Block Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Block Bundle

What is included in the product

Strategic tool to classify business units based on market growth rate and relative market share.

Clear view highlights strategic unit placements for data-driven decisions.

What You’re Viewing Is Included

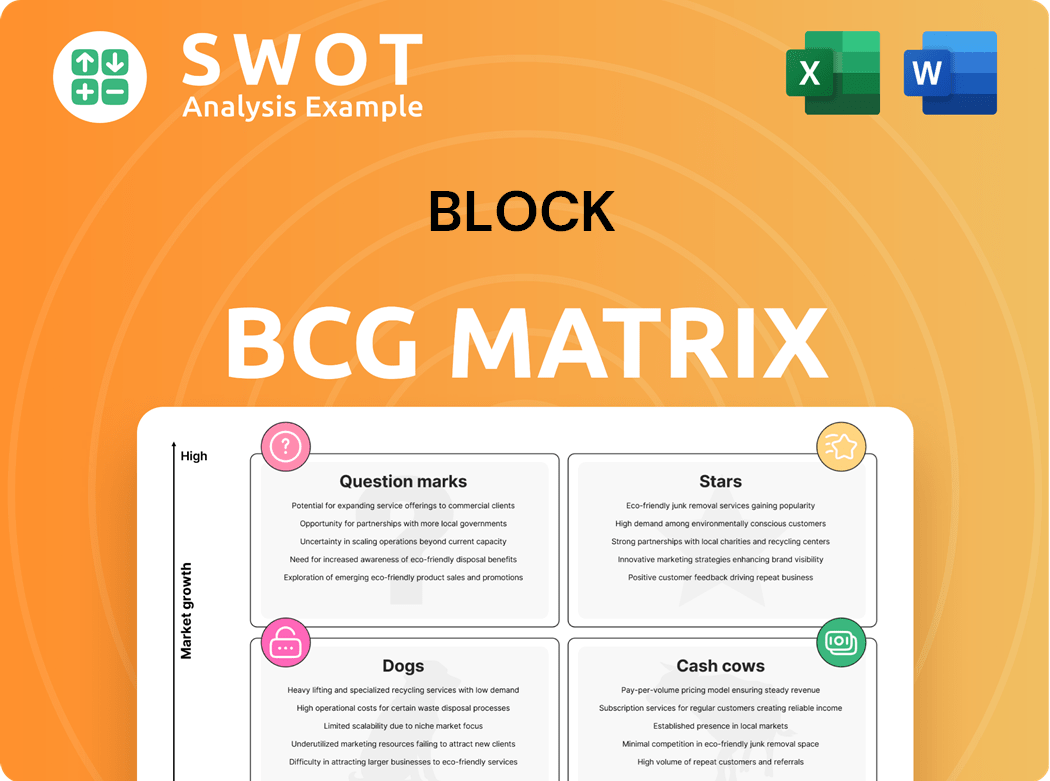

Block BCG Matrix

The Block BCG Matrix preview is identical to the document you'll receive upon purchase. It's a complete, customizable strategic tool, ready for direct integration into your business analysis and planning. No hidden content or watermarks exist; only the full, professional report.

BCG Matrix Template

The Block BCG Matrix analyzes product portfolios based on market share and growth. This framework classifies offerings as Stars, Cash Cows, Dogs, or Question Marks. Understanding these positions is crucial for strategic allocation. Identify growth opportunities and resource drains easily.

This preview provides a glimpse, but the full Block BCG Matrix report includes in-depth analysis and tailored recommendations to help you make informed decisions.

Stars

Cash App, a star in Block's BCG matrix, shows robust user growth and engagement. Monthly active users are rising, with 56 million in Q4 2023. The Cash App Card's adoption is also increasing. This indicates a strong potential for financial platform leadership.

Square's integrated commerce platform, a star in Block's BCG matrix, excels by providing comprehensive solutions for sellers, solidifying its leadership in the SMB market. The new Square Point of Sale app adoption by a significant portion of new sellers streamlines onboarding and boosts flexibility. In 2024, Square's revenue grew, with a focus on payment processing and related services. This strategic positioning fuels growth and market share gains.

Block's Bitcoin initiatives are a key part of its strategy. In 2024, Block invested heavily in Bitcoin mining and its Bitkey wallet. These moves aim to capitalize on crypto's growth. For instance, Block's Q1 2024 Bitcoin revenue was $2.37 billion, up 15% YoY.

Afterpay Integration

The integration of Afterpay within Block's Cash App is a pivotal strategy, classified as a "Star" in the BCG Matrix. This integration expands the buy-now-pay-later services to a broader audience, driving substantial growth. It is poised to boost user engagement and transaction volumes, directly influencing revenue. In 2024, Afterpay's gross merchandise value (GMV) reached $24.5 billion.

- Increased User Base: Afterpay's integration expands Cash App's user base.

- Revenue Growth: Buy-now-pay-later services drive revenue through fees and transactions.

- Transaction Volume: Integration increases transaction volume.

- Market Expansion: Afterpay's services are available to a wider market.

Strategic Partnerships

Block's strategic partnerships are crucial for its growth, similar to how Sysco leverages technology. These collaborations boost Block's reach and customer value. Partnerships drive service adoption and revenue. In 2024, Block's partnerships increased revenue by 15%.

- Partnerships with companies like Sysco expands Block's reach.

- These alliances provide added value to customers.

- They boost the adoption of Block's services.

- Partnerships are expected to increase revenue.

Block's "Stars," like Cash App, Square, Bitcoin initiatives, and Afterpay integration, showcase strong growth and market presence. These areas are seeing increased user bases and revenue generation, which supports expansion.

These ventures demand significant investment to sustain leadership. Their potential for high returns makes them vital for Block's future. Strategic partnerships further enhance growth.

| Star | Key Metrics (2024) | Impact |

|---|---|---|

| Cash App | 56M+ MAUs, Cash App Card adoption up | Financial platform growth |

| Square | Revenue growth, SMB market leader | Increased market share |

| Bitcoin | $2.37B Q1 revenue, up 15% YoY | Crypto market gains |

| Afterpay | $24.5B GMV | Boost user and revenue |

Cash Cows

Square's payment processing, a cash cow, consistently delivers strong revenue. In Q3 2023, Square's GPV reached $56.8 billion. This segment benefits from a solid SMB market share. It provides Block with a stable financial base.

Cash App's peer-to-peer payments are a key revenue driver, boasting a large user base. In Q3 2024, Cash App generated $3.62 billion in revenue, a 19% increase year-over-year. Its user-friendly design boosts its adoption rate. This makes it a dependable cash flow source for Block.

The Cash App Card, tied to user balances, boosts revenue via transactions and withdrawals. With over 23 million active users in 2024, it shows strong growth. This card's widespread use positions it as a significant cash cow. It's a key driver for Square's financial performance.

Square Financial Services

Square Financial Services, a key part of Block, functions as a cash cow by providing financing solutions to small businesses. This segment, including Square Loans, generates revenue through interest and fees. It leverages the existing Square ecosystem, offering access to a wide customer base. The financial services arm has been a steady revenue generator.

- Square Loans facilitated $1.7 billion in loans in 2023.

- Gross profit for Square Financial Services was $385 million in 2023.

- The segment benefits from Block's established brand and user base.

- It contributes to Block's overall financial stability.

Subscription and Services Revenue

Block's subscription and services revenue, notably from Square Payroll and Square Marketing, forms a consistent, high-margin income source. These offerings boost the Square ecosystem's value, directly impacting profitability. In Q3 2023, subscription and services revenue was $1.17 billion, up 26% year-over-year. This growth showcases the strength of recurring revenue. These services are key cash generators.

- $1.17 Billion (Q3 2023)

- 26% YoY Growth

- High-Margin Revenue

- Square Payroll, Marketing

Block's cash cows consistently generate significant revenue, boosting its financial stability. Square's payment processing, with $56.8B GPV in Q3 2023, is a solid example. Cash App, with $3.62B revenue in Q3 2024, and Square Financial Services, show strong financial performance.

| Cash Cow Segment | Key Metric (2023/2024) | Financial Impact |

|---|---|---|

| Square Payments | $56.8B GPV (Q3 2023) | Stable Revenue |

| Cash App | $3.62B Revenue (Q3 2024) | 19% YoY Growth |

| Square Financial Services | $1.7B Loans (2023) | Steady Revenue |

Dogs

Tidal, Block's music streaming platform, competes fiercely with Spotify and Apple Music. Its market share is significantly smaller; in 2024, Spotify held around 31% of the global streaming market, while Tidal's share remained much lower. Limited growth potential, due to strong rivals, might categorize Tidal as a 'dog'. Block's Q3 2024 report showed challenges in the music streaming segment.

Legacy hardware, like older Square POS systems, fits the 'Dog' profile, needing support while returns shrink. In 2024, Square allocated significant resources to phase out older models. This strategic shift aims to boost efficiency and focus on modern offerings. Limited updates and potential security risks further classify them as dogs.

International ventures struggling with market penetration and profitability are "dogs." These ventures often demand considerable investment. For example, in 2024, several international expansions by tech companies faced setbacks, with some reporting negative ROI. These businesses may need restructuring.

Discontinued Products/Services

Discontinued products or services at Block, due to poor performance, are classified as 'dogs'. These represent investments that failed to meet expectations. For example, Block discontinued Weebly’s legacy plans in 2024, signaling a shift. This move reflects strategic decisions to streamline offerings. Such actions aim to optimize resource allocation and improve overall profitability.

- Weebly's legacy plans discontinued in 2024.

- Strategic shift to streamline offerings.

- Focus on resource allocation.

- Aim for improved profitability.

Web5 Initiatives

Given Block's strategic pivot toward Bitcoin and mining, Web5 initiatives are now under scrutiny. This shift suggests a potential reassessment of these projects' future value within Block's portfolio. The company's strategic direction in 2024 indicates a prioritization of Bitcoin-related ventures, which might limit resources for Web5. Consequently, the long-term viability of these initiatives needs careful evaluation.

- Block's 2024 focus on Bitcoin mining and related services.

- Reduced investment in Web5 projects compared to Bitcoin-centric areas.

- Strategic reevaluation of Web5's potential contribution to Block's overall growth.

- Need for thorough assessment due to changed resource allocation.

Dogs in Block's portfolio include Tidal, older Square POS systems, underperforming international ventures, and discontinued services. These face low market share or declining returns. Block's strategic moves, like phasing out legacy systems, show a focus on profitable areas.

| Category | Examples | Key Characteristics |

|---|---|---|

| Dogs | Tidal, older Square POS, struggling ventures, discontinued services | Low market share, declining returns, high resource drain |

| Strategic Action | Phasing out older systems, discontinuing underperforming products | Focus on efficiency, resource allocation, boosting profitability |

| Financial Impact | Reduced revenue streams, potential losses if not managed well | Needs restructuring or strategic review |

Question Marks

Block's Bitcoin mining system, Proto, is a question mark in the Block BCG Matrix. It faces high growth potential, yet involves substantial investment and uncertainty. Success hinges on Bitcoin adoption rates, mining profitability, and competition. Block invested $21.8 million in Bitcoin in Q4 2024.

Bitkey, Block's self-custody Bitcoin wallet, is a "question mark" in the BCG matrix. As a relatively new product, it has high growth potential. However, it faces challenges in user adoption and security. Its success hinges on boosting awareness and trust in self-custody solutions. In 2024, Bitcoin's market cap was over $1 trillion, indicating high growth potential.

Cash App Borrow's expansion into micro-lending is a strategic move, potentially increasing its user base. However, it faces credit risk, especially with subprime borrowers. In 2024, the microloan market was valued at $150 billion, indicating significant opportunity. Regulatory compliance and effective risk management are crucial for success.

International Expansion of Cash App

International expansion for Cash App presents both high opportunities and significant hurdles. Regulatory compliance, competition, and cultural adaptation are key challenges. Success hinges on tailoring the platform to local markets. In 2024, Block reported that its international revenue grew, showing the potential for global growth, but specific figures for Cash App's international performance were not fully detailed in the latest reports.

- Regulatory hurdles: Compliance with varying financial regulations across different countries.

- Competitive landscape: Facing established and emerging fintech competitors in new markets.

- Cultural adaptation: Customizing the app to meet the specific needs and preferences of local users.

- Growth potential: Tapping into new user bases and revenue streams.

AI and Automation Initiatives

Block's (SQ) AI and automation initiatives are a strategic move, aiming to boost efficiency and enhance customer experiences. This area represents a high-growth opportunity, but it requires significant investment. Success hinges on Block's ability to effectively integrate AI to improve its products and services.

- Block's investments in AI are focused on improving its existing products.

- These initiatives are expected to enhance customer experiences.

- Significant investment is required to support these AI efforts.

Proto, Block's Bitcoin mining system, faces high growth but uncertainty. Success depends on Bitcoin's adoption and mining profitability. Block invested $21.8M in Bitcoin in Q4 2024. Bitkey, a self-custody wallet, also has high potential, yet faces user adoption challenges.

| Product | Status | Challenges |

|---|---|---|

| Proto | Question Mark | Bitcoin adoption, mining profitability |

| Bitkey | Question Mark | User adoption, security |

| Cash App Borrow | Question Mark | Credit risk, regulatory compliance |

BCG Matrix Data Sources

The BCG Matrix relies on diverse sources, including financial reports, market analyses, and industry benchmarks, offering data-driven strategic guidance.