the Taskforce on Nature-related Financial Disclosures (TNFD) framework gained traction, influencing corporate strategies. The World Economic Forum estimates over half of global GDP depends on nature's services.

- TNFD framework adoption is increasing among large corporations.

- Nature-related risks are becoming a focus of financial reporting.

- Investment in nature-based solutions is projected to grow.

Blackstone addresses environmental factors via renewable investments and decarbonization, with green energy exceeding $10 billion in 2024. The firm aims for emissions cuts across its portfolio, integrating climate risks. They also focus on biodiversity and regulatory compliance, targeting EU's 55% emissions reduction by 2030.

| Factor | Details | Impact |

|---|---|---|

| Green Energy Investment | >$10B in 2024 | Supports sustainability & market growth |

| Carbon Emissions Reduction (Real Estate, 2023) | 6% | Reduces environmental footprint, lowers risks |

| Regulatory Compliance | EU's Green Deal | Avoidance of financial penalties, improved reputation |

PESTLE Analysis Data Sources

This PESTLE Analysis draws on official government data, industry reports, and financial publications. Sources include legal frameworks, economic indicators, and technological forecasts.